A lot of attention was placed upon HBD over the last few months. This was a step forward to try and rectify the "peg that wasn't". A lot of effort is going into to try and solidify this token, providing Hive with an important component going forward.

Since the start of the chain, the backed dollar caused a great deal of controversy. At the center of the issue is the fact that the peg was totally non-existent. To serve as a stablecoin the price needs to be somewhat stable. That was not the case for the longest time.

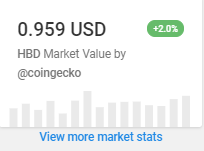

At present, we are looking at a token price of .959 according to Coingecko.

This is not exactly what we want but it is getting closer. If we look at the chart, again using the information from Coingecko, over the last month, this is what we see.

We are starting to see some stabilization. The price of the token is certainly flattening out which is vital. A stablecoin that skyrockets in price is no good. Nor is it beneficial to have it falling on the downside either. Hence the goal is to have as tight a range as possible, perhaps a couple cents on either side. It appears we are moving in that direction.

Why Hive Having A Stablecoin Is Important

Many asked why should we bother? The entire concept should be scrapped. Over the years, it proved itself to be anything but stable. Hence, we should code it out and move on.

To this my response is simple: nobody attempted to stabilize the token price before. There were a few minor attempts but nothing that compares to the dedication that was put in of late.

As for the answer to why it is important, there was a post by @blocktrades a couple months back that summed up a lot of what is taking place with this entire situation.

Here is an excerpt from that article:

When you want to contract for any kind of long term work, it’s important for your contract to be formed with a relative stable payment value. This is because an unstable payment value leaves either the buyer or the seller unhappy because an originally fair agreement (fair from the perspective of the buyer and the seller), becomes unfair. And if either party is unhappy, it causes ill will, and discourages further contracts.

This makes a great deal of sense. When entering into commercial agreements, having a stable currency is vital. People want to know what they are being paid (or paying) for products or services. After all, do you want to pay twice the amount for a product if the price of the currency fluctuates wildly? The answer is no.

We also have another point to consider: Code Is Law.

Here is a statement that many espoused throughout the blockchain/cryptocurrency world. It is a basic tenet according to many in this space.

With HBD we see the issues with some of the other stablecoins removed. It is now being asked how much of this USD backed tokens are actually backed by USD? Is there really a justification for the peg or is it just smoke and mirrors?

So what is HBD backed by? Basically the code which says that each HBD can be converted for $1 worth of HIVE. This is in the code and will not fluctuate one iota. Anyone can take advantage of this at anytime.

Hence we see the ideal stablecoin. This can allow for commerce on Hive since each HBD will always net out $1 worth of HIVE on the conversion.

Market Action

In spite of coding providing a situation where each HBD is convertible for $1 worth of HIVE, we see the price fluctuating greatly. Here is how markets have a mind of their own and can do as they see fit. It is also what opens up opportunities for traders who see the misaligned of things.

Markets, among other things, are based upon supply and demand. Traders look at this as having an impact upon price. Simply, the less supply, the higher the price and vice versa.

With the release of the next hard fork (HF25), we will see a feature implemented that will allow for a better "correction mechanism" if the price of HBD moves to the upside.

Again, from the linked post:

This new operation will have more power to pin the price of HBD than the current stabilizer bot, mainly because it will enable faster creation of more HBD. As mentioned previously in the section on the stabilizer, this is the main limitation on its ability to fight a pump in HBD (the budgetary limits imposed on the DHF when it comes to distributing HBD to the stabilizer)

The simple idea is that when the price moves up, people can "mint" more HBD, thus increasing the supply. This occurs because traders see arbitrage opportunities by using HIVE.

Presently, we have the feature on the downside. The conversion feature allows users to convert HBD ---> HIVE, thus limiting the supply of the former. However, there is no way to go in the opposite direction.

Both of these should allow market forces to help stabilize the price of the token.

Why Does The Price Move To The Downside?

Of course, one might ask, if the downside conversion mechanism is already in place, why do we see a HBD price below a dollar? Doesn't this show that the feature is not working?

We can see how this is something that obviously was considered.

A lot of HBD is not resident on Hive. I would presume that most are keeping it on exchanges whereby it is traded like any other token. The conversion mechanisms are only available on Hive through the internal wallet. Hence, exchange wallets will not likely engage in this behavior.

