A huge week for options expiry. Was expecting a heap of assignments especially in nuclear - got just a few. Assignments are hoping for a big uranium run in the long run - or BUST

Portfolio News

In a week where S&P 500 dropped 1.6% and Europe dropped 0.38%, my pension portfolio dropped 2.55% - a lot of nuclear and uranium pain.

Big movers of the week were Panther Metals (PNT.AX) (112.5%), Azincourt Energy (AAZ.V) (33.3%), Loop Industries (LOOP) (28.3%), Lithium Universe (LU7.AX) (25%), KEIWA Incorporated (4251.T) (21.9%), Evolution Energy Minerals (EV1.AX) (20%), Blue Star Helium (BNL.AX) (16.7%), Kairos Minerals (KAI.AX) (15.8%), Gemfields Group (GEM.L) (13.6%), Kaiser Reef (KAU.AX) (12.5%), Hercules Metals (BIG.V) (11.3%), POSCO Holdings (PKX) (10.5%), Stroud Resources (SDR.V) (10%), WhiteHawk (WHK.AX) (10%), Zinc of Ireland (ZMI.AX) (10%).

No surprise to see a short list of only 15 big movers. A few big themes and some surprises. No news about Panther Metals - their response to ASX query was short - No, Not applicable, No, No = no information. From the top gold/silver mining (5 stocks), lithium (2 stocks). One might be an escapee from tariffs - Korean steel. Two weeks in a row for Gemfields.

Markets wanted to go higher after the Monday holiday and did for a while - then the nerves hit with a big selloff Friday on nerves about growth. No surprise with DOGE starting to hack out jobs in the government - where do those people go?

Crypto Stumbles

Bitcoin price pushed higher a few days midweek and then went with stock markets on big ETF outflows ending the week flat with a trough to peak range of 6.7%.

Ethereum price tried to rally twice in the week but failed ending 1.5% lower with a peak to trough range of 8.5%

The charts show big drops into the next week - delayed from the stock market falls on Friday (Feb 21). It is clear that crypto markets are increasingly correlated with financial markets. Now there have been stories circulating around Trump coin and the potential for rug pull across platforms - coin was launched on Solana. The rumour is it could be switched across to ERC20 on Ethereum - no idea what the truth is BUT this chart tells me something is not happy in the land of Solana

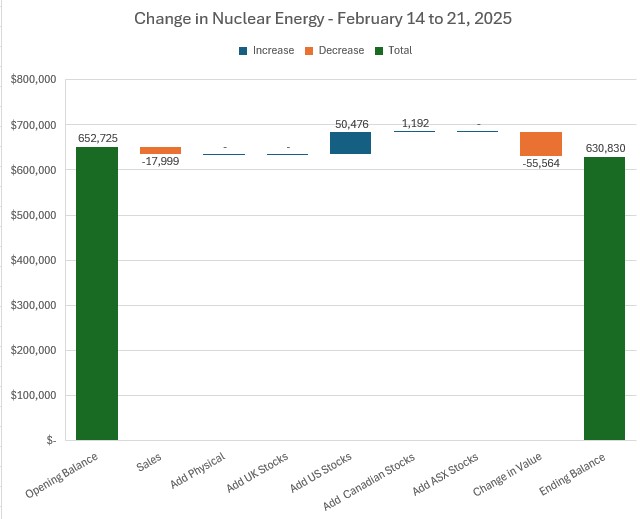

Nuclear Energy Holdings

A few purchases in the week and a busy options assignment time makes for some big moves in the portfolios. At the front end of the week it looked like there would be a lot more stocks sold on covered calls. The selloff late in the week stopped that. Sales and purchases in Nuclear Technology almost balanced themselves out. The adds were in ETF's and in the producing, near producing, 2027 on stages. The notable number is the 8.5% drop in value - a lot of this is marking to market of stocks assigned on sold put (i.e., stocks bought above market close)

