Price Dynamics

When it comes down to the prices of assets it's pretty straightforward. The price goes down the moment that there are more people selling than buying and the price goes up when there are more buyers. Especially for games, this tends to be a matter of new players having to come in to support or increase prices which is a model that inevitably will fail as a peak eventually is reached and players tend to get bored looking for other places to have fun. In that regard, It's not the best sign that for the Genesis League Goals a new token was released and not everything that the team does going forward will fall under the SPS window. Also if too much value goes to asset holders, the devs always will have the power to make sure it goes to them one way or another.

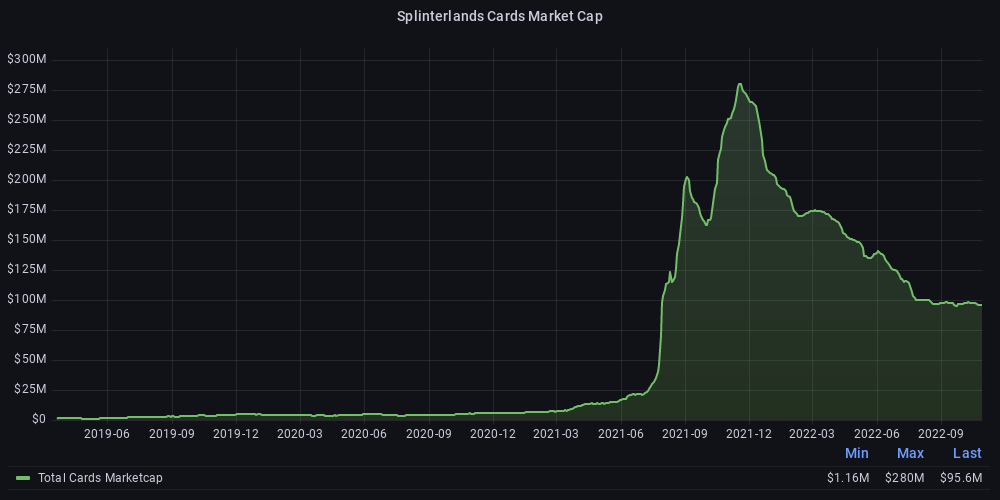

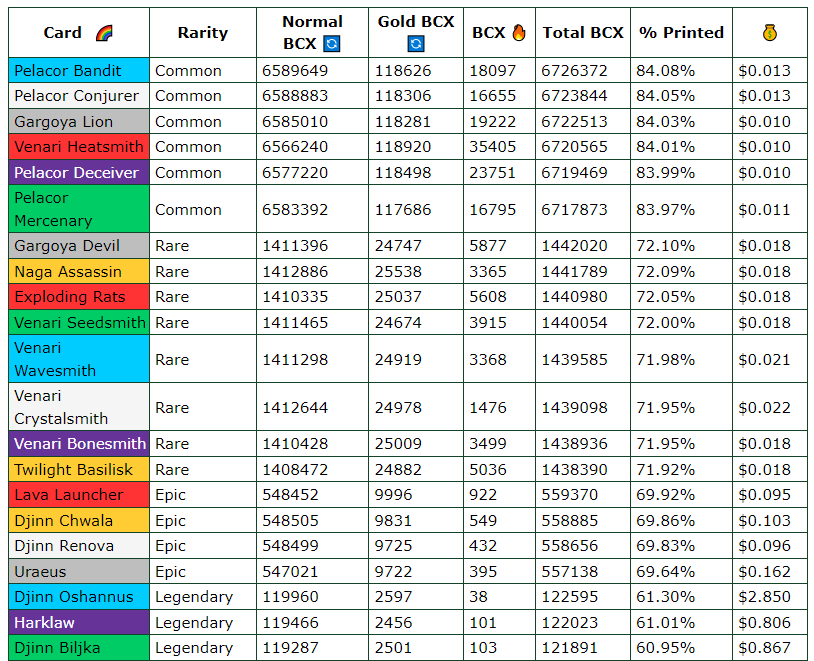

Card Prices

The card prices and especially those from the older cards have been butchered compared to the top they reached before Chaos Legion was released. For the newer sets where packs are available, the average prices on the market always range below what it costs to buy packs, otherwise, there is a hedging opportunity that the market makes use of. With the average price of a chaos Legion pack around 1.9$, it's safe to say that should be around the average value when opening most likely with potions.