It is also safe to surmise the larger traders of HBD (if they exist) are not doing so on Hive's internal market. They are going where the liquidity is. Therefore, the lack of attention to this matter is playing a role.

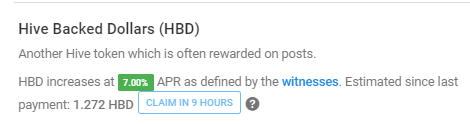

The solution is simply more HBD and activity on Hive. This was addressed, at least in part, by the recent decision to pay interest on HBD held. This was something that started at 3%, moved up to 5%, and now sits at 7%.

It makes sense to pull the HBD in from the exchanges. This should help to feed into the market mechanisms for HBD stabilization when the features are in place.

Presently we are on the downside of the peg by about 4%. This presents an arbitrage opportunity. Those who specialize in this stuff can help to stabilize the price by making themselves a profit. Ultimately, this is what will keep a peg strong.

According to the market pricing, 1 HBD is, at the time of this writing, available for $.959. Thus, someone can take $.959 worth of HIVE and buy 1 HBD. However, the conversion rate tells us that 1 HBD will pay out $1 worth of HIVE. Hence someone could make 4 cents per HBD.

The conversion will reduce the amount of HBD available, a move that should close the gap.

When the HIVE --> HBD converter is in place, the same ability will be available if the price of HBD starts to drive over $1. People will then be able to transact in the opposite direction.

It might be worth to mention that Hive has no transaction fees on the internal market, making arbitrage situation more profitable since the margins tend to be slim. Try doing that on Ethereum without a huge pile of money.

Here is where market players enter the picture. If a small traders is doing this, little impact will be felt. Converting a few hundred HBD is not going to do much. However, if there are some major players who are leveraging the opportunity, we could see tens of thousands of HBD converted in a short period of time. This would likely have the impact of moving the price up closer to the $1 area.

In a few weeks, after the hard fork, if the price overshoots to the upside, traders will be able to reverse course and start "printing" HBD, thus pulling the price down towards the $1 level.

This is the theory anyway so we will see how it works out. In the meantime, enjoy the 7% return on holding HBD. That is not a bad payout for "parking" some money for a while. It sure beats the money market returns that brokerage accounts are paying.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

One of the largest issues with HBD is the lack of exchange listings and trade pairs to USDT and other variants.

Since it's traded against BTC at the moment it'll suffer from swings in the BTC market. It absolutely needs a USD/HBD trade pair.

Communities I run: Gridcoin (GRC)(PeakD) / Gridcoin (GRC) (hive.blog)| Fish Keepers (PeakD) / Fish Keepers (hive.blog)

Check out my gaming stream on VIMM.TV | Vote for me as a witness!

More exchanges would be helpful without a doubt but there is really not a need to be paired with USDT as a trade pair if HBD achieves a peg.

Then it will take on the role of stablecoin itself.

We will see if that comes to fruition.

Posted Using LeoFinance Beta

I was glad seeing HBD flunctuating between 1.2 and 0.90 somehow for the past 3 weeks or so its actually stabilising, hive of course needs it pretty much so, at the end of the day, we're gradually getting there.

Posted Using LeoFinance Beta

You should use a log chart (or a volatility metric) to show stability, because at lower prices the same level of volatility appears more stable on a linear chart.

(That is not to say it is not getting more stable, it's just the better way to present it in a chart)

Incidentally this is the last year on a log chart:

I think there is kind of an upper peg but nothing on the reverse right? If HBD is like $0.9 like it was when we woke up, we know HBD is a bit cheap and if people wanted fiat value, they can store up some HIVE for fiat.

Posted Using LeoFinance Beta

There are four mechanisms that peg the price. Two downwards, two upwards.

That sums it up ideally. I wish I had this comment when I wrote the post. It would have fit in very nicely.

Posted Using LeoFinance Beta

If HBD is .9 when one wakes up, the opportunity to buy HBD for 90 cents worth of HIVE and then "sell" it through the converter for $1.00 worth of HIVE is in play.

This is where the market mechanisms (those who arbitrage) can help to hold the peg for what I can understand.

With the next Hard Fork, that will exist on the high side too.