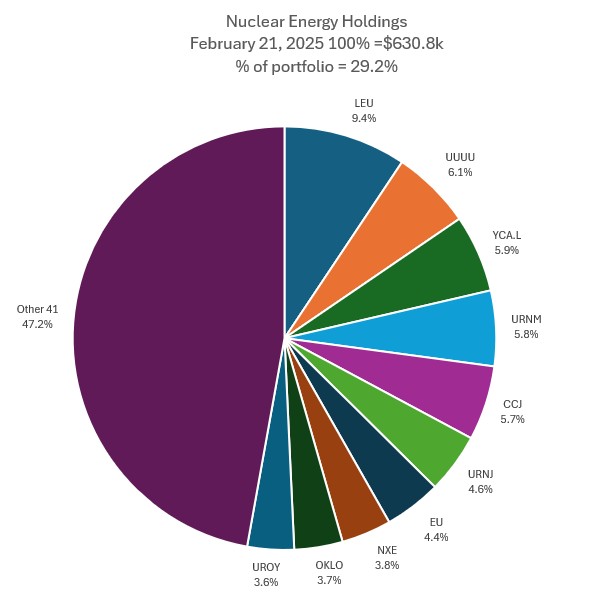

A few changes in the Top 10. Energy Fuels goes up 5 places into slot 2. Yellowcake PLC (YCA.L) goes up one place into slot 3. Sprott Junior Uranium Miners ETF (URNJ) goes up 3 places into slot 6. NexGen Energy comes into top 10 into slot 8. Oklo (OKLO) and uranium Royalty (UROY) swap places. Dropping out of teh Top 10 Is Lightbridge Technologies (LTBR). Share of portfolios drops 0.3 points to 29.2%

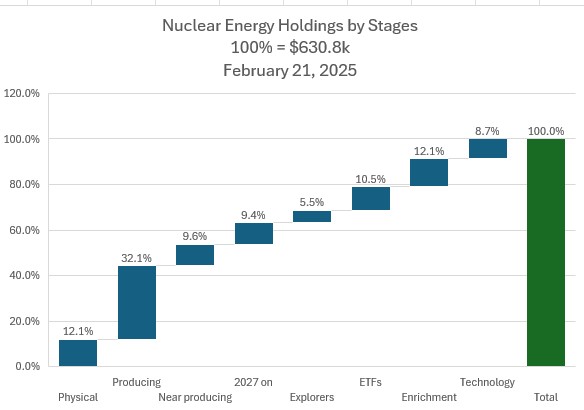

Some key changes to the holdings by stages. Producing goes up 0.9 points, 2027 on goes up by 1.4 points, ETFs up by 0.9 points and the drops in Enrichment down 1.2 points and Technology down 2.1 points. The change in value really hit these last two stages the hardest.

