I’ve been in this space since 2017. This will be my third bull market.

I’m not much of a gambler anymore. I hold the coins I understand well and fully believe in. I’ve given up on altcoins, not because i think there are no other good projects, but what could be better than Hive and Leo for me? They are the two coins I am following most closely and understand the best because I am part of the community.

As for the wider crypomarket, and most importantly bitcoin, You get better at understanding the socioeconomic temperature after years in the crypto space, especially when you start to watch how the macro envrionment effects the crypto industry.

I definetly can’t definitey predict how things will turn out, no one can, but I think I am getting better at predicted the range of possibilities and which are more likely.

The 4 year cycle is like nature, but how it plays out is different every time, and I see an overarching pattern forming.

There is only so much bitcoin can grow before it becomes the ultimate store of value or crashes and burns suddenly due to some unforseen exploit (I’ve heard of a few potential ones but the most concerning of them are decades away at least).

But is the world ready for a bitcoin standard?

It’s getting there, but usually we start to dip our toes in an idea for 4-8 years before it becomes reality. I think we are 1.5 to 2 cycles away from bitcoin being widely accepted as a store of value similar to gold. There are many who aready recognoze it as such but still many many who do not.

There are a few things I don’t think most people realize about this cycle:

The market cap of bitcoin is still much smaler than it could be and likely will be but it’s already very big and so it is much harder to move in terms of %. At some point volatility will decrease. That doesn’t mean it won’t go up to an exciting degree, but the things that cause it to move to that extent will have to be much bigger. Luckily we have many things like that.

Bitcoins scarcity is REAL and we are going to start feeling it more and more as nation states and institutions start buying on a massive scale. This doesn’t mean it will reach $1 million tomorrow.

More institutions than we previously imagined are already holding bitcoin. Whenever Blackrock buys, that bitcoin is flowing to custodial accounts of things like state pensions and high-net-worth individuals. The institutions are already more onboard than we realized. They will continue to double down, but we already feel a lot of the buying pressure of the second wave. This bull market will be the second half of that second wave. The first half was too smart to be noticed.

British pension funds, Michigan state pension fund, the country of Bhutan have all been caught with bitcoin. We will continue to learn of these things after the fact. So whenever the price pumps, thats someone big getitng in a few months before they go public. The price is too high for regular retail to move at this point.

BTC will rise due to institutions from now on, not retail. Retail is going to end up buying custodial bitcoin which won’t move the price unless the custodians can’t keep up with their buying habits. A lot of what the hedge funds are buying now will become what retail ends up buying so retail wonnt move the price as much.

A large portion of thr population has been fed narratives that bitcoin is useless or evil. A lot of people lost money because they didn’t know what they were doing and got played. Bitcoin and crypro will be adopted by thr masses but the first moves and early adopters and some of the early majority are already here, a lot of those remaining could end up adopting bitcoin and crypto through their financial advisors, through apps that don’t even feel like blockchain, or they are going to have some financial insecurity (hyper inflation, locked bank accounts, bank collapse, etc.).And some will never get onboard.

For this reason I don’t expect the same level if societal wide hype as 2017 or 2021. As the price rises, the hype becomes less extreme. If i see crazy hype, im selling asap.

Institutions are thinking of BTC in terms pf USD and anyone who hasn’t bought BTC already has a very different concept of it’s value than those of us who have been here a while. They’ll invest millions when millions can only buy a few dozen bitcoin and that will be normal to them. A billion dollar investment is where the market starts to react quickly now. Soon it will take 10 billon to shake up the market.

At some point the cycles will become so smoothed out they’ll resemble the current of ocean on a regular evening. I wonder if we might get a much smaller and earlier blow off top this time around, followed by a very muted bear market.

I do think there will be FOMO but it’ll be all the institutions who were on the fence and realized theyre already late to the party. It’ll be nation states that are waiting to see what the superpowers do. It’ll be Warren Buffet with Apple. Not too late, but unnecessarily late.