Posted Using LeoFinance Beta

That´s why the 3 day convertion to HBD/Hive ? To make 1usd / 1hbd on hive current price? Current when the pay is done or at the time of received deposit?

Thanks for this post, awesome as usual!

Posted Using LeoFinance Beta

This is just a guess but I would think it is to prevent manipulation. With such a small market, instant impact could open things up to massive manipulation.

Thus, an average over 3 days is a lot harder to move. When the average is taken into account, those who see opportunities will take advantage and profit. However, a bit harder to game.

That is just a guess and I would welcome others who have more information on that.

Posted Using LeoFinance Beta

But there is a way to trade it in the moment could be. But i dont know either! There are some aspects of the network functionality not hidden but not organized well enough to be accessible =/

Is this account im talking to official or just a taskmaster´s fan acount?

It is my leo account. Both are the same person.

Posted Using LeoFinance Beta

Haha i have to ask! =P

!PIZZA

$PIZZA@taskmaster4450le! I sent you a slice of on behalf of @cre47iv3.

Learn more about $PIZZA Token at hive.pizza (1/10)

I didn't notice the APR on holding HBD raised from 3%.

Didn't they say they'll wait for HF25, to only offer additional interest to HBD held in savings, and no interest to that held on the regular account? Reason being to not pay (an even bigger) interest to exchanges for custodial HBD funds, while customers receive nothing, most likely.

UPDATE: There is a potential reasoning behind this, at the cost of printing more HBD. To incentivize (more) exchanges to list HBD because they receive interest on it, for customer funds.

Posted Using LeoFinance Beta

The APR is not needed through hard fork, the Witnesses set that. A couple weeks ago, some moved to 7% which pushed it, on a median basis, to 5%. I did look but I guess more of the consensus Witnesses raised their rate and it moved it higher.

I do believe you are correct that the interest will only apply to savings and not HBD held out in fully liquid form. I cant swear to that but I believe that is what will happen.

Posted Using LeoFinance Beta

Correct. After the hard fork, only savings will earn interest.

Having more exchanges listing HBD is not a bad thing and it could be a great move. Help them make more money which gives HBD (and Hive) wider exposure. Of course, there is also the incentive for the individual to remove the HBD from the exchange and put it in one's saving's account to earn the return (if that is what is instilled in the hard fork).

Posted Using LeoFinance Beta

It's not stable enough to be use as a real stable coin. And I still think HBD has some more pumping action in it :)

Posted Using LeoFinance Beta

Not today but it is moving in the right direction. We will see what happens when the next fork takes place and more features are in place.

Posted Using LeoFinance Beta

Thank you for reviewing this, and giving me a post to refer people to. I especially like this quote:

I think the stability of the original steem-SBD was a feature, not a bug when I got here and the 50/50 payout in steem-SBD made sense to me. I understand people’s frustration with it nit performing like all the other stable coins in the market, but I always thought it wasn’t like all the other stable coins it was tied to steem and subsequently Hive and that was a good thing.

Thanks again.

Posted Using LeoFinance Beta

I guess it is a feature if it holds. When the price runs up to $9 like SBD did, that isnt a feature. It then becomes a speculation toy, which mirrors all other crypto and, incidentally, why we dont see a great deal of commerce taking place in it. Who will spend it when it can 100x over the next year (or whatever)?

Posted Using LeoFinance Beta

Good point, if it can 10x or 100x it loses its functionality as a stable coin and becomes more of a speculative asset youhold, instead of using.

Posted Using LeoFinance Beta

Yeah. The key to a stablecoin is maintaining a peg which then can encourage commerce. We then are looking at increasing the velocity so as to develop a thriving economy.

As you can see, the first step is the peg.

Posted Using LeoFinance Beta

Hmm, I did not realize there is an opportunity to convert HBD to Hive and then use the Hive to buy HBD, and then repeat the process. Would it really work? If it works, it means free Hive. Somehow I think people would jump on the opportunity to make free Hive. What is the catch? Why aren't people converting and making free Hive?

Posted Using LeoFinance Beta

The catch is the risk that HIVE price fluctuations means you might get more or less than $1 at the end. You get the average (median) price over the 3.5 day period which isn't necessarily the same as the price at the end when you receive the HIVE.

