I had a training session that I was able to finish 30 minutes early, as the people I was training went through faster than I expected. That sounds pretty early, but it was a seven hour session. It is hard to time such long sessions, especially when the proficiency of participants is somewhat unknown and there is no way to predict what questions or complications will arise as the day progresses. Today it was nice, both participants from the same company were knowledgeable, engaged and willing to share screens and discuss a lot together, making the day far more interesting for me than having to lecture into the void.

It also meant that we could have some random conversations and both of them are looking at buying flats in or near London - or wherever they can afford. The problem is, they are both priced out of the market, as even if they can manage to get the deposit collected, they can't get the loan size as they don't earn enough to satisfy the banks. While I don't know what they each earn, they are both professionals and while young, shouldn't really have this much issue.

I was reading about the real estate situation in Australia, which keeps hitting new highs, but the people who can actually afford a house are decreasing, since the younger generations just can't get in. However, there are people at the other end of the scale that are buying investment properties. What is going to be interesting is that in time, the people with multiple apartments will eventually start kicking the bucket and if they do happen to have children to inherit them, the children are likely to offload them to cover their lifestyles.

Back at the GFC in 2008 and the next few years, there were complaints about "Russians buying all the summer cottages" without the factoring in of "Finns selling all of the summer cottages". There were media stories about how people were doing it tough and that is why they were selling, but this was only part of the story, as during that time, there was no decrease in the sale of luxury car brands.

What people were doing were selling their inheritances in order to keep their level of consumption. This is living now on the wealth generated in the past, but without replenishing that stock, the well will run dry. Finland never fully recovered from that recession and instead maintained lifestyle by increasing debt.

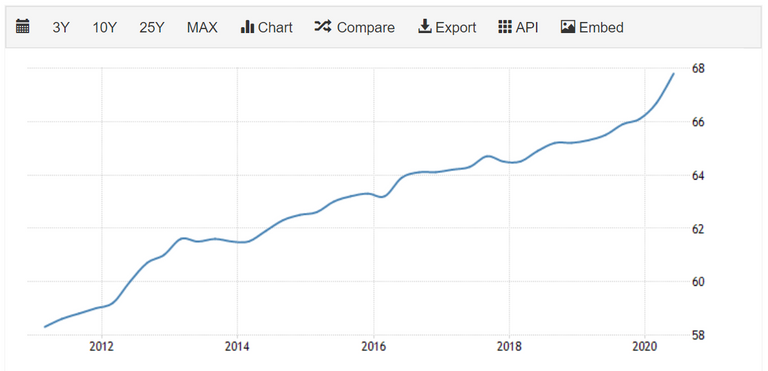

This is the 10 year chart on household debt in relation to GDP:

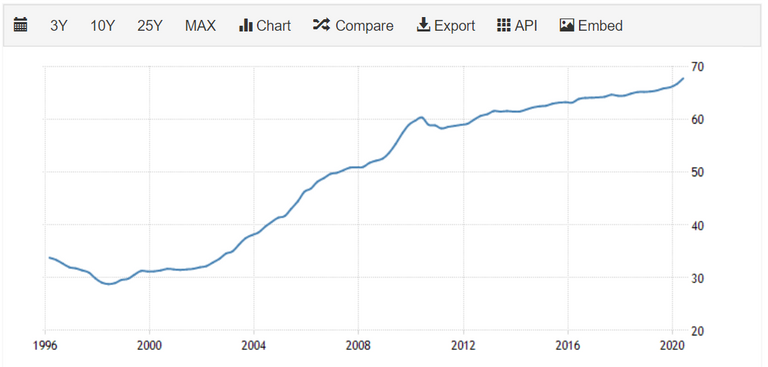

This is the 25 Year chart:

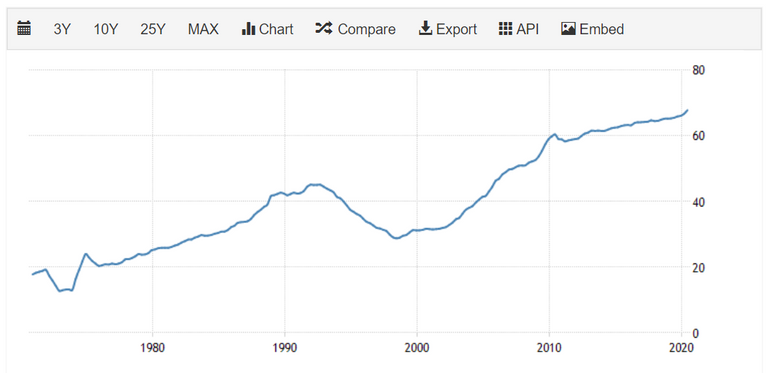

And the max available:

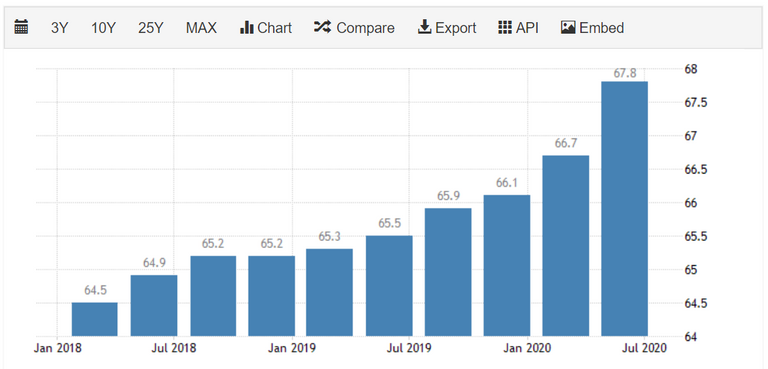

That means that debt against GDP has more than tripled since the 70s. But, what is interesting is that after the recession of the late 80s and early 90s, it was effectively reined in and almost halved, maybe as people suffered through and remembered tough times. It seems that the GFC from 2008 hardly made a blip on peoples debt extension pathways. And looking at the three year chart:

It looks like the trend is going to continue.

Not only have households taken on more debt, governments are extending their debt enormously too, with budget extensions on what are already deficit positions blowing out even further. What is also incredible is that while debt is mounting, there are news stories of sharemarkets hitting highs. This is interesting as while households are narrowing the gap in the debt to GDP ratios, the companies invested into keep growing in value. As GDP is made up of all expenditures of households,, businesses and governments - it is incredible that in a period when governments are spending the most, the increase in household debt is still closing the gap. Whichever way it is looked at, things don't add up to a healthy economy and the "great reset" seems imminent.

With so many pieces of the economy positioned to collapse, what is going to stop freefall? How much exposure does a person have when most are not only living in debt, but their government is taking on more and their retirement funds are investing into a market bubble poised to burst? How much crypto is enough to insulate against what is coming? I don't have enough by a longshot and even if I did, what kind of world will we be living in when the average person and family loses near everything?

But, this is an economy and the wealth is pooling somewhere, as we have seen when it comes to the mega rich clubs, where the last year has seen the largest percentage gains on average possibly ever. Wealth attracts wealth, but this indicates that the reverse is true and I think many of us already no this.

Debt attracts debt.

It has to be this way as wealth attracts wealth because it can be invested to passively earn, but that earning has to come from somewhere, which is often from the interest on debt and with debt increasing rapidly, those who are profiting from it will gain accordingly, while the indebted go in the other direction. Now, the governments have decided to increase the speed of wealth attraction, by borrowing heavily on the future, indebting their citizens for life - and the lives of the generations to come.

I feel like there has been a paradigm shift where the wealthy have given up even trying to pretend that the economy can work and instead, it is wholesale take all you can get no matter what happens to those who can't get anything. It is going to get challenging out there, in here - and everywhere.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Yes, I am afraid, I have to agree with you, @tarazkp. There is a debt-time-bomb ticking away. How much longer before...?

