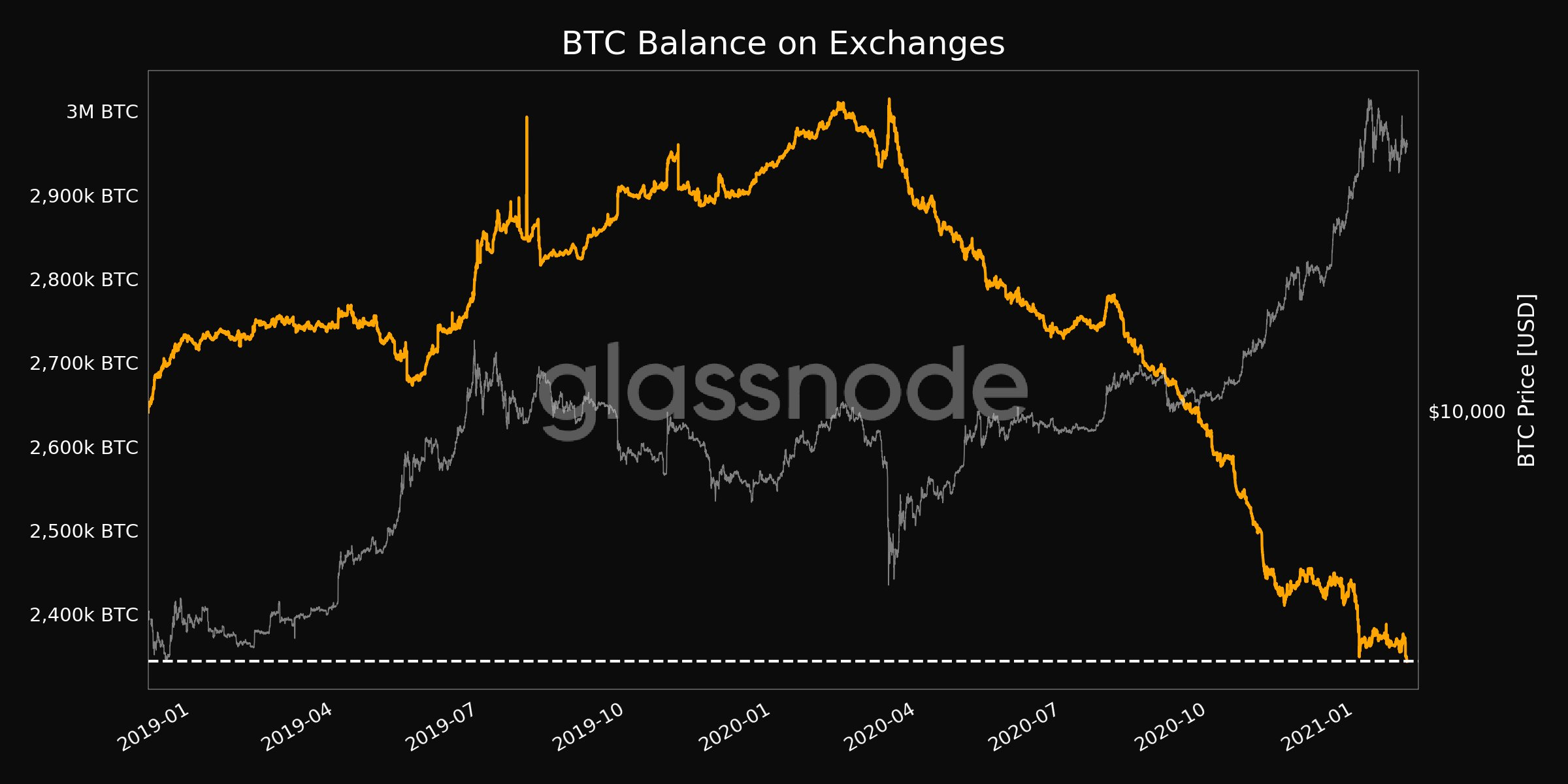

The supply of Bitcoin sitting on Exchanges just keeps dropping...

With the price of bitcoin stagnating the last few weeks, I am sure some started to wonder if perhaps the supply sitting on Exchanges had stopped going down...

It hasn't.

Based on the latest data from glassnode, it looks like the supply of bitcoin sitting on Exchanges is now at the lowest levels seen in roughly 3 years.

Check it out:

(Source: https://studio.glassnode.com/metrics?a=BTC&m=distribution.BalanceExchanges)

While the supply on Exchanges dwindling doesn't necessarily guarantee that the price is going to go up, it certainly does provide the opportunity.