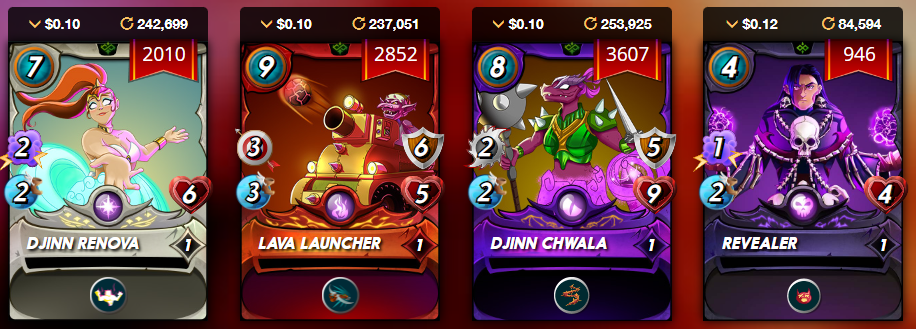

Reward Cards that have an insanely high print rate remains the best way to get cheap collection power at the price of 1$ for 1000CP just based on the epic cards. There used to be a time with 15k Collection power that was needed to play in Silver 1 costing 700$+

At this point, it's safe to say that cards are intended to be somewhat affordable and aren't supposed to get insanely valuable with the value coming from being able to play the game and get rewards that way. The pace at which they are printed is just way too fast based on the actual player base and it's just impossible for most players to keep up.

Prediction: Land will likely be a big supply shock for cards and it is said that there will be a 3-month period between Chaos Legion being sold out (/burned) and Rebellion coming out which might act as a period where prices might pump a bit again creating a selling opportunity for those that want out. For now, I see the current downtrend slowly continuing unless there somehow is another crazy hype and onboarding of many new players.

SPS Price

SPS based on the fully diluted market cap right now is valued at 178 Million Dollars which isn't that small or unrealistic just looking at the game in the state it is now. It is a Real Yield asset as it generates Vouchers when staked that players need while there are also burn mechanics. The devs also have full intention to do what they can to support the price and make it increase over time. Right now the supply and dilution of tokens being given out from rewards in all sorts of ways is not really absorbed by the market demand. More future use cases for sure will be needed and they will in one way or another have to take part of the revenue from the company which they also need in order to maintain their 140+ Employees.

The good thing however is that the lower it goes, the more tokens are needed to purchase Riftwacther packs and those get locked into the DAO.

Prediction: In the short term I would not be surprised to see SPS going lower as selling pressure likely is bigger than the demand since so much of the supply now is being put in circulation. Long-Term however I see it at a good buying zone offering good value and real yield. My personal aim remains to have 100k SPS Staked and take profit from there on out. Right now I'm at 84k and I likely will buy some more at the current price range. If there is another bull run, prices might go extreme again and I don't really see how the total market cap would be justified to go above 1 Billion which is the range where I will potentially take profit on some of my stack.

Dark Energy Crystals (DEC) Price

DEC is currently trading at 0.64$ for 1000 DEC which is 36% below where it is supposed to be pegged at. While DEC was the main reward token a lot of it got printed which was not enough during the crazy adoption and expansion phase where it traded well above the peg. Right now there is still too much of it printed for the price to be closer to the peg. At least it's quite stable around the current price and each time it goes below that, the cost of using it to buy Chaos Legion packs gets to a point where you can buy packs, use earned potions and sell the cards at least at an expected break-even price.

Prediction: I guess it will take quite a long time before DEC really goes back to what it is supposed to be pegged at while there also is a limited downward selling pressure since many will want to pick it up if it goes too low. With the new mechanics of being able to mint DEC for burning SPS, it is almost impossible for it to go above 1$ for 1000 DEC as the upside value will all flow into SPS.

