We are taking your deposits and then pretending we have far more than that to lend, trade and invest with, knowing that if you all want the little bit of "real money" that you deposited, we can't even get you that. This is all legal of course, as we wouldn't dream of breaking legislations we have helped develop.

0%

During the pandemic of 2020, the Federal Reserve reduced the reserve requirements to 0%.

Nothing to see here.

Not any money anyway of our money, anyway.

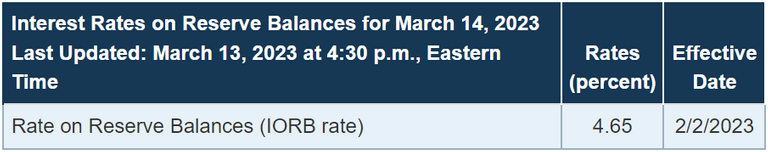

Banks must hold reserves either as cash in their vaults or as deposits with a Federal Reserve Bank. On Oct. 1, 2008, the Federal Reserve began paying interest to banks on these reserves. This rate was referred to as the interest rate on required reserves (IORR). There was also an interest rate on excess reserves (IOER), which is paid on any funds a bank deposits with the Federal Reserve in excess of their reserve requirement. On July 19, 2021, the IORR and IOER were replaced with a new simplified measure, the interest on reserve balances (IORB). As of 2022, the IORB rate is 0.10%.

So, let me get this right (I could be very wrong). As of 2008, the Federal Reserve started paying interest on the money held in reserve, as an incentive to hold it. But, the rate of interest paid in 2022 was 0.1% and the reserve required by banks is zero??

So, they are saying that people should put their money in the bank (remember how much "savings" were accrued through the pandemic?), but not even a fraction of that (used to be 11%) need be secured? Instead, the entirety of deposits can be used to invest and loan out and the only incentive not to do so, is a small interest payment by the Fed, on money held in Master accounts at Fed banks?

What was driving the 2021 pumps in stocks?

There was talk last year of crypto exchanges being illiquid and unable to cover withdrawals, so how liquid is the banking system at the moment, if even a small portion of depositors chose to take their funds out?

Granted, the current interest rate payment on those accounts is:

However,

US Inflation Rate is at 6.41%, compared to 6.45% last month and 7.48% last year. This is higher than the long term average of 3.28%.

So, the money kept in those accounts is losing value being in there. However, with a 0% reserve, there is no reason to have it sitting there losing money, when instead, it can all be loaned out to earn interest instead. Sure, that means there are no reserves in case anyone wants their money, but that is a risk the banks are willing to take, as are the governments. Anything to keep the game ticking over and if it all collapses, don't worry -

Taxpayers will foot the bill, using their value from the future. Again.

I don't know....

The more I learn about the banking system and the way the economic mechanisms work, the more obvious it becomes that it really is a house of cards with a shiny, plastic façade, that is going to burn sooner or later. And at the rate it is being jigged, it feels like it is on its last legs and those with the means are squeezing as much blood from it as possible, before the next reset.

The company I work for has funds in Silicon Valley Bank that it uses for its US operations, and while it is only a portion of cash on hand, it causes some headaches. However, it will be protected, so it is safe, but in some respects, I think there shouldn't be bailouts again. Nothing changes unless there is immediate pain, but bailouts are protracted pain that will become increasingly painful into the future.

The system doesn't need a reset.

It needs to be scrapped.

There is no baby, just bathwater.

As I have mentioned many times before, the Covid pandemic was the fastest transfer of wealth from poor to rich the world has ever experienced. And, the greed didn't stop there, because the "system" then used the little wealth we left with it for safe keeping, to play the markets again and drive the values up, as if they would never come down again. And, they crashed, not because small investors lost faith, but because the large investors pulled their funds - made their run on the markets.

Is there a shift happening?

Too early to tell. But it is inevitable.

Isn't it?

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

What is interesting to understand from this SVB crisis is the spark that catalyzed everything.

1.- Silicon Valley Bank decided to change its strategy and invest in long-term financial assets (10 years) instead of short-term ones (months). Those investments were done with customers' deposits during the pandemic when interest rates were around zero, so their customers were getting no APR for those deposits.

2.- The Fed decides to raise interest rates to fight inflation and consequently the deposits lose value as now there are other products in the market offering better APR, so customers decide to start withdrawing. The same solution from the past (increasing interest rates, creates the same problem it did 90 years ago and forced Franklin D. Roosevelt fire chat speech. (minute 1:25).

