With the cost of living increasing and inflation on the rise having an accurate understanding of outgoings is, in my opinion, critical and with this in mind I periodically evaluate mine. That means weighing up price increases and the value I receive for the additional cost (if any), the need for continuing to pay for that thing (goods and services) and other evaluations and I'm able to minimise my outgoings and be more economically viable; that little "health check" is insurance against being over-charged.

Speaking of insurance, I recently had a glance at my household and contents insurance policies for my properties and was annoyed to see they had risen steeply.

For ease of use and to be time-efficient I have direct debits from my bank on a monthly basis to pay most recurring outgoings including my insurances and because it's set and forget the "health check" process is important because when premiums go up in cost it happens out of sight and if I was to miss the "increase notice email" then I'm unaware and that could mean paying more than I have to needlessly; the process is insurance against paying too much.

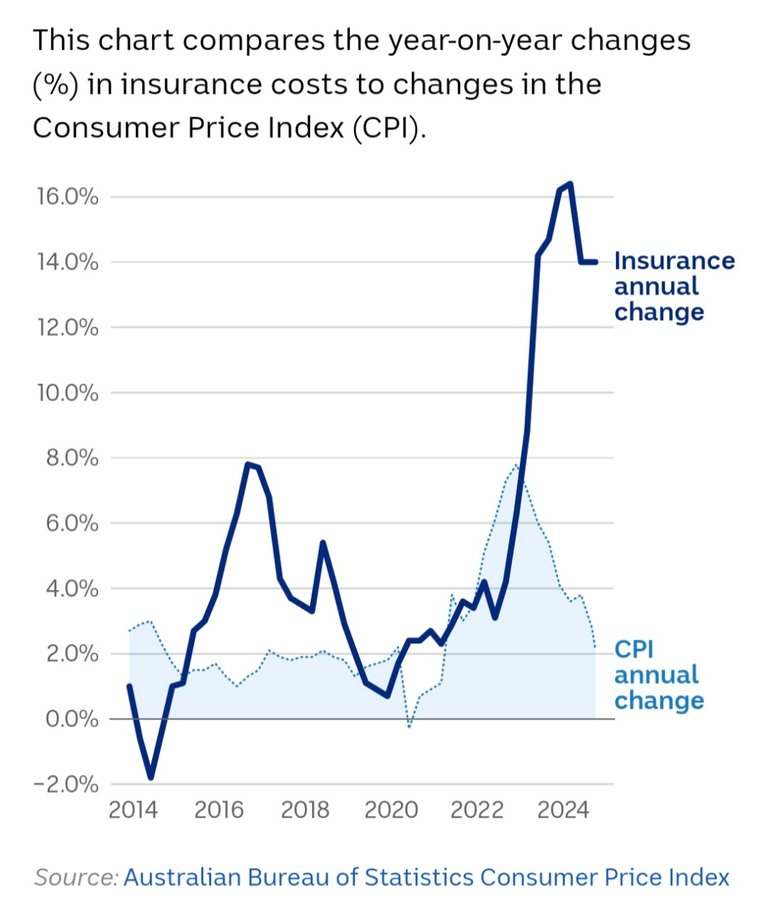

Something that's been going on here over the last ten or so years is price gouging, companies raising prices disproportionately against the Consumer Price Index (CPI). The graph below demonstrates it clearly over ten years with the dark blue line being the annual costs of house insurance in relation to the dotted line which is the CPI. Disproportionate right?

But let me put that in dollar terms on one of my on houses.

Currently, I pay $2,217.67 annually for house and contents insurance on the property, so $184.80 per month. Two years ago the same house and contents insurance policy on that house was $1,136.57 annually ($94.71 monthly) meaning it's increased by almost double and I have multiple policies so get group discounts; other's aren't so lucky.

They blame the rise on increasing occurrences of natural disasters, higher house values and repair costs and inflation of course. Yep, I get it...but it seems like price gouging to me and a lot of other people including many consumer-advocate groups who are calling for a national watchdog on the insurance industry.

