Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Summary of Key Labor Market Indicators (March 2025)

| Indicator | Recent Value (Feb 2025 unless noted) | Implication |

|---|---|---|

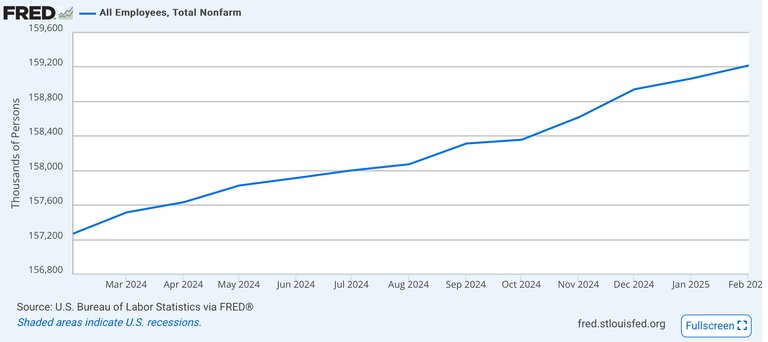

| Nonfarm Payrolls | +151,000 | Positive but below prediction |

| Unemployment Rate | 4.1% | Stable |

| JOLTS Job Openings (Jan 2025) | 7.7 million | Increase a bit |

| ISM Manufacturing Employment | 47.6 (contraction) | Weak in manufacturing |

| ISM Services Employment | 53.9 (expansion) | Strength in services sector |

| Conference Board ETI | 108.56 (Feb 2025) | Decline, signaling potential slowdown |

| Conference Board LEI (Jan 2025) | 101.5 (down 0.3%) | Decline, suggesting future weakness |

Based on recent labor market indicators, the labor market remains stable. However, weaknesses in manufacturing and leading indicators (ETI, Employment Trends Index) suggest potential risks that require continuous monitoring.

We are in a period of uncertainty due to factors such as Donald Trump, the Ukraine-Russian war, and recent tariff wars. These uncertain conditions raise concerns for the labor market.

Despite this, the U.S. labor market remains resilient, supported by a strong services. Various factors, including illegal immigration, tariff wars, inflation, and Federal Reserve policies, may influence labor conditions.

Almost all these factors are already in the public sphere, waiting for the next developments—whether they merge with others, strengthen, or weaken. A major shift seems to be approaching, moving steadily and clearly.