March has historically been one of the worst performing months for Bitcoin, but that trend may not hold this year...

If you do a quick google of seasonality returns and bitcoin you will quickly see that March is one of the worst months for bitcoin in terms of returns.

It's not THE worst month, but it's up there. It basically depends on how you define "worst" and which inputs you include or don't include.

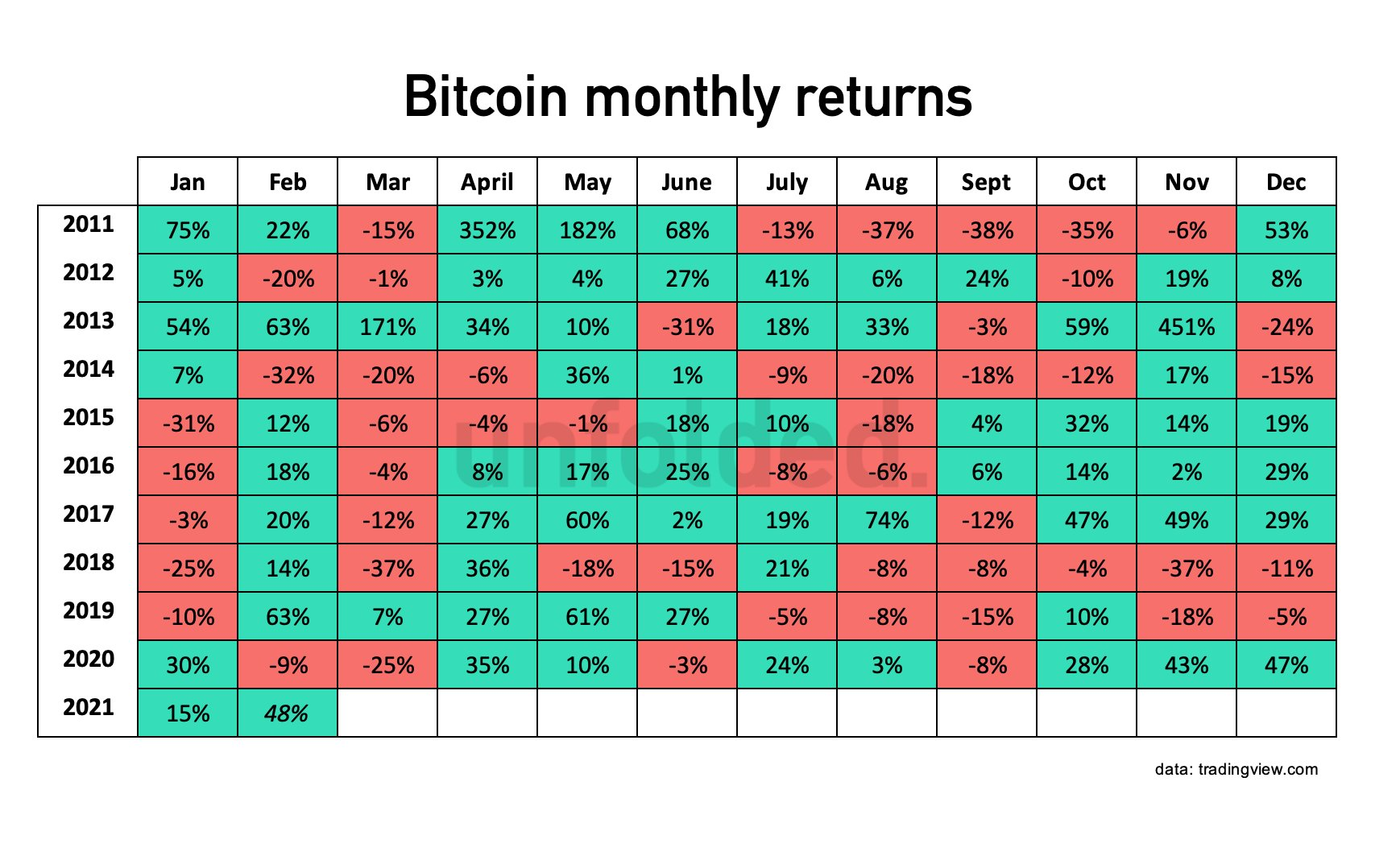

Here's a basic chart of the monthly returns in bitcoin going back to 2011:

(Source: https://ambcrypto.com/heres-why-march-2021-wont-see-bitcoin-dip/)

As you can see, strictly from a red/green perspective and not taking actual numbers into account, you can quickly see that March tends to be a red month far more often than a green month.

