This is an outline of the needed Hive tokenomics improvement for the next HardFork that should happen somewhere in Q1 2025.

As many of you know I have been griding data about Hive for a while now on this chain and I have been digging a lot of the many aspects that the Hive ecosystem and tokenomics have.

The Hive tokenomics are by no means simple. In fact, I would go and say that they are probably one of the most complicated in the crypto industry. The Layer 1 dual currency model is imposing this complexity.

The proposed improvements here are not coming only from me, but they have a wider user feedback, from my communication on chain and off chain, mainly on discord with other Hive users.

For some of the proposed improvements there is already awareness in the Hive dev community and other members of the Hive community have probably seen them and come to the conclusions by them self.

Point been is this is not in any way my personal conclusion and proposal that I want to take ownership of, it’s something that has been talking about from many users, devs and non devs in the community for a long time. There might be people already coding this stuff, that I’m not aware off.

I’m just putting this post out to increase even more awareness and to push even more that these points are been given attention to and covered for sure in the next HardFork as I believe they will improve the Hive tokenomics and make sure this community is around for years to come.

1. Hive Inflation Base

The way new Hive is put in circulation is by calculating the quantity from the current virtual hive supply and multiplied by the current inflation rate.

As many of you know the inflation rate is set to go down by roughly 0.5% per year and should stop at 0.95% per year somewhere in 2036 or at block 220,750,000. We are currently at around 6% inflation, initially it was 9.5% when these mechanics were put in place.

The inflation rate itself is not an issue. What is an issue is the inflation base or the hive supply that is multiplied with the inflation rate.

The formula for the new Hive is as follows:

auto new_hive = ( props.virtual_supply.amount * current_inflation_rate ) / ( int64_t( HIVE_100_PERCENT ) * int64_t( HIVE_BLOCKS_PER_YEAR ) );

The link for the repo where this is defined:

https://gitlab.syncad.com/hive/hive/-/blob/master/libraries/chain/database.cpp#L6404

As we can see the inflation base is set as the virtual hive supply, that includes the HBD supply converted to HIVE at the feed hive price (3.5 median hive price).

Currently we have:

- 460M HIVE

- 33.5 HBD

- 0.275 hive feed price

- 582M VIRTUAL HIVE SUPPLY

The base for the inflation is not 460M, but 582M, or 27% higher inflation base, meaning 27% more hive put in circulation. Furthermore, the HBD that is used to calculate the virtual hive supply includes the HBD in the DHF, that is close to 23M HBD, while the freely circulating HBD is 10.6M HBD. For example, the debt calculation takes only the 10.6M HBD.

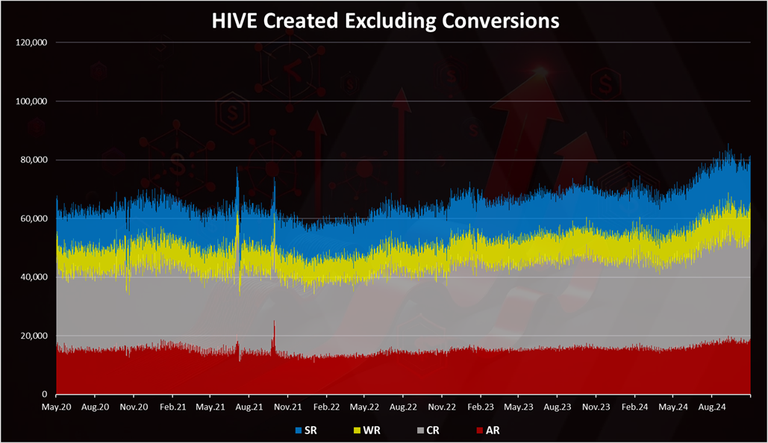

The effects on the newly issued hive from the changing inflation base can been seen from the chart.

We can see that back in 2020 the new daily hive that was put in circulation was around 60k, while we are now at 80k hive daily. This hive is the regular inflation so to speak, excluding the hive created from HBD to HIVE conversions.

