As I am nearing my first full year deeply engaged in the world of cryptocurrencies, blockchain technologies, and token economies, I am reflecting back to what started this astonishing journey of exploration. Back in August of last year I bought my first token, a stablecoin called UST and deposited it in Anchor Protocol. This single event kicked off a whirlwind of discovery that has taken me into studying and trying out hundreds of protocols, dApps, and blockchain tools.

Not So Stable After All

Even though I had already diversified and traveled far beyond the borders of the Terra ecosystem, it was still shocking to see the sheer speed with which such an enormous ship could snap its anchor and crash into the depths. I was more fortunate than others, in terms of being able to cover the losses with profits made from UST yields in Anchor earlier; however, the entire event was an eye-opening experience. It was exhausting and I needed a breather after those tumultuous events in May and June, triggered by the de-pegging vortex in the Terra ecosystem. I made a decision to stay away from these poorly named and not so stable tokens!

Predictable Utility Tokens

I tried and tried, weeks led to nearly two months, learning and engaging with protocols, without using a single stable token. I used governance tokens from busy blockchains as a form of currency, just to avoid using the pegged tokens. After burning many precious ATOM, JUNO, and OSMO tokens in the Cosmos and ETH in Ethereum, I finally realized that this was not a workable strategy and the use cases for a stable token are enticing, after all.

Here is why:

- Volatile tokens require constant repricing of other digital assets bought with them.

- Constantly re-calculating your entry, holding, and exit prices is a pain-in-the-neck.

- Many governance tokens do not travel across blockchains very well.

- The apex governance tokens that are represented well from one blockchain ecosystem to another, incur substantial amounts of gas fees to move them.

- Some of these governance tokens are investment quality and spending them for network fees or swap fees is simply painful.

I came to the conclusion again that we need tokens that have the following characteristics:

- Limited to no volatility in their price.

- Readily transferable from our home country’s or preferred fiat currency.

- Easily purchased and traded on all decentralized exchanges in the ecosystem.

- Used for settlement in finance and business.

- Function as transactional money (many times faster than fiat).

- Accepted as payment for transactions across many or all dApps in the ecosystem.

- Serve as a reference value or standard denomination against all other tokens.

- Used as an example to educate new users in the concepts of blockchain technology.

In other words, I have come full circle and realized that we do need widely accepted utility stable tokens! Being actively engaged in the Cosmos ecosystem, I studied what is currently in circulation and what is being developed to fit these characteristics and challenge the incumbents.

