As stated on a number of occasions, the relationship between $HIVE and the Hive Backed Dollar (HBD) is one of the most interesting aspects of the ecosystem. Here we have a situation where we can see buy demand essentially created for $HIVE through the desire to get HBD.

We got the most recent monthly report telling us how the numbers looked for the month of February. To the surprise of most, $HIVE was actually deflationary for the month. This means there were less coins available at the end of the month as compared to the beginning.

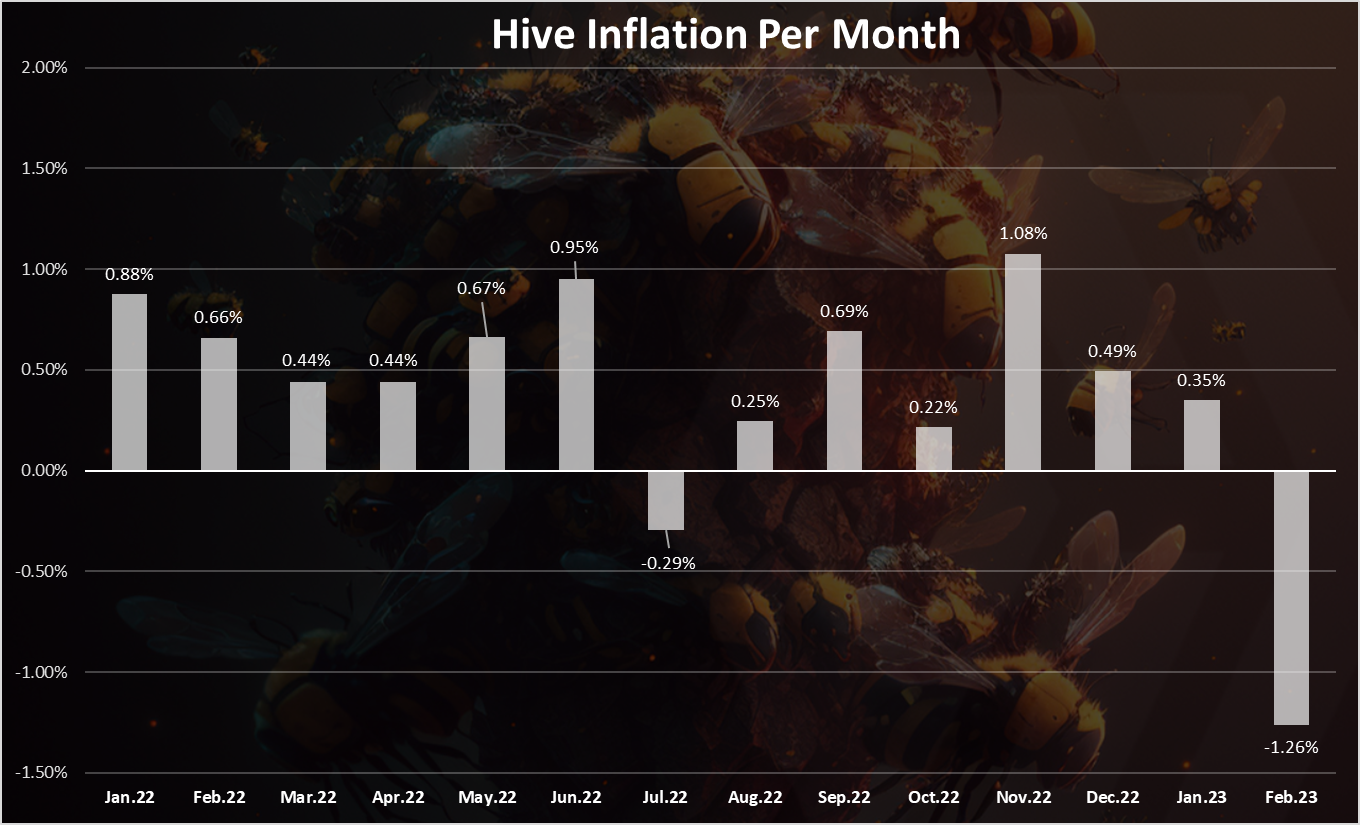

As we can see from this chart, the deflation rate for the month was 1.26%.