In a meanwhile the inflation rate went down from 8% to 6%, but hive created went up from 60k to 80k because of the hive inflation base and the increase in the virtual hive supply.

Whenever the hive price drops the virtual hive supply goes up putting more hive in circulation.

Another big disadvantage of using the virtual hive supply is the inability to calculate and predict the future hive inflation because the inflation base through HBD is dependent on the hive price, that by itself can not be predicted.

Proposal: Change the inflation base from virtual hive supply to regular hive supply.

What this means is instead of the currently 582M virtual hive supply, use 460M regular hive supply. Note that these numbers are dynamic and will change, for any future references.

2. Debt Calculations

The way the debt is calculated is using the available HBD supply, currently around 10.6M HBD, excluding the HBD in the DHF around 23M HBD. For the hive market cap, the hive supply that is used is the virtual hive supply and the hive feed price (3.5 median hive price).

Hive_debt = available_hbd / hive_market_cap

The way this is setup is basically to give the lowest debt possible, enabling more HBD to be created before the haircut rule kicks in. Furthermore, by using the virtual hive supply, the HBD is treated as both asset and a liability. It is used in both the debt and the market cap. You cant take more debt by putting debt itself as collateral.

The way this should be is again to use only the regular hive supply to calculate the market cap for the debt. If the change is made to the inflation base, this should follow as well. This will slightly increase the debt, but not by a lot, for example under current conditions, the debt will go from 6.7% to 8.5%, or an increase of 1.8%.

Proposal: Use regular hive supply for the market cap when calculating the debt instead the virtual hive supply.

3. HBD in the Decentralized Hive Fund DHF

The amount of HBD in the DHF is now close to 23M HBD, while the market cap for hive if we use the regular hive supply is 125M. Furthermore, there is 39M HIVE in the DHF, remains from the initially 83M HIVE that were transferred from Steemit Inc during the Hive HardFork. These 39M HIVE is being slowly converted to HBD at a rate of 0.05% per day. This HIVE adds another 10M HBD to the 23M HBD, under current conditions.

A total of 33M HBD in the DHF to 125M hive market cap, that is more than 26% share. This is a big share of the tokens controlled by the DHF. Imagine an entity controlling 26% of the BTC supply. For example Saylor is now close to 2%, while Blackrock is just above 1%.

As example the share of the regular inflation that goes to the DHF is set to be at 10%. Some variation from these 10%, for example 5% more or less is not an issue but the current share is too much.

What has been the consequences of this is that in the last two years, 2023 and 2024 the Hive ecosystem has overspent on DHF projects, roughly 3M per year, while the regular hive inflation to the DHF has been at 1M per year. This has caused additional inflation in the hive economy putting more hive into circulation and slightly diluting the value of the existing hive stakeholders.

Additionally the other sources for HBD in 2024 have been much less than the DHF. Author rewards for example are under 1M, while interest is at 1.2M HBD.

While having funds for development is a 100% a must, and 3M USD per year is a small number when compared to some of the bigger projects, they need to be in line with the size of the project, and currently they simply are not. If the projects that are funded deliver growth in the future, they might all be worth it but that is all uncertain.

In order to put the spending in correlation with the size of the Hive ecosystem a share of the tokens in the DHF needs to be burned. There are many ways how to go around this, and I’m not proposing a final solution, but one of the ways to do it, without causing instant shock to the economy is to put some of the funds in slow burn mode, similar how it was done for the conversions of HIVE to HBD. For example, the remaining HIVE of 39M can be but in slow burn mode at the same rate as now of 0.05%, or some absolute daily number and be burned in the next three to five years.

Additionally, we can simply put burn proposals to burn X amount of HBD from the DHF for years to come. For example, 10k HBD per day will burn around 10M HBD in the following three years.

The end goal of reduction of the token share in the DHF would be to bring it close to around 10% of the hive market cap.

Proposal: Put the remaining HIVE supply in the DHF in a slow burn mode.

