Cool story bro, did you catch the game last night?

A lot of people in crypto try to spin this story that fiat is worthless, especially Bitcoiners. To these maximalists I would ask... How much is your token worth? Today Bitcoin is worth around $97500.

What is '$'?

Perhaps the most insufferable rhetorical question of all time. Dollars are the thing we measure all value in the entire world by. It is the universal ruler of the whole economy. Everyone knows what USD is, even though USD stands for United States Dollar. This is irrelevant; the asset is worldwide. It is the global reserve currency, and this isn't changing anytime soon. So imagine my surprise when I see people use a product every day without even thinking about it but also trying to say it has no value. Make it make sense.

But Bitcoin will become more stable with a higher market cap!

No, it won't. Why would it? That's asinine logic. Bitcoin will never be stable because the supply is completely fixed. In fact we could easily make the argument that BTC already has net zero inflation today. Taking this one step further, Bitcoin is already deflationary when we consider that it's estimated that 5M coins are already permanently lost or otherwise inaccessible (and counting). Seeing as there are only 1M more coins left to be mined it's quite obvious that BTC has already flipped fully deflationary.

It's no longer 21M.

21M is just a meme.

Compare this with gold

Gold can never be deflationary. We can dig it out of the ground; we can forge it in a lab; we can mine it from asteroids. We will never run out of gold. It's a rare resource but it's also an abundant resource when considering industrial applications. The fast majority of its value lies in pure speculation and collective belief. And even gold has a somewhat volatile spot price across 'small' plots of time like 5 years.

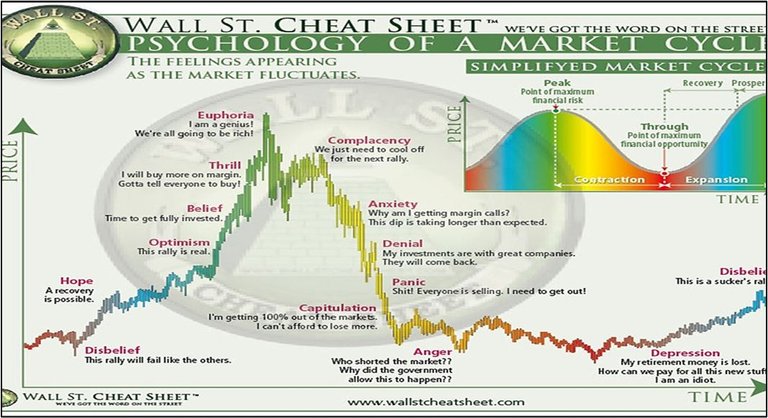

Bitcoin is exponentially more rare than gold (and exponentially cheaper, for now)... meaning stability is an absolute impossible fairy tale. The cycles are clear and defined: number keeps going up; people get greedy and pump it with leverage; number goes up too much; euphoria sets in; the entire market crashes into the mountain. This cycle will not and can not change due to a purposeful lack of elasticity between supply and demand. It is a deliberate function of the Bitcoin network to avoid stability at all costs.

The market cycle will continue unabated.

Also, why would you even want it to be stable?

The allure of Bitcoin is that number goes up forever over long time periods (aka 4-year halving cycles). Stability implies that number is no longer going up... or maybe it is going up but slowly by marginal amounts like 20% CAGR. Even in this case that wouldn't make Bitcoin or crypto any better than the stock market; what's the point? And those 20% gains are also measured against, you guessed it, dollars. So as the dollar declines in purchasing power that cuts into yearly gains hard.

Eurodollar Network

So why does the entire world collectively agree that we should all be using USD as the global unit-of-account? Ah yes, well there is a long history there, but this is just kind of how it worked out. And now that it's been done it cannot be undone so easily. Banks use USD because a universal measurement of account is a very valuable resource for a bank to have.

Some will try to say that the dollar reigns supreme because of the military might of America. Vernacular such as the "petrodollar" is employed as if to imply that countries buying crude oil with USD is what gives it its power. None of this is accurate. USD is the world reserve currency because that's what banks choose to use, unsolicited, of their own volition. Banks measure things in USD because it is convenient and valuable to them, not because the USA forces them to.

Eurodollar Network

In fact my recent research into the Eurodollar revealed that banks will measure assets in dollars and lend each other dollars without ever having any dollars whatsoever. One doesn't need dollars to know a coffee from Starbucks costs $4.95. One doesn't need to pay back debt in dollars when they have another asset of equivalent value at the ready. That is why USD is the world reserve currency: banks willed it to be and now it is permanently embedded within the legacy financial system.

That's all well and good but one day the dollar will weaken and no longer be the world reserve currency! Checkmate!

Wrong again!