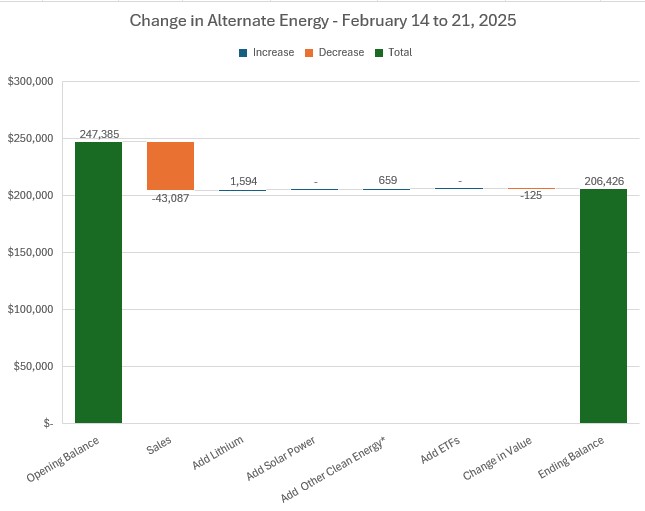

Alternate Energy Holdings

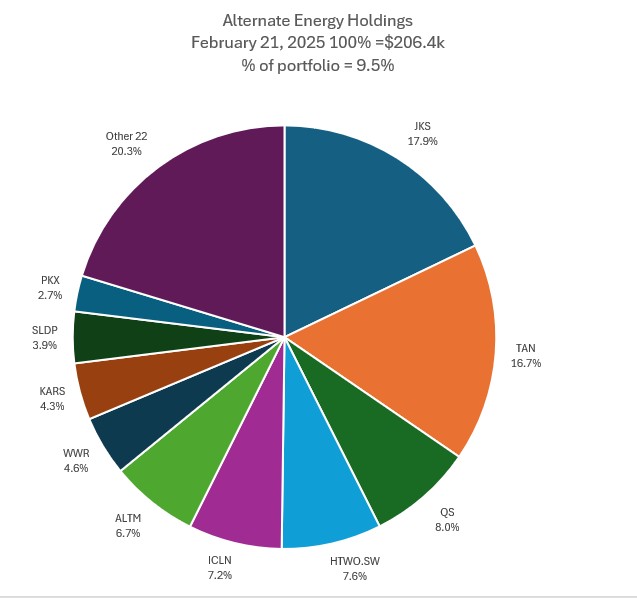

Two big sales - one on a pending order and one on covered calls is the key change in the week with a few more small adds. Portfolio value was basically flat - down 0.2%. The share of portfolio drops nearly 2 points to 9.5%.

Big changes in the Top 10 with two sales. New number one is Jinko Solar (JKS) with previous leader Arcadium Lithium dropping 5 places to slot 6. Air Liquide (AI.PA) drops out. QuantumScape (QS) goes up two place to slot 3. WestWater Resources (WWR) goes up to places into slot 7. Posco (PKX) creeps into the top 10 in slot 10. Share of portfolio drops to 9.6%.

Bought

Denison Mines Corp (DNN): Uranium. Assigned early on sold put. Breakeven after 2 cycles of sold puts is $1.78 vs $1.62 close (Feb 14) - after price had dropped from $1.75. In the ball park. Partial assignment early and then fully in managed portfolio. Breakeven there is $1.79 vs $1.54 close (Feb 21)

AuKing Mining Limited (AKN.AX): Base Metals. Cobalt Blue (COB.AX) announced that they had reached a joint venture agreement with AuKing on their Koongie Park copper-zinc project. Am already a shareholder in Cobalt Blue - find it often pays to be both sides of these deals especially with the dilution on the Cobalt Blue side with $200k worth of shares issued to AuKing.

Chart shows a stock that is pretty wrecked trading 7/10s of a cent. Going to be a 10 bagger at least or kiss good bye to $1000. Good news is someone else is funding the next $2 million of expenditure (Cobalt Blue shareholders = me). AND AuKing say they will focus on their other gold and uranium assets.

ASP Isotopes Inc (ASPI): Nuclear Technology. Scaled in on a down day - might have ben better off waiting to the end of the week. Kicked the can down the road on all the sold puts.

FMC Corporation (FMC): Agricultural Chemicals. Price was beaten down on weak earnings the week before - averaged down entry price in pension portfolio - looking for a bounce and exit. The appointment of RF Kennedy as Health Secretary could be a contributor to the downside - he wants to change the use of chemicals in agriculture. Dividend yield 6.16%. Wrote covered call for 0.8% premium with 12.2% price coverage on the new holding

Glencore plc (GLEN.L): Base Metals. Assigned early on sold put after share price was smashed - guessing troubles in Democratic Republic of Congo drove that. Price was around the breakeven level until news broke - plans to move off London market too did not help sentiment. Markets hate that stuff.

Breakeven at £3.62 vs £3.25 close (Feb 20) - got some way to get over that. In personal portfolio, assignment was at a lower strike giving a breakeven of £3.52.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Assigned early on sold put. Breakeven $17.72 in managed portfolio - some way above $16.99 close (Feb 21). Breakeven higher in personal portfolio.

GoviEx Uranium Inc (GXU.V): Uranium. Added a parcel to pension and managed portfolios to scale in. First tranche was on back of CEO talking about the revised PFS for Muntanga in Zambia. Later in the week CEO talked about reopening of discussions with Niger government about the Madaouela mine. This is an important development as life of mine is 100 Mlbs.

https://www.world-nuclear-news.org/articles/goviex-niger-agree-roadmap-to-resolve-madouela-dispute

CleanSpark, Inc (CLSK): Bitcoin Mining. Assigned on sold put in pension portfolio - breakeven after 6 cycles of sold puts is $5.86 well below the $9.25 close (Feb 21). Gonna be a long road but off a low cost base = no problem,

NexGen Energy (NXE): Uranium. Assigned on sold put leg of a 8/6 risk reversal in pension portfolio. Been writing sold puts for some months now - breakeven is down to $0.93 - not worried about the correction for this. Assigned also in personal portfolio.