Most would cheer this on although, as we will see in a bit, this might not be a good thing. Nevertheless, it does highlight the impact HBD can have.

HBD Liquidity Crisis

We stated in the past that HBD has a liquidity crisis. There simply is not enough of it out there. This is only going to get worse as demand for the coin grows with increased utility.

At this moment, we are aware there is a large appetite for this from one account. That is over 1 million HBD in savings, with the intention of going to 4 million. Here we see how the demand can really skew things.

Since there was little HBD on the market, the likely approach was to purchase $HIVE and convert it. This, along with other ones, caused the change in inflation rate.

We are going to need a lot more HBD. There are a number of use cases being constructed and this is going to put further pressure on the amount available.

Therefore, we can expect months like this in the future.

As Expected

Over the last 18 months, we discussed the idea of currency a great deal. The reason for this is most misunderstand how things truly operate. What we are seeing here is not unexpected.

A basic ideas here is that fixed income investors are much different than speculators. The former is going to invest when they see things are right, no matter what the market. Yield and putting money to work is more important than timing.

It is important to take notice that real world operations went in the exact opposite direction as many theorize. Aren't we told that people will convert HBD when the price of $HIVE is low and then convert it back when price moons, creating a point of vulnerability? To put it another way, the threat is that a huge amount of HBD is created when the market runs and then, when the price drops, tons of $HIVE will be created.

We have to prepare for this possibility and work to prevent all potential points of attack to the ecosystem.

Yet here the exact opposite happened. The conversion took place at a level where many of us feel $HIVE is cheap. What happens when $20 million wants to get into savings and take advantage of the outstanding return provided by Hive's stablecoin?

Where will 20 million HBD come from?

This is why we can expect months in the future to reflect this.

Is Less $HIVE Good?

Many feel that Hive being deflationary is a good thing. However, here is where things can get cloudy.

The common belief is less token or coins, price goes up. Thus, the reverse also has to be true.

Unfortunately, as we are seeing, this is not exactly playing out this way. What is really happening is the multi-faceted, convoluted practices of currency.

With $HIVE, we are dealing with an access token. That means that less available equates to less Resources Credits available. In turn, not only can less activity occur on-chain, expansion is stunted. The reason for this is less accounts can be claimed, in theory, due to the reduced supply. Obviously, we are not at 100% staked but the point is clear.

