There is industrial strike action scheduled for next week in Finland, with a lot of services affected, including flights. With about 300 colleagues arriving at the start of the week, most of them won't be able to leave again, so they will have to extend their stay. As you can imagine, the cost is pretty extreme to make the changes, and it is going to be disruptive, but that is life.

The industrial action is a response to the government's austerity measures, where they are making a lot of cuts that will likely have the greatest impact on low-income people, which is par for the course. But, I am also not a big fan of the economy as it is anyway, so regardless of what they do, something has to change.

In Australia, there is also a tax change being debated, where they are potentially getting rid of the highest tax bracket, essentially putting more money in the pockets of the already well off and very rich. This would essentially see billions of dollars taken out of the governments tax coffers. However, the election promise to do so is set to be broken, which really is no surprise.

Personally and since taxes aren't going anywhere, I am in favor of a single, flat tax rate, where everyone pays the same, no matter what is earned. I don't know what that rate would be, but for instance, something like 25% is workable. And, I think that it should be the same for companies, where the company pays the same percentage as the employee. This system where a company can wind down their obligations with creative accounting practices to around 10 percent, but their employees can be paying upward of 40 percent, is ridiculous, and it adds in a lot of unnecessary loopholes.

Simplify it.

But, it is more than just simplifying the tax system for fairness, it simplifies the conversation around tax systems and then pushes the conversation into other areas that are likely more pressing. For instance, taxes on investments. Should the tax on investments be higher or lower than the taxes on work performed? Of course, investors would want lower, but perhaps it should go the other way. Perhaps it shouldn't be as lucrative to earn passively, but there should be incentive to increase working income, where there is a direct relationship between action and value generation.

I love passive income, but at some point, value has to be physical in the sense that it makes an impact on our lives. In my opinion, the economy is so unhealthy because we have a "profit at any cost" system, where the incentive is to generate wealth, but it doesn't have to generate wealth. This means that society and the people within it will inevitably suffer, because the focus is about creating efficiencies, reducing costs, generating more wealth for the inputs - higher profits.

And, it is because of this drive for profits that we have not only such enormous wealth gaps, but also gaps in so many parts of our society and outcomes. There has to be incentive to benefit from being the best, or better than most and scale down, but the differences may be too extreme, especially when "the best" isn't tied to the health of humanity and is instead driven by influence and market manipulations, as well as government-created conditions.

Look at some of the largest companies in the world, and how they make their money. Other than the value they generate for the employees of the company, are they creating things that really benefit society? Social platforms, pharmaceuticals, oil companies, consumer goods distribution... Are we fundamentally better off because of them, or are they catering to a demand that is doing more harm than good? And, even if they are doing more good than harm, is the good enough, or are there other activities that could make more of a positive impact?

While I don't have many answers to these questions, my point is that while governments spend an inordinate amount of time jigging tax systems, and people spend an ordinate amount of time discussing them, if we are really looking to improve the outcomes of society, we need to look elsewhere. Tax systems are not the answer, yet they are a point that has been elevated as if they are going to improve society. Instead, we need to look at the entire economic model, and look to see what we are incentivizing, and why.

Economic incentives should be driven by what makes us better as a people, which means that we have to also shift the incentives of demand. Demand drives supply, so if we aren't willing to change our demand behaviors, our outcomes are going to keep being incredibly unbalanced. However, while all individuals make an impact, the incentives to make behavioral demand changes for better outcomes, have to be aligned.

But, with so much noise and confusion due the engineered complications in the economy, we aren't having the right conversations about what we should do. Instead, we are arguing over insignificancies, whilst the massive loopholes are being leveraged to generate immense wealth for a few people and corporations.

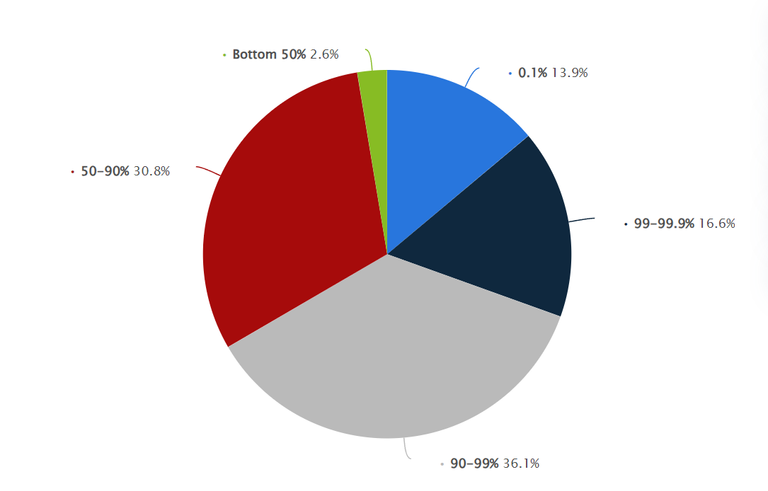

One thing to remember is, if you are poor or even in the mid-range, a tax break is not going to make you rich, or ease whatever struggles you have by much. If you are already rich, you will get richer. A good view of this is by looking at wealth distribution now.