As it stands now there is less and less supply available to be sold than basically any point in the less 3 years.

This is likely due to institutions buying up bitcoin and sending it to Grayscale as well as institutions buying it up and holding it in cold storage, which makes a lot of sense for a number of reasons.

But wait there's more...

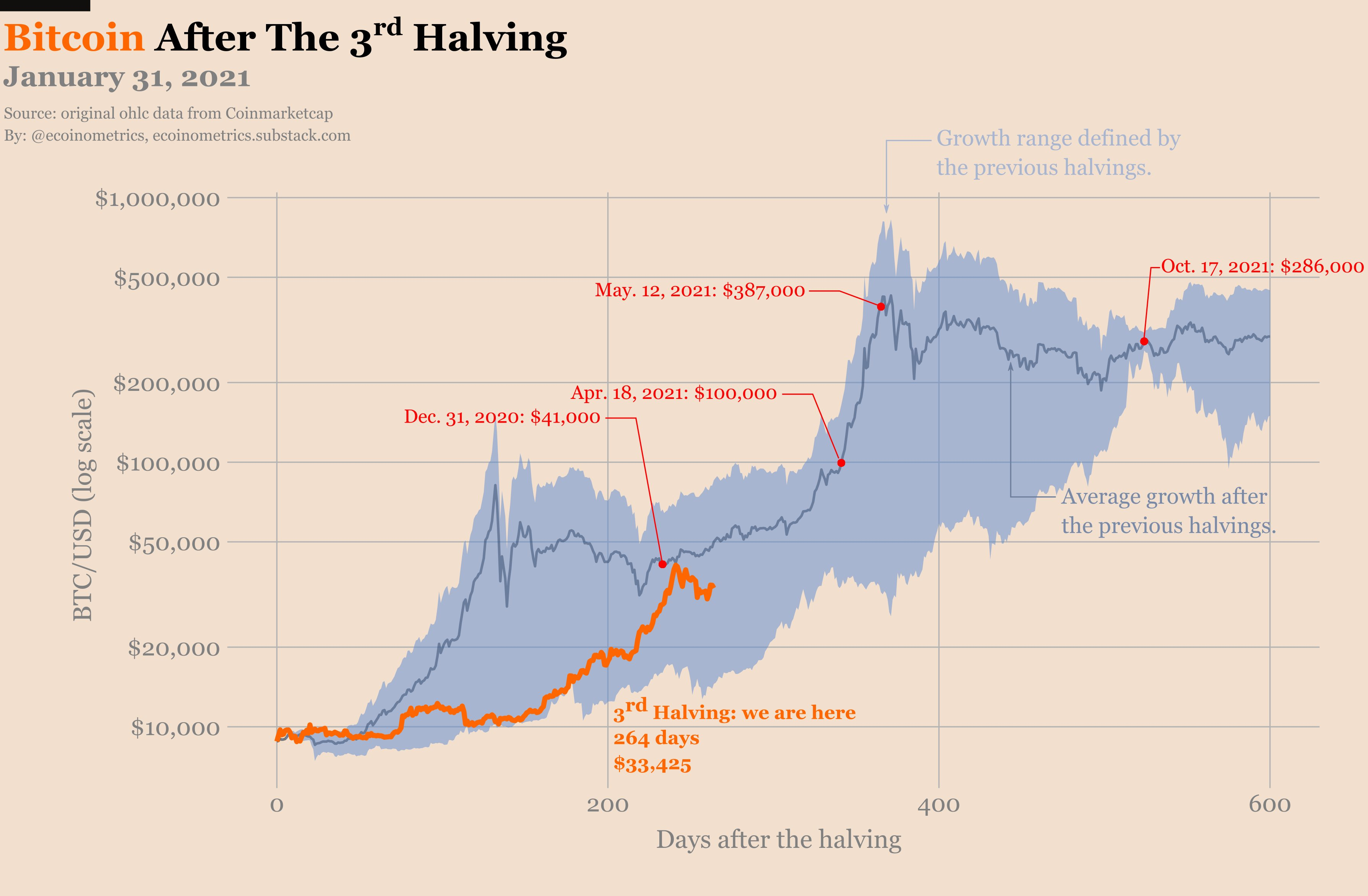

Some seem to think the fun in bitcoin is over for now, and perhaps in the very near term it is.

However, we are pretty much exactly where we should be at this stage of the post halving bull market rally.