3.- SVB is forced to sell those 10-year bonds at discounted prices in order to let its customers withdraw their deposits bringing the bank to insolvency and forcing the Insurances to take control of the bank.

History repeats and repeats, back then ppl were purchasing gold or keeping cash, the difference is that now we have "out of the system" assets and the world is much more interconnected. I foresee the start of a rollercoaster year...

Thanks for the highlight points and yes, history repeats. THe only way out of this predicament happening over and over, is to move to alternative systems that will self-regulate on the fly en masse, rather than having a few heavy hitters control everything.

I only have minimum amount of money in my bank I would really like to convert all them to Bitcoin or in the cryptocurrency but it's hard to convert it back as I am not in Europe while in future I might be saying i has zero percent saving in my bank account and its not safe to put money in the bank

It is getting pretty unstable to have anything in fiat. The inflation rate is high devaluing it, and then, if you need it, they might not give it to you.

Well Bank offer interest rate of 7 to 10% but we have inflation rate of 9 and above so where is the profit in it and it's full of risk

Looks like it is a popular blog, so hopefully someone can answer me for my 2 questions here.

The FED made the statement - where they highlighted:

No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312b.htm

The Silicon Valley Bank assets auction is ongoing, however hard to imagine it will end well.

If that doesn't cover the deposits, the FDIC funds in play, what are 1,35% of total deposits. (the system is just wonderful, that a company can offer insurance with 1,35% of coverage!!!) According to Wikipedia, it was 120 billion in 2020. Well, maybe that covers this bank, maybe an other one, too. But what after??? Again money printing???

https://en.wikipedia.org/wiki/Federal_Deposit_Insurance_Corporation

And then the crypto question. Obviously all exchanges have some bank connections, hold some money there (and plenty coin issuer, too), so the question is which coins, exchanges how much have in banks and which banks? I was trying to find it out, but there is no database about it, nothing, you can go 1 by 1, and even then, if you hardly find anything (as they are not transparent at all regarding bank connections) you won't know the actual numbers, only will be available for public, if it goes down. Insane!!!

Just an example, some people mentioned ByBit in the last few days, as an exchange where you can short USDC, so I checked out ByBit, it mentions only partnerships with Chainlink, Circle (USDC issuer). So for sure, it is highly connected to banking world, the question is how big % to which bank??? And you won't find it out, I spent couple of hours with that. Nothing. (Also insane, they offer short for their partner's stable coin.)

Because of that I missed the crypto pump, but I am very far from confident, if it turns out a crypto exchange (like FTX) goes down because of bank failure, we can see the FTX effect in crypto, and it can start a domino effect very easily.

So the question: Anybody know any 'regulator' or any other site, source where the coins, exchanges banking connections are detailed in any form??? Would be great to find it out very fast!!!

Anyway, tried to search for European bank failures. There is no database at all, even wonderful EU doesnt have it. What the hell they good for... Meantime, I know 2 very small ones what went down last year, but no mention about it, if the msm doesnt write about it, and search engines - even Brave - completely blind about it, for European bank failure getting results about American and 2008 failures... :) :) :) The amazing AI technology, programmed by amazing humans... :) :) :)

bit too long, anybody has answers?

Answer to the first question is, I assume more money printing.

In regards to the second part, I don't know where to get that information from either. I assume that if the exchanges have some fiscal responsibility in their practices, they will be parts of several banks, rather than just one or two. The company I work for likely has around 10 banks it deals with, partly because of risk aversion and partly because of localization convenience. This is what they had with SVB.

And what do you think, know about the crypto exchanges, coin issuers?

My experience, most of the companies are tied to 1-2 banks. I never worked for a really big, international one, what had more. And crypto market is still not that big.

Based on Circle (USDC) and the few exchanges I checked, I assume, that's the situation in most case. They tied to 1-2 banks. However, I can't find exact bank names and amounts.

Anyway, it's ironic, that I worry to lose my crypto because of banks, monetary system... :) :) :)

Aye, scale matters. Our company works with one bank only since the money is always in motion, we're not accumulating much, and it makes no sense to split what you are going to spend anyway. Any loss would be the worth of a few days of income. Which is bad enough, sure. Still, in the case of SVB, I read or heard about companies keeping half a billion in one place where only about 250 k are insured. Which is just laziness that turned out bad.