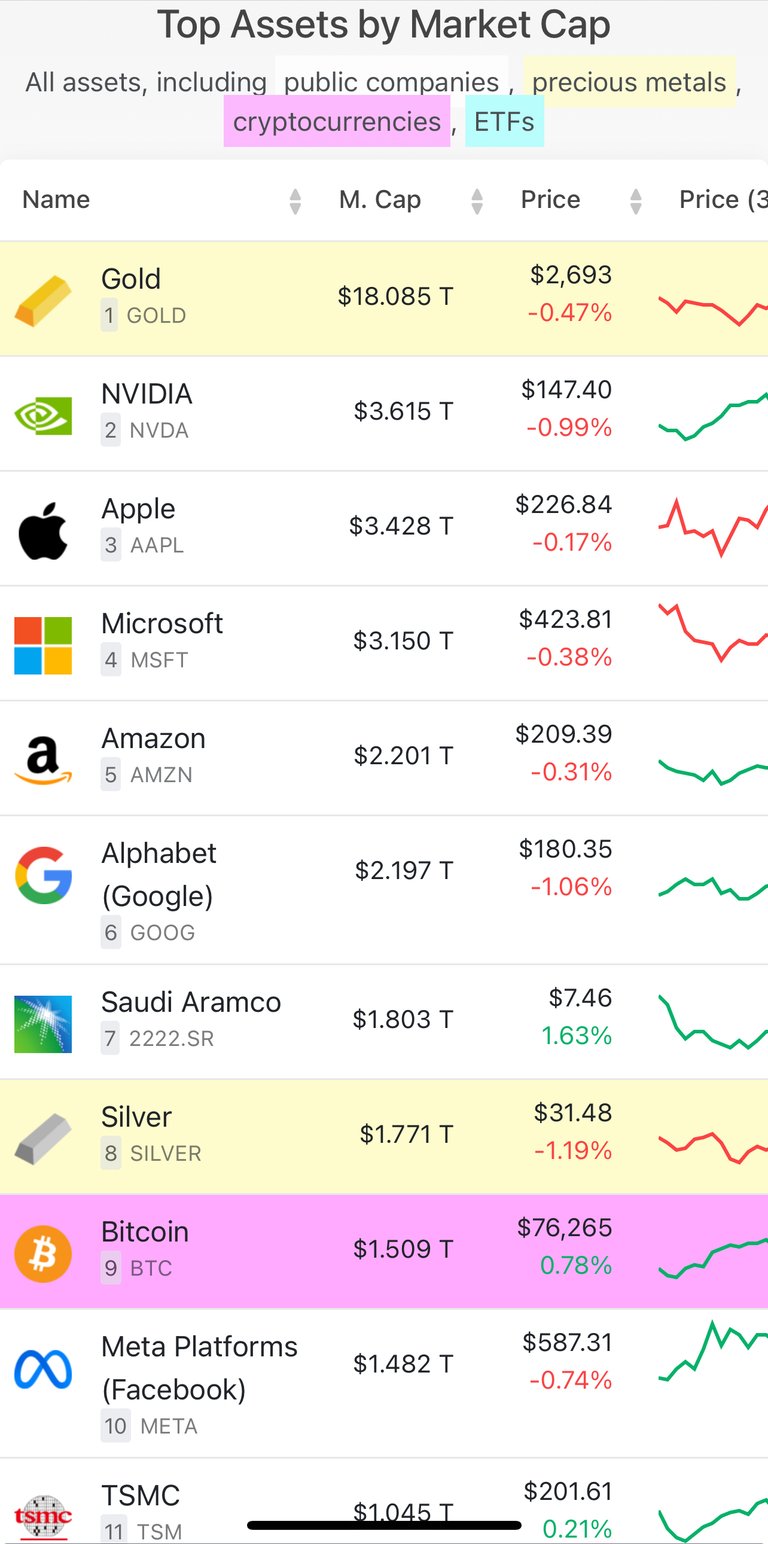

I do not think bitcoin will reach the market cap of gold this cycle. It would have to explode much much more than it has in the past two cycles. 15x’s are likely a thing of the past unless the USD conpletely collapses.

