Interest rates spike across the world. US markets focus in on earnings and rates. I am back in the skies in Australia and mining for uranium elsewhere. Interest rate action is in Japanese banks and US rates. After last month's successful covered call writing, time to write some more.

Portfolio News

Market Jitters - Tariff Tantrum Markets focused in on earnings and rising yields to push banks and tech stocks higher.

Maybe the important news of the day came from the strong words from Iran. Donald Trump pushed back by tweet, as he likes to do. The threat from Iran to close the Straits of Hormuz came back to the front.

Normally this would push oil prices up - they went down. This move is less likely as two countries that Iran wants to have on their side, India and China depend on oil flowing through the straits. More bluff, I fear. Oil price seems to be reacting more to the potential of increased production than the rhetoric.

https://www.marketwatch.com/story/oil-prices-spurred-higher-by-trumps-tough-iran-response-2018-07-23

There is no doubt there was a linkage from rising Japanese yields and US interest rates. There appeared to be more sellers than buyers.

The key feature is that the yield on the 30 year is now back over 3%. The market is linking the potential for Bank of Japan to start to pull back on its monetary easing. Strange really as it is still below its inflation targets.

https://www.cnbc.com/2018/07/23/us-bonds-and-fixed-income-auctions-and-economic-data-in-focus.html

Bought

Mizuho Financial Group (8411.TK): Japan Bank. The sudden shift up in Japanese yields flowed through to a spike in banking stocks. I averaged down my entry price in one portfolio and added exposure in another than does not have banking exposure. On a day when Japan markets went down over 1%, banking and financials stocks went up leaving my portfolios on an up day. The chart tells a story of failed break ups. Maybe this time.

Cameco Corporation (CCJ): Uranium. Cameco mines uranium in Canada, Kazakhstan and US. I presented some analysis of the uranium industry as represented by the Global X Uranium ETF (URA) yesterday in comments on a post. The industry looks like a dead dog and is in need of some form of catalyst. The possibility of tariffs is a catalyst. I compared URA to Cameco and found that Cameco was showing signs of life. Here is the chart.

I felt it was time to have another go. I bought a January 2020 10/17 bull call spread for net premium of $2.16. [Means: Bought strike 10 call options and sold strike 17 call options with the same expiry]. With closing price of $10.98 this is already in-the-money by close to $1. The trade offers a 224% maximum profit potential if price closes above $17 at or before expiry. Let's look at the chart which shows the bought call (10), breakeven, and 100% profit as blue rays and the sold call (17) as a red ray with the expiry date the dotted green line on the right margin.

Price has just been travelling down since the Fukushima disaster. There is no value in looking for recovery price scenarios. The trade is more speculative than that. Breakeven is around the 2018 highs. 100% profit is above 2016 highs and maximum profit is at 2015 highs. The industry needs a catalyst and Cameco are best placed to bring production levels up if those come along. And they are somewhat protected from the threat of US tariffs as they operate in the US as well as other locations which could be hit.

Qantas Airways (QAN.AX): Australian Airline. Signal came from research house to buy on the retracement. They have been watching the stock and trading in and out profitably. Expectations are for solid earnings to presented in upcoming earnings announcement which could push price through the $6.80 which has been a resistance level. Risk in the trade is rising fuel costs.

Sold

Dick's Sporting Goods, Inc (DKS): US Retail. I wrote about buying a January 2020 30/37 bull call spread in DKS in TIB239. Price passed the sold call level ($37) not long after I bought. I have been trying to close the trade out at maximum profit and just could not find buyers. I ran out of patience and closed the trade out for 30% profit since December 2017. With the closing price $34.99, exit was well below the maximum profit. The chart shows the sad story - race past the top and fall back. Maybe upcoming earnings will see it spike back.

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): I watched the Japan interest rate story and sensed that this would play out in other markets. Euribor broke below the level it has been trading in for the last month. I have plenty of short exposure there.

I added another short December 2019 future on a 4 hour reversal on Eurodollar. Price did then make a lower low after my entry. I was gratified to see 10 year Treasury yields rise in US markets overnight.

Income Trades

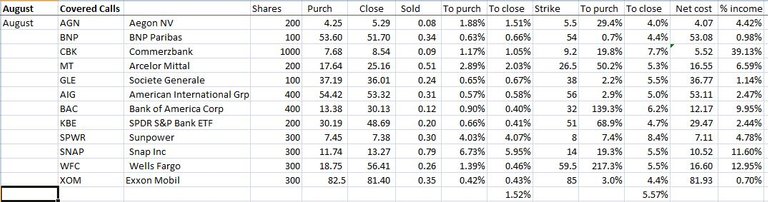

A full slate of covered calls written for August expiry. A reminder on the process for writing covered calls.

