This is a report for the Hive inflation for November 2021. Tracking the HIVE supply has always been challenging and this monthly post aims to provide an overview of the flow of inflation, conversions etc.

Let’s take a look!

Hive has its regular inflation that follows the following formula

Hive inflation = (978 - (head_block_number / 250000)) / 100

It also gets rounded up at 0.5. At the moment the Hive inflation is 7.5%.

The thing is Hive has a double currency system HIVE and HBD and there are conversions between them that add or remove HIVE from circulation on top of the regular inflation. Further more there is HIVE in the DHF that is slowly being converted to HBD and also HIVE sent to the DHF is also converted to HBD. Because of this additional mechanics the HIVE inflation and supply can be drastically different in real time then the regular one.

To be able to follow the HIVE supply we need the following.

HIVE Created:

- Author rewards

- Curation rewards

- Witness rewards

- Staking rewards

- HIVE from HBD Conversions

HIVE Removed:

- HIVE to HBD conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null + null as post beneficiary

- New accounts creation fee

Next the HBD.

HBD Created:

- 10% share of the inflation to the DHF

- HBD Author Rewards

- Interest payouts

- HIVE to HBD Conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

HBD Removed:

- HBD to HIVE Conversions

- Transfers to null + null as post beneficiary

When all the above is sums up we will get all the differences between them and how much HIVE and HBD was created or removed in a certain time frame.

With this said let’s take a look at the charts.

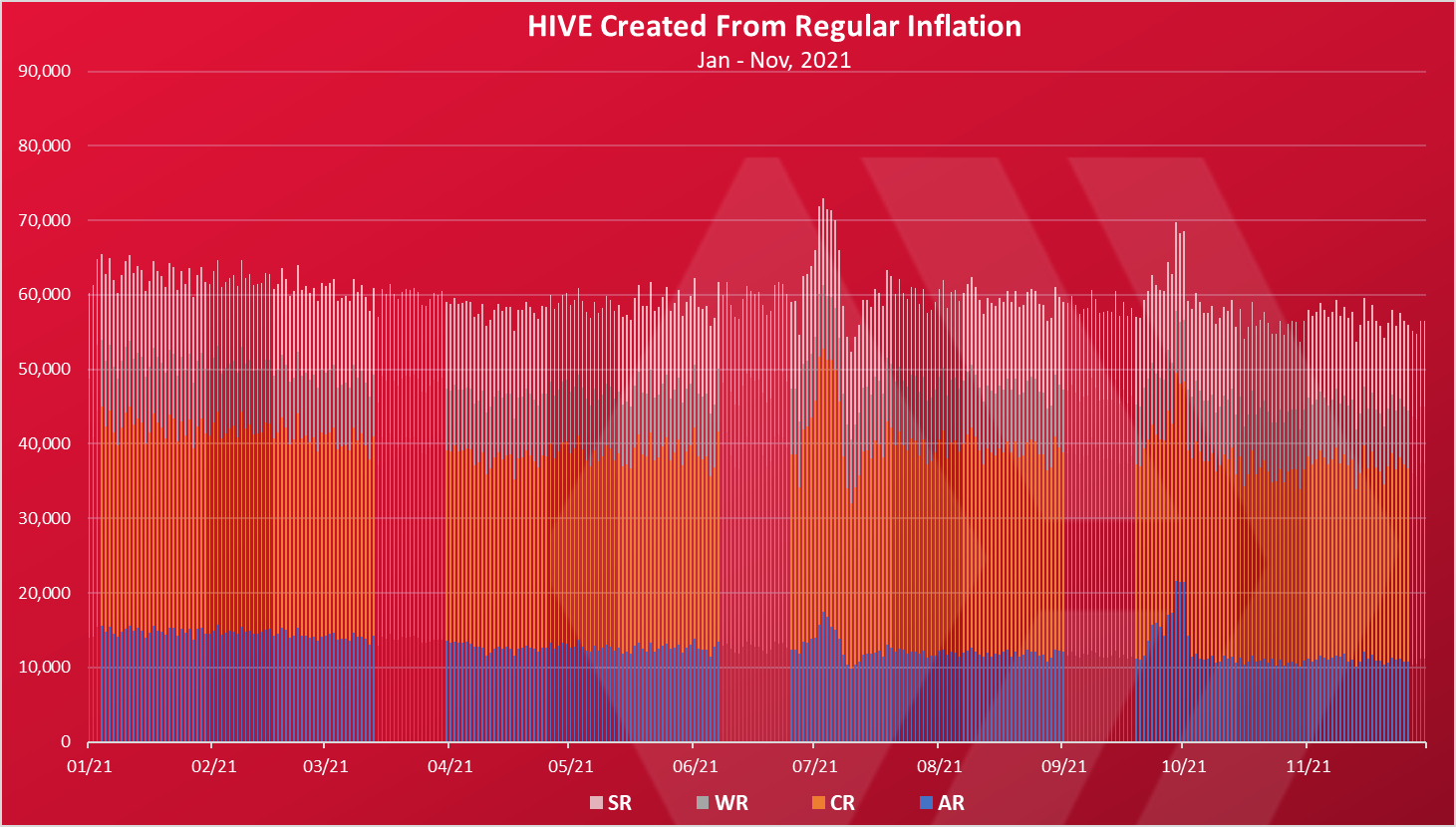

HIVE Created From Regular Inflation in 2021

First the chart for the regular inflation for HIVE in 2021.

- Author rewards

- Curation Rewards

- Witness Rewards

- Staking Rewards

These are the regular ways HIVE is created without the conversions. All the above are paid as Hive Power or VESTS, except in a case where the HBD debt is high and post start receiving liquid HIVE instead of HBD.

As we can see this type of inflation is around 60k HIVE per day and it has been slowly decreasing in 2021. The few spikes that we can see in July and then in October is where there were liquid HIVE payouts to posts because of the high debt for HBD.

The curation rewards take the biggest share of this type of inflation.

A total of 20M HIVE in 2021 was created from the inflation above, out of which 1.8M in November 2021.

