GDPNow, Source: Atlanta FED

GDPNow, Source: Atlanta FED

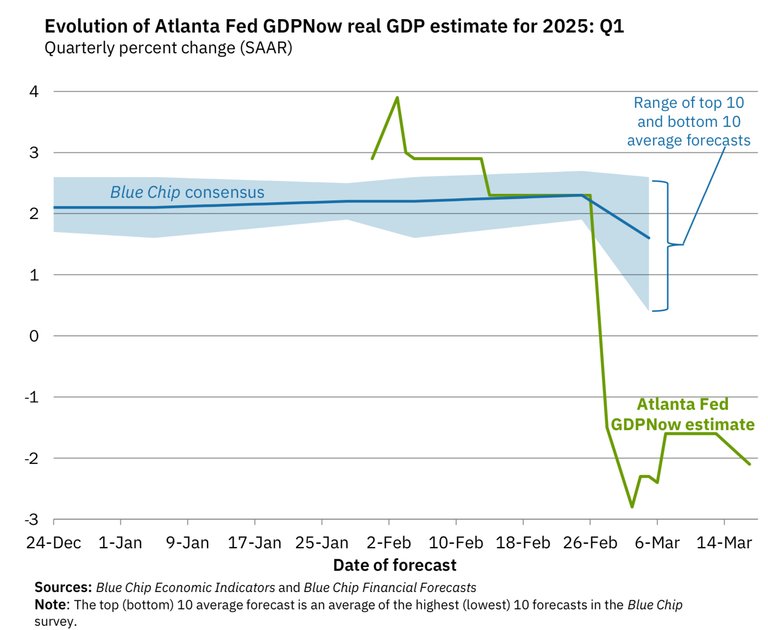

GDPNow shows a much bigger drop to -2.1% that many investors may be concerned about a lot at this critical moment.

But the significant drop seems to come from gold imports in last December and January. US imported $10.3 billion and $30.4 billion in last December and January respectively. This huge amount of gold imports may be due to physical gold deliveries for gold futures contracts. So the amount of gold imports should be taken out from the GDP calculation.

So, it is too early to be concerned about an imminent recession based on this data.

One bad point from this GDPNow data is PCE (Personal Consumption Expenditure) that is one of the key components of GDP. It dropped from 1.53% to 0.27% in GDP growth.

CNBC projects a 36% probability of recession that surveyed strategists, analysts, and economists. This number is not yet a "highly possible" result for recession that is still below 50%. There are several major factors that many financial stakeholders closely monitor: consumer spending, the labor market, inflation, tariffs, and FED rates that reflect all previous factors.

I guess that the Federal Reserve may have a cautious stance for rate cuts not to ignite market sentiment in either direction. Labor market and consumer spending should support this cautious FED stance not to make big decisions that ignite a huge market crash.

Just now, tariffs are the bad guy playing the bad role that push up concerns about the labor market and consumer spending.

This post is also published on Medium on March 18, 2025, by the same author.