Depending on the Hive market cap in the future, additionally burn some HBD from the DHF via proposals.

Some might say that this will reduce the development funds and have negative impact, but I don’t see it a reductions in dev funds, but bringing dev funds in correlation with the project valuation.

The regular hive inflation will still continue to the DHF, and if the price of hive appreciate, say $3, or $10, the there will be much more funds then 3M per year, but they will be in correlation with the project valuation.

Final Remarks

I know some of the topics above might be controversial, especially when it comes to the DHF funds. For the first two points I don’t see any issues to be implanted, except maybe from dev time and operational issues, but the changes by them self-do not require a lot of dev work imo.

The main goal of all of the proposals above is to strengthen the Hive tokenomics and economy. All the proposals are in this direction.

I do not want to cause any fears, but theoretically the way the Hive tokenomics are currently set there is a possibility for a semi-death spiral. The total collapse like Terra/Luna and UST is not possible, but I can see a possibility for the Hive supply going more than 3x in short period of time with an end result hive being worth much less and HBD devalued by a lot.

Some can say that these are bear market issues, and higher hive price will fix them all, but this is only masking the issue. The cycle will come back and maybe with even higher stakes. Imagen instead of 10M HBD, there is 100M HBD in circulation, or even one billion HBD, and then we have a semi-death spiral scenario. The sooner we strengthen our tokenomics and while in a low market cap the better.

All the best

@dalz

for 1.

I have no problem with that as long as we recalculate inflation rate to be in line with intended increase in Hive supply. I do agree that current system increases inflation when demand for Hive is low and decreases it when demand is high, adding to volatility instead of dampening it, so that proposal seems reasonable.

for 2.

It is calculated correctly. HBD is collateralized not with existing HIVE, but with new HIVE that would be issued when conversion is finalized. Or to put it differently - internally HBD is just a different form of HIVE, that's what virtual supply represents. The only questionable element of the calculation is HIVE that is on DHF balance - since we are not counting HBD on DHF balance, we should not count HIVE on its balance either. That way whole DHF budget is excluded and there is no inconsistency.

There is other reason to not do any change in that area. In practice it changes nothing until we are close to at least soft limits, which are still way out of reach, but such change requires heavy testing.

for 3.

You make it sound like it is a bad thing. DHF is not some shady entity - it is our common budget that we all control.

Heavily disagree. DHF should be financing more, f.e. whole work of @blocktrades team should be funded by DHF, which would make it rival hbdstabilizer for spot as largest item on tab (and since stabilizer returns assets back, it is not actually a cost to DHF as its daily pay would suggest - I assume you've taken that into account when calculating that 3M per year expenditure). Hive is still young project and like any startup it needs to spend (of course it has to spend reasonably, not throw away money, but that's what voting on proposals is for). Only once the basics are set and we have some leeway in funding optional things, then DHF will spend no more than its inflation share. And guess what - spending from DHF decreases its share in virtual supply, which you said yourself is too big :o)

I'm not a fan of burning tokens, especially not in a system that was not balanced around constant burning. But like you said, it is possible to make a proposal with

nullas receiver and let the community decide.Thanks for the feedback.

On the no.3 I appreciate your opinion, I can further elaborate that funding is needed, but in proportion with the project size, but there will always be different opinions on the topic.

About no.2, I'm not totaly sure what do you have in mind. Yes HBD can be treated as HIVE, but it is debt no matter what the form is. So to use debt as colateral for more debt is just not in line. Plus if we put the inflation base as regular supply it is logical that to be implemented in the debt calculations as well.

On no.1 we all good :)

Well put, I agree with these feedbacks especially for no. 3

I agree with all of this.

This is what I was thinking after reading the proposal.

Someone asked for more opinions from large stakeholders, so I'll briefly add my opinion. All the tokenomics you've discussed were already discussed and coding plans were made as early as Hivefest, as I recall. Even we discussed briefly in discord. My opinions basically match that of ABW (and apparently smooth as well).