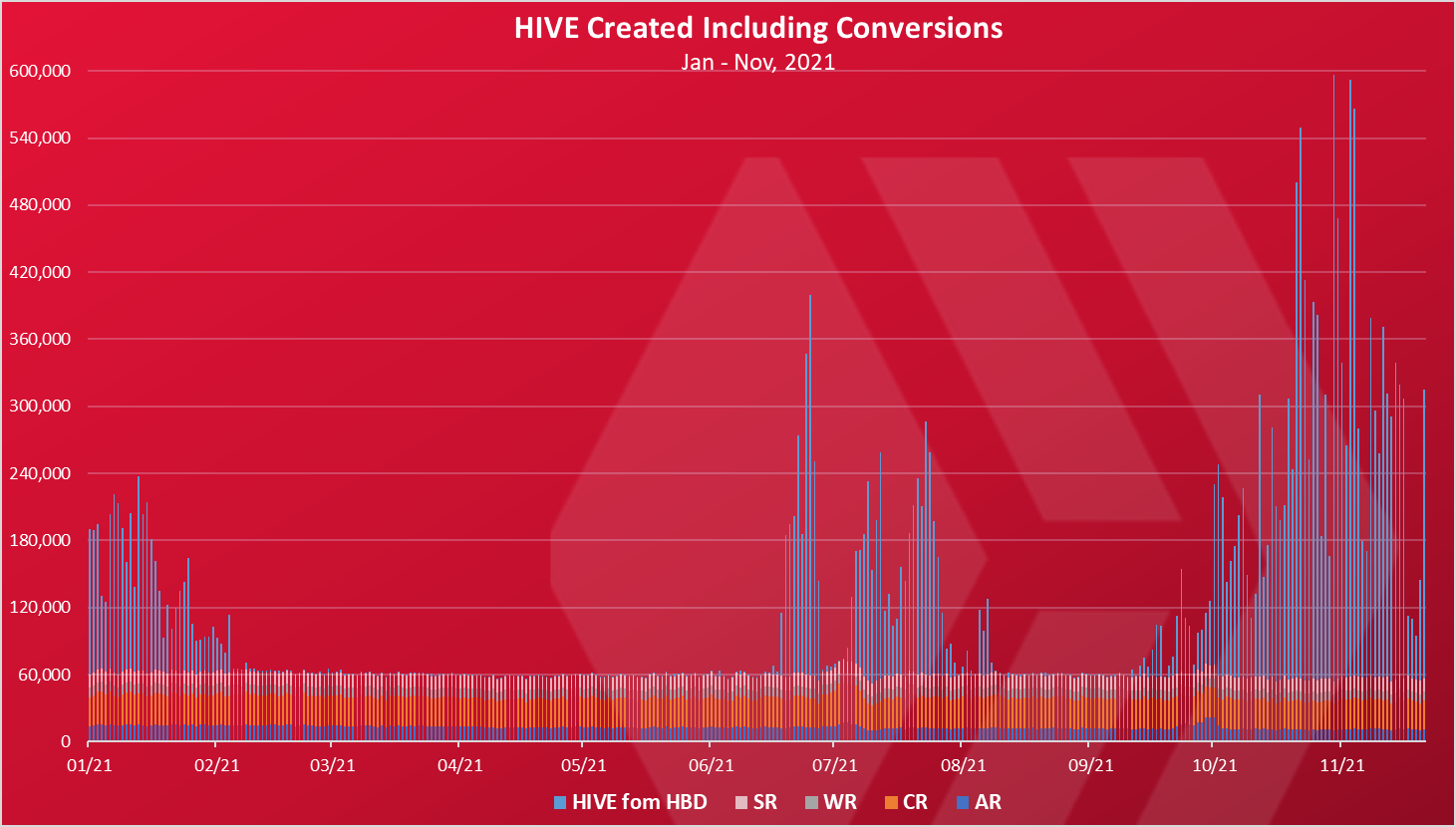

HIVE Created From Conversions

When we add the conversions from HBD to HIVE on the chart above we get this.

We can notice that the conversions are quite volatile with big swings happening at occasions. HBD to HIVE conversions are happening when the price of HBD is bellow the peg, bellow one dollar. When this happens if you convert HBD to HIVE the blockchain will still give you HIVE for the value of HBD of one dollar, does making conversions profitable to external markets.

In the last year the @hbdstabilizer has taken on the role of stabilizing HBD and a large share of the conversions are made from this account, but there are other accounts doing it as well.

In 2021 a total of 20M HIVE was created from conversions out of which 8M HIVE in November 2021.

Cumulative from regular inflation and conversions a total of 40M HIVE was created in 2021, out of which 10M in November 2021.

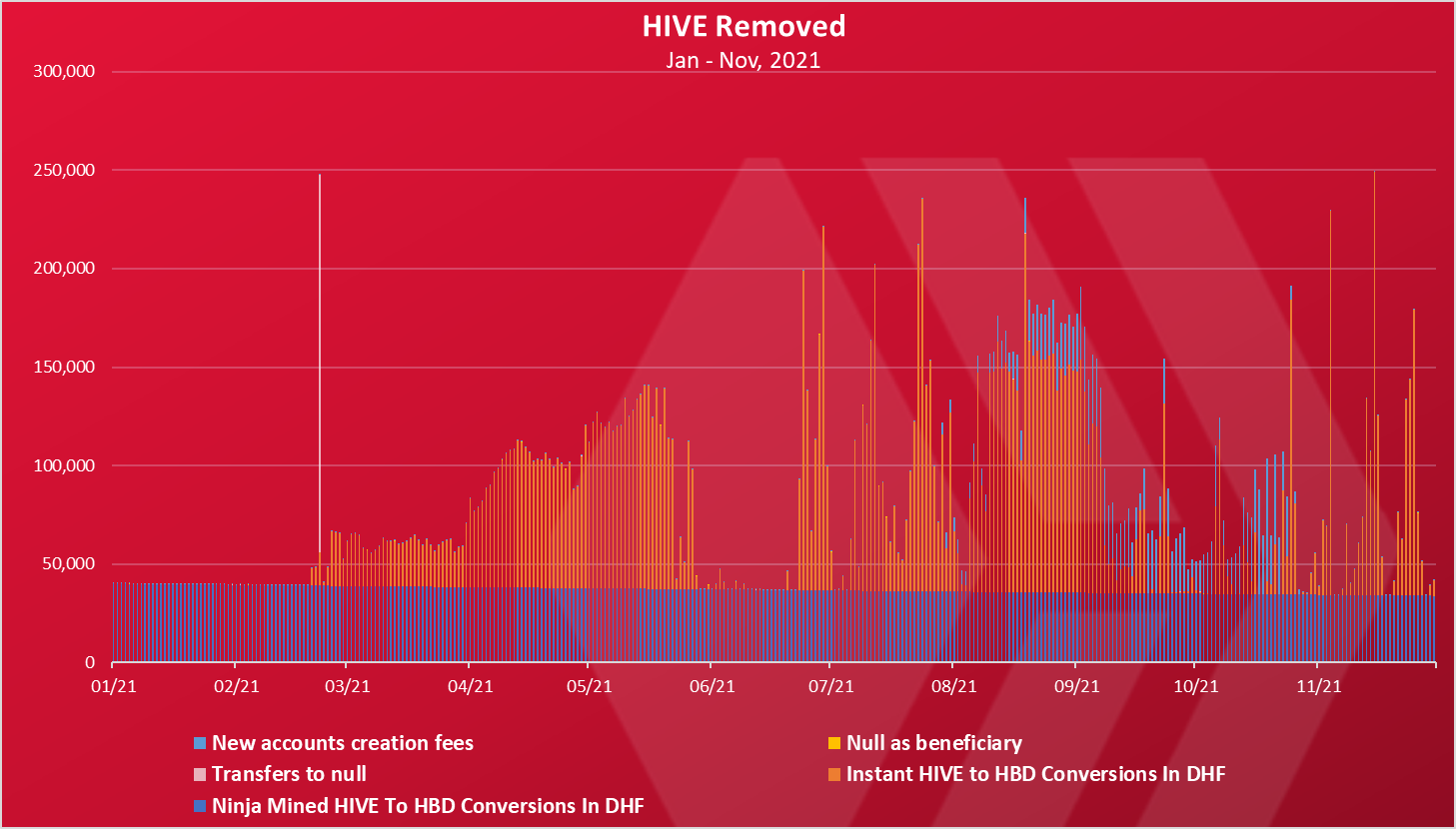

HIVE Removed From Circulation In 2021

Here is the chart.

