The GameStop-frenzy of last week won’t terminate well for all small investors. Shorting and long buy both are legal only if they aren’t manipulative. The dollar may weaken, but the total collapse seems unlikely. Stock Dividends and Buybacks in the US May Drive Markets Even Higher This Year. Why did I bought Litecoin?

We live in exciting times in the markets, cryptos are skyrocketing, commodities surging, many stock indices stay near all-time highs. The huge money printing of central banks may raise most prices, cause some sort of “all-asset bubble”. The breaking news about the GameStop price explosion and the fight between “Robinhood-traders” and “Wall Street Whales” also encourages new investors to buy stocks or cryptocurrencies.

Inflation fears also strengthen demand for cryptos, precious metals, stocks, real estate. Some people think the dollar may collapse totally, but they forget central banks may also “taper.” Retire a part of the money from circulation. So, inflation may be higher in the short and middle term, but the total collapse of the dollar and other diluted currencies can be avoided. Anyway, preparing for inflation and staying invested in real-assets seems to be a good idea this year.

This is my post recommendation for you with a few new publications on my financial web page, Ageless Finance. Shorter and longer, comprehensive articles about investing themes. With many charts and lists. If you are interested in more details, click on the images.

Oh, No, Is GameStop Short Selling or Buying a Sin?

Small investors trying to “squeeze” GameStop short-selling institutional investors was the most interesting story of the last week. Is sort selling something weird, sinful, illegal, or strange? Only sometimes.

- Short selling itself is normal, the same as long buying.

- The “let’s blame the short sellers” game is ancient.

- Are short-sellers the bad guys? Or long buyers?

- Only if they are manipulative.

(Opinion)

Click the picture to view the full post:

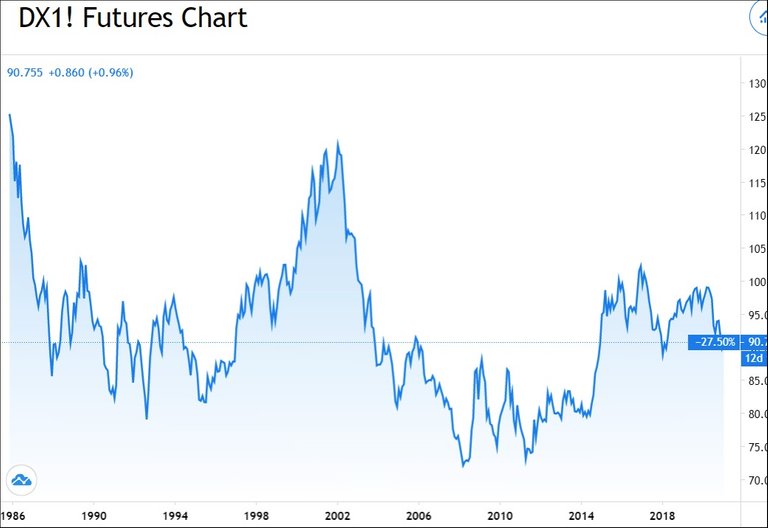

Is This the End of the Dollar? Will Fiat Currencies Collapse?

The US dollar will collapse. Fiat currencies are ending rapidly. The Biden–Yellen team will lead to a debt explosion. Only real assets, physical investments, gold, real estate, cryptocurrencies, may survive–can you read in many posts.

- Many authors fear the total collapse of fiat currencies or the end of the dollar.

- They forget that central banks can not only print money but retire it from circulation, too.

- Higher inflation of the dollar and other main currencies is very likely, but a collapse is not.

- But investing in real assets is also a good choice if you aren’t expecting the end of paper money.

Click the picture to view the full post:

9 Reasons I Invested in the Digital Silver, Litecoin

Why is the digital silver, one of the oldest cryptocurrencies, Litecoin attractive? Some reasons:

- Its transaction system is faster than Bitcoin’s.

- The transactions are much cheaper.

- Litecoin is supported by all crypto-exchanges and many ATMs.

- In the last years, it got much cheaper compared to Bitcoin.

- Litecoin is part of many crypto-indices, funds, and mixed portfolios.

- Modern mobile trading and saving apps are also supporting it.

Click the picture to view the full post:

Stock Dividends and Buybacks–a Strong 1-Trillion-Dollar Force Driving Markets Higher

Despite the incredible economic crisis in 2020, the dividend payments and share buybacks on the American stock market stayed on high levels.

- Stock dividends rose slightly and buybacks fell 30 percent in 2020.

- This year, both may rise again.

- Means over 1 trillion dollar payout for investors, a yield of 3.1 percent p. a.

- As interest rates remain low, this may drive stock prices further.

Click the picture to view the full post:

Follow me!

You can follow me on Twitter, Telegram, Facebook, Steem, Hive, and Mastodon.

My Previous Post and Chart Recommendations:

Bright Era of Commodities? Interesting moves in European Stocks, Lumber Price, Turkish Lira, Zoom

The Big Tech Winter, Greedy on Energy Stocks at the Bottom, Real Highs of Platinum, Historical Lows of Crude

My Best Posts: Part-Time Jobs, the Real Price of Gold and Silver, the Longer-Term S&P 500 Sectors Performance

Extreme Crypto Transaction Fees, Natural Gas Price Explosion, Traps in Blogging SEO–Posts of the Week

The Down of Fiat Currencies? Golden Age of Silver and Gold

(Photos: Pixabay.com, Charts: Tradingview.com)

Disclaimer:

I’m not a certified financial advisor nor a certified financial analyst, accountant, nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research or consult your advisors before making any investment or financial or legal decisions. I may have positions in the investment assets mentioned in this post.

Just read this nice article on Steem. :)

Is it legal yet, publishing the same on both chains, or did I miss something?

😨

😱

😵

No :)

I am very interested in the part where you say Dollar won't collapse, because I have been telling everyone dollar collapse is immtent so buy all the BTCs that you can you know.

It's about the economy right, the fundamentals, the US economy is doing bad, unemployment, dept then like currency could collapse. Possibility.

It will be a first time for all of us if that happens, as if its WW2 era time.

It does not sound bad, because we anyway thinking because of global warming in our times only world will collapse and all!!

Lets see...there is always a chance that we can improve things and stabilise before it gets too late you see... both for the dollar and the environment.

The collapse of the dollar would be very unpopular, a huge defeat for the government and Fed in the US. I don't think they would risk it. But a higher inflation between 5-15 percent would be logical. They also inflated the government debt (treasury bonds) after WW2. I suppose they will do the same now.

Buying precious metals, (cheap) real estate, stocks, cryptos seems to be good idea for me.

Your post has been voted as a part of Encouragement program. Keep up the good work!

Boost your earnings, double reward, double fun! 😉

Support Ecency, in our mission:

Hivesigner: Vote for ProposalTry https://ecency.com and Earn Points in every action (being online, posting, commenting, reblog, vote and more).Ecency: https://ecency.com/proposals/141

Thank you.

Congratulations @deathcross! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 19000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: