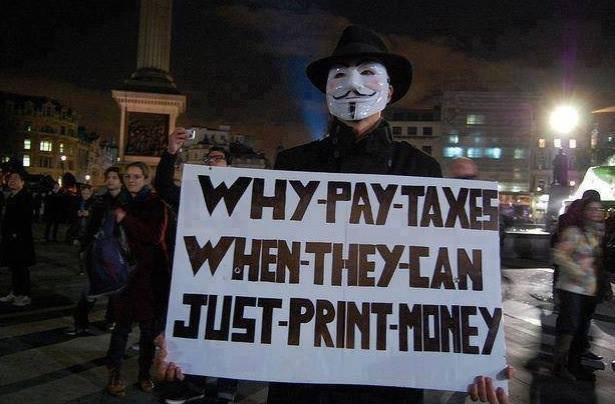

Hello SPIers, today we look into "Why do we pay taxes?"

What are taxes are?

On HIVE, we are from all over the world but 1 thing is for certain, we all pay taxes. We pay taxes on our income, when we buy anything and when we sell something for more than we paid for it like a house are investments.

The money raised from taxes goes to pay for essential products and services. Depending on where you live in the world, this could be schools, emergency services, roads, healthcare, defence and benefits for those on low income or retired.

In theory, taxes make sense. The government takes money from its population in whatever form it calls taxes and uses that money to improve the quality of life for its population. If the government can stick to a budget and spend equal are less than it collects in taxes, seems like a fair deal.

Where it all went wrong

Well, it started back at the end of 1913 when the FED Act was voted in. There was no inflation in the US before the FED in the USA, can you imagine that? There was but it was a mini average of 0.3% between 1790 and 1913. Well, it was an average of 0.3% between 1790-1913, so very low. The price of everything never goes up for your whole life, working the same wage all your life, paying the same rent, the same for food, everything. In some cases, the prices of things went down as technology advanced and companies could make products cheaper to produce.

When the FED Act got voted in, the GBP was the reserve currency of the world. The GBP de-pegged from gold in 1931, lot all its spending power and was replaced by the US dollar which de-pegged from gold in 1971. This is the final nail in the coffin and we've been kicking the can down the road ever since by printing money from thin air and deflating the spending power. Much of this printed money is used by governments to top up the shortfall between what they spend each year and what they collect each year.

Current State of things as of 2023

- In the US, they collected $4.5T from taxes and spent $6.2T

- In the UK, they collected $1.2T in taxes and spent $1.5T

- In China, they collected $3.3T from taxes and spent $4T

I could find many other examples but you get the point. We can see that governments are now spending more than they collect in taxes. We all understand that compounding debt that can never be paid off is a 1-way ticket to economic death.

The debt of every country can never be paid off, it's not possible. When the money in the world economy is issued from a central bank that charges interest, the game is fixed. This is the same as paying off 1 credit card with another credit card with the same bank operating both credit cards 🤣

So, why do we still pay taxes?

When the governments are spending more than they are bringing in and they borrow the rest, why not just borrow it all? What's the difference? Increased inflation? Big whoop!

It's not like governments can ever pay back the debt or like they even plan to. We're living in a debt economy and in a few years time, im sure government spending will be 2-3x what they bring in from taxes.

Taxes became irrelevant and optional when they turned on the money printers and started making money backed with a promise instead of gold.

Taxes are part of life

Sadly this is true and we'll always pay taxes but the government are smart and very good at rewording things. The government does not say it's borrowing more money, it's doing quantitative easing. They will never remove taxes but they might introduce a universal basic income for everyone.

I understand we'll always pay taxes in some shape are form but when money comes from thin air, why?

Share your thoughts below and have a great day

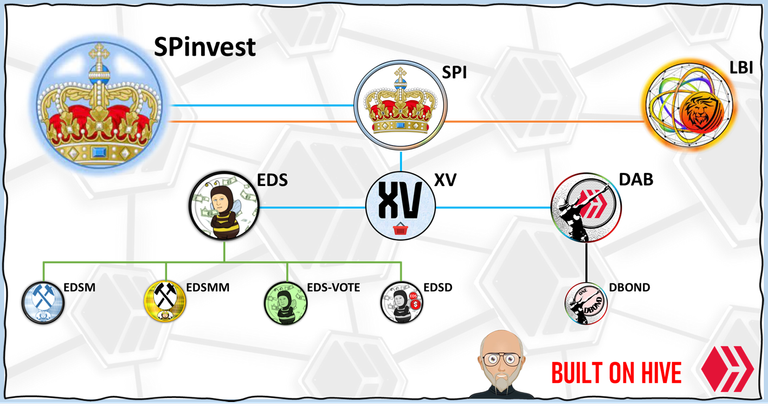

Getting Rich Slowly from June 2019

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

Careful, now. You're going to red pill some folks. 😉

The problem is that not always and not every government really uses the tax money for the benefit and improvement of the lives of its population

Really? Spain had 3 bouts of inflation in the 1500s.

What you are stating here isnt true.

I think there have been other times as well. I seem to remember something about the expansion of the Roman Empire, and again in the Middle Ages when global trading accelerated. Apparently then, the merchants and traders ignored their country's rulers and set up their own system of coinage and contracts. I'm pretty certain there was inflation around the time of the Renaissance. It seems to be linked with expansions or new ways of trading.

Does that change the principle of the article that we're living in a debt economy?

I am talking about America where the FED was created, google says inflation in the US was an average of 0.3% between 1790 and 1913. The US dollar being the reserve currency today is the one the rest follow so it's the one I focused on. I edited the post to say "There was no inflation in the US before the FED, can you imagine that?"

The Spanish thing in the 1500s happened because Spain brought in lots of gold and silver to Europe and they increased their money supply that was backed with those metals, not debt. As more currency circulated and its population remained consistent, its currency value decreased compared to goods leading to a rise in prices. It's inflation but for very different reasons.

I thought money came from trees

nah, 1 & 0's my friend