Wealth distribution in the United States in the third quarter of 2023

In the third quarter of 2023, 66.6 percent of the total wealth in the United States was owned by the top 10 percent of earners. In comparison, the lowest 50 percent of earners only owned 2.6 percent of the total wealth.

Taxes are not the answer that helps the most economically vulnerable people, because they are playing with so little wealth, it doesn't matter much. Taxing the rich doesn't help, because the richest will, be finding ways to reduce their taxes through corporate mechanisms. But, if to get rich, it meant having to do something that benefited people, now that would make a difference.

Government handouts, are never going to lead to a healthy society. The only way to create a healthy society, is by demanding a healthy society. Not from the government, but from the goods and services we buy, and the corporations we support. And of course, in the jobs that we do.

We are all misaligned.

Will we ever change course for the better?

Taraz

[ Gen1: Hive ]

It's an extremely complex and interesting subject. In France, the debate on taxation and wealth inequality is also a hot topic (the kind of thing you avoid talking about at the dinner table). France, with its progressive tax system, is trying to reduce income inequality, but the challenge remains to strike a balance between fair taxation and promoting economic growth.

The idea of a single tax rate has been discussed, but opinions are divided. On the one hand, it could simplify the tax system, but on the other, it could also lead to an increase in the tax burden for lower incomes and a reduction for higher incomes... Thus, increasing inequality. And I agree.

But yes, this challenge goes beyond the question of taxation, and it's really hard to think about.

If the income tax was a flat rate, so people can earn whatever and pay the same, but there were higher taxes on investments, it would mean that the richer who can invest, will still make gains, but not as much. The incentive should be there to work and add value in some way to society, not just make money.

In fact, it's crucial to strike a balance that doesn't penalize the lowest incomes. I'm very bad at economics (not small-scale economics, but big economics like a country's), so it's hard for me to go any further here. That said, applying higher taxes on investments for the wealthiest seems like a viable solution.

We are over taxed and have little representation for our taxes. We can change things I suppose with power of the purse in how we spend money. I personally believe that taxation is voluntary and illegal. Yes I pay my taxes but it is a system to keep us down as peasants and the lowly.

The lower half has to spend all of their money to live. The upper 10 percent invest most of theirs to make more.

I'm with you. I think that a flat tax is the better way to go. I'd be find with 25%. I would even be okay with 30% I think. That is about what we are paying now. It might hurt the lower income families that don't really plan for it.

Imagine if the economy was to start again - wouldn't a flat rate make sense? So, shouldn't we be heading that way?

I would hope so.

I think that single flat tax rate would mostly treat for us too, employees as tax evasion is always easy for companies.

I would like to see the numbers if all companies paid their full rate of tax. That reduces passive investment returns also.

Constantly, but it's hard to stick to that healthier course ;^)

Everyone just wants dessert ;P

sugar should be taxed more ;<)

Say that again. Not until people realize their power and rights. Then we are going to move forward

I am not sure we have any rights inherently. But, we might have responsibilities.

The tax system does need to change because it is not exactly fair for everyone. The companies using the loopholes like a country like Ireland is offering should not be allowed to happen. To think that Apple pays such a small percentage in tax is madness. We are all being screwed over by the system.

We are definitely being screwed over. Imagine if all those corporate loopholes were shut, what do their profits look like, and what is the ROI for investors? It changes a lot of things.

Remember how much money governments print out of thin air… and then put the debt of interest on you to pay, while going and blowing trillions on war budgets, corporate subsidies supporting anti-life/health systems & agendas, and a wide variety of what’s essentially politically-sanctioned money laundering.

Kinda crazy to see/read anyone on this platform even suggesting there might be such a thing as “fair” tax on income, given the libertarian-lean of many here into crypto & it’s philosophical roots. Lol.

