Compound Annual Growth Rate

The 8th wonder of the world, as they say.

Compound interest is when you earn yield on a principal amount, but instead of taking that yield and putting it into your pocket: you roll it back into the investment to earn more money. If this sounds risky... that's because it is, unless we are talking about bonds or some other asset that is considered inherently not risky.

In Crypto Land we all saw how compound interest was a honeypot trap in DEFI 2020 that sent a lot of stacks straight to zero real fast. And then after that happened Bitcoiners started chanting nonsense like, "If you can't explain the yield you are the yield." These same people wouldn't be able to explain any type of yield to you with any success. Classic Bitcoiners. They love being right for all the wrong reasons.

Examples of compounding growth:

Let's say I find a sweet yield of 30% APR. This is high enough to be considered wholly unsustainable by any traditional economist considering it's higher than average stock market gains. So if I put $100 into this position I'll end up with $130 after 1 year. No big deal.

However if I was somehow able to farm this yield for ten years straight we would end up with an extra $1278 at the end of the decade instead of $300 on the non-compounded side. This is due to the fact that the profit keeps getting rolled into the position every year and you earn interest on the interest. The reason why Einstein is credited with calling it the "8th wonder of the world" is because this is the magic of exponential growth: it defies logic and explodes out of control if left unchecked. This should sound familiar to everyone considering the industry we find ourselves in.

Technology is exponential.

Everyone round these parts understands that the dollar in their pocket loses a little bit of value every single day. However technology is so exponentially deflationary that the cost of a computer or phone can still go down even with price of everything else going up. Tech allows us to produce more for the same or less cost. How much do you pay for long-distance phone calls? Sometimes the value of an asset literally goes to zero because giving the thing away for free has more marketing value than micro-charging consumers for it. Capitalism.

However, the central banks have been quietly syphoning off these gains into their own pockets for decades now. Even an inflation rate as low as 2% (which is the worldwide inflationary target) is 2% exponential theft every year. It doesn't seem like a lot but it stacks atop itself over and over and over again until it becomes an astronomical amount. The only variable required for compounded exponential gains to become absurdly massive is time, and these institutions have existed long before you or I were ever born.

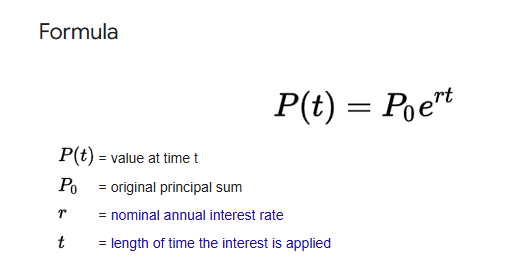

Weekly vs Monthly vs Yearly

There can even be huge differences between when the interest is calculated. If a 30% APR is calculated every week (0.57% every week) it ends up being 35% after a year. An extra 5% gain just appears seemingly out of nowhere on the same timescale. There's even an equation for calculating this type of yield in real time where the algorithm calculates the interest infinity times every second using limits as time approaches zero. This is called Continuous Compound Interest, but it's honestly not that much better than weekly or daily so the point becomes a bit moot on a practical level and only serves to amuse mathematicians.

The equation that most people use to compound interest looks something like:

( 1 + APR ) ^ time - 1

- 23% APR would be represented in the decimal form of 0.23

- time can be years or months or any other ticker increment

- and 1 is a placeholder that represents the 100% principal amount.

- This placeholder is useful because 1 x 1 = 1, simplifying the equation.

20% for 8 years would be 1.2^8 = 4.30

multiply by 100 to get 430%

but we also have to subtract the principal amount for a total +330% gain.

I've been using this equation a lot recently to calculate perpetuals yield on Hive. In the case of perps the time increments are either 4 hours or 8 hours long, so if we want to calculate the APY for Hive we need to consider there are six 4-hour ticks in a day and 365 days a year for a total of 2190 funding periods market makers can get paid. Even though the interest rate is low (2% maximum and 0.01% on average) the fact that it can happen over 2000 times a year means the exponent is huge.

The APR on 2% funding every four hours is 4380%, but the compounded APY would be 682,929,949,073,531,120,761%... meaning if it was possible to get this rate for an entire year you'd basically own the entire world and then some with an investment of $1. That's what would happen if you could double your money every six days, which is around what a yield of 2% every four hours would give you. With this in mind it becomes obvious that Einstein was not exaggerating when he said that exponential growth is comparable to humanity's most impressive constructions.

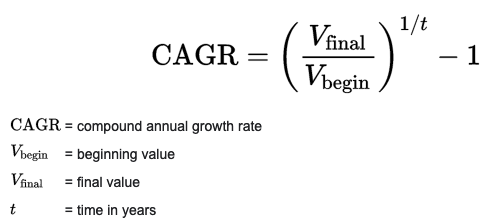

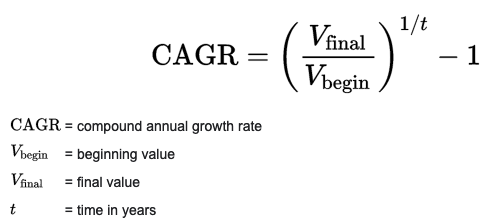

And then there's CAGR

This is basically the inverse of the function we just used. Instead of calculating how much we will have in the future given a certain rate of return, the CAGR assumes we already know how much we made + how long it took... and we want to know the year over year percentage. I bring this up today because Michael Saylor has been talking about Bitcoin being valued around $11M after two decades. This sounds like a lot... but is it actually a lot?