Tokens Currently in Circulation across the Cosmos

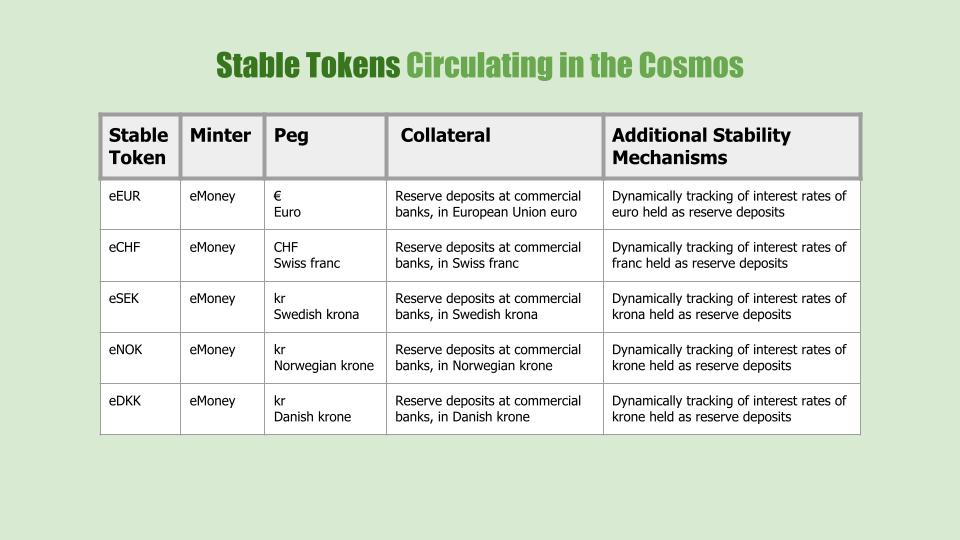

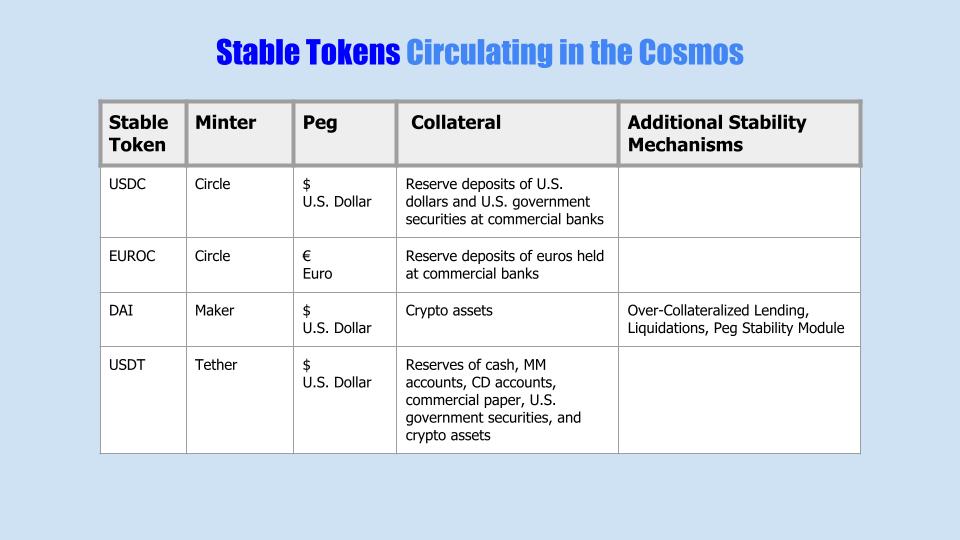

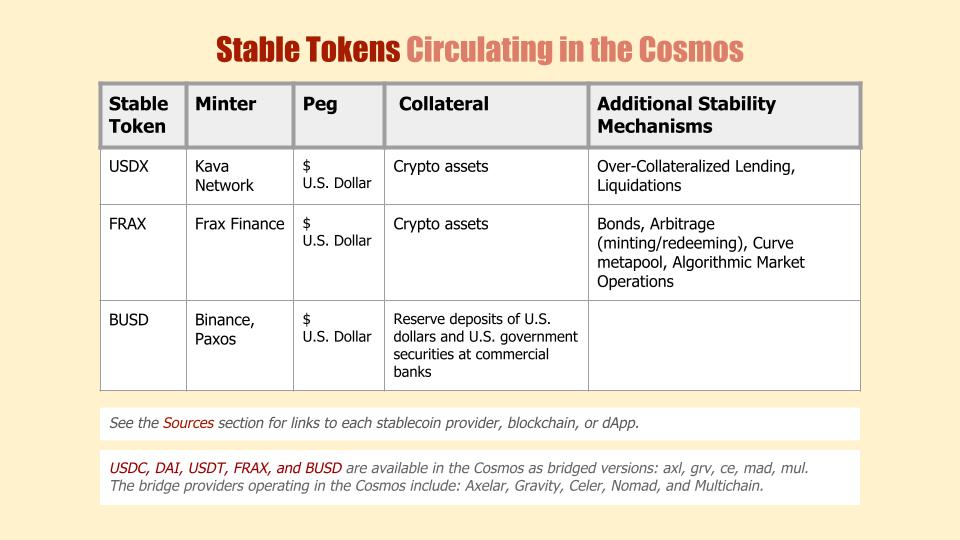

The stable token giants of the Ethereum ecosystem quickly took advantage of the vacuum left behind after UST fell from a dollar to mere pennies. Circle’s offering, USDC, charged to the top of the charts and became the stable token of choice for the vast majority of Cosmonauts. Maker’s DAI, Tether’s USDT, eMoney’s eEUR, Kava’s USDX, Binance’s BUSD, and Frax Finance’s FRAX brought up the rear, but most users sought refuge in USDC during the neck snapping market downturn that marked the months of May and June.

