Hey Tarazkp, even though I didn't comment a lot (compared with others at least) I just wanted to say that I read your content regularly and I appreciate it a lot. I appreciate the thought and effort that it takes to write such long pieces like the ones that you produce.

Let me correct you in something:

Liquidity.

Only just over 2% of LEO is liquid, making the market very thin...

While this is true and only 2% of the current supply is 'hanging around doing nothing', the market is a lot deeper than it seems.

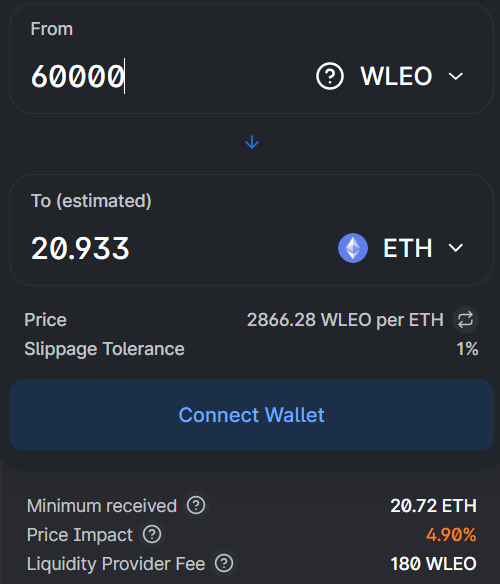

Why? Because you should also count the 19,24% of the supply allocated to the liquidity pool. These tokens are 'liquid & locked' at the same time. You can use this tokens to 'get out' with ETH but at the same time, these tokens represent a commitment from investors who decided to allocate an equal amount of value in eth into a uniswap pool.

This makes easy for anyone to step in/out.

If you want to sell your rewards LeoDex is more than enough, but with the Uniswap pool you could sell literally 1% of the total supply moving the price 'only' a ~5% (which is nothing, If you ask me).

Have a great day!

Posted Using LeoFinance Beta

Thanks for that info mate. I was wondering about how it works in this regard but wasn't sure. I think for a lot of people who might be coming in from Hive, H-E / LeoDex is their likely gateway to begin with. I will have to look into it deeper.

Thanks again for taking the time to explain it :)

Posted Using LeoFinance Beta

You're welcome! Any doubt, just shoot ;)

good to know. Thats what we also need for Hive!