The above takes into consideration five different ways of HIVE removed

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null

- Null as post beneficiary

- New accounts creation fee

As we can see the conversions of the HIVE in the DHF (blue color) are happening constantly with a slow decline over time. At the beginning of the year there was around 40k HIVE per day converted in this way and now there is around 34k HIVE.

The other big category is HIVE sent to the DHF (orange color). This is mostly being done by the hbdstabilizer and it is happening in conditions when HBD is above the peg and the stabilizer is selling HBD for HIVE on the internal market and then sent the HIVE to the DHF where it instantly converted to HBD.

Another interesting thing are the account creations fee, the light blue, we can see those happening from august. This is mostly because of Splinterlands.

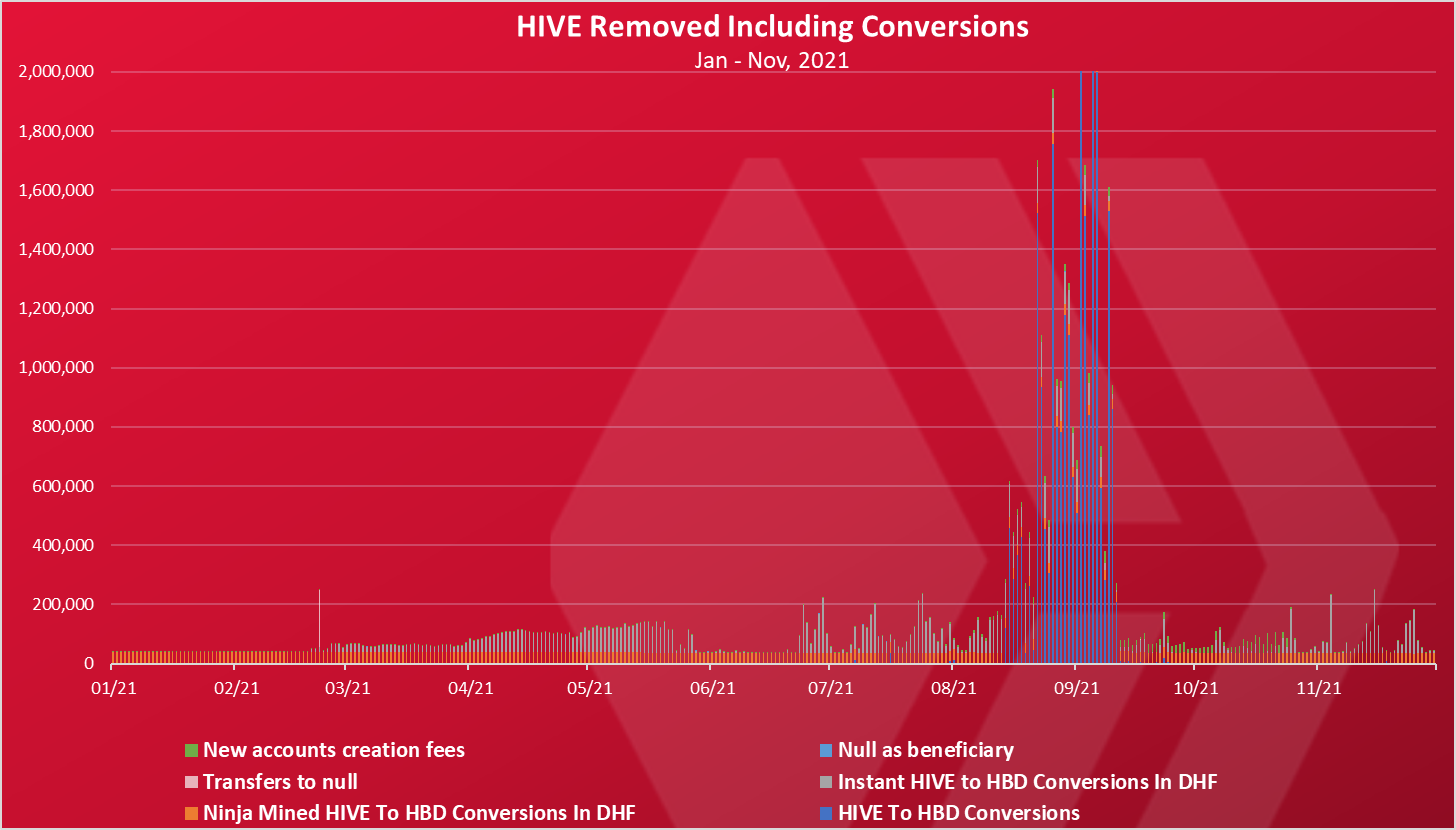

The above chart doesn’t include the regular HIVE to HBD conversion. If we add those, we get this.

As we can see this conversion distort the chart a lot. There were massive amounts of HIVE being converted to HBD from the middle of August to mid September 2021. There was a spike in the price of HBD in the period that caused a lot of HIVE to be converted to HBD. In these 30 days, around 30M HIVE were converted to HBD.

Cumulative a total of 52M HIVE was removed in 2021, out of which 2.5M in November 2021.

Now let’s take a look at HBD.