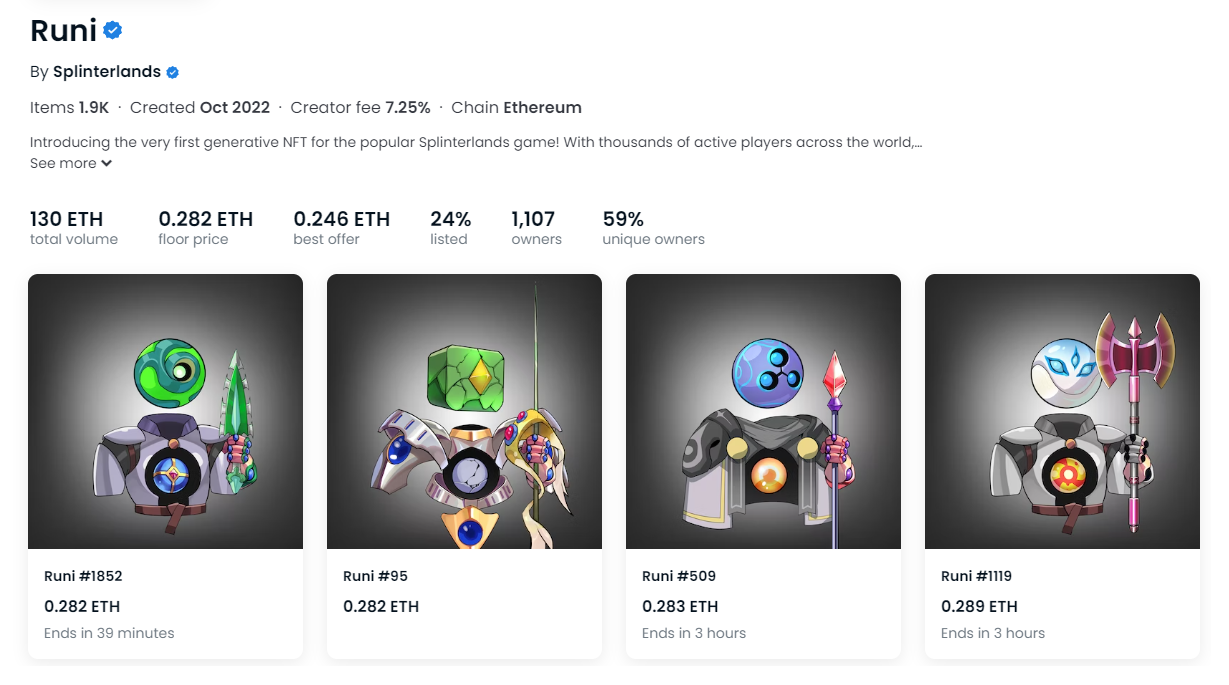

Runis

Right now there is some hype around the Runis with the floor price at around 380$ and the public 500$ mint still to come. I personally didn't get one as I'm simply not willing to spend that amount of money on something I don't really care so much about. Most players are also unable to use the max level of this card and quite a lot of them are printed (for a max level version). Also, I don't know what will be done with the profit generated from that PFP project which surely will add up. While I do think some (big) players could be onboarded because of it, I don't like this idea of just turning on the printer and diluting the existing card supply with another card that deliberately is made Overpowered giving another Pay2Win advantage.

Prediction: I see a slight decrease in price once the hype of the Runis dies down and limited onboarding because of them but lots of funds flow to the devs from the sale.

Land Plots

Land plots went for as high as 700$+ in the past and are now going for around 200$ ever since the SPS rewards were activated for holding them. Land has been a case where the devs earned all the money from them upfront which made it less urgent causing a delay of years. My guess also would be that they are going to use land as a way to burn a lot of DEC and lock up cards, especially older ones which will make it so that owning land plots will only be a small fraction of what it will cost to actually mint the spells & Items. On top, many that got an entire region were in an all-or-nothing situation as individual plots could not be sold yet. Once that is possible there will most likely be a lot more selling pressure created. It also remains to be seen how fun the introduction of Spells & Items will be as they likely will increase the Pay2Win factor of Splinterlands to even more extreme levels.