I have no idea when, as it keeps getting propped up by government debt extension - but eventually the music stops and the 99% have the seat ckicked out from under them. We are hanging ourselves.

The line just continues to get thicker between the rich and the poor, great analysis!

Thanks mate.

Definitely, yet people seem to focus their attention on a whole lot of useless.

People can also change their circumstance, it's those shiny objects and trends and a lot of social pressure (these days) that get people stuck in the debt trap.

I agree. I was just saying to @phusionphil below that fundamentally, economics is about behavior and we as a society are taking less responsibility for our own.

The friends I have in debt, got mad at me for explaining economics to them, they think economic words are political, so I guess there's nothing you can do for someone drowning and asking you to keep the air away from their lungs because that's scientific and and don't believe in science.

It is funny these days how common this is. While there is plenty of politics in economics today, people forget it is fundamentally about managing behavior. Personal behavior and then by extension, the dynamics of group behavior. Perhaps with the increasing unwillingness to take responsibility, behavior becomes more controllable by those who can predict it.

Although I have a feeling it's pure cognitive dissonance with conservative beliefs caused by the very extreme views the liberal populations are involving in politics about UBI.

There seems to be a common belief that people who need income support are victims, when in reality they are just poor and stupid, or poor and unable to access a market.

plenty of poor and stupid - it is the poor and unable to access a market that is an issue.

The polarization is a problem because people are forced into extreme habits in all areas - otherwise - they are "out of the group". There is safety in groups - everyone fails together.

In regards to groups. There is one that inherently demands the virtues of the individual be the most important in all life's engagements. Sadly the public eye, and fear of the unknown, have polluted the likes of Dharmatic Satanism, which originated in ancient India as a powerful source of individualism and self enlightenment.

The capitalistic system based on the debt we've been building for a long time will definitely have to end somewhere. Unless we will never charge positive interest rates anymore. Since the last decade financial institutions, governments and companies receive money when taking on debt. Most of it seems to flow towards stock markets (and asset markets). As in Australie, also properties in my tiny country the Netherlands is skyrocketing. Corona or no Corona, doesn't matter. The main reasons for the increase of property value: 1) foreign investors buying a lot of property, 2) long term interest rates are rock bottom allowing those who earn decent to good money, to pay more for the same (and better to buy something rather than putting the money in the bank with almost zero interest).

Any sound thinking persons can only conclude: This system must collabs. But I'm afraid, not so many people think that far into the future. All the people I try to discuss this topic with, say: "Time will tell. We had hard times in the past, and the wold always survived. We have this financial system for a long time, why will it collabs, the governments and financial institutions will not let that happen." It's almost funny to notice so many people are living in the same tunnel and not worry that the tunnel may have a dead end, or end up at places we all don't want to be.

Posted Using LeoFinance Beta

Would this mean that whenever cash comes in, it will go out to something just so it doesn't lose value? I see this is why the foreign investors are able to buy, as they can put it into something "solid" and owned, rather than leave it in the bank.

And the light at the end of the tunnel is a train.

I try to explain my view to people and most think I am crazy or a conspiracy theorist. It is interesting when economics is considered a conspiracy.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.No positive interest rates anymore means essentially borrowing money doesnt cost money therefore we can start borrowing limitless. Debts are increasing, but will not fly into endless debts due to interest. But when interest rates start to become positive again, suddenly all the debts are increasing by itself, without taking more loans. We may see collabs of economies when the central banks start using positive interest rates again. Nobody knows what this will mean, but in EU we already have more than 10 years of negative interests rates for short term debts. Now we see 10 year loans approaching zero interest rates as well. And more money flowing into the 'economy'... well, shares, governments, and rich peoples pockets.

One that is approach us, not driving in the same direction as we are waling. Its gonna be a huge 'bang'.