I imagine it will take at least another 6-8 years for bitcoin to reach the price of gold, maybe 12.

I hear people talking about $200k bitcoin. I think it’ll be more or less than this, partly because everyone is expecting it and party because of the trajectory of bitcoin matching goldnin the next few years.

I am guessing $150k BTC if anything unfavorable happens and 300k otherwise. If BTC reaches 150k, we will see $300-500k next cycle and 1 million the cycle after that. If bitcoin hits 300k, we might get to 1 million dollar bitcoin in under 5 years.

The former seems more likely if you don’t account for inflation and a supply shock. I think in the end, the latter is more likely due to currency debasement.

The USD will likely remain strong compared to other fiat currencies but increasingly weak in comparison to other assets, including bitcoin. And so we may get $1 million dollar bitcoin in 5 years but it could be worth a half a million today. That would be around 20 Trillion USD, the price of gold today. Bitcoin could either overtake gold then and there or Gold will double in value due to economic uncertainty and the next cycle (8 years later) will be about catching up to gold.

I am just a random dude with no expertise in any of this. I just make observations and this feels like it fits the overall pattern of everything I’ve seen.

Should be fun to watch!

—-

I just learned that YouTube gives my channel a bigger boost when people search for it and watch rather than watching from a link. I would really appreciate it if you could search “Untangled Knots” and watch and like the most recent shorts, esepcially if you are interested in cuktural differences, mental health, philosophy and all that! All support is super ultra appreciated!!!!

Posted Using InLeo Alpha

To me the bull run just start bought some btc at 44k sold some of it ,regretting it right now but like my brother use to say their is not wrong time to sell your coins as long as you make some profit or breakeven ,I believe the position of trump in the bitcoin space will still have more impact more than what we’ve seen or imagine

I bought at around 6k and still hodling. It wasn’t much at all but now it’s a meaningful emergency fund. I hope to take out some profits this time and buy a new computer, new guitar and maybe even move to an apartment that feels like a real home instead of this shoe box!

6k now at 81 ,investing early will always bring yield more profit ,this is why am still looking at ton coin trading at 5$

Thanks for sharing. Good points. Agree with you on the price-timeframe. My prediction is more or less the same: 150-200k Bitcoin this cycle, 500k next one and the one afterwards the 1M USD for one coin.

this seems like the most reasonable prediction but I think inflation of asset prices hastening it is becoming more and more likely. I think we will know by the end of next year.

Bitcoin has demonstrated its strength and stability over time. Sooner or later it will beat gold. I wonder how the new economic system be where BTC would be the standard

I think a bitcoin standard recognized by everyone is still 15-20 years away but we will be able to see it more clearly in maybe 5 years. Jeff Booth says it will cause prices to go down forever. He claims that even if we earn less money, we will be able to get more for our money because “prices always fall to the cost of production”.

I think he’s right about BTC but it definitely won’t be a fast or smooth transition and who knows how regulations and other coins besides bitcoin will affect things.

I am not sure how the BTC standard will facilitate price to go down. 🤔

basically prices naturally would go down from competition forever (if you believe free markets work, I kind of do and kind of don’t) and they should be now but because inflation we feel things getting more expensive

Check out Jeff booth. I like his arguments although I think free markets lead to monopolies, but controlled markets seem to do the same and worse so Iduno 🙃

!LOLZ. I don't know either.

Honestly speaking, I feel like skeptical about everything.

I believe anything can be used for monopolies and selfish interests dpending on who holds the power

lolztoken.com

Because his paint was running.

Credit: reddit

@selfhelp4trolls, I sent you an $LOLZ on behalf of amberkashif

(1/1)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

right? I understand 🤣 it’s an interesting theory on btc thoguh!

Of course it is a fact that when we hold coins it takes a long time but a profit must be made, that's why we are now seeing that those who held Bitcoin are making a good profit. So we should always cash the profit.