Prediction: My prediction is that the hype of Land if it's about to be released will both create some demand but also sell pressure from players that got entire regions that previously they were unable to sell individual plots. I'm also expecting the requirements in order to mint items and spells likely will be very heavy reducing the actual value of the land itself. With The current SPS rewards, I'm happy to just hold on to my 12 plots and I might sell 2 in case there is some hype that pumps the prices.

Vouchers

I think it is 20k Vouchers that are printed each day which is way more than the actual demand. This translates in the price going down after a pump at the time when the Riftwatchers pre-sale was done. New ways need to be found to give vouchers use cases which is one of those things that inevitably have to come at the cost of company revenue. I assume that they also will have to require them for Rebellion packs. Changing the print rate might increase the price but it won't really increase the returns that SPS investors get since they will receive less of them. At the current price, a buy & hold likely is something that over time will give a good return. Everything is in the hands of the devs when it comes down to these vouchers as decreasing the supply and increasing the use-case will pump the price.

Prediction: I can see vouchers continue to go down followed by the devs announcing new ways for them to be used on a more regular basis and an eventual pump at some point when these things are put in place. I currently am just holding on to the ones that I earn. If price goes a lot lower I might stack up on some more of them in anticipation.

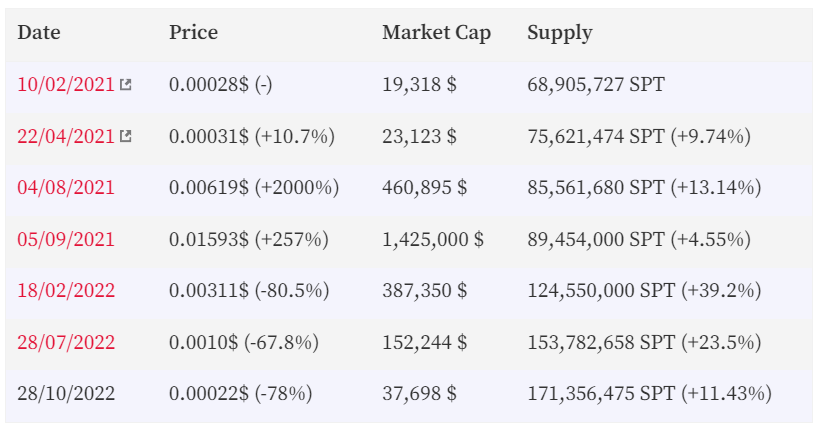

SPT (Splintertalk Tokens)

Way back before the SPS airdrop, I was speculatively bullish on the SPT token anticipating them to get a use-case which made me cost-average 2 Million tokens at prices slightly below where it is at now. I staked those having them delegated to @monster-curator which has been given me daily passive returns which I have been taking profit on ever since. I also managed to get a lot of SPS to the point where I already got a lot more out of the investment than it costed me even if SPT would go to 0 tomorrow. So despite not dumping it at the top which would have been more optimal financially, I'm quite pleased how it all played out.

This is the price evolution since I have been tracking it.

Right now SPT has no real use case and it is a Splinterlands asset that mainly is speculative in the hope that the devs will once again support it in one way or another. The inflation rate remains quite heavy and the current market cap of all tokens sits below 40k Dollars.

Prediction: I honestly would not be surprised if no extra use case was created for SPT tokens looking at how the PAL tribe token which comes from the same Devs is basically completely dead right now. The price is mainly supported by people that speculate on it getting another use case while right now there is no indication for that. I will just continue to hold onto my 2 Million SPT which served me well so far. I might get another batch but only if there are some clear hints from the devs that they will do something for it.