Only crypto on the blockchain is protected by the blockchain. Long term, it should not be tied to the fate of the banks it seeks to replace. Currently, though, we still transact in fiat. Crypto transactions are a small, next to none, percentage of what matters to the everyday dude, dudette, or dudity.

I have found out just recently, this 250k insurance thing, basically nothing else, just PR stuff, illusion to the people, that their small money is insured. The FDIC has 1,35% of the total under 250k$ deposits in its fund, so basically it's nothing. How I see, before 2008 even this did not exist. (So they can pay 1 out of 75 under 250k deposits from the fund... :) :) :) how can they call it insurance...) I try to find out what about Europe and rest of the world, nothing for sure, but it looks even worse.

When I wrote it, I meant two things, 1., a coin goes zero, so doesnt matter where you store (how it is still a possible outcome in USDC case) 2., the market will crush because of exchange failures, so I lose value, again: doesnt matter where i store (how it happened in the FTX case).

Maybe, it is interesting for you, too and to the rest of the readers. I asked several exchanges about it. They all denied to answer. They don't share it! Kinda like black-market... :) :) :) So I guess, I must buy more privacy coins...

This is the 'answer' I got from ByBit:

Fractional Reserve it was called. And it's now an Empty Reserve.

Besides the pump from 2021 can be justified from the monetary mass injected from FED and other Central Banks https://fred.stlouisfed.org/series/CURRCIR

Thanks for sharing such great (and well explained contents)!

When your car's reserve is empty, you aren't going anywhere fast :)

And yes, the monetary mass caused the pump, but they had even more to play with, as they didn't have to store any of it for a just in case scenario.

Well, if every customers anywhere in the world would ever draw their money, we would see that there was not enough money in the banks. That's why Biden needed to make statament yesterday.

Exactly. It is trying to stop people from panic withdrawing - what do you think the businesses are doing?

So-called leveraging the economy.

It's pretty scary.

Indeed.

I have had a negative balance on my Dutch bank account ( between 0 and -500 Euros ) for quite some time now, as I prefer to pay a tiny bit of interest on that and invest it in crypto ) and I only have a tiny amount of money on my Portugese one. I stopped trusting banks years ago.

Two can play that game.

The lie is unfolding... Wait unit people want to take their silver contracts and metal prices skyrocket.

Pretty ridiculous. This happens to crypto and they are crying bloody murder. Then it happens with the banks and they are going to bail them out!

I have like 10% in the cash reserves in the bank. and 90% in crypto, but I am finding harder to move funds from crypto to the bank lately.

Meanwhile there has been arguments with the youngest who thinks crypto is worthless and wants to drop his for "real" money. This other stuff isn't registering to him or he's downplaying anything he can't dismiss outright because he's either refusing or incapable of seeing anything other than crypto is much harder to spend than real money (and all he wants to do right now is spend).

At least he has the excuse of being 14.

Meanwhile a lot of the adults I know will grumble and whine about how this is a thinng that's being done but don't want to change because that's too hard and scary and anything different simply has to be a scam, no exceptions, and they would rather stay with the devil they know even though it's demonstrably and irrefutably bad.

Perfect description of the situation.

There are few things that nobody addressing. For example , some rich people burning money in falling startups, like some startups burn money and are nothing but waste. Another is some business people are investing in doomed economic nations and playing religion and empowerment game which is wasting money on reforms that never work like investing in economies like afghan, pakistan? to do what? those nations didn't changed at all. yet money is burned.

Left narrative also gets alo of money, i mean people pay millions for greta thunberg? Banks, covid, rich people all are playing with people who are falling for this unfortunately.

The system is messed up and I don't think those overvalued companies deserve a bailout. It's just going to be passed to the average citizen to pay off those. It's so corrupt and I don't think any of the banks are safe.

Posted Using LeoFinance Beta

Yes the change is inevitable, thanks for the clarification.

Insightful post there! So many of my friends panicked over this piece of news, dumped their equities, cryptos, etc - while I remained unfazed and just watched this saga unfold. And now cryptos have gone up - and they are shocked. Oh well. Haha.

This is just another step by the US regulators to vilify banks that are crypto adjacent to make it more difficult for people to have on and off ramps for their fiat into the crypto space. The scummy moves taken by these US regulators to desperately hold onto the US dollar's grasp over the world money supply is coming to an end and it won't be pretty. Get me outta here, I want to be somewhere crypto friendly when the cards finally come crashing down.