- Select stocks I am happy to sell if I get exercised.

- Calculate 5% move up in price from previous day close

- Choose a one month out call option closest to 5% move up in price.

- Place a bid between bid and ask. Ideally one should aim for a premium of about 1% to make this worthwhile

Options volatility has gone up offering a better average this month (1.52% compared to 1.33% for July). The list of trades is similar to last month through I did get a bid on Exxon Mobil (XOM) and I reduced the size of the Sunpower (SPWR) trade as only half of my holding is profitable. Total premium received this month was higher than last month.

The table shows purchase price and closing price, the premium received and the % relative to close and to purchase price. The strike is shown and the important columns after that are the amount price has to move to reach the strike price - you will see they are all around 5% with a few more than that. The net cost column is updated each month to show purchase price less accumulated premium received - the percentage column at the end shows what contribution income has made compared to purchase price.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $431 (5.8% of the low). Price did make the higher high and is testing the next resistance level at $7800. The talking heads agree with my assessment of a divergence on quality coins that is dragging Bitcoin upwards. There are more buyers than sellers. Be aware that the stochastic momentum indicator is overbought - price could well pull back before it moves ahead again.

Ethereum (ETHUSD): Price range for the day was $23 (4.9% of the high). Price rejected the resistance level and traded lower exactly as I expected. Volatility was lower than Bitcoin for the first time in a few weeks. Price has not made a lower low and there is still scope for the price to push through the resistance at $475.

CryptoBots

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-43%), ZEC (-53%), DASH (-58%), LTC, BTS, ICX (-64%), ADA (-47%), PPT (-70%), DGD (-61%), GAS (-73%), SNT, STRAT (-59%), NEO (-69%), ETC (-42%), QTUM (-62%), BTG (-67%), XMR, OMG (-45%).

ETC (-42%) joined the 40% down group and QTUM (-62%) went to 60% down. GAS (-73%) remains the worst and is now well over 70% down. Most coins dropped 3 or 4 points - this confirms the divergence I posted about in TIB270

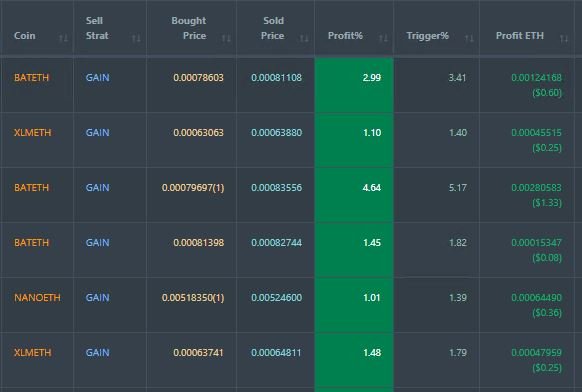

Profit Trailer Bot Seven closed trades (2.11% profit) bringing the position on the account to 0.92% profit (was 0.81%) (not accounting for open trades).

Star of the show was newly admitted member BAT which produced 3 winning trades one after one level of DCA. The chart shows the steady build of volume since the Coinbase intimation that it could be listed there - this does not look like a pump and dump.

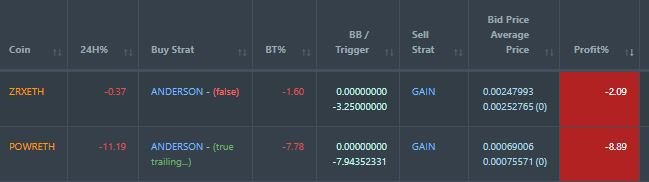

There are two coins on the Dollar Cost Average (DCA) list, both new adds.