Many people I talk to, just dont want to believe. They dont understand that the 4th industrial revolution we are in, is gonna be life changing for humans, in relative short amount of time (decades). They say: Same they said about 1st, 2nd and 3rd industrial revolutions. General behaviour of people, dont want to think too much, and when they try, fall into the trap of taking the history to 'predict' the future. One statement they make regarding technology and automation: History shows that when we automate we take away jobs, but we also create jobs again, so no worries. They forget, in this industrial revolution we are at the start of, automation will take away jobs, whilst it will not create new jobs anymore, since AI will repair itself. But here is the problem: Many people don't understand what AI is. They don't understand what it means when we get Quantum Computing commercialy available and as small it can fit into our watch, or body. They don't understand what it means we do in bio-tech making advanced steps towards endless life (or at least extension of life with a fcator of 2 and more). Very interesting how this works. Recently, some of the people I talk with on all these topic already for as long as I know them, come back to me and say things like: "Recently watched a documentary, news items, and you are right edje, they said..."... slowely, very slowely I see people gettting similar information through other channels then my own mouth. I suppose, TV items have more value then the human word of a friend or family member :) But I'm happy the come to me with this information, since I can build on this further. Suddenly these people start believing my 'SyFy' stories, understanding my SyFy stories are more realistic then they expected before.

I don't really know my way around, I dare anyway.

Yesterday I overheard a conversation that was getting louder and louder. A boy wanted a toy. The mother said, I only have 20 euros. The boy begged for all he was worth. The mother said, you can stay here too. The boy said, I want this. The mother said, now you're about to get a slap on the face. In another day, I heard that the child asked relentlessly for an ice cream and the mother refused. And again, a father has said to his child, if he is not immediately quiet and well-behaved, he will be put in a bag by Santa Claus and taken away. As I then said, you mustn't say that to the little boy, he said, I don't know my way around at all. And then I have another experience, where the smoking mother did not allow the boy to ride the little merry-go-round, which was in front of the store. And if he continues to be so bad (because he was crying) then he doesn't get it at all and stays at home next time.

I think that none of this would have happened if there was basic income. It is also not at all compatible with a modern life with intelligent people and one should be ashamed of what we do to many families with their children. I mean, everything fits if the father has good income, even if the mother has good income. But if that's not so, then people suffer and especially children want yes the things that the other children can afford and then when it is not so, then it can sometimes, I think quite hurtful. Either absolute poverty with too "small pants with holes" or absolute poverty, which then go hand in hand with debt. And poor people are additionally burdened with higher interest rates by the banks. Maybe as an adult it's easier to deal with little money. Children don't. And on top of that they will ridiculed at school.

I think if we satisfy the basic needs of children, greed in adulthood will not be.

Maybe the consciousness of man turns something in this society because of Corona?

It is a cycle, but a basic income has to be earned in some way, otherwise it comes "too easily" and gets undervalued. What needs to really happen is that everyone has to start recognizing that ownership of a piece the economy is the only way to distribute the risk. This would mean less very high earners, but less very low earners. It takes time and a paradigm shift in mindset that most will not choose, because we live in an instant gratification world, and people want things they can't yet afford - so take on debt.

Posted Using LeoFinance Beta

Hello tarazkp :) Thank you for everything.

I don't think basic income should be earned in any way, it can never be too easy because I think life is anything but easy and I dare say many children perceive the world as very threatening and that often does not change anymore. And I don't mean that basic income would be undervalued. People would be happy and a great burden would be lifted from them. It would be a way that the girl, for example, would not have to be afraid at school and tears would come when the teacher would ask where they were on vacation and everyone was in Italy or at the seaside and the girl herself was at home because the parents did not have the money. And it would be a way to lower a little bit the pressure of education and the need to find a job would be lowered and one's own spirituality could be felt and one could do one's own things that would come from the depths of the self, where the person in school often cannot achieve this and often only paralyzes him and many children, with grade 3 or 4-6 are declared a non-achiever.