I'm lucky to have the ability to pay for what I use including all my insurances like house, contents, vehicles, life, income and so on but many cannot and it's becoming increasingly difficult for people to pay for the basics...this is causing many people to drop what they see as non-essential spending and that means insurances. The problem is that many perceive there to be no real value in insurance until one needs it such as when health declines, a job is lost, the house burns down or there's a natural disaster and the house is damaged or destroyed, vehicle crashes and so on...that's when insurances become important. Without the correct insurance a person would be left in a world of pain should those things occur but if there's not enough money to pay...well, you see the quandry.

I know so many people who seem almost afraid to review their financials out of fear of finding issues they cannot address but for me I think it's important to know so changes can be made and doing my "health check" process a couple times a year helps me gain some insurance against paying too much.

How do you see and find the issue in your location? Has the cost of insurance for things like house, contents, vehicle, life and income insurance caused you to scale back or terminate those insurances? How do you think being under-insured may affect you moving forward in the advent of an issue and how would you cope without insurance payouts in the advent of the worst happening?

Feel free to comment if you'd like to.

Design and create your ideal life, tomorrow isn't promised - galenkp

Want a free Hive account? Click Here

[Original and AI free]

Image(s) in this post are my own

J takes care of that side of things (safer that way, one of us can actually read numbers properly). I'm vaguely aware of stuff continuing to go up and up and up. Definitely sounds very long overdue for some new systems/supply chains/processes.

I tend to get the idea that no one really knows how to fix these issues so it just goes along as per normal and gets worse and worse. Oh well, there's going to be a time when it'll come to a head for many people and most of them will be completely unprepared.

I haven't had any insurance I'm not legally required to have, for 20 years now.

It breeds complacency. Best way to halve the road toll would be to ban collision insurance. It should be a crime to run a service where you pay a monthly fee to not have to worry too much about crippling me. Peace of mind should come from competence and nowhere else.

One is not required to have house insurance, is that something you forego also?

I got it for a year when we started the mortgage, then let it lapse.

Ten years later the bank did an audit and emailed us to say we need it or they'll close out the mortgage. I bought it for another year and let it lapse again. That was five years ago, I think.

House hasn't burnt down and I've saved about $20k.

A guy reversed into me a month back. Fairly minor. Probably $3k worth of repairs. It was a company car, so they decided to just pay me outright instead of making a claim and pushing up their fleet's premiums. So they pay for this thing they might need one day, but then when they need it, it's such a bad product they decide not to use it. So why pay for it?

Yeah, it's a bit of a farce really, a money making scam as such I suppose.

Those huge skyscrapers don't pay for themselves.

We had both garage and house roof replacement last year due to water damage. Over $20k (usd) cost

That nearly tripled our annual. Had we known that, we would have never done the insurance route and I would have done the repairs and a metal over shingle meeself.

It raised our mortgage $600 monthly as the homeowners comes out of it.😡🤬😡

Yep, insurance can be somewhat of a trap when it comes to rising premiums due to claims. It's shit really.

When I had my house far away... I had an insurance that was increasing more and more, too much inflation and I had to take it off. As my workplace, computers and various items were there, I found it necessary but then the cost became so high that it was impossible to pay for it with my income. The same thing happened to my brother who had a computer business.

Here it is included in the rent and the owner of the flat pays it but I heard from my friend that it has also gone up, for the same reasons that you mentioned here... it gets complicated.

Insurance for your personal possessions are covered by someone else's insurance? Sounds risky.

No, mine, not the flat's, which was there before I came in, I have my own insurance on my belongings.

In this decadent Europe, what is a universal and seemingly unsolvable phenomenon, the depreciation of the currency, is repeating itself. It is certainly not possible to plan for the future without taking inflation into account.