In fact, it's only been a green month 2 times going all the way back to 2011.

As you might have guessed, no other month has that many red months over that same time period...

What gives?

The long and short of why March is often one of the worst month in terms of bitcoin returns is likely related to taxes.

With the tax deadline being April 15th, many investors are forced to sell some of their bitcoin and crypto holdings in order to come up with the fiat dollars to pay their taxes.

Interestingly enough, when we look at where we currently, which is the year after a halving event, we can see that one of those green months just so happened to also occur the year after a halving event, that being 2013.

The other 1 year after halving period was 2017, and bitcoin saw negative 12% returns during that month.

Taking those two into account, it looks our odds of having a positive March is about 1 out of 2.

However, that has nothing to do with why I don't think March is going to be bad for bitcoin...

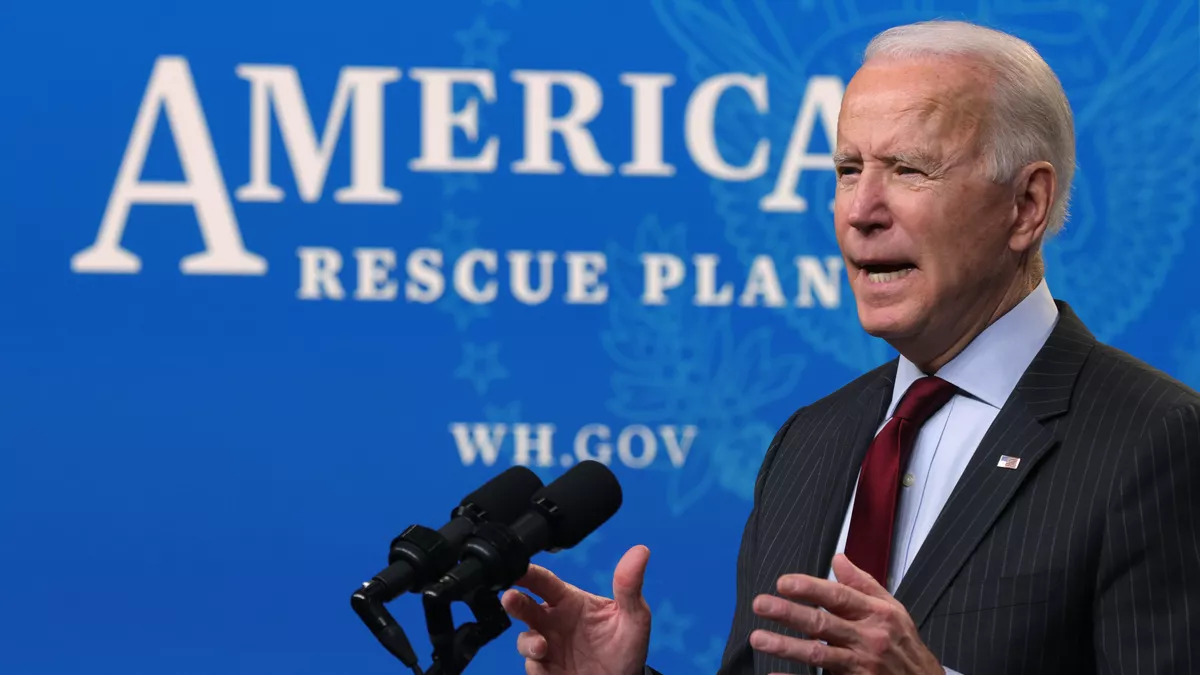

Stimulus Stimulus Stimulus!

