All of us here know that gold and silver prices have been manipulated to keep them down. And many have predicted that there would come a time when the manipulators would lose their manipulations.

Is now that time?

Or, are we looking at a time when the manipulators are allowing gold and silver to rise a little to cool off the upward forces? And if they are doing this, will playing out a little line ultimately break their grip?

The problem is, that along with the prophesied meteoric silver price rise, is a lot of ugly stuff happening in the financial markets.

So, what await us?

What about inflation?

Given the inflation we have been seeing in food and gasoline prices, we surely would have seen a surge in the price of silver. Somewhere around 50% inflation over the last two years, and just now silver peaks up?

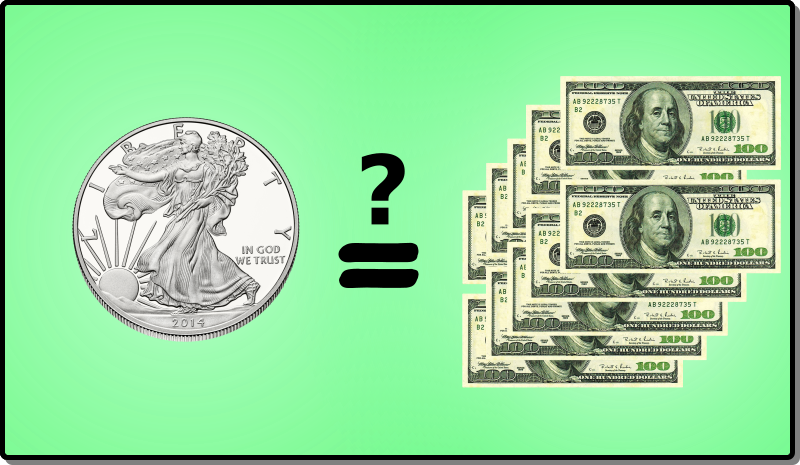

You would think that more people would be looking for a safe haven in PMs, and it does seem supplies are limited, but no price movement. Really, silver should be over $50 just to keep up with inflation over the last few years. Well over $200 if you count inflation from the previous $50 ATH.

Coming Stock Market Collapse

People who are actually watching the stock market (not the talking heads on the MSM) are screaming that the alarm bells are ringing.

So, what happens when the stock market crashes?

First a lot of sell off of assets happens to cover shorts and such. Gold, silver, bonds, and even crypto will all go down with it. Then there will be a lot of movement into "safer" assets. However, half of the "wealth" (at least) will be gone, vanished. Poof.

The stock market crash will have huge effects. It will probably scare all the boomers who were looking to retire. But, most people are really struggling now, and probably won't even take time to notice.

I am sure that PMs will get a lot more attention after that, however, what will be consequences of the stock market pulling all the money out of all investments.

Higher Demand for Industrial Silver

Already we are seeing squeezes on supply for building things like solar panels and smart phones. But, what if some new technology comes along that NEEDS silver? There just really isn't any extra silver. It is used up as fast as it is mined.

But, you want that new flying/floaty car? Its going to need an ounce or two of silver to build. Will you open your stash to get one? Will you sell some of your stash because a lot of people want one, and they need more silver.

What is your price point? $500/ounce? $1000/ounce?

Yes, this means that new iPhone is going to cost $50-$100 more to manufacture. But, it was already hella expensive.

Silver price go up?

Silver prices should be much higher. And more reasons why are about to be piled on top. It is just a matter of time before silver prices break free from control.

Is now that time?

If it is, we will probably see an increase in price of a dollar a day. And then $5, then $10.

We just do not know. People, who have all the money in the world, are manipulating things, and it is hard to work out what will happen when you do not know their game plan. The manipulators will keep the price down until they decide it needs to be higher. Maybe to save JP Morgan. (they are holding the COMEX silver, so they will have lots of "money" in an instant to balance their books.) Or, and it is inevitable, the manipulators will lose control of their manipulation.

In my opinion we will see $500 silver… $1000 silver.

My concerns are, what does $500 buy at that time? And, can you sit on it? Will the price hold into the future, or go back to a more reasonable level, like $300 an ounce. (Mexico will, for sure, start ramping up mining production)

Or, will someone try to make it money/coinage again? The mint may stamp $20 on the new coins. But, if there is paper fiat still in circulation, no one will trade an ounce coin for a $20 bill.

Well, all i can advice is, if silver skyrockets while the financial system is still intact. Sell the silver and pay off all debts / mortgages. Or better trade silver for what you really need. An old reliable car and a homestead.

Make sure to make plans for your new silver wealth. Move it out of the space of wishful thinking, and into the realm of solid plan. Because, things are happening.

I hope my cash reserves last long enough for silver to do it's intended job. There are plenty of stories of some Stackers were doing okay until inflation overtook them and are forced to liquidate their stacks. Until then, one moonshot at a time.🚀

Back at the February Ag price dip, I took the chance and bought way more than my usual DCA purchase.

Yes indeed, all kinds of stories of markets staying irrational longer than one can stay solvent.

In Phase One of the U.S. Monetary Correction, the One Ounce Silver Coins will be Corrected with $10 Face Values, and yes, their Spending Power "will be" 1,000 of today's Fiat Dollars per ounce...

Yeah, that is what the rumors said they are minting onto coins, but it is all hearsay, even with photos.

$20 sounded better when i was writing. It is what gold was, before it wasn't

Do you think silver will hold its ultra high price long term?

The day will come when One Ounce of Silver will get you Two Ounces of Gold...

Whatcha gonna do with that gold? Make a frying pan? (ultimate non-stick, hypo-allergenic cookware)

We're going to make $10 Gold Coins, $20 Gold Coins, $50 Gold Coins and $100 Gold Coins... Our $10 Gold Coins will contain 1/10 ounce of Gold... Our $20 Gold Coins will contain 1/5 ounce of Gold... Our $50 Gold Coins will contain 1/2 ounce of Gold and our $100 Gold Coins will contain One Ounce of Gold... Trust me what I write that "We the People" have Staggering amounts of Silver and Gold, standing by...

Some things i have thought of in gold-money are small bits of gold being embedded in another material.

Like a dollar bill, with a window (plastic) with like a piece of gold foil, encased between two sheets of plastic, embossed into some shape, detail.

Also, may be done in coin form (thicker plastic) with a piece of gold embedded in it.

It may work, it may not. It may never come about because of bitcoin. Or maybe it will because of it.

This sounds exactly like Goldbacks...

Source

I think our Silver, Gold, Platinum and Palladium Coins will be all we really need to back our Paper coinage, our Electronic Coinage and our Common U.S. Coinage... We already have Staggering amounts of Common U.S. Coinage... Our Money will be Sound and very Stable...