If anything, Hive needs to be spending more right now, not less, but spending more requires more ideas and programmers capable of implementing them. And as ABW has already pointed out, until at least SPL proposal, I've personally been spending more than entire DHF expenditures on devs. And of course at some point, DHF will have to take over those costs, as I won't fund it forever on my own.

But the root cause of our disagreement is your argument that reducing DHF will help Hive price. I completely disagree with this thesis. Of course, on each side it is just a guess, so there is no way to definitively prove it except to stop spending on DHF (which IMO would be a complete disaster).

Note I don't always agree on every proposal (as you can see I don't vote for them all, especially ones that ask too much without clear enough benefit), but nonetheless despite that I think the overall result of DHF spending will be beneficial to Hive in the long term. Spend or die is the proper way to look at it, IMO. As far as I can tell, the biggest stakeholders in Hive agree with this idea to some degree. This is also the method by which I was ultimately successful in business, I should add.

Tnx for engaging. Looking forward for the next HF!

I think you still vote most of them proposals. People still have most of theirs doubts with your votes. Whole problem that people prefer to burn DHF funds than spend them on projects might be weird voting on your side. Do you have post explaining your votes? You don't ever make mistakes? Any case that you voted but realized they just trick you? You vote proposals that have something like 100 votes total and your vote is 90% of power, proposal passed, no one really vote it, just you, and it continues year by year. Don't you see how it becomes too easy for some projects to get your vote and they don't even try to get votes from their own users? For some projects we can doubt they have users.

Maybe whole problem with lack of activity in governance voting is connected with this centralization of voting power, where projects don't need votes from users, care less about users, whole thing becomes mostly imagination between small group of people pretending that they do something.

Over spending, low work efficiency, situation when it's better to not finish work but continue it over years to extract more money from government, are very basic issues with governance. There is 99% chance it exist here. We shouldn't deny it, but improve our awareness about it. Possible you completely ignore these problems, and people at the ends prefer to burn DHF money cause they can see all the waste while you don't.

Generally I would prefer to not burn DHF money, but distribute it better way. Maybe we should create some metrics and track some data, cause sometimes I think projects intentionally avoid statistics cause it looks very bad. Would prefer discussion about these proposals, maybe you shouldn't be so consistent with voting on some projects, but let them prove their value, let them ask users for vote.

That comes from someone who made some applications on this blockchain. One of them distributed something like 200k HIVE to users(2 years), and saved much more. I made a proposal for that one, very cheap, something like 25k$ per year, compared to 200k$ generated for users, very cheap. You didn't vote it. You probably don't know about it at all. I abandoned project half way cause didn't want to drop another 25k$ from my own money to fund it. How you recognize good project or bad? How you inform community about your decision? Cause I have very clear statistics, metrics about my project and you can compare it to projects you vote, only if you want to.

Whole thing becomes political struggle between conservative approach to spent less and progressive approach to spend more, and possible problem is created by huge centralized power that doesn't try to reach between these options, but always pick one(currently overspending). I talked few times before that eventually @blocktrades flips to other side, and we fund nothing. But reaching middle ground here will be very exceptional, hard to imagine, requires much more work, thinking etc. Probably most beneficial for network, but who cares at this point.

For me it is more how it is being spent and what we are getting in return, there is a vast difference.

At that point you're arguing individual proposals. Obviously there is disagreement on the merits of different proposals. As I stated, I don't agree with all of them myself, and of course many disagree with ones I'm voting for as well.

No doubt you and I disagree on the merits of many of them. But probably the bigger disagreement between us is the impact of such spending. Generally i don't think that "most" of the proposals I disagree with are causing much actual damage to price, for example, even if they aren't the best expenditures to makes. There's only one I can think of that's large enough it may have real impact.

It's not the spending it's the sell pressure, most of which with no real benefit to Hive or gaining users/investors. Just as I have no illusion that burn posts actually does anything for price, but the reduced sell pressure may.