The main reason why I don't think bitcoin will have a bad March has to do with stimulus.

As it stands now, the democrats are steadfast on pushing through a roughly $1.9 trillion dollar covid stimulus bill via budget reconciliation.

It will include $1400 checks for qualifying adults and children as well as $400 federal unemployment benefits going through August.

The plan is to get this done prior to the previous unemployment benefits expiring, which just so happens to be mid-March...

While there is no guarantee this bill actually passes, though the odds do look pretty good at this point, this amount of money coming out in the middle to late March will likely send asset prices soaring.

Retail would receive their biggest benefit to date in terms of free money from the government, and there is a very good chance at lest some of that money finds its way into stocks and bitcoin/crypto.

So, while March has historically been a weak month most likely due to taxes, this year the government may be injecting a ton of cash into the system right about the time it's usually leaving.

Add it all up, and there's a pretty decent chance that March ends up not being that bad of a month for bitcoin.

That being said, it really sets up for an awesome April-June, which are historically awesome months for bitcoin.

March is all going to depend on stimulus...

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

nah it will be scary, 30k i think. easier to go to 30k and back to 60k than from 60k to 100k yet same money made. Get ready for the Bitcoin is dead memes. Dead at 30k LMAO.

Considering we are already 25% below the highs to start the month and more stimulus is likely on the way, that doesn't seem likely to me. Also a drop to $30k would be larger than any drop back in 2017 in percentage terms.

yeah im not sure it will go back to 30k but if it does i won't be surprised.

Yea I'm starting to think the lows are probably in for this recent pullback. :)

I'm not sure who doesn't qualify for this stimulus, but as strange as it may sound, maybe it will be used to reduce the amount of fiat needed to cover for tax payments, thus less crypto selling pressure to pay taxes.

Posted Using LeoFinance Beta

It also depends on where you start the month from, in this case it looks like the lower 40k area, which is already ~25% off the top. With all the increasingly stronger underlying buying pressure opposite the shrinking supply, it's tough to imagine things going much lower. It could end up being a "wash" - a month's worth of sideways trading within a humongous range? With a panic sell to 30k included? Possible to likely?

Edit: From a technical viewpoint, a panic to 30k is not very likely, but that never rules it out . . .

A touch on the moving average and a bounce would be hugely bullish. But, there are 900 coins being minted a day. At $45k that's $40M/day, $280M/week that "potentially" have to be gobbled up. Obviously not all (if any) is hitting the market but....it's still either being accumulated by miners who will have to sell some at some point, or it's being accumulated by institutions who then aren't actually buying on the open market. Either way, that number grows the higher it goes so...we might stick around these levels for a while.

Posted Using LeoFinance Beta

Great point! Since we are entering the month already down 25% or so, it's going to tough to have a bad month. We are already off to a great start today!

Great information to build on and

Prepare for what to come.

How about Hive? It will be our anniversary

From the debacle.

That Bitcoin monthly returns chart is pretty, haven't seen that before.

Here's to an ok march and hopefully a green April, may, june, july!

Posted Using LeoFinance Beta

Yep, I am thinking May-July is going to be epic for bitcoin and altcoins. A couple dollars may be coming for ol HIVE...

There are already loans where the collateral is bitcoin and they lend you dollars, this month may not be so bad

Posted Using LeoFinance Beta

Great point! That likely does minimize the impact of tax related selling on the price of bitcoin compared with previous years.

This year feels different.

With all of the institutional money pouring into BTC and the stimulus, crypto has to be the better option to hedge wealth.

Posted Using LeoFinance Beta

A year ago, Bitcoin went $3k level. That's before pandemic. Hoping it won't go the same this year.

Posted Using LeoFinance Beta

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

The market usually does the opposite of what people expect. This year, everyone's sharing how bloody March always was and that's why I think it will go a different way this time. Let's get the bull going!

Posted Using LeoFinance Beta