In the tables below, I compare these stable tokens, across several characteristics. Links to the web sites for these stable coin issuers are in the Sources section, at the end of this article.

These stable tokens can be traded at the decentralized exchanges and aggregators across the Cosmos, including:

New Tokens Under Development in the Cosmos

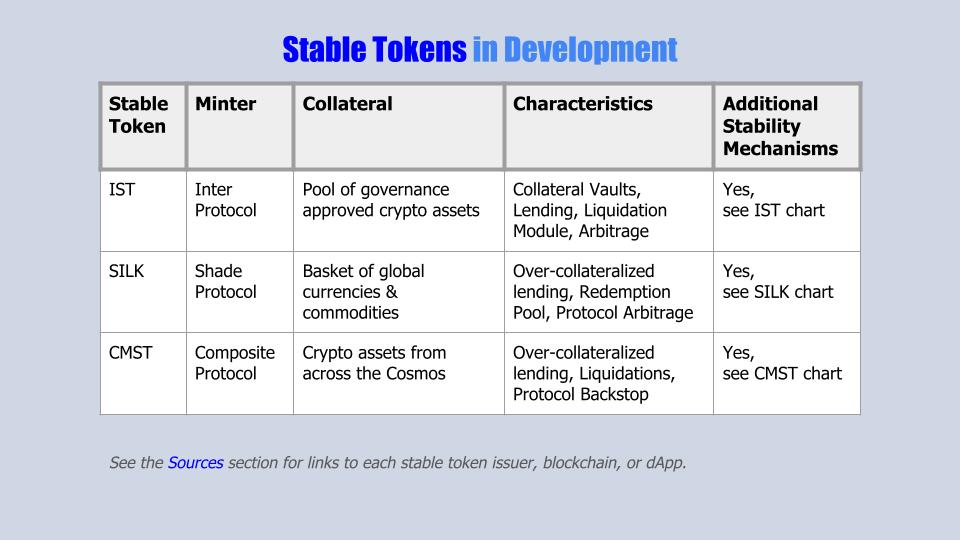

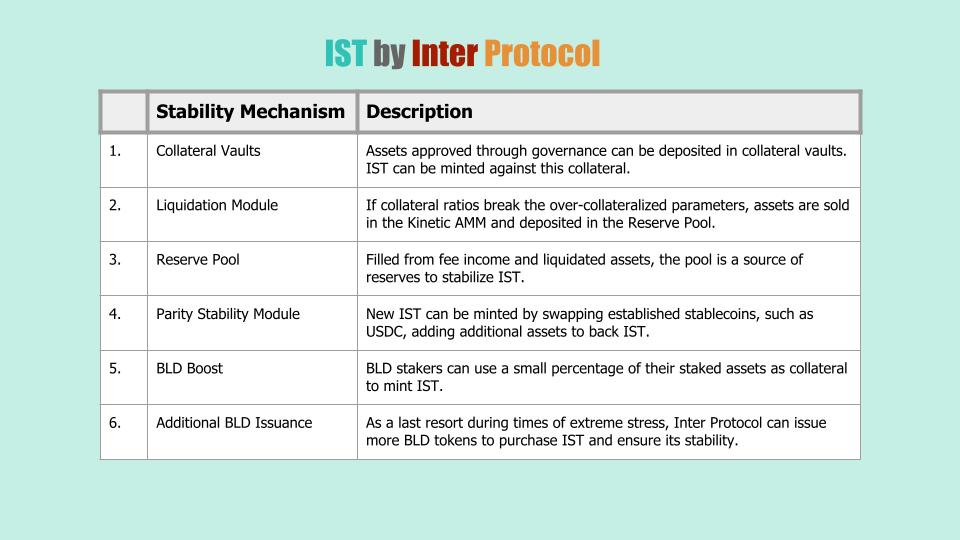

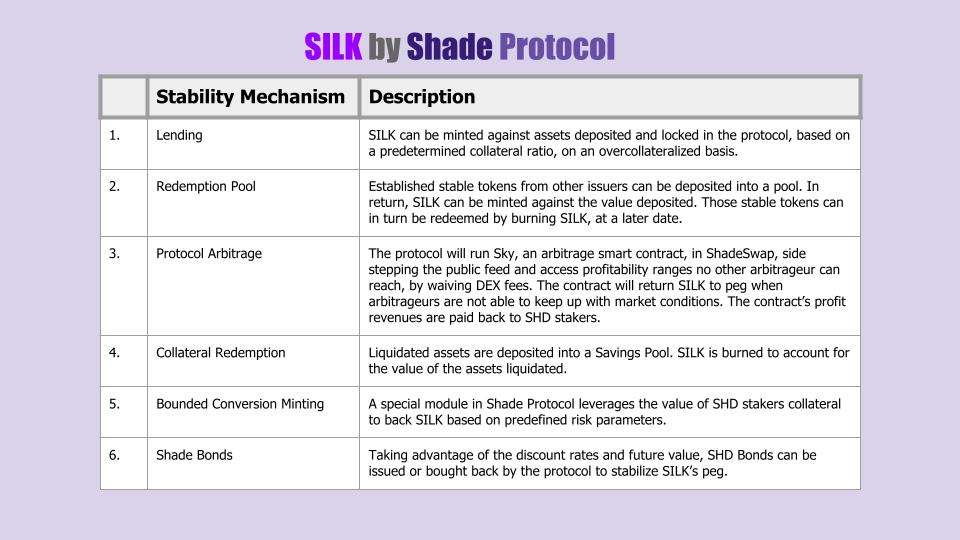

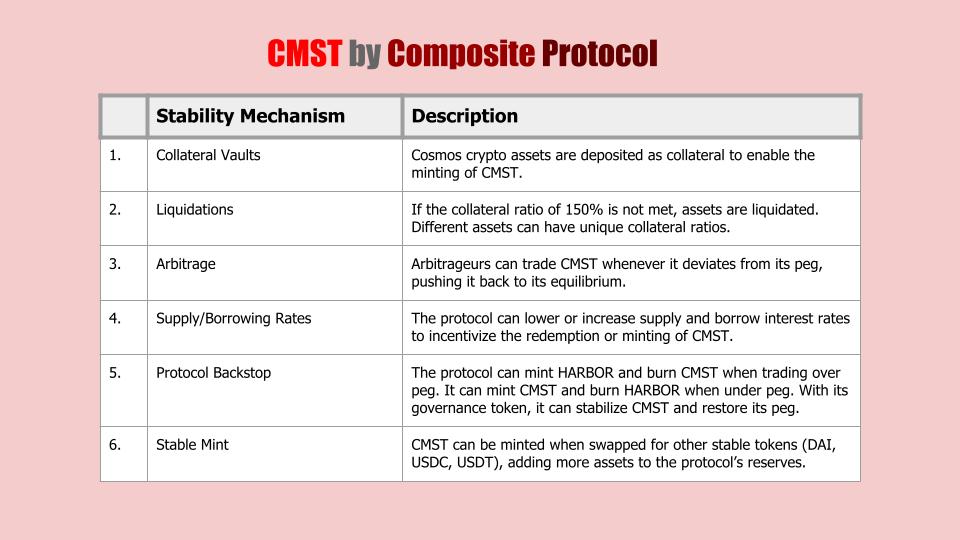

Three exciting native stable tokens are nearing their unveiling in the Cosmos. It appears that their launches were delayed due to the events in Terra and the subsequent market turmoil. Using the events of the past couple of months to fine tune the mechanics of these new stable tokens is simply smart.

In the tables below, I delve deeper into what the Inter, Shade, and Composite protocols have in store for us. I have also provided links to each project’s website, blog, a couple of video channels, and articles I have written previously, in the Sources section.

Utility, but not Stability!