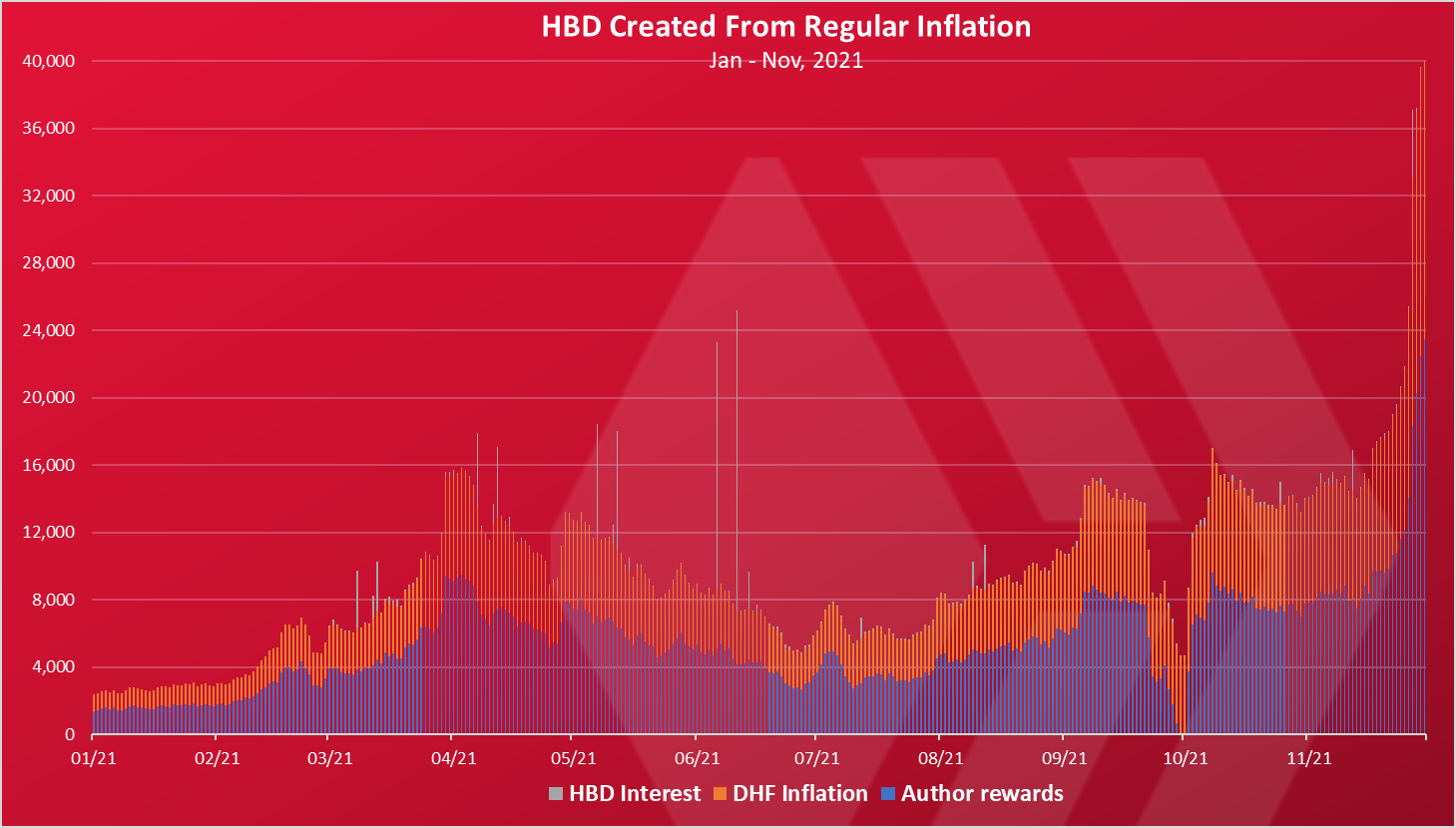

HBD Created In 2021

Here it the chart.

The above is a chart for HBD created without the conversions. It includes to following.

- 10% share of the inflation to the DHF

- HBD Author Rewards

- Interest payouts

This chart follows the HIVE price. As the HIVE prices increases so does the printing HBD to the DHF and to author rewards. We can notice that the author rewards are a bit higher then the DHF inflation. The interest payouts to HBD holders are quite small. Before the HF in July interest was paid to all HBD holders, and now to HBD holders that have moved HBD to savings only. Some of the spikes in the interest payouts are because big accounts claim the interest on that day.

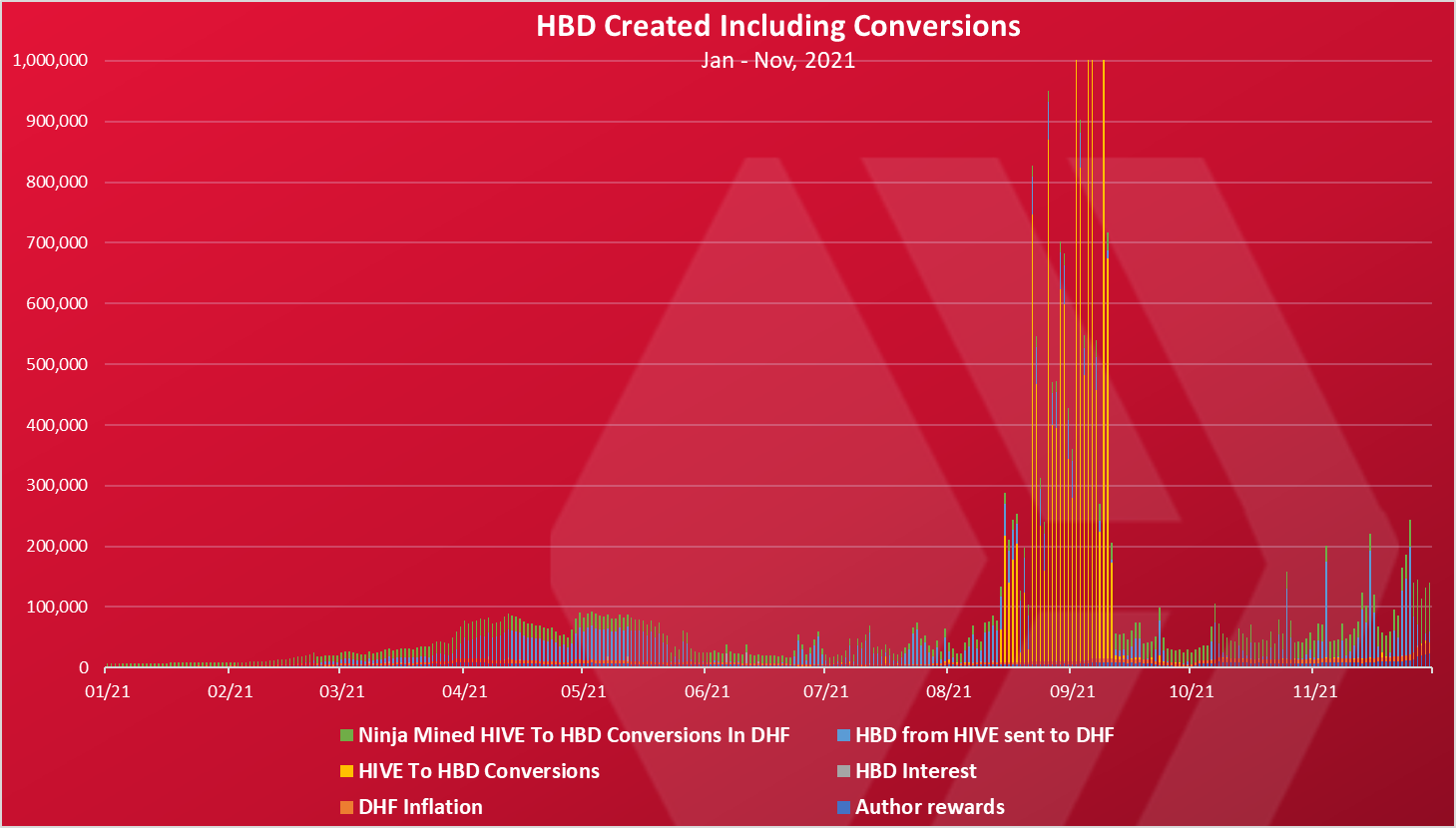

When we include the conversions, we get this.