NuScale Power Corporation (SMR): Nuclear Technology. Assigned on sold put in pension portfolio - breakeven after several cycles of sold puts is $9.86 well below the $19.04 close (Feb 21). Was aggressive in setting strike for this sold put to get back into the stock as was expecting to be called away in Oklo (OKLO).

Halliburton Company (HAL): Oil Services. Assigned on sold put in managed portfolio - breakeven $27.58 vs $26.26 close (Feb 21)

OKLO Inc (OKLO): Nuclear Technology. Assigned on sold put in managed portfolio - breakeven $43.87 vs $38.79 close (Feb 21) - profit on sale of Lightbridge (LTBR) makes up what is a effectively a nuclear tech swap trade

Energy Fuels Inc (UUUU): Uranium. Assigned on sold put in personal portfolio - breakeven $4.75 vs $4.64 close. No problem

Westwater Resources (WWR): Graphite Mining. Assigned on sold put in personal portfolio. Breakeven $0.66 vs $0.85 close. Trade set up selling in-the-money put to harvest a big discount based on high implied volatility. Might well do that again.

Sold

Arafura Resources (ARU.AX): Rare Earths. Scaled position size down to $10k - locks in 112% blended profit on a FIFO basis since May 2017/September 2018. Holding started after a chance meeting in Aileron in the Northern Territory many years before - "lots of trucks driving around the hills behind here", said the man. Going to need to hold for a while longer as a few entries are at higher levels than this exit.

Arcadium Lithium plc (ALTM): Lithium. Pending order at 52 week high hit triggering 8.4% blended loss since January 2024. With the takeover by Rio Tinto (RIO.AX) would rather be invested in pure play lithium investments - been waiting for price to get close to implied value of the deal. Holding in Arcadium Lithium arose after the merger between Allkem and Livent Corporation (was holding the latter). Over the life of the combined time, overall profit was 29.7% from February 2020. 90% of that profit came from income trades (calls and puts).

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Assigned on covered call for 2.4% profit since November 2024. Income trades since the previous assignment in Oct 2024 have delivered additional profit of 107% (i.e. double plus 7%)

ArcelorMittal S.A. (MT.AS): Europe Steel. Assigned on covered call for 1.8% blended profit since June/November 2023/October 2024. Stock screen idea. Covered calls provided a further 3.4 times profit in that time.

RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Assigned on covered call for 8.3% blended loss since December 2023/April 2024. Stock screen idea. Income trades mitigated 29% of the losses. Paris Olympics did not deliver what was expected.

3D Systems Corporation (DDD): 3D Printing. Assigned on covered call for 13.6% blended profit since April/August/November 2024. This has been a long clawback of capital losses - thus far income trades have recovered 76% of capital losses - one holding still in place will claw back some more. Will keep driving this - low strikes make it a neat options play

Lightbridge Corporation (LTBR): Nuclear Technology. Assigned on covered call for 59% profit since October 2024 in managed portfolio. This stock has been a great addition - too bad Uranium Insider did not get his members onto the nuclear technology sector. Incme trades have added a further 65% to the profits. 90% blended profit since October/December 2024 in personal portfolio

Aurora Cannabis (ACB.TO): Canadian Marijuana. Assigned on covered call for 27.6% blended profit since February/April 2024 on a maximum gain basis. Am working the sold put process to claw back some large capital losses going back to 2019. My accountant will account on a FIFO basis to bank the big ugly loss.

ENCE Energía y Celulosa, S.A. (ENC.MC): Paper Products. Assigned on covered call for 5.4% blended profit since May/June 2024. Stock screen idea. This has a renewable energy angle as they use biomass to generate electricity

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

oOh!Media Ltd (OML.AX): Advertising. Bought half parcel as earnings are ahead next week. 2nd time around on this stock. Dividend yield 3.54%

Chart shows price breaking downtrend and making a double bottom off support level from 2023 lows. Stock price is strongly earnings driven for a business in a competitive industry.

Top Ups

Nufarm Limited (NUF.AX): Averaging down entry price for the 3rd time.

Chart shows first entry after price breaks downtrend - makes 3 cycles higher but not enough to reach profit target. Next entry (middle blue ray) is one cycle long only and falling over. Maybe this time as price has revesered off a support (green line) that goes way back in time.