An abrupt ending of calamitous proportions notwithstanding, Terra’s UST token worked very well as a utility token in its ecosystem. Until that fateful weekend in early May, transactions were all denominated and valued based on one dollar equivalent. Processing was blisteringly fast, super easy, and consistent across more than a hundred different dApps. The tokens were easily transferable and onboarded quickly and inexpensively.

Clearly, this particular algorithmic “stable” token turned out to be as steady as the Titanic in the Northern Atlantic; yet, the aforementioned characteristics and functionalities of a utility stable token are exactly what a vibrant ecosystem like the Cosmos needs.

Native Stable Tokens in the Cosmos

With a fully collateralized backing and multiple stability mechanisms, new entrants like IST, SILK, and CMST can fulfill the promise of a true transactional multi-purpose token. Once in circulation, I will add these tokens to my portfolio and begin experimenting with them. I will also continue to diversify my portfolio of stable tokens and report back later as to how well they fared and what my experiences were. In addition to the tokens discussed here, another stable token, ULTRA, is being developed and it is expected to launch on the Juno Network in the near future. There is not enough information available to evaluate it, at this time; however, I will delve into it when more details are released.

I am cautiously optimistic that the new decentralized stable tokens about to launch in the Cosmos will provide the levels of utility that can usher in a new wave of transactional efficiencies. Personally, I believe that properly managed stable tokens will be a critical element to onboarding the next generation of Cosmonauts!

Het avontuur gaat door – Opa.

Sources, References, and Further Reading

Agoric – https://agoric.com/

Agoric Twitter – @agoric

Inter Protocol Twitter - @inter_protocol

Agoric Blog - https://agoric.com/blog/

Inter Protocol Whitepaper Draft - https://agoric.com/wp-content/uploads/2022/05/Draft-Inter-Protocol-Whitepaper-v0.9-1.pdf

My first article introducing Agoric: https://medium.com/coinmonks/the-future-is-built-on-javascript-with-agoric-systems-c7fdecb876b2

My second article examining the Agoric economy: https://medium.com/coinmonks/crafting-an-inter-chain-economy-with-agoric-74b74b3052c

Shade Protocol - https://shadeprotocol.io/

Shade Twitter - @Shade_Protocol

Silk Twitter - @Silk_Stable

Shade Whitepaper - https://shadeprotocol.io/pdf/Shade_Protocol_Whitepaper.pdf

Silk Whitepaper - https://shadeprotocol.io/pdf/Silk_Whitepaper.pdf

Shade Blog - https://medium.com/@shadeprotocoldevs

House of Shade YouTube Channel - https://www.youtube.com/channel/UCCK9tPCUf7HNFgg7P1lJd3Q

Comdex - https://comdex.one/

Comdex Twitter - @ComdexOfficial

Composite Money Twitter - @Composite_Money

Comdex Blog - https://blog.comdex.one/

Medium article “Introducing Composite: A Collateralized Stablecoin for IBC” - https://blog.comdex.one/introducing-composite-a-collateralized-stablecoin-for-ibc-bc76e15fa2ec

Comdex YouTube Channel - https://www.youtube.com/c/ComdexOfficial/featured

e-Money - https://e-money.com/

Circle - https://www.circle.com/en/usdc

Maker DAO - https://makerdao.com/en/

Tether - https://tether.to/en/

Binance - https://www.binance.com/en

Paxos - https://paxos.com/stablecoin-and-payments/#

Frax - https://frax.finance/

You can find me here:

Twitter - @KaasKop_Opa

Medium - https://medium.com/@KaasKop_Opa

Loop - https://www.loop.markets/user/52879

Leo Finance - https://leofinance.io/@kaaskop

Posted Using LeoFinance Beta

Really interesting write up! We see stablecoins as the future of commerce as a whole, but it will just take some time. UShiT, as I like to call it, is a serious skid mark on my portfolio for sure.

You should go give @carbonzerozone a follow! They are a Cosmos ecosystem validator that donates some of their comms to planting trees. They are actively posting on Hive and trying to find ways to bridge Cosmos and Hive together.

Congratulations @kaaskop! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!