The above chart includes the following conversions:

- HIVE to HBD Conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

We can see here that conversions are quite significance in the period of mid August to mid September. Around 17M HBD was created in this period. The ninja mined HIVE conversions are also adding significant amounts of HBD in the DHF, especially with a high HIVE price. Note that the HBD in the DHF doesn’t count as debt.

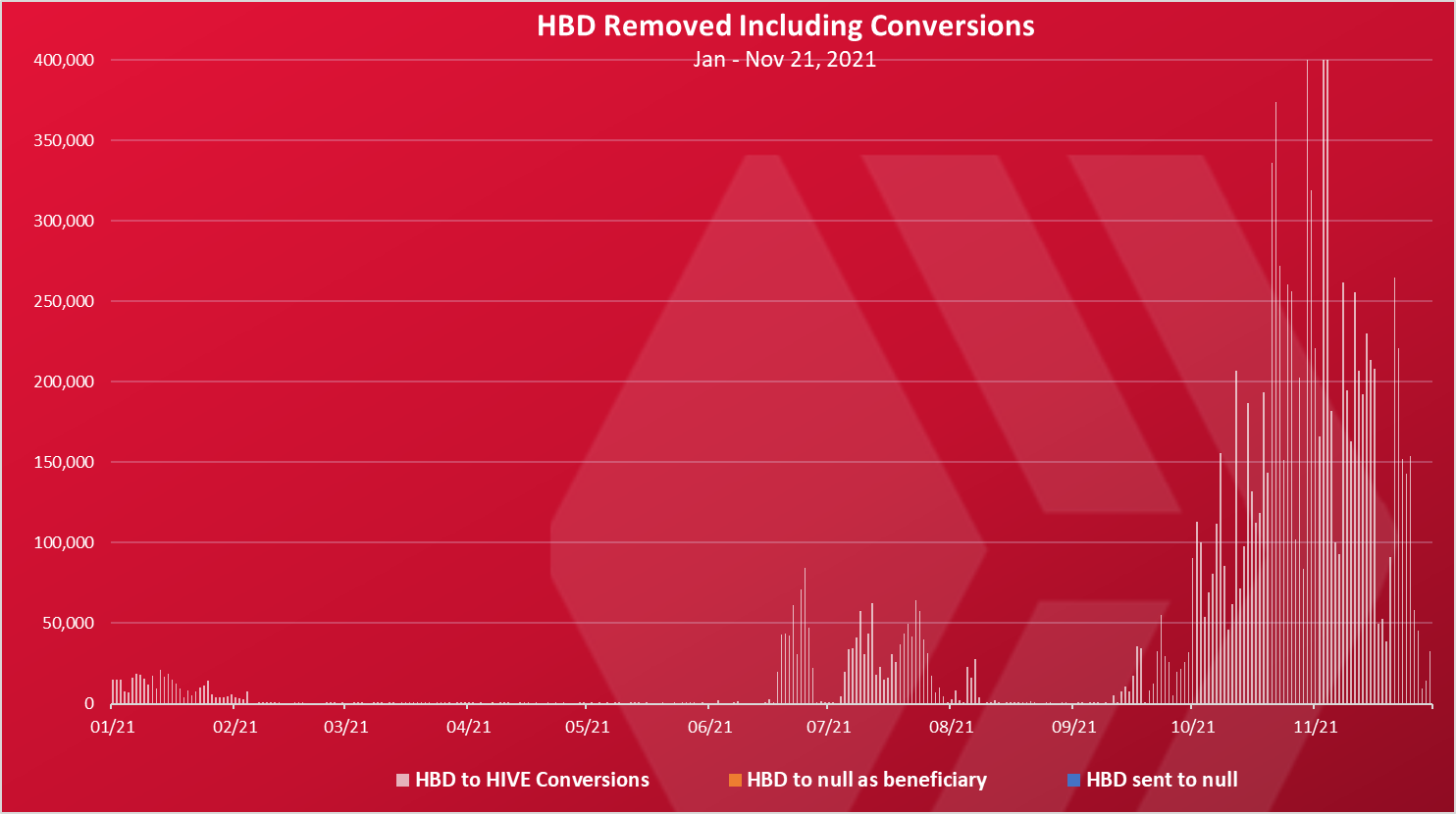

HBD Removed in 2021

Here is the chart.

HBD is mainly removed when converted to HIVE, but also with transfer to @null and setting null as beneficiary on posts rewards.

HBD is being converted to HIVE when the price is bellow the peg. We can see that in the last period there is a lot of HBD conversions. Even with this conversions and the hbdstabilizers constantly selling HIVE for HBD (buying HBD 😊) on the internal market, the HIVE price keeps increasing. These conversions follow after the huge conversions in the opposite direction in august and September. There is a possibility that a balance will be find soon.