One of the best simple reasonable alternate many have discussed elsewhere before: do away with the coercive, extortion-based slave-system of tax on income altogether and simply implement something like a 12% tax on all non-essential goods & services to make up for it. economics have crunched the numbers for simulations and they surprisingly end up with more revenue for the government in the end.

And then another potential puzzle piece to answer some of your questions: more entrepreneurship by/from/through conscious individuals utilizing the same systems and strategies differently - not just complaining about corporate tax cuts, but actually rechanneling the wealth we ourselves create, utilizing those incentives & strategies to build businesses that do some of the change we’d like to see in the world, putting some of it in the hands of others doing ‘good work.’ Like yeah, in some countries we might pay up to 50% if we wanna be rich ourselves… versus putting the same capital to work through a corporation of our own design & management, playing the game so less tax $ going to corrupt governments blowing it on stupid shit so there’s more to employee others and build things the world needs more of (in our opinions). “Own nothing, control everything.” Some guys might want a Lambo in their name and lots of cash sitting in the banks… the wealthy are content carrying good debt funding assets’ constructive allocation, driving the car owned by their corporation, using stuff like life insurance as part of an investment strategy, and aiming for lower personal net income so there’s more to recirculate creatively rather than give it to political crooks to squander. I’ve spent alot of time & energy in resistance to the reality of tax matters, but over time have come to see this might be the best way (for those who educate themselves and execute). As much as many of us might like to see grand sweeps of change beneficially affecting all, “be the change” philosophy might just have its greatest opportunities when it comes to these matters in the domain of more conscious entrepreneurship. (Of course, that may also be oversimplified, biased, and not practical/possible in/for many situations, too.) That or some crazy black swan idealistic revolution, lol.

You are mistaken.

Personally and since taxes aren't going anywhere, I am in favor of a single, flat tax rate, where everyone pays the same, no matter what is earned

Takes aren't going anywhere. It is a process that will take decades to change, let alone abolish entirely. People can argue all they want for a different system, and what would work, but the problem is, they can't get it implemented, making all the rants about tax impotent. Unless there is a near cataclysmic event of the human race, it is going to be an incremental change.

Are you suggesting that governments are okay the way they are to handle more money?

See the problem? They aren't going anywhere very fast either. There are far better systems for governance as we know, but try to flick a switch and make the change.

Even "be the change" only works when there is personally positive incentive behind changing, or heavy negative. We don't want to have to pay the cost as an individual, for what affects everyone, and the first to change, will pay the most. It is an adoption curve, and there is very little incentive to make changes that benefit society, and there is active influence to maintain the status quo.

We as a mass of people can defund a government overnight. We can kill any corporation in an instant. But as individuals, there is very little that we can do, fast.

Oh hell no, lol. I probably went off on a bit of a tangent/rant, while not speaking to the “taxes are not enough” point - which I do concur with (and thought might be apparent in the opening remark about how governments tend to spend.)

For sure, these are quite big, complex “problems”/issues, with no quick & easy solutions everyone could agree upon… let alone get implemented effectively. For sure, it may be “interesting” to watch in the years ahead as many of the old ways & institutions are failing & crumbling - likely much chaos while a new order emerges out of it (IF does)…

Add taxes on alcohol, ciggy, marijuana and many other spoiled things. More you tax such things more taxes would solve middle class issues. And taxes should be reduced on essentials. reduce or should be made low or nil.

Or, remove taxes on these things and let people fend for themselves ;)

All the arguments over what tax rates should be and where the burden should fall. No questions of whether the government has a right to extort the productive economy in the first place or monopolize any services.

The governments as they stand shouldn't exist. Yet they do, and like taxes, they aren't going anywhere fast either. Tax is a non-issue with a decentralized governance model.

We build the future without permission so future generations can be free.

It's tough but a lot of people just want to take the easy way out. I don't think taxes really work that well because there are a lot of ways to get around it through accountants. I have heard some people say a flat tax and I think that does work out well. Then again, people will always want the rich people to take some of their burden.

Taxes work as they are designed to work - to keep people who aren't owners, from becoming owners. :)

It's the sad truth of things. The tax law is just way too complicated for a normal person to understand how to use the system.