Also if HIVE were to drop a lot (around 50% from current levels) there is a haircut rule where you get less than $1 for the conversion. Given crypto volatility that isn't impossible in 3.5 days, but probably still reasonably unlikely.

Yeah, that's what occurred to me also. So I guess this means that after HF25 HBD will have an upper bound of $1.05 and a lower bound of $0.95 since people will have big incentive (and the ability) to convert between Hive and HBD and correspondingly sell or buy HBD, right? It would put an upper and lower bound to the possible fluctuations. At least the upper bound will definitely be there, which will also greatly help stabilize the lower bound as well due to the reduced upward fluctuation. If I'm understanding this right.

If by lower bound you mean conversion price, it is still $1.

Convert 1 HBD into $1 worth of HIVE

Convert $1.05 worth of HIVE into 1 HBD

As far as market factors, who knows.

It works as long as it is timed right. It does open up opportunities for arbitrage for people.

Of course, with that it all comes down to timing. But it can be a very profitable way to approach things if done properly. People little mint money in their bank accounts by engaging in arbitrage across different currencies, exchanges, and markets.

Big time traders might see this and leverage to their own benefit. Of course, to do that, we need those big time traders doing it on Hive which is not taking place at the moment.

Perhaps with the recent moves and attention to HBD, we will see more people take notice. The larger the market, the easier it is to operate in a tight manner.

Posted Using LeoFinance Beta

Why was the US dollar picked as the money to which to stabilize the HBD? Why not one of the other fiat currencies or the most popular crypto Bitcoin? Hive platform is used by people all over the world which use different fiat currencies. If their fiat currency is different than the USD, they will have exchange rate differences between their spending currency and the USD/HBD stabilized coin.

Because it is the world's reserve currency and encompasses the majority of the transactions around the world. Notice how all pricing of commodities are in USD. The same is true for most of the international debt.

As for crypto, how can you have a stablecoin tied to something that has enormous volatility and a lack of overall liquidity?

Posted Using LeoFinance Beta

I noticed I got some returns on HBD every now and then but I never bothered to understand why it was happening. This makes sense, thanks for the explanation.

Posted Using LeoFinance Beta

Yep. You can earn a cool 7% on your HBD.

That is something that has to help with the appeal of holding it.

Posted Using LeoFinance Beta

I did see HBD interest going up from 3 to 7%

i just store any HBD for long storage or the rainy-day fund i like to call it. SO more interest is always good to see, but we will see if the price is gonna stabilise back at 1

Posted Using LeoFinance Beta

After the Hard Fork, that is the only way it will pay interest so you are already ahead of the game.

Posted Using LeoFinance Beta

It's not really better honestly instead of holding $1.30-$1.50 we now bounce around $0.90 to $1.10 same range lol

Even a fluctuation of $0.01 -$0.02 is too much for a "stable coin" I'm not really sure if its possible to make it stable in the way they are trying to do it with pegging it to be worth $1 of Hive. Just seems weird why we always try to do everything in our own unique way instead of using what is already working with other stable coins.

The stable coins I'm guessing you are referring to (e.g. USDC and USDT) require you to trust their issuers.

We're designing one that requires less trust. Is this the only way to do that? No, we could have chosen other mechanisms. But this was the easiest tweak I could see to the existing code to stabilize the peg for HBD without requiring some external entity to promise to back it dollar-for-dollar.

The market is still too small. Like non liquid assets, there is major slippage. The same can apply here.

We need a lot more players and much more money to keep the peg tight. If not, we will see these fluctuations.

Posted Using LeoFinance Beta

Lets see how it works after the HF :)

Posted Using LeoFinance Beta

Yep. All speculation right now. There might still be more "tinkering" that is required.

Posted Using LeoFinance Beta

Excellent news. I get the feeling that we are on the right track towards stabilizing the HBD. Although the internal market does not generate interest with each exchange, it is also a point in favor, because it allows a better flow in transactions.

Having stable HBD will really be very useful to implement various features, work to be paid for in the future.

This will help a lot!

It would be huge. The first part is the peg. Will it take place? Let's see how things unfold.

Posted Using LeoFinance Beta

Right now HBD $0.885

Sort of. That's the price you could get on some exchanges (although when I just checked now, it's back up to $0.946). But you could also convert it for $1.00 worth of Hive, right now, if you're willing to wait 3.5 days to get your Hive.