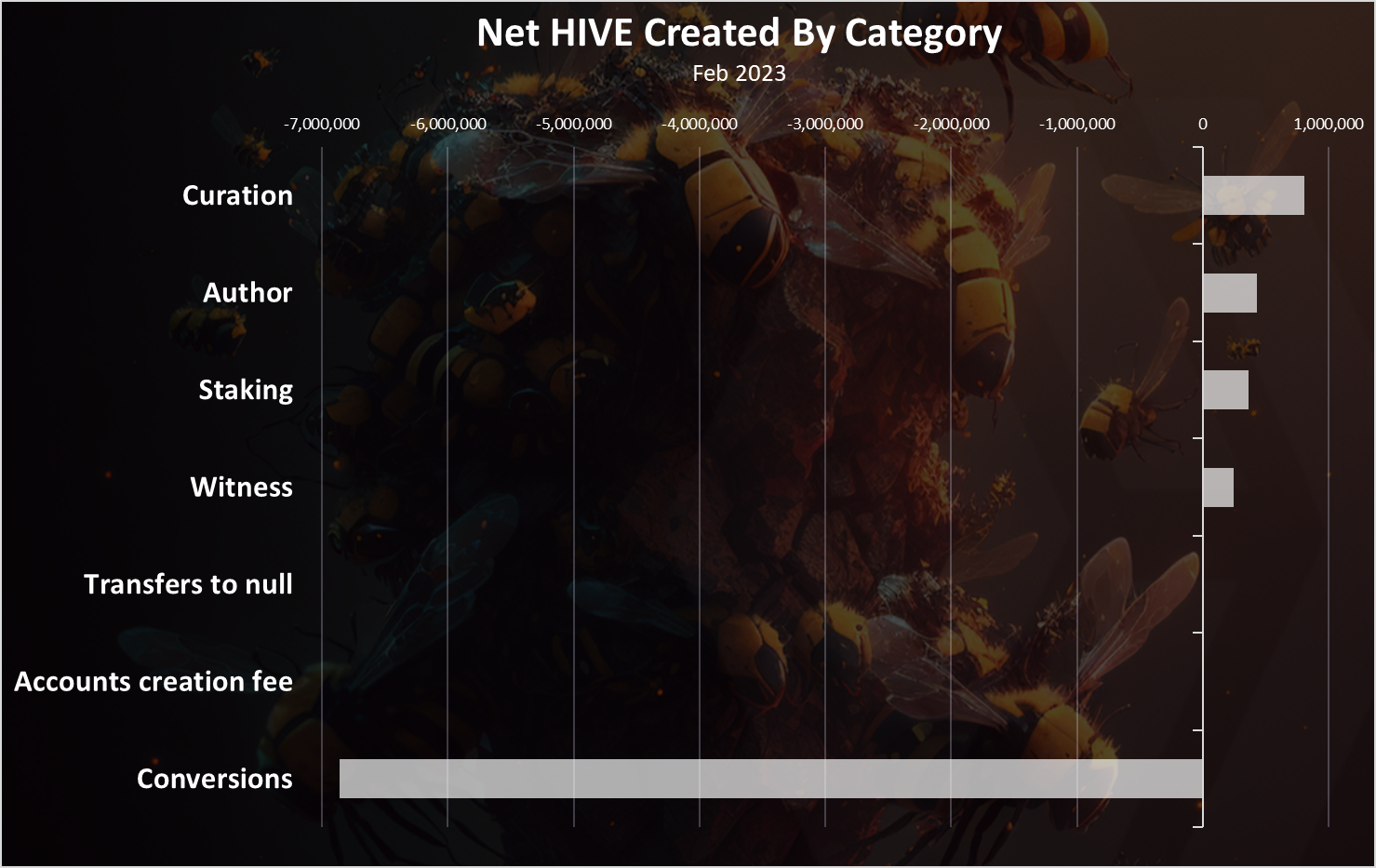

Another factor is the market capitalization is reduced. With the two coins, the value is placed upon each. We know markets are not exact. Nevertheless, if we create $7 million on HBD, that has to come from somewhere. Naturally, it would appear that has to be removed from the market capitalization of $HIVE.

Markets are never perfect which is why we say in theory. Nevertheless, we could see an increase in the ratio as it applies to the haircut. This is less of a factor since $HIVE had a freely floating exchange rate. Under this scenario, the USD price can fluctuate, helping to offset this.

Here is what the total numbers look like:

In terms of absolute numbers the HIVE supply in February has decreased from 396.4M to 391.3M, removing -5.1M HIVE from circulation. For comparison the projected monthly inflation is around 2M HIVE.

The haircut ratio is dependent upon USD pricing. However, Resource Credits operate without any regard to the market activity. This is solely based upon the activity and interaction with the blockchain.

Explosion In Price

All of this is proving what we covered in the past couple years.

There are a number of demands on $HIVE that will cause the price to appreciate over time. This can occur without the need for hype, pumps, or even a bull market. Instead, simple demand created by utility can push the price to insane levels.

One interesting stat would be to see the percentage of Hive Power compared to the total $HIVE in circulation. My thought is that, over time, this is going to have to increase. After all, the only way to get more Resource Credits is for someone to stake $HIVE.

As we saw in February, the need for more HBD drove the conversion to rarely seen levels. What happens when we have a much greater need for Resource Credits?

The answer is clear since the most freely moving variable is the USD price.

It really comes down to simple math.

Pictures and quote from article linked

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

" Hive Power compared to the total $HIVE in circulation" that is an interesting metric, it clearly says the direction the network is going, I think most people would be powering up during this times, Hive so low rn and bear market will be over sooner than latter, its been more than a year and I think by the end of Q2 we will see some upside pre halving, next bull run there is no reason why Hive couldnt brake ath

You are still looking at $HIVE from a price perspective.

The key is the access. This is where the metic of HP versus $HIVE will become important.

Posted Using LeoFinance Beta

When you say access you mean there will be less Hive available to buy, meaning it will be harder for users and dapps to get more Hive because its reduce as more HBD is generated and it less available as more ppl power up??

That would be an amazing hight. I've been hearing so much about this halving...I might have to read up on it.

I don't think this is accurate. The rate of RCs required for operations on the chain is not constant. If RC become more scarce (due to less HP), fewer RCs will be required to transact. The RC system is set up to control excessive resource usage, but it can do so at a lower (or higher) price in terms of RCs.

As I've said many times in comments to you, I don't really understand the finer details of what you are talking about, but I'm glad you do! I always enjoy reading your posts even if I don't totally get it.

That HBD interest is very very tempting, but I've been committed to growing my HP for the past three months so I haven't been taking advantage of it. My loose plan was to keep converting to Hive (and powering-up) until Hive hits a buck, then start saving HBD again. Hopefully it will still be 20% interest by that point.

Great plan. I built a good savings for myself...$100 all from posting. The next stop is 1k from every means 2k makes a dollar a day. @taskmaster's posts are awesome when you get to the deep of them...few people do

How long did it take to build $100

5 months there about

Wow!!

Wow... This is an eye opener and explains a lot about so many unclear things to me

Hive has demonstrated times in the past it can rally up regardless of the bull market, so the likelihood of it appreciating in price due to demand for it exists.

Posted Using LeoFinance Beta

The great demand that you are making many people want HBD grows every day, we are just starting, every day there is a lot of marketing of the benefits of HBD, in turn as demand from external businesses and investors grows

Posted Using LeoFinance Beta

Hbd is very temping and I am very sure more people will come here and invest in hbd. I just don't understand why I still choose hp over hbd but it is obvious that the success of hbd simply means that it is better to buy more hive now.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @taskmaster4450le ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

#boom ?

Boom !

Posted Using LeoFinance Beta

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1670000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

It's great that you provided links and references to allow readers to figure out that you are using @dalz's images and are expanding on his report.

However, I am curious as to why you did not give him more direct credit.

Maybe he does not want to be tagged or mentioned? Or maybe it was simply an oversight? Or maybe you prefer to not tag people directly?

Or maybe you think semi-automated reports should not be over-rewarded, and you choose to not promote rather than downvote (an approach I can certainly understand and respect).

I would not have even realized those images were not your own except that I immediately recognized them, because I regularly follow @dalz and had read his report last night. Maybe I am making something out of nothing here. It just caught my attention and it seemed (to me) that direct attribution would have been mutually beneficial in this instance.

I am very happy with my HBD … wish I had more.

Make that happen!!!

I am.

Interesting. So less Hive doesn't mean more value. I guess all we leaned in economics starts getting tested in a complex ecosystem like Hive's. The demand seems to be for HBD. A million dollars in savings is a lot.

I am kind of wondering what caused the need for more HBD. Did people convert it into HBD because of the price of Hive pumped? They can at least get some of it guaranteed and I think it could be safer right?

Posted Using LeoFinance Beta

The math is never simple 😆

Posted Using LeoFinance Beta

interesting

Interesting info, we'll need to wait and see how this will play out as the HBD affinity from investors increases.

Posted Using LeoFinance Beta

Oops, so that's the situation that deflates $HIVE. Everything you mention in your post is very interesting, but what is not clear to me is how the lack of liquidity of HBD will be solved... Because unless large capitals come to inject liquidity, I don't see how this could be .