Conclusion

When it comes down to the prices of assets in Splinterlands, it all comes down to how many new players come in, combined with how much of the profit that the devs are making they are willing to give up. It's safe to say that this will never be more than what is needed. There are so many different assets and tokens in the ecosystem that they all can't be supported and I do believe that the time when it was possible to get rich from all of it is behind us. That being said, I do still see a good future for the ecosystem and trust the devs to do what they can to at least not crush everyone that is invested giving them ok returns.

Play2Earn Games I'm Currently Playing...

|

|

|

Posted Using LeoFinance Beta

I agree with all of this. I've talked about land in the same way. It will be expensive to run and when these regions are able to be separated its going to create downward pricing pressure. I play upland also and they recently released factories. There's a currency called spark that you have to stake to build buildings like factories and its very expensive. I have $2000 in spark staked right now for 145 days in order to build a small factory. And once its done, manufacturing anything in it at full capacity would take closer to $5000 in spark staked. Splinterlands on the other hand doesn't really understand what scarcity is but I still think we can expect running and upgrading land to be pricey. People will need to sell some plots in order to have the resources to manage others.

They have said this is to give old cards more utility and not to create scarcity in all cards. That's disappointing to me but it does make these dirt cheap alphas seem like a buy.

I didn't buy a runi either. I think the whole thing is a cash grab that won't move the needle in splinterlands until the bull market comes back. Then it will just be amongst those in the community. The fact that most of them have yet to be released and the floor price is lower than mint is a problem. Especially when they have been bought by people who are supposed to care about this game.

There are 40k vouchers a day being printed now. 20k for sps holders and 20k for nodes. I know why they did that but it did work and needs to be rolled back. They also need to find a better way to distribute them so the top 100 investors aren't getting 75% of them. When tranche 1 sold out, people were selling vouchers to get SPS to buy nodes because some of these investors are getting thousands of vouchers per day. It's supposed to be that if you're buying a node you're incentivized to buy vouchers for a discount. But everything is so unbalanced it was happening the opposite way. Node buying was crushing voucher prices instead of lifting them.

This whole economy has been mismanaged by putting way too much out and encouraging a few people to buy up everything. They need to go back to the drawing board with how they put products out there.

ok, I always understood that vouchers were capped to 20k a day which already was a lot. The printers really are running overtime right now in every aspect of the game compared to the actual demand. The thing also is that last time the exponential increase in users was caused by prices going up since nobody was selling for the SPS airdrop.

It will be interesting to see where it all goes

Yeah, the next bull run in this game, assuming there is one, will not be like the last one. The whole structure is different now. I'm glad to see them FINALLY talking about cutting some fat with the potential pack burns, removing DEC from LP rewards and not adding anything new, and now some talk about there being too many vouchers.

This about face makes me think they are a little worried about the future. They just did all these major changes and releases and they expected them to get the game to take off but they didn't. I think they were a little carefree up until now with finances thinking that all this would respark the bull and they'd be fine. Instead it just diluted the game and everything lost value. They have been wildly optimistic and have been so focused on what they think will bring demand that they've not focused on the enormous supply of everything.

If they are looking out 6-12 months and realizing they might be in trouble if things don't turn around, they are probably also looking at the 320 million dec they are sitting on and can't access, as a cushion. But if they tried to sell it into the market right now it would be at a huge discount and it would drive prices lower than they already are. They need to dec to go to peg so they can sell that stake. I think they are also thinking they'll be fine if Rebellion is a huge success next summer, but they need CL to be in the rearview for that to happen. And because their projection of a sellout happening quickly on the last 5 million packs (again just so wildly optimistic it borders on delusion) they are now looking at burning.

I think it's a good move. Ignoring the fact that there are just WAY too many packs (still 3 million sitting purchased and unopened), but also because this will drive more sales faster if people perceive scarcity. That will build that DEC stake larger and dec should head back to peg over the next 6 months if it is removed from LP rewards.

Ultimately though, if they don't change up how they release rebellion, they will only be buying time. There are so many better ways to release packs that could make the game more exciting and make them more money.

I predict that at some point we all are going to be wishing we bought up these penny reward cards and $2 max cards.