I also believe that everyone should have ownership of a piece of the economy, but to this it is often not enough and many people need help to have this. It doesn't help a little girl or a little boy much when people do realize things and think that owning a piece of the economy is the only way to distribute the risk, but there is just literally nothing left at the end of the month.

Maybe a lot of adults live in a world of instant gratification, children don't, they have to beg for everything and are often, I would say, rather rudely rejected. I think, the poverty of people, and by that I mean, moreover, the poverty of children, and moreover, the poverty of children where the parents are rich, should be stopped.

!ENGAGE 25

Thank you :))

ENGAGEtokens.Thank you :))

I agree. I don't know about Europe, but here in the US it is obvious our elites in government have abandoned any pretense of sense or planning for the future. They are just using the government to steal as much as they can possibly steal from American savers and taxpayers. Do you think with this whole "Great Reset" thing they will usher in a grand debt jubilee or something like that in a few years?

It is going to be a massive party where 0.1% of the population is invited and there will be much laughter and celebration. The 99.9 will see a reenactment of it on Netflix.

in my opinion it mostly because of lack of sound money, governments control supply of money, so they have much bigger possibilities for using this newly printed money to stimulate debt in cost of savers, so saving is less rational in form of government money, and here cryptocurrencies comes ;)

I wouldn't use these words for Europe, but I believe in today and age, any democratic-like governance system, doesn't take longer-term future into accountt.

Every few years (4 or 5 years) they like to be re-elected. Any longer-term plan means higher changes the positive effects of the plans are not visible in the 4 or 5 years timeframe of their ruling, hence not of interest to focus on it.

The voters seem to remember only what happened today, and yesterday. But seem to forget about what happened two days and longer ago. Also, the public (the voters) are not worried about the future. Don't think of this. Believe it'll stay the same, and the government will handle it for them.

All of this leads to short term plans, and short term plans are just small changes to what has been implemented already. Executing on a vision is not possible anymore. But this is not only the fault of politicians. This is, even more, the fault of the p[public, the voters.

Just think of this: When the voters want a sound long term plan. When the voters don't care about short term plans at all. Politicians will suddenly come up with long term plans and start acting totally different from how they act at the moment.

Posted Using LeoFinance Beta

That was very well stated!

The monster was created and now is impossible to stop it.

Posted Using LeoFinance Beta

Just reading the title made me feel more broke

We know that wealth attracts wealth, but often don't consider that the opposite is true also and that is where most of us are. in debt.

It's painful.

The simplest explanation for the growing household debt relative to GDP is obviously the very low interest rate regime the whole world has been living under since the financial crisis of 2008. When interest rates go down, you'll have more borrowed money chasing after the same housing stock. It's the same story everywhere except that it isn't quite as bad in Finland as in the other Nordic countries. By far, the largest share of household debt consists of mortgages.

Posted Using LeoFinance Beta

This is always the case for household debt, is it not?

There is an over extension of debt driving a bubble into the housing market that will eventually burst. Not only this, the way they are getting people into the housing debt by offering interest only for two years and no need to pay monthly service fees for the same period, is going to trap many into lifestyles that they can't afford under "normal conditions" let alone if there is a rate rise or, continued economic hardship and compromise.

Yes, and I do not think it is a case of people primarily taking on debt to buy consumer goods. I also do not think people were selling their summer cabins to fund lifestyles they wouldn't otherwise be able to fund but because of the fact that summer cabins are more of a boomer thing. A lot of boomers were born in the countryside. When generation X and Millenials inherit them from their boomer parents and when they sell them, it is done for the most part because fewer people in our generation are interested in these mosquito infested labor camps that are a drain on the finances for as long as they are owned.

