Today being Sunday, it's time for another analyses of the two assets I've been charting for some time now.

January ended two days ago, so today I can analyze January, based on a closed candle, which is really ugly to be honest.

The monthly chart shows a very small bodied candle with a huge upside wick. For those of you who don't know how to read candles, the wick represents where price attempted to go and failed, while the body is where the most interest has been. The monthly candle failed to close above the order block (OB), which would have meant continuation to the upside. Not a candle I like to see honestly, but we trade what the market gives us.

At the time of writing, price looks pretty heavy on the monthly and chances for $0.3439 to be swept are high. On the upside, the next liquidity pool is at $$0.6896, but to get there, would mean a 2x move from where we are now, which will not happen overnight, that's for sure. I mean it can happen as last month's candle shows that, but for price to actually hold that level, a lot of buying pressure is needed, buying pressure which is missing right now.

The weekly chart is not painting a promising picture either. Even though price is bullish as we don't have a lower low printed yet, prince seems to have lost a major support level. Last week's candle was a doji, which means indecision, and this week's candle, although not closed yet, is bearish. There are a few hours till the candle close, in theory anything can happen, but being Sunday evening, I doubt we can get a different candle than bearish. Possible levels to watch for are $$0.6896 and $0.2108.

The daily bias is also bearish. Price not only lost the key level at $0.4288, but yesterday closed below the bullish gap (bullish till yesterday) that was defending price, thus the gap is serving now as resistance. The next possible levels I'd keep my eye on are $0.3439 and $0.3347. For bullish continuation, price needs to close above $0.4288.

On a more granular scale, the h4 chart can show you the level that should defend price. We have a bullish gap (marked with green), which is touched now by price. There are two levels, wicks inside the gap, which most likely are going to be swept soon. Sweeping those swing lows now it a healthy move. Should price lose this level, then the next one I would keep an eye on is at $0.3091 and ultimately $0.2889.

The sell side of the curve here looks good though, price is balanced and should we get a reversal here, there are no gaps to stop price till $0.4288.

Month ends and beginnings are always tricky as monthly close is an indicator for everyone and people are adjusting their portfolios based on the monthly close. This volatility we got this weekend was expected. The question is, what's going to happen next week and after. February is known as a bullish month, but we'll see as I take everything with a pinch of salt.

$BTC is back inside the inside bar pattern at the time of writing and just swept the swing low at $97,888 on the daily. For bullish continuation, the daily candle needs to close above the OB ($98,340).

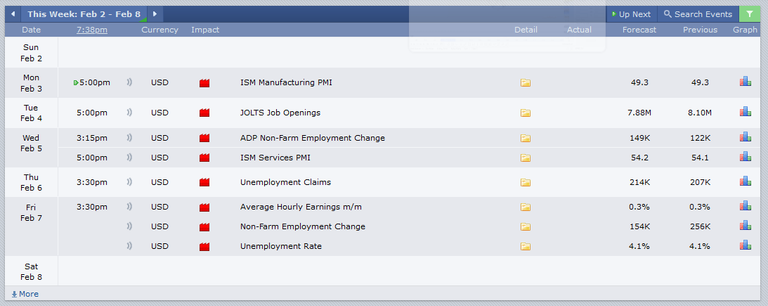

Next week we have red folder news every single day, so be ready for volatility and manipulation again.

This week my report is a bit shorter, not that I need to write a novel as my analyses is relies on data, but at this point it's better if I keep it simple and strict. I prefer to keep my opinion to myself.

However, be safe out there and protect your capital.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

I think the whole alt market tanked when Trump released his $TRUMP and $MELANIA coins - people are nursing total losses of $10 billion. When retail investors get burnt like that, they are not inclined to buy other alts, no matter how promising they are.

They don't say DYOR just to hear themselves talking. These 4 letters have a heavy weigh and a deep meaning. Everyone knew the risks of buying this 💩 however, I think this is just a tiny part of the drop. The rest can be attributed to other factors I prefer not to name here.

Hi Erika I miss your museum visits and your beautiful artworks you found, which have been inspiring to me.

What you are talking about in your current post I don't understand!

My life changed a bit in the second half of the year and my time was limited, so I had to give up museum visits, but starting from next week, I'll be back to visiting and posting about my museum visits. So no worries as it's coming.I'm glad you liked my posts.Hello @mandragora88 and thanks for stopping by.

This post is technical and I bet not many understand what I'm going on about it here, but it is needed I think.

Anyway, keep an eye on my posts as good and nice things are coming. Have a nice evening my friend!

Thank you for this explanation for those, like me, that don’t posses the knowledge. I guess is something we need to be in touch with to understand. I followed and favorite you since you are knowledgeable and your posts give good insight about crypto.

Hope things are better in the trading world.

Read you around … 🍀

Knowledge comes with time and practice, so no worries. The internet is full of free content, available for everyone and learning takes time. So no worries. Keep studying and practicing. That's what I do every single day :)

I will for sure. 👍🏻

Keep it up 💪

Thanks for your analysis @erikah let's hope the candle bends towards $0.6896 and above 🍷🙏🏼

Sooner or later it will :)