photo source Canva

Sparkpook Ethereum's largest staker goes public to prevent EIP - 1559

Smaller stakers side with Sparkpools stance

F2Pool endorces EIP-1559

Ethereum's future put at risk

Ethereum's future put at risk

Ethereum's transition has hit a rocky patch as the largest staking pools equating to 50% of Hash power battle it out over the EIP-1559 proposal which was Ethereum's attempt to bring mining fees down.

In summary Ethereum's EIP-1559 removed mining fees by implementing a burn on transaction fees which would be used to reward stakers for securing the network.

But with mining revenue reaching $US600 million in the month of February Source alone many are moving to prevent the transition.

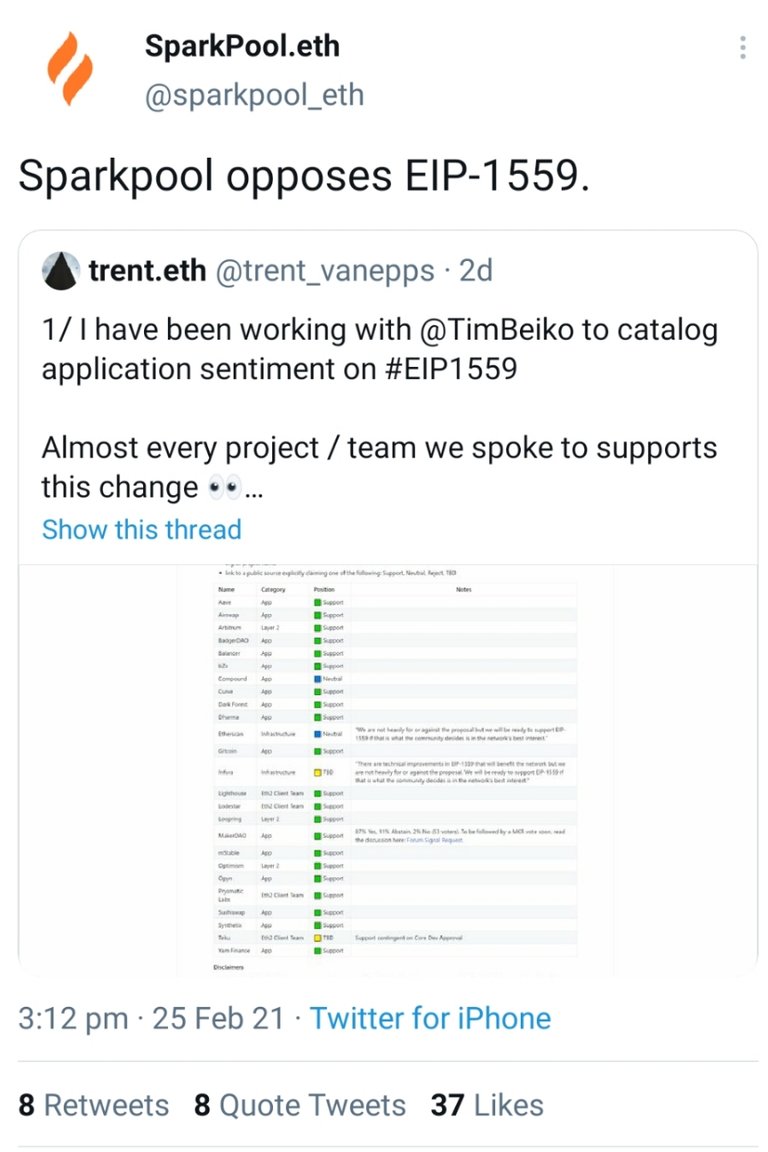

Sparkpool went public to gather support against EIP-1559 in a tweet that can be seen Here in a move that saw a number of stakers join their call. They believe the change will cost miners out and destroy Ethereum and turn investors away.

F2Pool has countered in an article and endorsed the transition which can be read Here

Price Impact

The broader community has spoke and mining fees are a concern to many ERC20 users and investors which are also limiting new projects. As factions emerge surrounding the future of Ethereum it will no doubt have damaging impacts on Ethereums price.

We've already seen investors flock to Binance to escape fees and Polkadot continues to draw in larger trading volumes daily with the latest Ethereum fee boom seeing hordes of investors dump Ethereum.

Opinion

My opinion is that if Sparkpool Ethereums largest staker is successful in fighting off the EIP-1559 which was developed by Ethereum's creator Vitalik Buterin to transition the network and provide market stability then Ethereum is as good as gone.

What are your thoughts?

Posted Using LeoFinance Beta

Another hardfork will solve it.

Posted Using LeoFinance Beta

Yup and another Ethereum token is created, everytime a fork is created it weakens the position.

Investors don't know what's what, Polkadot has a better solution to this..

Posted Using LeoFinance Beta

On the other hand, so many Bitcoin hardforks happened already and they didn't really make BTC's position weaker at all.

Posted Using LeoFinance Beta

!ENGAGE 25

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

ENGAGEtokens.Is it not in Sparkpools interest that the entire Ethereum network stays put? If the creator is saying something, I feel it should be in the favour of the network and not otherwise. And if they so have all that support, why don't they break off into another chain, why dismantle the entire network when forks could be carried out

Posted Using LeoFinance Beta

Yup it is, they want to continue mining to take the profits, however the broader community (userbase) has rejected high fees.

It will be interesting to see how this pans out.

!WINE

Posted Using LeoFinance Beta

Congratulations, @melbourneswest You Successfully Shared 0.100 WINE With @enison1.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/3 Successful Calls.

Total Purchase : 20548.377 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 1.200 HIVE

Looks like polkadot might just kill ETH the way things are going. I'm thinking of switching my ETH away to DOT.

It appears a number of others are doing that today, polkadot volume has gone up as has its price.

ERC20 is still down and Binance is up

Posted Using LeoFinance Beta

!WINE

Posted Using LeoFinance Beta

Congratulations, @melbourneswest You Successfully Shared 0.200 WINE With @charcoalbuffet.

You Earned 0.200 WINE As Curation Reward.

You Utilized 2/3 Successful Calls.

Total Purchase : 20548.377 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 1.200 HIVE

if you are the largest pool and having a large amount of stake, then its easy for them to oppose the way which prevent them from having more money.

but for longer term it might not be good for them. if they were abandon by the user, the higher fee means nothing.

anyway that just a new person thought. don't really understand how things works there, but the fee is just too much

Posted Using LeoFinance Beta