Congratulations on hoping into the tech and doing well despite the tough times. The only regret I have with crypto is not hustling on it sooner than 2017 when I got a chance to hop into it. I was skeptic and was learning more about traditional investing than venture into this unregulated territory. I do keep more than half of my crypto on staking and 1/3 is just play money, it's not much as most are kept on traditional assets. But it's just not a bright move to ignore this space given how abundant opportunities are there.

You are viewing a single comment's thread from:

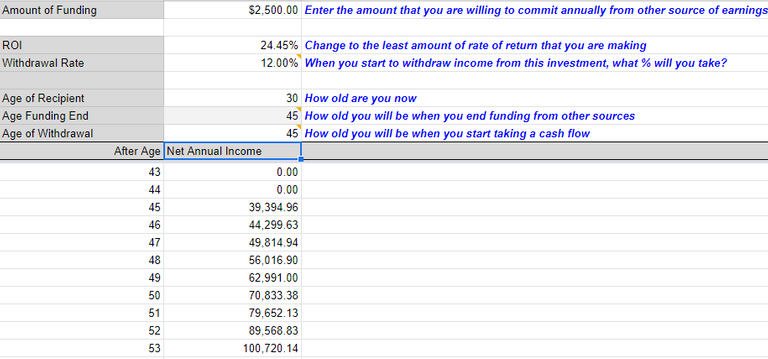

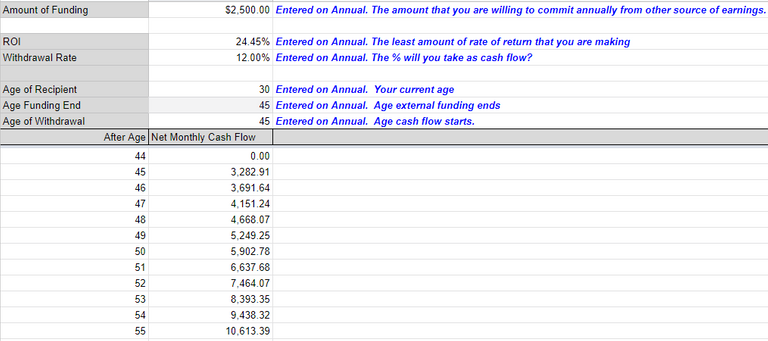

I have to remember to look at Hive more often - at least once per week. Have you posted what your end goal is? As I am approaching my last legs before retirement, I have set a monthly cash flow that I want. It includes estimates for living costs in some tropical paradise, travel, etc. I personally use a more complicated spreadsheet (multiple income streams), but I have included a link to a google sheet pictured below.

Annual Cash Flow

Monthly Cash Flow

Of course, these amounts change on a daily basis (depending on the APR) and the value of the coin against the currency. On my more advanced sheet, this is taken into account for multiple coins, but it means you must update the exchange rate daily as well.

Maybe in the future, I might create an App to automate this process, but I don't know if anyone aside from myself is interested in something like this.

Complicated spreadsheets and numbers about money are something I'm already interested in. I only have those for trading but not for computing retirement countdowns. You're on the right track and more organized than I am which is great.

I tried computing the projected income I need to maintain to keep my current lifestyle (not luxuries but comfortable) and I need 23x the amount to get by at 60 monthly at my country's current inflation rate which is more than twice than I initially projected pre pandemic. It's just nuts to think these scenarios are not far from reality and there are countless people out there not even doing spreadsheets to see where the economy is heading when they retire, just nuts.

I never entertained tropical paradise but a mountainous area in some province away from city where costs of living is the mental image I have working for me right now.

One of the advantages of computing using cryptocurrencies is that they are immune to your country's inflation rate. The danger is that the cryptocurrency you invest in may devalue; the upside is that anything you invest in now is probably undervalued.

I don't know how good this site is for predictions, but looking at BTC is very promising.

According to their prediction, BTC will have a price range of $16,587 to $79,207 by next year. This places it in the possibility of achieving a new high. Let's say you want to retire in 10 years; the possible range in price will be $276,642 - $795,565. That would put it at over ten times its current price in ten years.

Using that as a benchmark for your investments, attaining 23 times your current cash flow should be easily attainable in ten years.

I'd pick my country's inflation rate if it only took one law to repel any cryptocurrency used. The reality is that by a whim of the government, most people who are into crypto here would have a hard time accessing their funds and would just prefer fiat over risking it.

True to the first sentence. I'm not really into believing projections and relying too much on history since it's already in the past and it's information that other people can also access. Trading mindset just says don't get sold in the news because someone else has already in profit from you as soon as you received it. All this projections from a platform that has their best interest against retail traders or investors may not be the best indicator to rely on your future, but that's just me.

Learning from the hype from the last bull run where people say 100k BTC is happening, we know how it ended there so I'm just cautious with my money and take the present information as is as more important than a future or past.