Every Hero needs their Villain...

Our favorite Bitcoin bear and resident basher never misses an opportunity to take a jab at bitcoin.

On days when gold is up and bitcoin is down he tends to take exceptional delight in taking shots at bitcoin.

And I mean exceptional delight!

So, on days like today (and the last two days) when bitcoin is soaring and gold is taking it on the chin, I will be sure an return the favor. :)

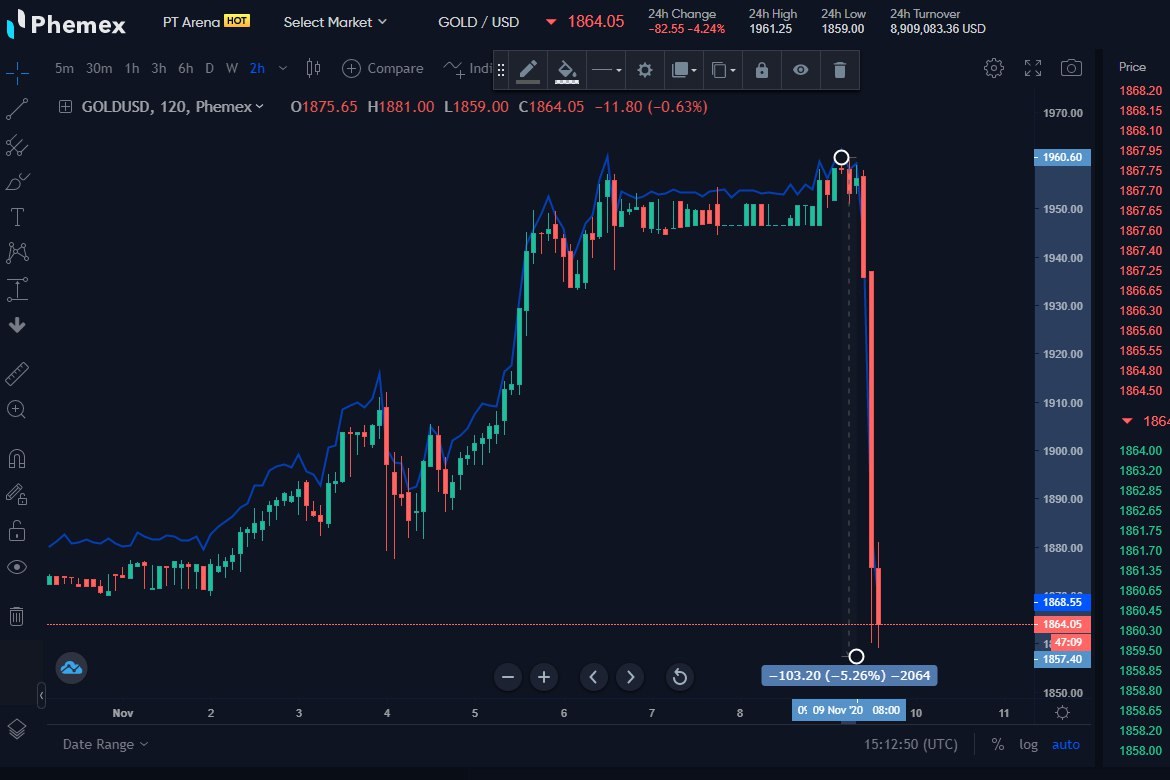

Over the course of the last couple days, gold has fallen by more than 5%:

(Source: ~~~ embed:1325825606844604419/photo/1) twitter metadata:Sm9zaF9SYWdlcnx8aHR0cHM6Ly90d2l0dGVyLmNvbS9Kb3NoX1JhZ2VyL3N0YXR1cy8xMzI1ODI1NjA2ODQ0NjA0NDE5L3Bob3RvLzEpfA== ~~~

While this is a very big move down in its own right, the fact that bitcoin is up more than 5% during this same time period is rather interesting.

As I type, bitcoin is getting very close to $16k.

In fact, a few more ticks and we would have touched $16k just a few minutes ago:

(Source: https://bittrex.com/Market/Index?MarketName=USD-BTC)

And again, this is all happening while gold is negative for the day.

Is there still hope for Mr. Schiff?

Had Schiff longed gold (he did) and shorted bitcoin (he probably didn't), he would have been hit with a double whammy of crapiness these last few days.

Luckily for him, he only got one plate of steaming crapiness (gold being down) served to him on.

I wonder how many more days like this it will take before Schiff is eventually converted to a bitcoin bull?!

My guess is that will never happen and that is ok.

In fact by Schiff constantly getting in the news and bashing bitcoin it gives bitcoin more and more press coverage, not that it really needs it at this point, but as they say "any press is good press."