Spending/sell pressure, two ways to look at same thing. Again, I disagree with the thesis that sell pressure from DHF is affecting price much, especially not when viewed against the positives to price (a chain with active development).

Anything specific you have in mind in that regards, @blocktrades?

Lol, leech

100% agree on all 3 suggestions!

Appreciated!

Defo 1 and 2, and 75% leaning towards 3!

Tnx!

1.Aye!

2.Aye!

3.Burn proposal, let's community decide

These are proposals I certainly could get behind and address some of the key issues on chain. Fingers crossed some of them get implemented.

I am very much in agreement with points 1 and 2.

I personally would hold off on point 3 until the effects of point 1 and 2 can be seen as the they could help offset the issue with point 3 to some degree.

I'm a hive witness supporting the blockchain please consider voting for me.

100% agree on 3 points.

Tnx empo!

I totally agree with this, how do we make it happen? I will support it in any way that is needed.

I think a lot of people will agree on any solutions to lessen the impact of the DHF burden on the Hive economy.

So anything higher than your proposed 10k HBD might be somewhat detrimental?

Agree on all 3, very good and reasonable proposals, should be adopted asap.

Fully agree with the first two.

As for (3), the proposal creation cost for @null beneficiary could be just the 10 HBD flat fee regardless of proposal duration to not deter anyone from making burn proposals to be voted on.

This is the best proposal I have ever seen in the Hive ecosystem since its inception. Surely it will check the inflation. Otherwise in theory only inflation is reducing but in absolute number there is no change, in fact, at times it goes up.

Thank you.

I’m all for fixing things at this level. Hopefully these proposals get through.

!BBH

This looks sensible.

I agree with changing the way the debt ratio is calculated, but I don't understand whether it would create more volatility in the figure we end up with and an increase in the risk of a haircut. Knowing this could impact my view on how much I'm comfortable having in HBD savings !

Although it's off-topic for this proposal, something I'd love to see is DHF funding for proposals split into two distinct categories;

These things require community discussion, especially the 3. proposal... I hope that we will see more comments from those with the biggest stake, as like this, it looks like HIVE is splitting in two...

Btw. all 3 proposals benefit ALL HIVE holders, so it is weird to not see a broader discussion... Hopefully, we will have it soon...

Personally, I'm for all 3 suggestions as they would benefit HIVE!

You are really doing a lot in providing us with these data. They help us know how things are going on the blockchain. Thank you.

Mi piacciono tutti e 3 i suggerimenti!

!hiqvote

!discovery 40

Will this be possible to do in January?

!BBH

@day1001 likes your content! so I just sent 1 BBH(13/20)@dalz! to your account on behalf of @day1001.

(html comment removed: )

)

@bigtakosensei likes your content! so I just sent 1 BBH(1/1)@dalz! to your account on behalf of @bigtakosensei.

(html comment removed: )

)

Such a good analysis. Thank you for making it available to us

Just sign off on this, the best idea I've read this week.

Good suggestions.

@libertycrypto27, the HiQ Smart Bot has recognized your request (1/3) and will start the voting trail.

In addition, @dalz gets !PIZZA from @hiq.redaktion.

Discord. And don't forget to vote HiQs fucking Witness! 😻For further questions, check out https://hiq-hive.com or join our

!PIZZA

$PIZZA slices delivered:

(1/10) @danzocal tipped @dalz

This analysis involved high level computing and it's very useful and helpful. Thank you for taking the pains to work on it.

I fully agree with the need to review the mathematics of virtual supply for real supply. Regarding the DHF, my opinion has little impact, after all I only have about 5,000 HP, but it really needs to be reformulated URGENTLY.

I'm not financial expert, but seems to make sense.

The last paragraph is truly important. So many people do not understand that crypto is a cycle, and just as it will probably continue up through most of 2025, it will go back down through 2026 and bottom in 2027. Hive does need to address this issue and others now, because this last bear has shown the strain on both the coin and the community, and neither may hold up into 2028 if what you describe occurs.