Most concerning is POWR at -8.8% though it has not completed a DCA level as the robot is trailing price waiting for a reversal. Stop loss will kick in at -10%. The one hour chart shows a step up in volume

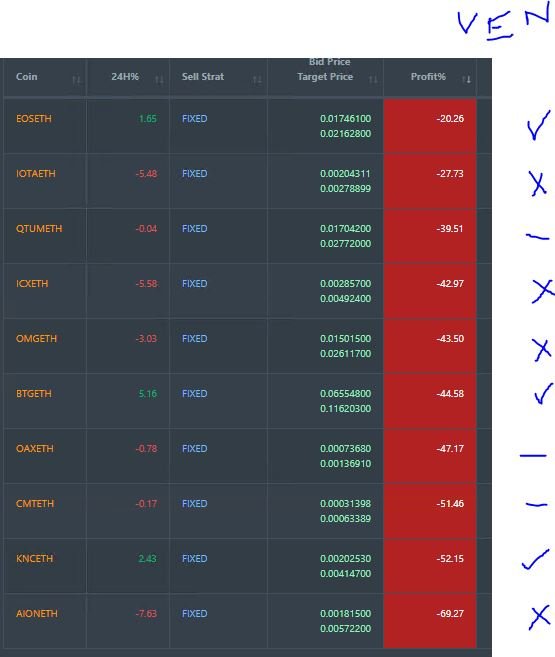

Pending list reduced to 10 coins with VEN suspended during its mainnet swap. Overall 3 coins improving, 3 coins trading flat and 4 worse. I will reinstate the sell order when VET lists.

Binance is supporting the VEN swap with trading of the new VET coin starting on Jul 25.

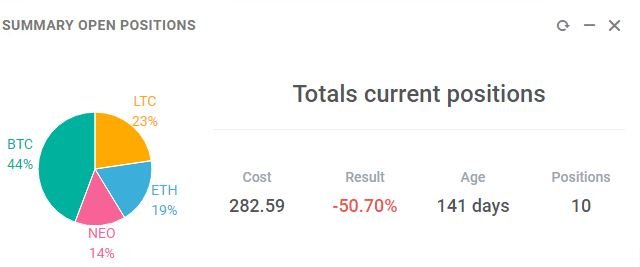

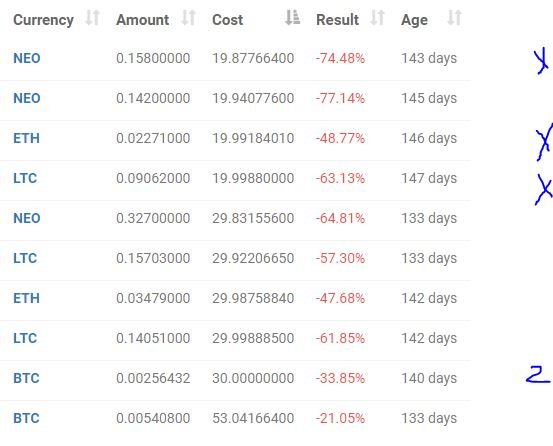

New Trading Bot Positions trade down a little to -50.7% (was -50.5%)

BTC improved 2 points and the other coins drifted. The divergence is clear even amonsgst the quality coins. Bitcoin is the game.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.9% (lower than prior day's 4.0%).

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.33% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and MarketWatch. Yields image comes from CNBC.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

July 23, 2018

Cameco may still be limited due to potential targeting of tariffs, particularly in these types of commodities that are highly regulated (uranium). I used to follow the stock given the dividend potential it had...

Market competition again fluctuates, thank you very much for the information @carrinm.

hi I am Dalwar... I am new member in partiko.So I need more and more upvote. if follow me, I will follow you. please upvote my post....

Posted using Partiko Android

One of the lessons of being new. Do not ask for upvotes and do not ask for follow for follow.

someone will start flagging your posts. The best way to get upvotes and followers is to read the posts and add value in comments. And write great posts yourself.

Where do you see oil heading next, more downside risk due to over supply???

Without good insight into truth and myth in the rhetoric it is hard to say. Last data I saw was that Saudi Arabia was being hard pressed to ramp up production beyond where it was. Libya, Angola and Venezuela are still in shortfall, though Libya seems to be back in business. No idea how much will actually come from Iran. Russia can increase but it is an unknown. Pipeline bottlenecks in Permian Basin continue. Syncrude plant in Alberta is not back on stream. All of that points to a shortfall.

Yet the talking heads are talking an over supply. I do not see it yet.

The best way to understand this is read everything you can in OilPrice.com. Latest article from Rosneft is an expectation of $80 for Brent for Christmas = a little higher than it is now.

https://oilprice.com/Energy/Energy-General/Rosneft-Sees-Oil-At-80-By-Christmas.html

Un resumen economico muy completo @carrinm, acerca del mercado de las Criptomonedas

Gracias

thank you very much for his information, very useful for me

Cool. Good luck