So, keep on doing that you are doing Mr. Schiff and hopefully you can stay in the game long enough to watch us overtake $100k by the end of next year.

You can still switch sides and back a winner, but we won't blame you if you don't.

After all, every hero needs their villain. :)

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Peter is wrong on a few levels, but also right about 2 times on the clock. His problem is he schills / schiffs it because it's his lively hood. However with that being said, I have studied gold for about 10 years.. gold is suppressed.. and it's suppressed for a reason.

The comex/banks have re-hypothecated gold. It could be 100x more valuable if you have it in hand.. but we see a price on the comex and believe that is the price. Perhaps Bitcoin's advantage is that there is a fixed supply that can be tracked. Gold can be Tungsten, or just paper!

Posted Using LeoFinance Beta

Great points and I agree. Hence why bitcoin matters... (among other reasons)

Gold also matters. It should never be one is better than the other. Firm believer in diversification. You need to have gold accessible and part of your portfolio.

Unfortunately a large chunk of bitcoin's growth is likely going to come at the expense of gold. Those holding gold will eventually move some of that into bitcoin, and thus bitcoin grows at the expense of gold. It's the low hanging fruit for bitcoin.

Well I'll tell you this.. I ain't walking to the jeweller and cashing any of the hard stuff. Yes I agree the SPECULATORS will hurt the comex price; but when it comes to delivery from a COMEX contract.. HAHAHA that's the fire works.

Gold works a lot slower.. Bitcoin is hyper fast and volatile. If Bitcoin get's too high in the eyes of those who are keeping gold's price low.. well.. it's something to consider.

The thing with gold has always been that when the price goes up, miners ramp up production. So there is a supply increase any time gold goes up. Not to mention there is asteroid mining etc that is going to start becoming a thing in the coming decade. I saw report out of NASA where they were offering incentives to companies willing to mine asteroids, the moon, etc over the coming years... All things that are going to impact the price. Not to mention how much easier it is to counterfeit gold compared with bitcoin. That's a major concern for anyone buying gold. Tungsten coated with a thin layer of gold feels and looks an awful like the real thing...

Of course the bullion banks play games.. old news. Mining an asteroid will cost billions of dollars.. cost vs reward.

Now what I keep telling you is the amount of unearthed gold compared to what is traded DAILY COMEX is completely fabricated. Banks borrow gold from each other 100 vs 1 . I said re-hypothecation for a reason. It's real. Now bitcoin does not have re-hypothecation (yet). In fact, anyone hoping for 25K Bitcoin or 100K Bitcoin or 1 Million K bitcoin has a lot more worrying to do. You think broke governments won't get all up in there? Of course they will.

Why did governments get RID of the gold standard to begin with.. (they didn't have enough of it). You think they have enough of it now? Or is it easier to control with manipulation. I do not think we are going back onto a gold standard.. in fact the future is digital (assuming we don't EMP ourselves).

Gold is here to stay..

Bitcoin is still a baby..

Both are speculative assets and have positives and negatives to them both. Bitcoin is just so young; you haven't seen the negatives yet.

Peter doesn’t realize that Bitcoin and the blockchain are a separate financial system. We may have fiat on and off ramps but they are not one in the same. Now when we get unsecured credit in Bitcoin with zero money down we can talk about bubble. But that will probably never happen.

Posted Using LeoFinance Beta

Exactly right. It's an entire monetary system.

Every court needs a jester.

Posted Using LeoFinance Beta

Schiff acts the way he does because he sells gold on his websites (and makes a healthy commission).

The sad truth is people actually listen to what he says. His calls for $5,000 gold is now about a decade old. He said to buy gold instead of stocks in 2010, something that didnt work out so well.

Of course, the case with Gold versus Bitcoin is much worse.

Posted Using LeoFinance Beta

To be fair gold has outperformed S&P500 since 2000. It just had that nasty correction from 2011 till 2016.

I believe this recent gold bull is just getting started but will never put 100% of investments in one area.

Posted Using LeoFinance Beta

Um... say what?

https://datatrekresearch.com/gold-vs-sp-500-tesla-qqq/

"Since 1990: gold lags the S&P, +357% vs. 831%, both on a price basis

Since 2000: gold beats stocks by a wide margin, +560% vs. +124%

Since 2010: gold hasn’t been great vs. stocks, +65% vs. +195%

Over the last year: gold trounces stocks, +22% vs. +8%"

Peter Schiff's main problem is being focused on one asset class... I guess from his stand point it makes sense since he is in the business of gold selling.

Gold and silver have there place in a portfolio just like stocks, bonds, real estate, etc.

Will bitcoin and other cryptos outperform... I believe so. Should every investor fomo 100% into digital currencies.. no.

Posted Using LeoFinance Beta