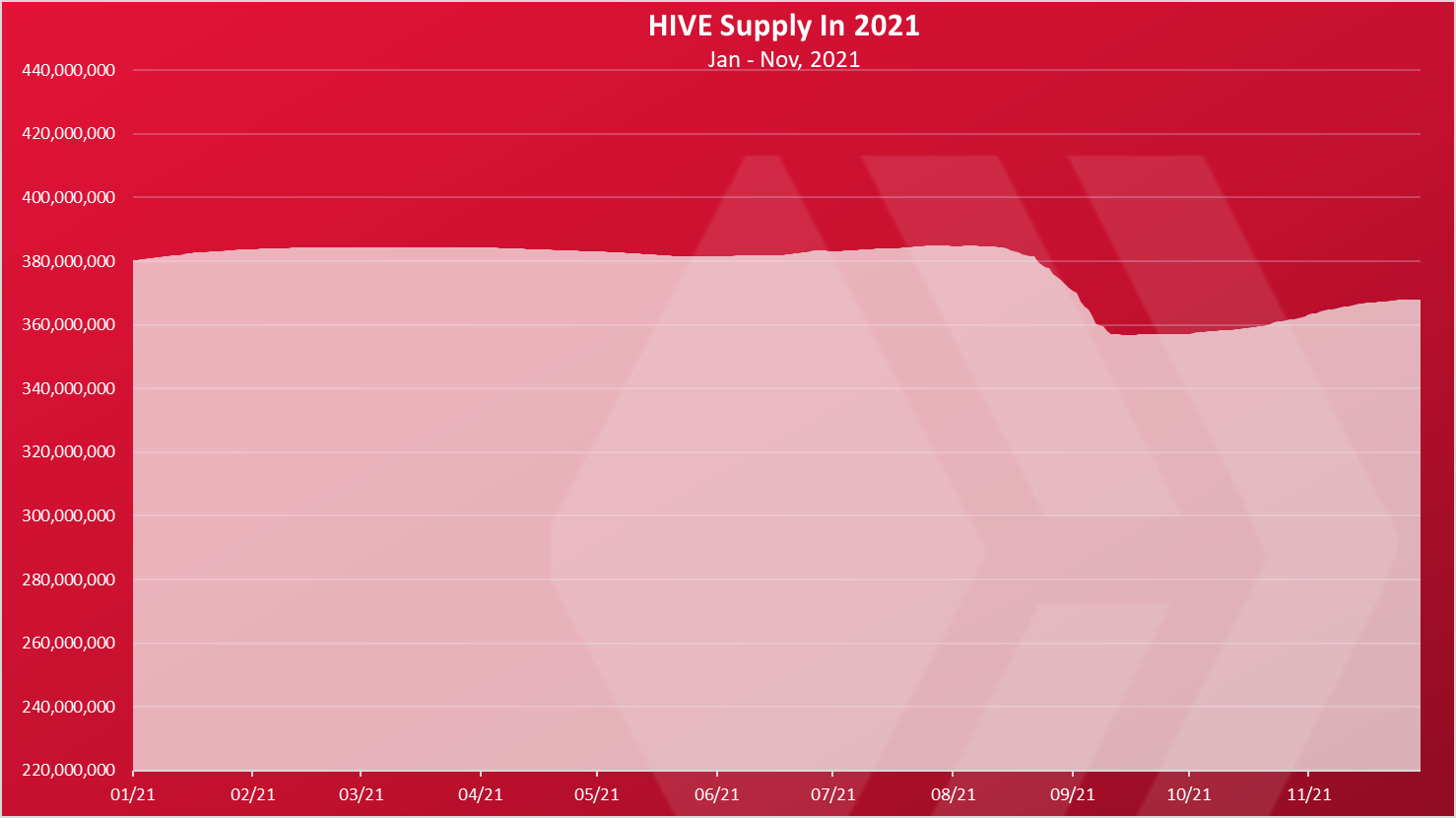

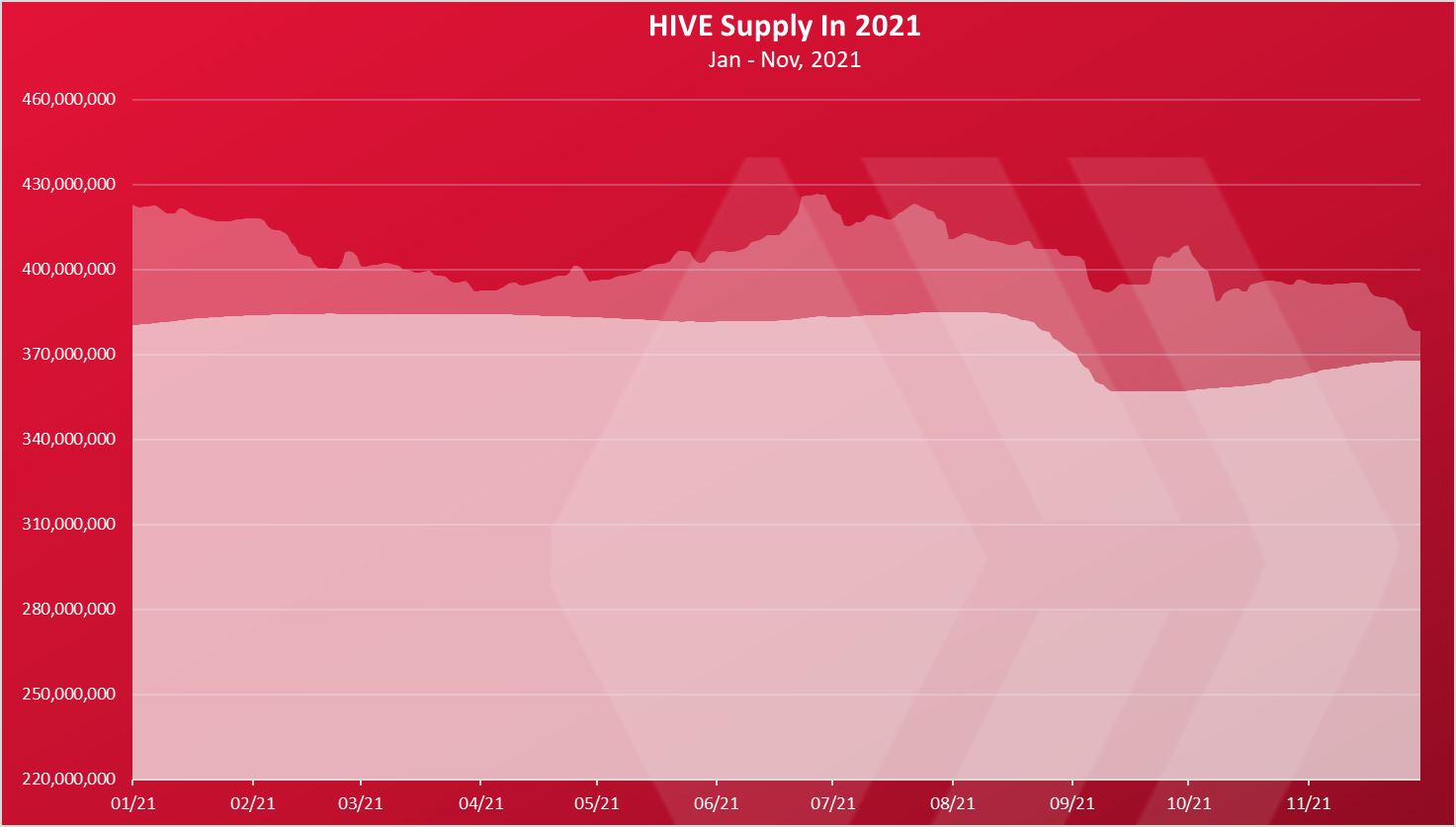

HIVE Supply In 2021

When all the above is added and removed we get this chart for the HIVE supply in 2021.

Overall, the HIVE supply in 2021 is deflationary!

At the beginning of the year there was around 380M of HIVE in circulation and now there is 368M. A reduction of 12M.

Up until August, the supply was almost constant with a small fluctuation. Then a huge drop in the supply in August and September, from 384M to 357M. An increase since then and now we are around 368M HIVE in circulation.