So let's plug it into the equation and find out.

To use round numbers let's say that Bitcoin has a value of $100k today and will have a value of $11M in 20 years. This is all the info we need to complete the CAGR formula. final is 11M begin is 0.1M and time is 20. The resulting CAGR is 110 ^ 0.05 - 1 = 26.5%

26.5%... wut?

Is Saylor an idiot? 26.5% year over year returns on Bitcoin is basically a terrible failure. That's not even better than the stock market and other securities that can print their token out of thin air. I have to assume that Saylor purposefully takes an extremely conservative stance here so he looks hyperbullish to those that don't understand the math and completely reasonable to those who do. Conversely if BTC CAGR was 50% for 20 years it would go x3325 to $333M per coin. Not too bad. Don't be surprised if we get there.

Conclusion

Exponential growth defies all logic and reason. Usually in the real world there are extreme scaling blockades that prevent exponential growth from happening for significant periods of time, but in the digital world of technology and software anything is possible. This has already been proven over multiple decades using Moore's Law:

"Computers twice the speed, half the cost" refers to the concept of Moore's Law, which states that the processing power of computers roughly doubles every two years while the cost remains relatively stable, essentially meaning you get significantly faster computers for about the same price over time.

Imagine what happens when the dollar in your pocket is no longer being inflated toward zero via central banking and fractional reserves. Money and technology are merging and the vast majority of the world is still blissfully unaware of what that means.

I struggle with the concept of technology being deflationary.

Obviously as technology increases making things gets cheaper, but I'm not sure that we as consumers are seeing that deflationary benefit. Sure, TVs are cheaper now, but we also need to replace way more often. Printers are crazy cheap but ink is insanely expensive and now HP requires a monthly subscription to extract even more from us. Smart phones are way more amazing, but somehow everyone is still paying a ton on plans and devices. Laptops are definitely cheaper than they were, but now so much software is subscription based. So while it is actually deflationary, I'm not sure the outcome is deflationary for consumers.

You'd think in 2025 only 1 in 1000 people would actually need to work to keep everyone sheltered and fed, but no, we're all just plugging away 40 hours a week.

Anyway, totally not the point of your post, I do wish we could teach kids how to use compound interest for their retirements and get them really locked in - but so many people benefit from us not doing that (Hello Amazon hiring retirees that ran out of money).

This comment is actually very much on topic.

Banks are hiding the money they are stealing by syphoning gains away from deflationary tech. The reason these things are not getting cheaper is because they are stealing it all using the convoluted mechanics of a fractional reserve and leveraged derivatives.

If Bitcoin gets big and stable enough to the point where we can actually measure value with it (unit-of-account) then it will become blatantly obvious what's been going on all these decades. The central banking system steals just enough to maintain maximum profitability. If they steal too much or get too greedy on leverage the system collapses and everyone loses.

Ah, I can see that. I thought the problem was corporations leaning into an monopolistic extractionist mindset over a 'creating a superior product/service' mindset, but the fractional reserve is always going to be the base layer of everything else.

The "greedy corporation" narrative has been very strong as of late that is true.

But there is zero evidence to suggest that corporations magically got greedier and more explorative in the last five years. In fact I would say it's not even possible as they couldn't get any greedier than they already were a decade ago. Human psychology hasn't suddenly changed. It's the banks. It's an unsustainable Ponzi that's on its last legs.

I don't put any stock in the bankers coming out of the woodwork to blame millennials buying avocado toast. It's the jackals that have been in charge for the last 50 years that have clearly fucked it all up, and the bankers are at the top of that pyramid. They're so rich we don't even know how rich they are because they point the finger at Musk, Bezos, and Zuckerberg as the richest people while they smartly keep their wealth and power completely hidden.

Just as people marveled when BTC reached 1K, we marveled at 10K, we're marveling at 100K, it's not unreasonable we marvel someday over 1M... or 100M

I wouldn't complain about that one bit!

Thanks for the info. Lots of good stuff here. I have been using compounding interest for a while now on my traditional investments. I really enjoy watching the number grow every year!

One reason you can earn a high compounding interest is the relationship between time and money. As humans our time is limited. When we agree to lock our principal or agree to let someone else use it involving a risk of loss for a period of time we must be compensated for that. The longer we agree to do it, the more in relative terms we must be paid. Even if there was zero growth in the economy, lenders would still require to be paid interest.

I was watching a street survey today in Stuttgart and they spoke to dozens of people and not one had an idea about Bitcoin or Crypto. Some heard of it, but mostly all apothetic. It's crazy shocking. I can't see much adoption after watching this, that will get us this CAGR when normies are so unaware what's going on. Love your $333M figure, that's seriously bullish. Worth to hold for that in 20 years.

Well normies are poor and not the ones who are going to make number go up.

Normies aren't going to use crypto like you or I do... they'll plug into some random frontend and might have no idea what the backend is even doing.

More than anything number will look like it's going up when fiat (the measuring stick) is actually just going down.

Good points.

This part of investing can not be emphasised more, compounding takes patience, but it’s so worth it