Posted Using LeoFinance Beta

100%, I regretted not doing that enough in the previous cycle.

The supply of these new reward cards is really crazy though, I guess most demand will come once land is released as price will be no factor in the powerful they will be for minting spells and items.

Still quite some supply left, once they start going to 90%+ printed I likely am going to start accumulating

Please, where did you get this chat from?

and I didn't know that their chart was a percentage of how many they are released.

https://kiokizz.github.io/Splinterlands/rewardCards.html

Great summary and analysis. I recently pulled the trigger on a license that was on Tribaldex. I plan to use the vouchers in a liquidity pool with Swap.hive The APR looks good but if vouchers. Also, I am stacking and staking SPS. I hate to see that my card values have not improved in a year, and have actually declined. The money earned from rentals is about equal to the decline in value of the cards in my case.

Good luck on the licence, I don't have enough knowledge on those to really get into them. I used to have vouchers in the liquidity pool but have too bad of an experience with impermanent loss to really want to take the risk.

For as far as the cards goes, I guess it all depends on the time horizon. in the long run I'm crushing it on my collection, compared to what was the top I got crushed. I kind of gave up on the fact that Cards will go up in value, if they remain somewhat stable and give some returns from playing and rentals I'm already happy.

Will you give me a little more information on the impermanent loss? I have been researching it but I don't understand the scenario in which a loss occurs. I greatly would appreciate a real world example from why you no longer are in the pool.

So if you put money in the pool, and the values of the 2 assets in relation to eachother changes a lot you will end up with more of the one that dropped in price and less of the one that went up in price in a way where you have less than what you started off with. That is the reason why there are these incentives to provide liquidity in the SPS rewards and the fees generated also help a bit.

Ideally the 2 assets remain relatively equal in value, worst case is that something goes down a lot which hits you with impermanent loss and later down the line goes way up in price again which hits you again with impermanent loss.

At least that is how I understand and have experienced it back when I provided liquidity for a low cap altcoin and Ethereum as a test, ever since I stayed away from providing liquidity trying to make some passive income from it.

From what I have read, more then half of the liquidity providers are actually losing money. https://www.nasdaq.com/articles/half-of-uniswap-liquidity-providers-are-losing-money

Not sure how it is with the Splinterlands liquidity pools but Voucher prices going up and down a lot likely is not good for those providing liquidity.

Thank you for the explanation. I understand it a little better, but no fully yet. That's probably an indication that I shouldn't be in liquidity pools. Usually, if I don't fully understand an investment strategy it has poor results.

If it's not a lot of money, I would say see it as a test and a learning experience. For all I know it will give a good return with limited danger of impermanent loss.

Regerdelss what you end up doing, good luck!

If they make DEC for Node Licence and burn more, the price may come back to normal. What do you think?

In the end, there is only a certain amount of money coming into the ecosystem and it is just not enough to support all the prices of all the different assets right now while a lot is still printed all the time. If they really put the focus on getting DEC back to the peg it will come at the cost of something else. only really if there is another crazy bull run with lots of new players coming in this will all get solved. The problem at this point will be that devs are going to get too optimistic again and print millions of new cards and such.

Everything combined though, it remains quite impressive what Splinterlands have done with an economy that still is going without having totally collapsed like most of the other Play2Earn Games.

Best Splinterlands post I read in a long time. Cheers.

Thanks!

The rewards earned on this comment will go directly to the people( @no-advice ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for sharing! - Underlock#8573

They have a plan definitely, but we all know that these price things can't be 100% correct, so I think all those new things coming out might just be to substance things until they bring the final blow or something, with their current focus it looks like they are wanting people who are investors from other blockchains to know that something fishy is happening, and try to poke to everywhere they can before things changes up, I feel there is something big but they have to get enough cards and stuffs to stand the crowd.

All this should help out in some way or another, but for the record I keep I see things, they got people from their own blockchain looking at Splinterlands, and people from other blockchains both big and small looking, and big gaming companies looking and then people from other outside non-profit gamers hearing about it. It's a matter of time before things turn into the MOAB.