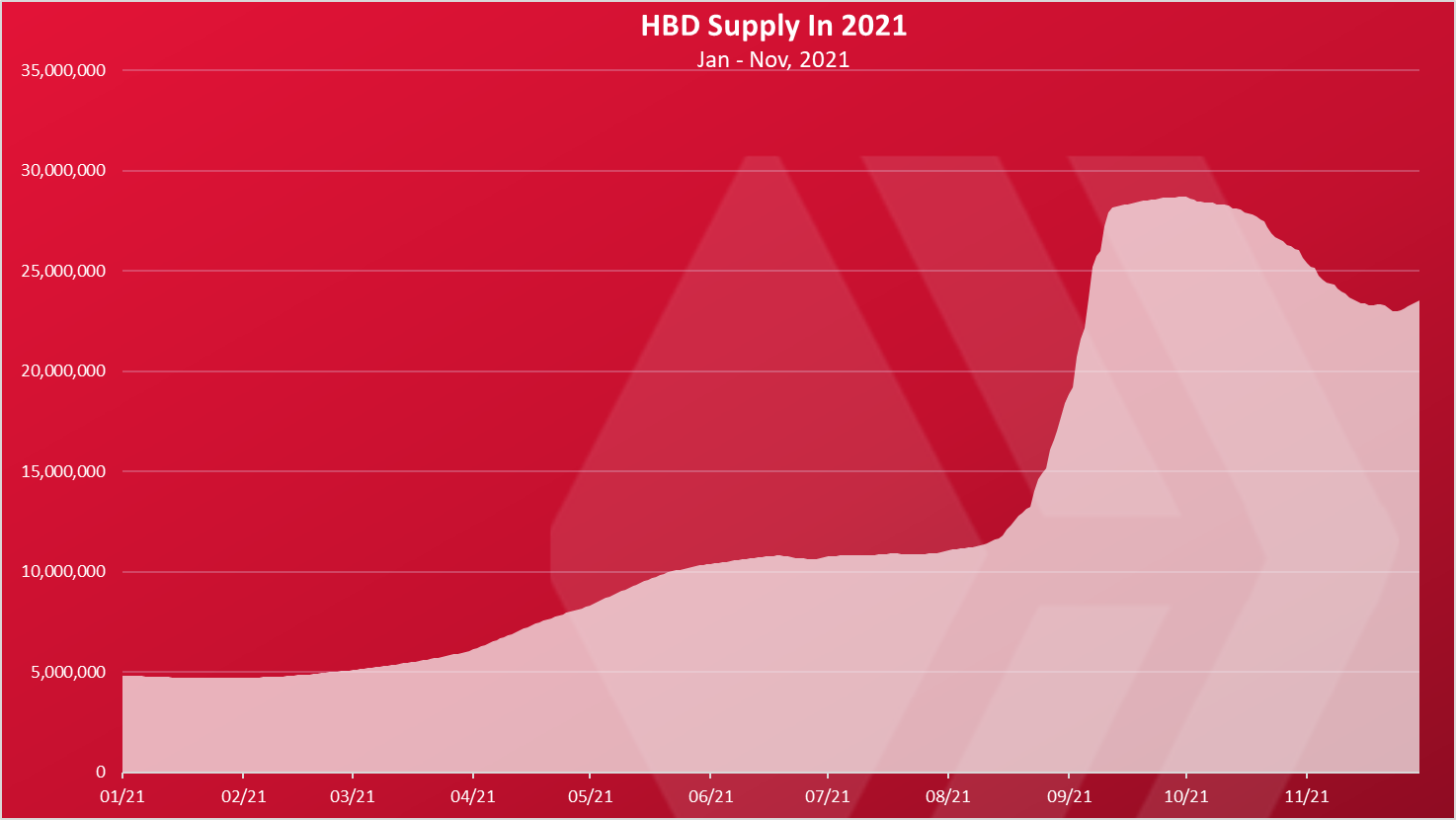

HBD Supply In 2021

Here is the chart for the HBD supply.

Well, the HBD supply has expanded quite a bit 2021. Started with around 5M HBD and now there is 23M. It was almost 29M back in September. The expansion of the HBD supply is because of the HIVE to HBD conversions, and we can see that a lot of those were happening at the end of August and begging of September. In the last month we have seen a reduction in the HBD supply.

Will see how it goes from here, but if the price of HBD increase above one dollar we can see more expansion of the HBD supply and contraction on the HIVE side.

Virtual HIVE Supply In 2021

When we add the HIVE equivalent supply from the HBD in circulation to the HIVE supply we get the chart bellow.

The light color is HIVE that in theory can be converted from HBD at the current market prices for HIVE. We can see that the virtual supply fluctuates quite a lot, mostly because it is tied to the price of HIVE. As the price of HIVE increases, the virtual supply decreases and the opposite. Notice the sharp reduction in the last days.

Supply Summary

Here are the numbers in summary for the month a

HIVE Created:

| Nov-21 | 2021 | |

|---|---|---|

| Author rewards | 332,034 | 4,298,072 |

| Curation rewards | 787,658 | 8,945,828 |

| Witness rewards | 235,912 | 2,789,012 |

| Staking rewards | 352,072 | 3,906,523 |

| HIVE from HBD Conversions | 5,546,641 | 20,517,546 |

| Total | 7,254,317 | 40,456,979 |

HIVE Removed:

| Nov-21 | 2021 | |

|---|---|---|

| HIVE to HBD conversions | 27,702 | 24,741,067 |

| Ninja Mined HIVE To HBD Conversions In DHF | 1,024,900 | 12,325,995 |

| HIVE transfers to DHF and converted to HBD | 1,400,577 | 13,535,157 |

| Transfers to null + null as beneficiary | 1,148 | 201,907 |

| New accounts creation fee | 1,350 | 1,946,832 |

| Total | 2,455,676 | 52,750,959 |

HBD Created:

| Nov-21 | 2021 | |

|---|---|---|

| HBD Author Rewards | 323,634 | 1,829,817 |

| 10% share of the inflation to the DHF | 255,135 | 1,381,524 |

| Interest payouts | 10,932 | 101,855 |

| HIVE to HBD Conversions | 28,087 | 14,181,255 |

| HIVE transfers to DHF and converted to HBD | 1,350,076 | 7,290,717 |

| Ninja Mined HIVE To HBD Conversions In DHF | 1,131,398 | 6,133,665 |

| Total | 3,099,263 | 30,918,833 |

HBD Removed:

| Nov-21 | 2021 | |

|---|---|---|

| HBD to HIVE Conversions | 4,892,674 | 12,127,252 |

| Transfers to null + null beneficiaries | 436 | 2,515 |

| Total | 4,893,110 | 12,129,768 |

Monthly and yearly balance

Here are the numbers for HIVE, HBD and virtual HIVE added/removed in November and for the whole year of 2021.

| November | 2021 | |

|---|---|---|

| Net HIVE Created | 4,798,641 | -12,293,979 |

| Net HBD Created | -1,793,847 | 18,789,066 |

| Virtual HIVE Created | -18,817,829 | -47,395,233 |

And the balance of HIVE, HBD and virtual HIVE on Jan 1, Nov 1, Nov 30, 2021.

| Jan-01 | Nov-01 | Nov-30 | |

|---|---|---|---|

| HIVE Supply | 380,208,202 | 363,151,359 | 367,950,000 |

| HBD Supply | 4,993,134 | 25,479,847 | 23,686,000 |

| Virtual HIVE Supply | 424,395,233 | 395,817,829 | 377,000,000 |

Note some of the numbers might not be 100% accurate due to the conversions differences.