I think the issue isn't really about the tax rate, but rather the ways the rich are able to go around them. There are tax deductibles, charity donations, and other legal tax evasion things they can do. CEO can get a car through the company, write it as an expense, and they don't have to pay a single cent for it. I think a flat rate is only good if it is lower than what the regular individual person already has, and if it is paid fully by the rich.

not exclusively for “the rich” (and there’s a huge world of difference between tax avoidance and evasion) - anyone has the right to open their own company and utilize the same strategies. It is a choice to be an employee and subject to its tax obligations rather than operate as an entrepreneur and conduct their affairs through a corporation of their own design & management.

but most “regular individuals” would prefer to remain uneducated in such details & entrepreneurship, follow the herd in a traditional 9-to-5 where they don’t have to take on the extra responsibilities, and then bitch about “unfairness” when they aren’t willing to put in the effort to level up. Granted, there are professions where more difficult to do - though plenty of possibilities for independent contractors & business for those willing to ‘think outside the box’ and make it happen.

Granted, the majority on this platform are likely libertarian-leaning, know what a racket the whole tax scheme is… though while many might hope/wish for the IRS’ abolition, it wouldn’t be advisable to hold one’s breath waiting for NESARA/GESARA to change it and would be much wiser to simply learn the game, get some proper professional counsel, and learn to play it smarter as a sole proprietor at the least…

Yeah, my bad on the avoidance and evasion term. I know there is a big difference in the legal aspect, but I was merely using the literal meaning of evasion. These 'strategies' have been set up for the benefit of the rich. Most "regular individuals" don't have, and can't borrow, the capital to start their own business.

It is interesting thought that you refer to "regular individuals" as choosing to remain uneducated. You do realize that not everyone can be or should be an entrepreneur or a company executive. The world needs all levels of profession to function properly. From the medical specialists, to the cooks, to the people who take out your trash.

big and/or bricks & mortar businesses, no. Though at least in Canada, one can operate as a sole proprietorship without any initial costs, or opening a corporation might be a few hundred bucks. As with any entrepreneurial venture, may take some hustle & grit to get things rolling at first, though especially with the availability of technology these days, accessibility is easier than ever - internet access, creativity, and a social media account… people flipping those basics into empires faster than ever. Plus with what dudes are using Chat GPT for now… my god man, the playing field has changed and is closer to level than ever. Investment of money, or investment of time into knowledge, self, and creation…

Of course, that wasn’t meant to be a blanket statement - and Hence, the “ Granted, there are professions where more difficult to do - though plenty of possibilities for independent contractors & business for those willing to ‘think outside the box’ and make it happen.”

And that’s not to imply “uneducated” is of a negative connection, but just objective when it comes to these matters. hell, I didn’t even begin to crack open awareness to these matters until my mid-thirties, thanks to the counsel of a friend / good tax pro, and it’s still been taking years to wrap my head around fully. For sure, there are many traditionally well-educated professionals with masters degrees who still go traditional employer routes and never even look into the alternative routes of conducting themselves as either sole proprietors or corporations. As well as the full-spectrum of traditionally “uneducated” doing needed & valued jobs… thus “more difficult” to do in many situations, and especially when very few of us ever have been properly financially-educated (as they sure AF don’t teach any of it in schools, and the majority don’t know, unfortunately).

Just imagine a world where we demand that the transactions of the governments and publicly traded entities had to be blockchained, and they are forced to pay what they owe, no loopholes, no offshore, no accounting in other countries.

Yeah, that would be great. More transparency is almost always better especially for government funds.

That's all reality. Some steps must be taken for that all

With how many views and clicks your content gets, why not publishing it from InLeo and get evergreen rewards, Taraz?

I had troubles using InLeo when it was released. Is it working well now?

Not at 100%, you might encounter a bug or two, but it's definitely gotten smoother to publish, comment and engage!

Focusing on creating wealth through activities that benefit society, rather than relying on government handouts, is crucial for building a healthy and sustainable society. The real change starts with our choices in goods, services, and the corporations we support.

This is not your writing.

I look at Australia's GST and think how much better off we'd all be if it was raised to 25% and we dropped income tax all together.

You don't pay taxes when you earn, you pay taxes when you spend.

Punishing consumption and rewarding production seems so much more intrinsically stable and fair. That would also hit the wealthy hardest, as they're the ones paying $4 million for a yacht. Hit them with a $1 million GST while the guy paying $400 for a cheap laptop pays $100.

This is the root of inequity and misaligned incentives for profit over communal good.

I'm not sure how much more of this society and the natural world will be able to suffer before something breaks. Then again, maybe we are just 2 or 3 generations away from the international wealth gap becoming so large that recovery becomes impossible due to the concentrated power of wealth in the hands of so few.

Maybe we've already passed the tipping point. The rich able to hide themselves away in their ivory towers while the general public languished out on the street. Without a younger generation to worry about (no kids/family), I'm just burning the candle at both ends until there is nothing left!