And since we cannot expect markets to behave differently than they naturally do; what can be done about all this? Because by the laws of market speculation, it is normal for people to always search buy $HIVE when it is cheap, and sell it when it is expensive; It is something that, as we well know, is completely natural, since speculators can thus multiply their holdings of HIVE; and that wouldn't exactly be a system attack.

As you said, all this situation of demand for $HIVE will make it appreciate over time, and this will happen because, due to the laws of supply and demand, if the demand collides with the shortage, then the tendency of $HIVE will be to rise from price

Posted Using LeoFinance Beta

Thanks much @piensocrates, when it is cheap, and sell it when it is expensive; It is something that, as we well know, is completely natural, since speculators can thus multiply their holdings of HIVE; and that wouldn't exactly be a system attack. It wouldn't be if mass decentralized newcomers and hivers enter the @hive with smaller amounts. Maybe? Attraction by large capitals come to inject liquidity into @hive and others is the end of decentralization, isn't it?

Posted Using LeoFinance Beta

Not necessarily. When big capital is in private hands, it does not mean the end of decentralization. In reality, the decentralization of the blockchain is not in danger, but it does the benefits derived from decentralization sometimes, when governments begin to try to impose their laws to try to control what they should not and cannot control. Greetings.

Posted Using LeoFinance Beta

Most of the time the capitals are in private ends covered or under governments, decentralized to us means into the people's hands not to be controled by rotten elite that maintain poors poors and weak weak, if the people can have an economical ecosystem where they can sustain their needs without risk of sabotage by confiscation or perishable money assets for debts reasons like in France where the French people and France as a country is being sabotaged both by private and by governement and public hands. Our situation with more than twelve million under poverty threshold joined by business owners middle classes and the rest makes us in a situation where even our democratie is being sabotaged as the governement decides to impose mostly against huge percentages of the population. The french government is not serving us he's dictating us as we are talking of 63% people minimum that are asking to stop this crminal behaviors, womenand couple cant go safe in our streets kids from eleven suicide themselves mental illnesses depressions rates are over 20% approx the same as in Great Britain. Big capitals in mafia hands makes mafias in production countries stronger and in distribution countries more powerful.

I love HBD for the 20% APY return, but I actually think that rate is unsustainable in the long term and potentially even dangerous to the ecosystem.

Something I don't understand (well, one of many things I don't understand, but I'm always trying to learn more !) is the mechanism that allows HBD to maintain it's peg to the US dollar. If a few whales come along and want to invest in HBD, won't that soak up all the liquidity, pushing the price up and making it harder to hold the peg ?

Posted Using LeoFinance Beta

Man this is incredible to watch take place. When I first joined Hive back in mid-2020, I did not believe $HIVE would ever be deflationary, since, back then, there just wasn't the demand to push up the supply of $HBD, even with an 8% APR. Now that the APR is 20%, and no other cryptocurrency "stablecoin" comes close to providing such a yield, you would think that fixed income hunters would flock to Hive because of this.

Hypothetically, if someone demanded 1M $HBD in a single month, could we witness an explosion in the price of $HIVE? What would be the effect on the USD-denominated price of $HBD? Would that also go up and then force buybacks by the Hive DAO?

Posted Using LeoFinance Beta

What can these be? We have to prepare for this possibility and work to prevent all potential points of attack on the ecosystem.

Which would or could be the potential points of attacks on the ecosystem?

Who would benefit or profit from these? by who? How? Why?

How about if in need of Resource Credits, is there an equation to be able to add some Resource Credits?

Hey @taskmaster4450, thanks for your #thread that's moving our grey cells by learning. The HBD tied to the Hive is showing that there isn't enough of @hive and @hbd on your thread, not only #hive. If newcomers enter and the demand grows as it is it seems, to allow cheap supply demand of #hive to get #hbd, does something need to be changed about the author and curator and the #rewards system? Is this only a #resourcecredits issue? Best+!