I think the problem is the fast pace of urbanization in the decade after the financial crisis. I think it was largely driven by the concentration of jobs into the largest cities. Offering interest only for two years was not some sort of scheme get people into too much debt but simply a way to compete for loan customers. In fact, they did and still do a stress test for each customer where it is assumed that the interest paid on the mortgage is 6%.

The crux of the problem are the interest rates that are too low meaning that they do not properly reflect the value of time. This is the case because of the deep structural problems in the entire developed world forcing monetary policy to plug the gap between government obligations and tax payers' ability to cover all the expenses. Shrinking work forces are one of the key reasons for this. What the money printing does is keep interest levels artificially low while growing the inflated valuations of properties among other things like cryptocurrencies. Without the abnormal macroeconomic environment we're living in Bitcoin would never have gained any traction and neither would Steem and hence Hive wouldn't exist.

Posted Using LeoFinance Beta

In bed now, but this interesting.. Look at Max view.

https://tradingeconomics.com/finland/consumer-spending#:~:text=Consumer%20Spending%20in%20Finland%20averaged,the%20first%20quarter%20of%201975.

Also, the links toward the bottom, where deficits are widening, exports falling, business production down... Consumer confidence up.

Ah, the effects of the corona situation.

The fact that consumer confidence is up is a blessing in this situation. Otherwise the situation would be far worse. It seems that people are expecting the situation to improve.

Blessing for who? It is going to crash hard.

Now would be the absolute worst possible moment for those consumers who have job security to start saving money aggressively. That would destroy the economy.

A national economy is not like a private household. A country does not retire, for example.

The cessation of international tourism has been a disaster for Lapland in particular. If domestic tourism were to come to a complete halt, it would only make things worse from a financial perspective.

A wave of bankruptcies can destroy production capacity causing long-lasting damage. Any austerity measures should be taken post-corona when the economy is on a surer footing.

“Debt attracts debt.”

I think this sums it up. The more debt you have, the more debt you don't mind having. And debt is so prevalent and inexpensive nowadays; people, corporations and governments use it frivolously.

Debt’s main purpose is to be used productively so the future earnings growth from the projects the debt was used for offsets the debt service payments. This use of debt is constructive in building modern economies. But debt nowadays is increasingly used for recreational boats, dividend recapitalizations and inefficient government programs.

I’m waiting for inflation to finally kick us in the ass, then central banks tighten monetary policy, and this debt-monetization fueled capital-asset party comes to an end, and takes the global economy with it. I’m Mr. Optimism today...lol.

This is a damn good post @tarazkp!

It is like stretching the stomach to fit more food.

Yes. Consumption of things that will only ever go down in value - thinking that the "experience" of being on a tropical beach is worth the debt.

:D

Perhaps I am rubbing off on people? I am generally optimistic that we can do something, pessimistic as I think we won't. :)

The title of this post says it all, haha!

Debt sucks!

Posted Using LeoFinance Beta

Sucks and sucks until there is nothing left.

I'm still mentally resisting the idea of bloody revolutions coming with great resets, though I would take bloody revolutions over just silently sinking into dystopia which is probably more likely XD

Yeah - I think we are the frog in the boiling water. lobotomized to boot.

Over here we kind of have the opposite where young couples are buying these houses that they really can't afford. It is funny that with all of the things they put in place after the crash of 2008, they are still giving out loans to people they probably shouldn't be. Sure they have PMI in place now and things like that, but it is still leaving a lot of people on the hook. Especially now that our housing market is booming and houses are selling for much more than their initial appraisal.

Posted Using LeoFinance Beta

That happens here too, but banks are a "little" more sensible and parents help out many. The housing market is going to crash pretty hard. I am glad that we are planning on staying in ours a while...

I am with you on that one. My wife talks about downsizing but I don't see us moving any time soon.

The younger generations will face indeed challenging times. This can help them develop resilience or passivity.

I think that based on their current habits, the only resiliency they have is to getting up and doing any work ;)

I don't know what the drive is to buy a home in these days. Setting down roots I suppose.