Regarding insurance, two years ago at this time I cancelled my life insurance. Paying about 600 euros a year seemed to me a small robbery. Regarding other types of insurance, I do not have health insurance, in principle the State covers the care of any citizen. I have the apartment insured and I also pay a professional liability insurance, which keeps going up every year.

Happy weekend.

Yeah it's an issue with so many moving parts and does anyone really know what's causing it or how to fix it? Who knows huh?

With insurances, it always seems an easy thing to drop off especially if no claims have been made but it can be problematic. One of the issues with rising premiums here is that people are pulling out of their policies and that leaves less income for the insurers to spread the load/risk over and that means the premiums for those who stay go up.

So many problems huh?

Yes, there are many things that are related to each other. It's like a snowball that keeps getting bigger and bigger. If you don't pay the insurance, the insurance goes up in price and if the price goes up, less people pay....

Happy Sunday (maybe a little early)

Life gets more expensive fast for sure, I think everyone should do these checks every now and then, or better yet: just once a year on a set point, let's say at the start of the new year.

In my country (The Netherlands) basic Health Care insurance and the insurance of your house is mandatory, last year the health care insurance got 7.4% more expensive, in one year 🤨in real life this means I'm paying €360 monthly for my wife and me, and our kids are 'free' until they turn 18 and are covered within our insurance.

Money is broken!

I think once a year is not enough as things change so rapidly these days. If you did it on, say, 1st Jan but things changed on 2nd Jan you'd have a whole year of paying too much. Every six months seems like a wiser course of action.

I agree, and many people are too, some due to things outside of their control and some due to their own stupidity. As I said in another comment on this post, I do not think anyone really knows the answer/solution to the problem and if they do they have a reason not to share it...also, no one seems committed enough to do what's required to fix things.

We have a famous economist in my country, Willem Middelkoop, he has predicted a great reset long ago, and I thinks that's what already started, the debts of countries pressing so heavily on everything, forcing them to print more money but that's only making things worse - the revaluation of gold is the answer and because of this, everything governments can't make more off, rise in value.

I think you're right on the 6 months indeed when things change so fast

I'm hoping there's a heap of better decisions made moving forward as the pressure on most people is mounting. Societies' focus seems to be on the wrong things I think.

And the funny part is Things keeps escalating yet prices keeps going up but yet salary is still the same it doesnt go up and remains constant so how do people managed to adjust to the prices of things,? For me it's just getting your plans together hoping for a better day

That's something the never seems to go up in line with the rising cost of living, good observation.

Exactly and it is something the government need to look up to

There's no reason to check, I know prices are going up, so insurance costs are going up as well.

My luck, so I live in an area where natural disasters (for now) are not frequent occurrences, and I also live in a residential building, so the apartment insurance has not become too expensive.

However, car insurance, as well as travel insurance, have doubled in price...

But, insurance is an expense that I would not skip, because there were examples that, without paid travel insurance, my life would be in danger. And there were also situations where, without travel insurance, hospital expenses would make life hell...

The check is about taking action to mitigate the increases than to determine that they're happening.

What you don't know wouldn't hurt you.

That's the idea people flow with when they refuse to recheck their financials.

If they're able to keep on paying these things with no problems... Then they feel there's no need to check and maybe discover or create a problem.

Yeah, trying to ignore something that is happening all around the world like inflation and the cost of living, is a good way to embrace disaster. Good luck to them, there's plenty of gutters for them to live in.

Is this real? Hahaha. I can never understand why people think like that. ><

I reached out to a few insurance companies a while ago to get some quotes and see if I could do better on my rates. They weren't able to touch what I am currently paying. Actually they could, but they played games to do it like increasing my deductible to get my premium down. I know my auto policy has been regularly increasing over the past five to ten years, but I think we still pay less than a lot of people with similar coverage. It's always good to review though and make sure you are being fiscally responsible.

Congratulations @galenkp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

You may be interested in my "Fine Tuned" version of the coming U.S. Monetary Correction... Most of my blogs focus on what's to come...