I personally don’t like the parameter for the virtual supply, since it is directly dependent on the HIVE price and can be volatile.

The standard HIVE supply is my preferable metric and we can see that it has decreased for 12M in 2021, while adding a 4.7M in November 2021. The HBD supply has expanded in 2021 from 5M to 23M at the moment. In November the HBD supply was reduced for 1.7M. But even with increased HBD supply, the virtual HIVE supply has dropped drastically in the year with 47M less on ayearly basis, and 18M on a monthly basis for November. This is because of the increase of the HIVE price.

All the best

@dalz

Posted Using LeoFinance Beta

Fantastic analysis!

That's a lot of number crunching to get to a very interesting result.

I had always assumed that the Hive supply was always increasing but its not.

Nope, 2021 has been in deflation

no wonder that a pump can be easily be concerted by group of rich whales, but i guess Hive tokenomics can now handle these spikes with more positive results to all stakeholders of the chain, right?

Great financial results and I like the template used like in the big companies' quarterly reports. Hive price increases thus the supply decreases and I think that HBD helps a lot as well. It is a great stablecoin to hold either in the Savings account or even on LPs on TribalDex.

Posted Using LeoFinance Beta

Cool and very detailed stats, exciting to keep track of it in the coming months.

Thanks. A lot of moving parts around the hive supply. Will try to make it better/simpler going forward.

Thanks for the info! Upvoted and rehived

Can you give us a look at how the categories of holders are doing in relation to each other along the lines of this report: https://peakd.com/steemit/@bitgeek/payout-stats-report-for-15th-december-2017--part-i?

I understand the data pulls are too much for daily reports such as this one, but occasional reports on how we are doing at decentralizing the stake would help, imo.

Dec 1, 2020

Dec 1, 2121

It appears to me that the percentage is increasing in the top two categories.

If decentralizing is our goal, it appears we are failing at that.

Something like what type of stakeholders are receiving the rewards?

It depends a lot from what type of rewards you will look at.

Inflation share:

On top of this, authors receive only half of their rewards in Hive power, meaning 16.25% of the total inflation on Hive power, goes to authors.

If you look at long term Hive Power holders will always get the most of the inflation, everyone has the right to power up and hodl. Hive at least distribute some share of inflation for non stakers (holders), unlike every other PoS coin there.

I'm not saying it is bad that those that support the system get the most, but it is something that will end in most of the coins going to the same people, centralizing the stake.

If over time the inflation doesn't spread stake out, it will centralize, and that is something folks should be aware of and discuss remedies for, imo.

I don't think we persist long term if the long term is that the rich get richer while the poorer get less as a percentage of the whole.

Who buys into that?

Strategies for mitigating this feature of the math are in order, iyam.

Achieving wide spread token distribution is not easy.

Hive as it is now, has some of the best token distribution in crypto. Distributing coins trough a social network seems to be effective. Can it be better? Sure! Where we will go from here .... dunno ... depends on human behavior.

Yes, the hive looks very good.

Much better than in years past.

However, 380 accounts hold 69% of the hive power, if the other 100k active accounts knew the hill they were trying to climb, they might appreciate a helping hand up.

The paradigm is being changed, resistance to that is built into the matrix that established itself.

What better serves the goal of decentralization, a controlling group diminishing their power, or one gaining more from those that have less?

The have's best interests, under crapitalism, is to resist this paradigm change at all costs.

I'd just like to know how much centralization is occurring.

My napkin math says some.

If that is true, then I think light needs shed upon that fact.

I have to agree that the system in place is almost always going to inflate the holdings of whales faster than the holdings of those below but I feel like this discussion is missing one important fact. Most of the accounts that are on top of the pile are actually active daily users that contribute a lot to the overall quality of Leo, Hive, and others.

dalz and Taskmaster aren't beating me in the race because they have more stake but because they publish quality stuff on a daily basis. Looking back at my own post rewards, if you can deliver useful and quality information to the community it will reward you proportionally.

My point is that this may or may not become a problem in the future but based on my own experience I feel like anyone can outpace the majority with consistency and quality. Even if we lean in the centralized part of the spectrum hard work and quality are rewarded according to the median post rewards sitewide and that to me seems like a fair playground.

For now.

Posted Using LeoFinance Beta

Yes, quality content is rewarded, and yes, with persistence, and a modicum of talent, one can stay ahead of the crowd.

The hive is in pretty good shape, but I think with a 1000mv vote limit it will be in even better shape.

Not a forced compliance thing like the whale experiment, but a voluntary putting down of power by those that have it.

Trending is not much up in quality, imo.

Plenty of plastic content still getting pushed to the top.

(Corporate speak and stock photos shouldn't trend, iyam.)

Even though curation rewards are linear, no advantage to piling on, anymore.

Instead of rewarding newbs for organic content latte art is getting hundreds, smdh.

You really nailed a lot of my questions regarding Hive inflation with this one. Also fantastic to see the supply is under control. I'm guessing deflation will really kick in when we have games and apps that contribute to Hive burning and that should be coming very soon from what I am hearing on 3speak and reading here on Leo.

Posted Using LeoFinance Beta

Hive inflation is not high, but it is dynamic :)

I think that having a HBD in the long run will actually deflationary for HIVE. If you keep locking value in a stablecoin from a coin that has tendency to growth in the long term, that is actually lowering the supply of the prime coin.

Informative as always! You're posting the best regular analysis reports on Hive. Thank you so much! I've really wondered about Hive supply & hoped you'd make one. Now you've made it :)

!LUV !PIZZA

Posted Using LeoFinance Beta

Tnx!

Glad it was usefull.

😎👍

(1/1) gave you LUV. | wallet | market | tools | connect | <><

@d-zero

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

PIZZA Holders sent $PIZZA tips in this post's comments:

(1/9) @d-zero tipped @dalz (x1)

Learn more at https://hive.pizza.

Glad to see that 2021 is turning around the traditions. Looks like the effect is clear on hive. But the goal of decentralization is not moving supposedly. BTW great analysis, keep up the good work.

Posted Using LeoFinance Beta