Below was my response to a really well written article I found here on Leo Finance. First Let me restate, the article was well written AND that I respect the writers views because they are coming from their perspective.

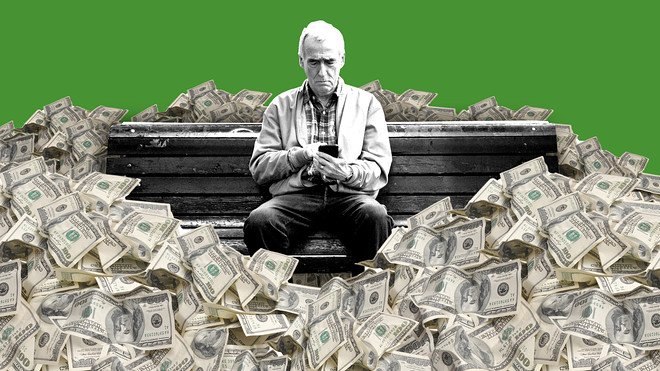

That being said... My Strategy will arguably make you RICHER, FASTER and with Relatively more certainty ASSUMING one thing... You can figure out how to make it work without losing all of your hair! I am bald now, so I made it work, but lost my hair in the process. Here was my response:

Duuuuuuude! We are forgetting about the biggest wealth builder in the world. This portfolio is missing the most highly leverageable asset.

REAL ESTATE should be the cornerstone of every investment portfolio. Especially Rental real estate which generates capital in whatever the currency of the time or location is.

IMHO A solid asset allocation would look more like this:

25% Real Estate

25% Equities

25% Crypto

10% Cash (whatever your local currency is)

5% Precious Metals (because they are just a store of wealth)

And then I leave 10% at the end for you to put into which ever asset class you see to do best with. In your case I would have to assume it would be Bitcoin and Etherium.

Real Estate is leverageable... Your $10k investment can be used to buy a $300k asset that generates $36k in gross rents per year AND appreciated 10% in 2019 and 2020.

Let's assume for simple numbers that your Net Operating Income is $10k for the year PLUS your building appreciated 10% on its $300k initial purchase price. You just made $30k+$10k and we aren't even talking about the depreciation you gained on the building for tax purposes which likely saved you another $5k. As well as the Amortization of your loan which likely paid off another $5k which ads to your equity (aka how much you make when you sell)

In a year like this past we just had your $10k investment would return a total of $50k giving you a 500% ROI (return On Investment)

All of this assumes that you paid market value of course... You could do what I have done every year over the last 7 years and buy this same house at $150k, put $50k into it and only be into the building for $200k (all borrowed bank money by the way) and have earned the additional $100k on top of that.

Totally out a $150k Profit if you flipped the house within that year and a 1,500% return on investment...

I'm not saying it is easy... Or that someone new to the game could hit the same numbers an experienced investor can swing at, BUT it does belong in your portfolio and unlike the rest of these digital, paper and metal assets... If you ever need a place to stay... You own a building.

My Sincerest Apologies If This Article Offends

You know what... I am going to turn this into a post. Great Article my friend! Thank you for the inspiration! Cheers To you on your Wealth building Journey and I am looking forward to seeing you a very wealthy millionaire!

Posted Using LeoFinance Beta

This really does seem like a fine way to go, perhaps gradually one can begin to build slowly one after the other, crypto is still "it" for me, for now, eventually the plan is to diversify into other asset classes

Posted Using LeoFinance Beta

@mistakili I agree with you. Real Estate just happens to be the avenue that has the most upside potential, but as long as you are investing and learning you are doing better than the other 95% of the planet! I used to do a lot of day-trading and stock picking before real estate and even if I had invested in bitcoin or tesla 10 years ago with my first $10k it wouldn't be as much money as my real estate portfolio has allowed me to build.

Stick to what you know and what is working for you and definitely put real estate on your radar to get into one day. cheers to your financial freedom!

Posted Using LeoFinance Beta

Thank you so much for the advice. Taken

So you can purchase a 300 thousand dollar property with only like 3.5 percent down payment? I always thought rental properties required more like 20 percent.

Posted Using LeoFinance Beta

@TBNfl4sun that's right! As long as you are owner occupying the house you buy up to a 4 unit building with 3.5% down payment.

This can work for your first 2-3 houses, as long as you move into them. After that you are on to the 15-25% down payments that professional investors make until you get out of the small stuff and shift into larger buildings... At which point we are into large assets with no money down because they are based on the assets value.

Posted Using LeoFinance Beta

Wow, that opens so many doors for people that have some cash sitting on the sidelines. I would have to sell my house I'm in now because the capital gains won't kick in on my first home when I sell, I have good equity but heard if I rent it out I lose the tax break when I sell.

Posted Using LeoFinance Beta

Congratulations @gualteramarelo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Boom! That is what I'm talking about. That looks alot like my portfolio. ;-)

Posted Using LeoFinance Beta

Spot on! And no offense taken brother. More viewpoints just add value to the information, especially from someone active in the field. Like your example showed, no other asset can give you the type of leverage that real estate does so it should definitely have priority.

Posted Using LeoFinance Beta