I’d prefer if HBD’s price mirrored what SBD is doing

Posted Using LeoFinance Beta

Greed at its finest. Steem Dollars (SBD) is currently worth $6.04 USD. That is not the goal with Hive Dollars (HBD). There is a lot of ongoing effort to keep it close to $1 USD as much as possible, because it is (or rather supposed to be) a stablecoin pegged to the value of USD.

You nailed it. Someone who shows either little understanding or little concern for what is taking place.

Posted Using LeoFinance Beta

You guys really are trying to tell me that hoping for a $10 hive is GREED? Especially you @taskmaster4450le you make plenty of rewards why wouldn’t you want each hive you earn to be worth more? and you @blocktrades you seem to agree that it is greedy to want our project to appreciate in value. Makes absolutely no sense but ok guys 👍

Posted Using LeoFinance Beta

How is it greed lol you rather hive go to $0.10 or $10? Am I greedy for preferring $10?

Posted Using LeoFinance Beta

You wrote HBD, not Hive. HBD is supposed to be pegged to the value of the USD. Hive is not.

I have been here since July 2016, there are 2 constants since then even though a lot has changed.

But what hasn’t changed are:

Authors and curators will consistently dump the price through the author and curation rewards. Does not matter if its whales upvoting each other then selling or if its thousands of 3rd world participants selling to live off of. Until there are better reasons to buy hive it will inflate to reward and dump leaving price stagnant and below $1

HBD wont keep its peg, never did before, and unless there are code based changes to its design it will continue to not hold its peg.

Incentives drive engagement and proof of brain. Nothing was as vibrant as when steem had voting bots. If you shit post, and paid for a bot to upvote you relative to how much you pay, you risk losing your investment to downvotes, now with free downvotes we should bring back vote selling and allow the market to buy up hive and hbd and let humans manually curate who should remain on the front page and who should think twice before buying their way to page 1 for a few minutes.

I know a lot of you love the idea of having a 1 usd peg but really there are so much more important things to focus on like creating demand for hive and hbd and finding more user.

Posted Using LeoFinance Beta

View or trade

BEER.BEERHey @taskmaster4450, here is a little bit of from @pixresteemer for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 950000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIs it limited to $1? Could it make sense to have it increased much more as one $1?

I think it's moving towards it... I hope we can get it to stabilize as it would be great for the economy of Hive

Posted Using LeoFinance Beta

Having a true stablecoin on Hive would add a dramatic amount of utility to the Hive blockchain. Not only would it allow the blockchain to "capture" assets and keep them here, it would also open the door to possibilities like having a CUB/HBD farm and potentially paying both CUB and HBD in dividends, thus tying Leo/Cub even more closely to Hive. That is just one example of the utility it could provide. Once LeoDex/TribalDex/Hive-Engine are able to engage in meaningful trading of some of the bigger and more well known cryptos out there, having HBD as a stablecoin could again add enormous value and utility to the exchanges. I have absolutely NO idea of how to make it work but I firmly believe it is a goal worth striving for.

I would think it could also make it possible to start onboarding fiat directly into Hive and tribes. Not sure what else would be involved there but that could be a game-changer as well. Definitely worth paying attention to see where this goes.

Posted Using LeoFinance Beta

i think it's good for more stabled hbd after all it's meant to be a stablecoin now at this moment is looking to be dependent of Hive itself as hopefully a demand for cheaper prices since it's pegged with the crypto market, I for one believe we'll be seeing new investors as well as old investors buying more. Obviously hbd is closely dependent with how Hive is working now even though it wasn't built for that I believe. Love the new interest might have to put my dividend stock ass brother to get on the action haha

Honestly I’d rather us use a separate stable coin and only earn in hive not Hive Dollars. As u say the peg doesn’t exist.

I remember 2018 and steem dollars going to like .50 cents. The shooting to $4.00 or higher is a problem too. Hive will be negatively effected if we don’t see this thing get stable to point of .99 - 1.01

Otherwise there’s just no point

I wasn't really aware until I noticed it's stable around $0.9 to $1.

Posted Using LeoFinance Beta

A stable HBD would solve a lot of things here and would bring good investment, as the hive blockchain would be seen in a better light.

Posted Using LeoFinance Beta