EML Payments Limited (EML.AX): Payments. This is a challenging stock.

Chart shows price broke the downtrend with an entry (blue ray) at the top of a surge. Price drops back to test a support level from late 2023. Am hoping the short term uptrend can be held and find an exit somewhere above breakeven.

Sold

Synlait Milk Limited (SM1.AX): Food Products. 60.7% profit in 8 days - just wow.

The chart shows a stock beaten up and then bottoming out. Was not expecting price to break like this. Why did it? Synlait is a large exporter of dried milk products, specifically kids formula, operating out of New Zealand. Going to guess the jump is because of emerging tariff war between US and China - China shifting sources away from US.

Stockland Group (SGP.AX): Property. Hit profit target for 36.5% blended profit since November 2022/April/June 2023. Hoping cut in bank rate will push through to other property investments

This was one of the longest held stocks. Chart (a weekly) shows trade was first entered when the downtrend was broken. 2nd trade was a new signal. 3rd trade was a scale in on stocks that had moved between 5 and 10%. Exit target set when price produced a 52 week high - took a while.

Mayne Pharma Group Ltd (MYX.AX): Pharmaceuticals. Closed at profit target for 48% profit since October 2024.

Chart shows the strategy at work. Price breaks the downtrend but takes over a month to show a one month high before the entry is made (blue ray). Profit target set when price is getting close to 40% ahead - the green ray set as a limit price. Target is taken out when price gaps higher on takeover announcement from Cassette.

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Assigned on sold put.

Income Trades

A big options expiry period with gains way outweighing the losses across the portfolios. In the managed portfolio gains were 21% of capital deployed with pension portfolio doing 19.6%. That pays the outgoings for at least 2 months. In the pension portfolio, capital losses dragged the overall profit down by 16%. Puts were 90% and calls were 27% of the net profit - does not add to 100 on account of the capital losses.

Covered Calls

71 covered calls went to expiry with 7 assigned (UK 4 Europe 8 (4) US 57 (2) Canada 2 (1))

Naked Puts

54 naked puts went to expiry of which 15 were assigned (UK 7 (2) Europe 11 US 35 (13) Canada 1) - sounds like a lot but credit risk was being managed - and the new stock positions am happy to be holding. Only one assignment is ugly after news break.

Sold puts on stocks likely to be assigned on covered calls

- ArcelorMittal S.A. (MT.AS): Europe Steel. Return 1.5% Coverage 4.7%

- RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Return 1.6% Coverage 1.1%

Rolled out sold puts on stocks likely to be assigned

- ASP Isotopes Inc. (ASPI): Nuclear Technology. 46% profit on buy back. 32% cash positive. Return up to 22.2%

- Builders FirstSource, Inc. (BLDR): Building Products. 253% loss on buy back. 1.5% cash positive. Return up to 1.3%

- Centrus Energy Corp. (LEU): Uranium Enrichment. 0.2% profit on buy back. 70% cash positive. Return up to 8.1%. Down in strike

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 84% profit on buy back. 342% cash positive. Return up to 27.9%. - partial roll up - price could end just above or just below sold strike

- Global X Lithium & Battery Tech ETF (LIT): Lithium. 56% profit on buy back. 89% cash positive. Return up to 7.1%.- completed roll up of whole tranche from last week

- Oklo Inc. (OKLO): Nuclear Technology. 16% profit on buy back. 153% cash positive. Return up to 14.8%.

Sold puts one month ahead on stocks happy to hold at lower entry

- iShares Silver Trust (SLV): Silver. Return 1.8% Coverage 3.5%

Credit Spreads

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. New spread. ROI 37.9% Coverage 1.4%. Added a spread as stock will be assigned. Hydrogen idea.

VanEck Uranium and Nuclear ETF (NLR): Nuclear Power. With price closing at $83.69, 87/85 credit spread traded TTB incurring a 312% loss on net premium - ouch. More work to be done on this ETF - it offers some interesting concentrated angles that are more than uranium.

Pan American Silver Corp (PAAS): Silver Mining. With price closing at $24.44 (Feb 21), 21/19 credit spread expired out-the-money for a 30.7% return

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 17-21, 2025

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh