Content adapted from this Zerohedge.com article : Source

The recent tax and spending bills that came out of Congress and the Trump administration did not win it any friends among the banks.

Goldman Sachs is the latest to get on the bankwagon about the United States financial situation. Looking specifically at debt as compared to GDP and interest expense, Goldman concludes the United States is on an unsustainable path.

Goldman's view is as such:

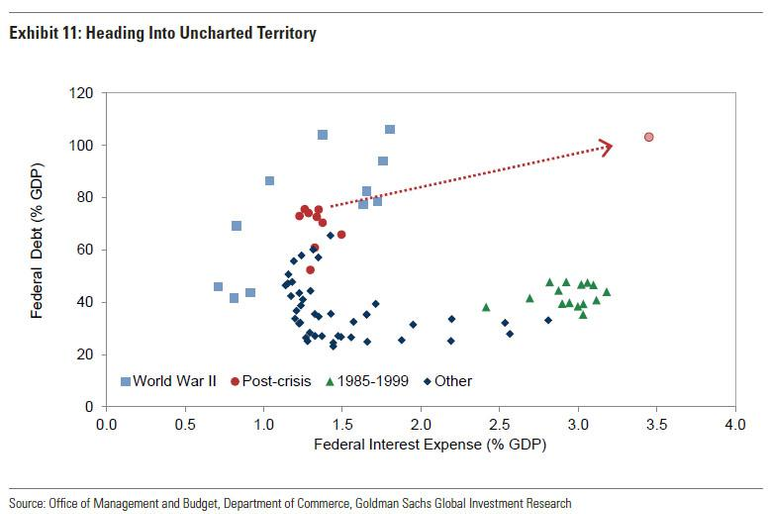

The US appears to be headed into uncharted territory—at least for US fiscal policy—regarding the relationship between interest expense and the debt level.

As shown in Exhibit 11, interest expense considerably exceeded the current level during the late 1980s and early 1990s, though the debt level was moderate. By contrast, the debt level was slightly higher during and just after World War II than it is today, while the level of interest expense was similar.

However, we project that, if Congress continues to extend existing policies, including the recently enacted tax and spending legislation, federal debt will slightly exceed 100% of GDP and interest expense will rise to around 3.5% of GDP, putting the US in a worse fiscal position than the experience of the 1940s or 1990s.

Congress and the U.S Fed will have a chance to avert any crisis depending upon the moves they make. History shows these two organization have the propensity to kick the can down the road. The Fed is now sitting on trillions of debt it bought through a number of rounds of easing. This was nothing more than a temporary reprieve to a larger mess.

Look for this to happen again down the road.

Non-adapted content found at zerohedge.com: [Source}(https://www.zerohedge.com/news/2018-02-19/goldmans-chart-showing-us-headed-banana-republic-status)

Thanks as always for the insightful article @zer0hedge, you've become somewhat of a one stop news outlet for me to keep up to date with these stories daily.

It's crazy to see a projection of federal debt exceeding 100% of GDP.. that is ridiculous, and as you mentioned, it puts the US in a more financially insecure predicament than in the 1940s-1950s.

The world really seems to be pitching itself up for a bit fall, I have been recently reading about big banks in my country selling of large groups of mortgages to foreign investors.. Sounds just like the 2008 crash. Let's see how it goes!

Thanks again for sharing.

We're heading into very treacherous times. There is now about $1.4 trillion in student debt, most of which is guaranteed by the U.S. government and a big chunk of it is likely to default in the coming years. When it does, the U.S. government will have to stand behind its guarantee. That will further blow the budget deficit and add to the national debt, in addition to deficit spending arising from the recent federal tax cut, the budget deal that will result in more defense and domestic spending, and the end of sequestration. The U.S. debt to GDP ratio will start to approach that of some the PIIGS countries in Europe.

I'm not holding my breath on Congress and the Fed acting to stop this. Meaningful reform would be too painful politically, and we've just seen that the Republicans are really no better than the Democrats when it comes to fiscal responsibility. The Republicans want to spend more on defense and the Democrats want to spend more on domestic programs, but they all want to spend more. Eventually there will be a price to be paid for the trillions of dollars of deficit spending that's taken place in recent decades, to say nothing of the off balance sheet promises that have been made by the government but will not be able to be kept, such as Medicare, Social Security, etc.

With the stroke of our President’s pen, the national debt officially surged over the $20 trillion level. For every dollar the debt increases, the amount of money the government has to recreate out every year just to service the interest payment goes up as well. We’re talking staggering amounts of money.

Trump just signed a bill raising the debt ceiling limit for the next I think three months. The debt will require an extra $7-8 billion interest payment annually. The US government spends a unbelievable amount of money simply paying interest on the increasing debt. Now think about this; the US government is making these huge payments in a low interest rate environment. The average rate on US Treasury debt today stands at about little over 2%. What would happen if interest rates rose to a more “normal” level – say 5 to 6%?

I’m afraid that higher government spending and less central bank easing are two reasons that have been taking the interest rates higher, and the stock market has finally taken notice as interest rates rise.Stocks sold off because of a move higher in yields. I believe that from credit cards to mortgages even student loan debt the credit markets are getting into huge trouble, because with the rising interest rates beginning to affect all sectors with cheap credit are starting to find out it is not as cheap as they got used to. I think that this is only the beginning of the credit market meltdown as interest rates rise. This is a repeat of 2007-2008 or worse. The credit defaults start, then the banks start defaulting on their loans from the fed. As the defaults increase, banks stop lending in order to defend themselves. This starts the credit freeze and financial crisis, then all bubbles pop! I believe this upcoming crisis will be the biggest crises of all and rising interest rates will be one of the main reasons. To be honest I’m worried.

It is almost impossible to say anything positive about the US economy right now. Every single number is fake and optimistic. None of them include "unfunded liabilities" which should worry everyone but yet is never spoken of.

As far as this year's budget - it is another "kick it down the road" farce. I am only shocked by how long this continues.

I thought the Goldman Sachs "Boys" were now running the show and so far I'm not impressed!

To the American people, a rising deficit that has yet to yield dire consequences has given us a false sense of security. It is also clear that running up debt is far easier than paying it off. As things stand America continues to rack up a deficit each year of nearly $2,500 for every man woman and child in the country, such deficits were unheard of in the past unless it was during a major war.

The fact is with the artificially low-interest rates of today many people seem to have little desire to cut spending. We are literally gorging on debt, and most Americans seem to think that it is just fine and dandy to wildly run up debt as if there is no tomorrow. More on this topic, and some ugly numbers, in the article below.

Imagine you buy a Laptop in China for $500. Your friend buys the exact same laptop in America but has to pay $1000. Now according to nominal GDP, your friend simply has a laptop that is twice as valuable as yours.

The idea of PPP and why it is arguably a better indication of how big an economy actually is, is that it attempts to tackle the problem of price difference for the same stuff. Basically it does what you do to calculate inflation. You create baskets of goods and services (service costs are usually the biggest difference) and compare the price for that by country. Problem obviously being finding comparable baskets. But it's still way more representative than nominal GDP. You can imagine that GDP in the the US, where services are about 80% of GDP, is overvalued compared to a country like India or China, where you get most of those same services for a fraction of the price.

That is why countries like India and China are way, way undervalued in the nominal GDP calculations that end up completely misrepresenting the real world economic powers that they have.

@zer0hedge.I think our Congress and Justice system is a greater illustration of our Banana Republic status than our debt. Every country has its share of debt and they are going to print to infinity until the reset. Convention of the States is our only peaceful hope.I see older people checking prices, using coupons (sad because the best deals are from your phone) and looking worried. I see more men shopping. I noticed a very thin Russian gal at the meat counter that was shoplifting large pieces of custom meat right in front of everyone. She was ordering the custom cuts and putting them right into her bag. By how thin she was I knew she wasn't eating that meat. I doubt that she was stopped leaving the store. Overt theft prevention is frowned upon as it upsets the customers. (I overheard her talking to the meat counter butcher and recognized the accent).

Back in November or December I remember hearing from a cashier that someone had slit their wrists and was running through the store, bleeding.thanks for sharing.

The bill signed by Trump recently is only boosting the US economy in the short term as it is boosting the growth of the total size of the US GDP by 0.8% though the US debt level is already so high. Congress is enacting tax and spending legislation and still continues to extend more policies.

There is huge spending in the near future which is causing deficits as I see it, with deficits reaching $1trillion in the current or next fiscal year double what the congressional budget office had projected less than a year ago for 2018. The US debt being projected to rise from $20.5 trillion today to an unprecedented $29.9 trillion in 2028.. over 100% of projected GDP well into the danger zone. This debt is going to kill the American economy. These debts have been historically low for years but are now going up and may continue to rise for some time. America is heading for a looming disaster of deficits and debt which is the Banana republic status Goldman is talking about.

I think trump should work on strengthening the state of the economy. An increase in the debt level will surely worsen the economy which increases the expenditure level .

What is that implying?

The federal government will have to look unto various ways to reduce the debt level of the country through the use of fiscal policy.

An increase in tax will reduce the velocity or circulation of money which will reduce the cash deposit volume to banks. On the other side, banks may be tempted to reduce the bank rate to induce people to save more.

The overall result cames back to the central bank which may reduce the reserve ratio quotas to release the rare currency in circulation.

Who takes the burden? Is it the government, central bank, commercial banks or the citizens?

I think all of them face challenges though manipulated by the government but most the poor citizens suffer most. In Africa, this situation (debt) is a disaster and many governments do not wish to talk about it and end up having continuous debts!!!!

In conclusion, each actions brings out consequences, positive or negative. Debts will surely increase the price level of commodities and reduce the level of income and then reduce the level of expenditure.

My views. Support me if I'm wrong

Thanks

Earlier immediately, we mentioned an in a single day report by Goldman which, when summarized, advised that until one thing vital adjustments within the coming years, the present US fiscal coverage will result in a debt disaster. In an unprecedented warning, the financial institution which spawned Trump’s chief financial advisor Gary Cohn, and the architect behind Trump’s fiscal technique, warned that “the continued development of public debt raises eventual sustainability questions if left unchecked.”

It is clear that running up debt is far easier than paying it off. As things stand America continues to rack up a deficit each year of nearly $2,500 for every man woman and child in the country, such deficits were unheard of in the past unless it was during a major war.We have all the technology and resources we need to provide for all the needs of everyone in the nation and then some. As evidenced by the amount of aid we send foreign countries, and the ridiculously high number of immigrants and refugees we take in year after year. We have more vacant homes than homeless, etc etc. Having poverty in America is a choice we made so that a few people like Bezos, Buffet, and Gates and be wealthier than 50% of the rest of the country. We let this happen, and to change anything lots of people are going to have to die or continue wallowing in poverty.

Thanks for the information

It's all well and good for Golden Sacks to complain about this, while at the same time being a major part of the problem. Being the direct beneficiary of policy and crony lobbying.

I am very pleased to see @zer0hedge on Steemit even if its not 'official'.

thanks for this wonderful post you always provide us with the latest information.

Good post 👍👌, Please upvote back me, @hazmisyahputra, thank you.

it is all of governments fault.the printing of money out of thin air, expenditures on war(covert and overt purposes,unnecessary expenditures by politicians etc. etc.the list go on and on.

God info in there > Thanks

I don't know if we are headed towards a banana republic, but it certainly can't be sustainable. If we look at Japan and their 250% OF GDP PUBLIC DEBT compared to them USA is a butterfly without a care.

Here is something interesting in numbers

With the changes in taxation, I think things will get worse before they get better. And for them to get "better" the whole system should collapse and be replaced.

Everytime I hear people saying that the sovereign debt crisis is over and the economy is recovering, I just don´t understand how such a small recovery gives such confidence to everybody.

We are already going in the "right way" to have a even worst crisis than this recent one... But not many are talking about the debt situation of the countries, especially China and big countries.