Check it out:

(Source: ~~~ embed:1355901175556501505/photo/1) twitter metadata:ZWNvaW5vbWV0cmljc3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9lY29pbm9tZXRyaWNzL3N0YXR1cy8xMzU1OTAxMTc1NTU2NTAxNTA1L3Bob3RvLzEpfA== ~~~

As you can see, as of yesterday we are pretty much smack dab between both the trends from 2013 and 2017.

Interestingly enough, had we followed the average expected in the above model, we would have hit $41k by December 31st.

We didn't actually hit $41k until January 8th, so we are about 9 days behind schedule. ;)

It's pretty amazing that we have moved right in between the previous two models so consistently. If we keep that up and move back up towards the average returns line, we would hit $100k by April 18th.

Sounds a little optimistic to me, but who knows, we only missed the last projection by about 9 days.

I think we will start to move towards the lower range of this pattern and mostly copy what happened in 2017.

If that is indeed the case we are going to peak on/around October 17th of this year at a price of over $200k.

Works for me!

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Institutions are draining exchanges from Bitcoin supply, which means Bitcoin value will crash hard if the trend continues...

People simplify and think scarcity will push the value upward, but markets don't work that way in long term. When there isn't enough trading volume, people stop both selling and buying.

Like I have said earlier, OTC trades don't affect public valuation of Bitcoin.

I disagree.

Supply and demand are very much the key factors like always.

Of course, OTC trades affect the public valuation of Bitcoin. Bitcoins being drained from exchanges certainly will not cause the price to crash. This is empirically true. The mining reward halvings are what drives the price action of Bitcoin in four-year cycles. The less miners will be dumping on exchanges, the higher the price given constant demand. Demand for BTC exists because fiat is proving to be such a bad store of value and because the world needs a store of value.

Posted Using LeoFinance Beta

Miners don't "dump" value of Bitcoin by putting too large sell orders, quite the opposite... They try to drive the value higher so they get same amount of FIAT... But because relative value of FIAT has gone down, they don't need to put as large sell orders as when FIAT was stronger.

It's the other traders (people who don't or can't mine) who cause the massive volatility of the Bitcoin as they try to ride the ups and downs and are too impatient to wait for the high and low points.

Miners try and get a high as possible price for their BTC. But at some point they will always have to sell because of their costs.

Bitcoin's value proposition is largely about the supply cap and a stock-to-flow ratio doubling every four years. This has all to do with supply and demand.

Posted Using LeoFinance Beta

A lot of the times miners sell less than what they mine, because the exchange rate is higher than required... It's only during halving period when the rate usually is less than they need.

Lately when institutions have bought Bitcoin, they have bought it favorable exchange rate as they want to buy as much Bitcoin as possible, so they can't bargain with the exchange rate... Even if they buy solely OTC, the coins are still off the potential amount that would have been sold on exchanges.

A lot of people think it's the highest sell that matters, but real traders know it's the average exchange rate that makes things either profitable or not...

Yep, I agree.

This isn't accurate. Dwindling supply in the face or rising demand pushes prices higher, economics 101.

Your point assumes the demand is rising, but it isn't... The demand has existed for a long time, recently it has just moved from inside exchanges to OTC.

Like I have said long time ago... The demand is either flow towards other cryptocurrencies or towards cashing out... The demand is never towards HODLing even if some account holders like to HODL some of their coins.

Demand doesn't even have to rise. Static demand in the face of shrinking supply still sends prices higher.

BTW, demand for bitcoin is absolutely increasing.

Like I have said earlier during last 6 or so months focus has shifted from Bitcoin and Ethereum to Litecoin and Dogecoin... That means demand of Bitcoin has dropped.

One of the reasons is sharp decrease in number of altcoins and value of some of the remaining altcoins dropping to sub-satoshi levels.

The other big reason is that people don't need to swap their FIAT to Bitcoin first anymore as services like Coinbase support other coins too... People save a lot when they don't have to pay large network fees commonly associated with Bitcoin.

If everyone or most people believed in the model, it would be invalidated because everyone would try and outsmart everyone else. But because it works we can surmise there is plenty of stupid money out there. :D

Posted Using LeoFinance Beta

Agreed. It means people still don't trust it. It also probably means there is some manipulation at bay...

I think that is a tough call $100k by April, but then again what do I know. I could easily see $50k by then, but that is just me. You can't really argue with the numbers. Pretty exciting stuff no matter how you look at it!

Posted Using LeoFinance Beta

I thought $41k by end of last year was a tough call, but it was only off by a week or so.

@tipu curate

I would love to see those prices.

Upvoted 👌 (Mana: 0/78) Liquid rewards.