When I bought, over 6yrs ago now, it was never seen as an investment or even a "smrt" move, but we wanted a place that we could change, grow, tear down walls, etc. We did most of this ourselves but now life and other committments take all this time, so we found a good carpenter to help finish everything we started.

If I didn't own today, I wouldn't buy. I would put all that stress on an owner and spend my money and time in other ways.

The millstone of a house never goes away, there is always something that needs fixing or replacing, a stove, furnace, door needs painting, etc.

We need to stop pressuring people into buying, and glorifying the process.

It is NOT AN INVESTMENT!

The prices for rent in Finland aren't cheap, so it is generally around the same price to buy if possible. Best (in my opinion) is to put some sweat equity into a fix-erupper and make some money on the smaller places.

I think the problem with many not buying is that many end up having no assets in old age and have to live off government support only, which doesn't go very far. It is starting to be a problem here now.

Posted Using LeoFinance Beta

I don't know much about the living costs, etc in Finland.

In most areas in North America, if the mortgage and rent costs are equal, you are still better off renting purely based on the typical operational costs of having a home.

After 25 years, does this still hold?

I see a house as a kind of store of value - rarely will it make a profit, although I have made a profit on the last two apartments I have owned and renovated (all other costs considered). This allowed me to move from one to another and then build the deposit for the house, plus some extra for renovation costs.

Typically, unless you get lucky and buy a home in a speculative market and are able to sell when it is high, vs low.

Over the entire province I live in, the average is a 4% increase in value a year, but that is heavily driven by the urban area. If you assume that rent will increase about the same AND take any operational expenses from owning and put in the market, which has a typical return over any 10yr period excess of 5%, you come out cash ahead renting over 25 yrs.

I haven't done the detailed calculations recently (in the last 6yrs / since I bought) but I did often as my father pressured me to buy because I was "wasting money renting". The truth is that the flexibilty of renting PLUS the extra cash from not having the operational costs, allowed me to move across the world chasing amazing opportunities (both monetary and experience) in my 20s allowing me to have the cash in the bank to buy a home when we were ready to settle.

We ONLY bought because we wanted a place to mould to our wants. Something that we could move walls, add to the property, etc. My partner is an architect and I have lots of construction experience from jobs growing up.

Buying home is less of a financial decision and more of a lifestyle decision.

Unless you put cash into it, it is likely a depreciating asset, an asset that is relatively illiquid compared to stocks, bonds, cash, bitcoin, etc. with its own set of market pressures that are typically out of your control.

This is as it should be.

When it comes to having the extra cash, I am not sure that on average, it would be extra at all, meaning that the majority of people will expand their lifestyle and consume it, not invest it to generate income now or in the future. If we look at the lifestyle of a student who can live off little and still get drunk, that habit doesn't seem to change as the same student earns in a career - they still get drunk on the excess, though it might not be cheap beer and condoms :)

Oh yeah, and don't forget about all that sweat equity that you do yourself, that has an opportunity cost compared to what you could earn with that time.

If you do the renos for love and "hobby" that cost is reduced, but it is still there.

If you are someone that wants to just "hang" in their spare time, and you have to pay someone to do all the "work" rarely will buying make sense.

Like the extra, it is the same thing. Having time, doesn't mean that the time will be well spent. People can game a full-time job of hours a week, but complain they don't have enough money to invest. If they spent half that time working at a fast-food joint, they would be far better off - but who wants to take a second job at a fast-food joint?

I think that a person has to consider their own willingness and likelihood of behavior, when looking at the op cost of time spent. It is the same thing with - if I had bought 1 dollar bitcoin I would be worth hundreds of millions now.... but how many would have held? Most would have happily sold at 3 dollars and feel pretty good - at the time.

oh, I missed this. It is a pretty effective store of value and since we have to live somewhere, it offers a roof at the same time. This depends case by case though, as over extension with debt is a killer.

Posted Using LeoFinance Beta