The world economy LOVES a weak dollar. LOVES IT! You know what the world economy hates? A strong dollar. The strength of a dollar going up is DEVASTATING to the debt market. Why? Because when debt becomes more valuable everyone that borrowed assets using that denomination owes back more money than they did before. This is why fiat is designed to permanently devalue itself over time. The system requires constant expansion just like any other unsustainable Ponzi, but this Ponzi has been going strong for 100+ years. Gee, there must be something to it, wouldn't you say? Just because an economic system might be exploitative doesn't mean it's "worthless". It's just not very fun for the people being exploited.

So the FED has the power to collapse the entire world economy?

Absolutely they do. Of course nobody wants this as it often leads to a situation where everyone collectively loses. Economics are not a zero sum game. We can all win and all lose together. Many Economists seem to forget this simple fact. Meanwhile the layman seems to believe that the real threat is inflation or even hyperinflation, while deflation and a rising cost of debt is much more dangerous.

Fractional reserve

The ultimate point I'm attempting to make here is that there is a big difference between the dollar in your hand and measuring the value of an object in dollars. Measuring value is a completely abstract idea that doesn't require actual dollars. I don't need a million dollars to know that there are things in this world valued at $1M.

However, clearly manipulating the real asset has an affect on the measurement. Our economic ruler keeps getting bigger every year. Banks are constantly printing this stuff out of thin air without actually having what they gave on the books. This is the nature of the fraction reserve system. Our entire system is built on leverage and ballooning liquidity.

Is that a bad thing?

Will crypto change the way we do things? Will the need for debt go away because everything can be financed with real money in real time? Not only do I not know the answer to this question, but I'm also not confident that I know enough about legacy finance to even make a reasonable guess.

It stands to reason that the need for people to borrow capital from someone else at interest will never go away. It would be difficult to imagine debt not needing to exist entirely. The question we have to ask from this point is: what exactly are they borrowing?

For example: if someone borrows Bitcoin, they will never be able to pay back that debt. Borrowing Bitcoin means shorting Bitcoin. If you were to borrow Bitcoin to buy a house you would 100% go bankrupt and never be able to repay the loan... unless the house gains value faster than BTC... which it's not going to.

Herein lies the problem: How can we give people loans if we aren't printing money out of thin air? Of course I have to believe that crypto will inevitably solve this problem, because what is crypto if not printing money out of thin air? It's just a matter of how we print the money out of thin air, who controls it, APR, and the elasticity between supply and demand. Clearly there are an abundance of undiscovered solutions we have yet to stumble onto.

1 Bitcoin equals 1 Bitcoin.

#deep #thoughts

Ironically last summer my tracking of ETH was done against BTC and although the dollar value of ETH was higher than it had ever been last July or so it was tanking against BTC. It was for that reason that my decision was to sell off my ETH to buy a 36' ocean sailer. ETH began to tank against the dollar days after that. My understanding is that it has not recovered to last summer's high, as of this writing.

ETH was offered to the owner of the boat, at the time of purchase, yet they preferred that it be changed into FIAT for payment. Just because folks value their BTC in a dollar value speaks more about the person's mindset more than anything else, in my opinion.

Interesting story, but it seems like you may be conflating measuring value using dollars with accepting dollars as payment. The example you give has nothing to do with measuring the boat's value.

The value of everything is priced in USD, not because of risk aversion, but because USD is the most stable/known asset on the planet. If I ask you to name products you can buy for $5, $20, or $100 you'll be able to tell me. If I ask you the same question in a year or two you'll give me similar answers.

This cannot be done with Bitcoin or ETH. If I ask you what you can buy with 1000, 10k, or 100k sats you won't know without doing the conversion to USD or a local fiat currency. In a year or two the answer is pretty almost always completely different. Unstable crypto will never be a unit-of-account. Personally I believe that stable crypto will be invented (that isn't pegged to fiat) but until then this is what we have.

Tis the plight of the HODLer. Afraid to purchase anything with BTC in case the price of the item turns out to be a million dollars in a couple of year. :)

Some of the rises in crypto is actually the weakening of the dollar - but to see a strengthening dollar AND strengthening crypto? That's ideal. If we decide to buy crypto, it's with a strong and valuable currency. If we decide to sell crypto, it'll require many many strong dollars to compensate us. Win. Win.

A strong dollar sucks liquidity out of everything and tank risk-on markets.

In fact this is what's been happening for years with the FED raising interest rates faster than they ever had before. We've been getting a deal on crypto this entire time without even realizing it.

The purchasing power of my CAD for crypto is goddamn abysmal right now.

Yeah that's pretty not great.

At least you're not Nigerian :D

got damn!

hahahah at least there's that!

That means crypto is worth more than it seems. !BBH

via Inbox

you are right, Bitcoin can never be stable.

I'm going to agree 💯

Everything is worthless if you don't know its value 😁 we have so many examples in everyday life. Like you say, It seems that some people simply don't know what money/fiat is for! 😅

i have always felt CASH IS KING. its still true... no matter what btc does.. 😉😎🤙