While nothing is guaranteed, it's true that you very well could double the amount of gold you could possibly hold today by not buying today, or by trading it away—at least for now.

This article is a followup to what turned out to be sorta introductory in yesterday's article. As far as actionable info, you don't need to go back and read that one. This will do. If you're interested in some background info, it might be helpful.

A little over four years ago I wrote an article on Seeking Alpha, encouraging investors to consider playing the ratio between gold and silver rather than merely building up their gold holdings. If one looks at the historical swings, an unmistakable pattern emerges that can be taken advantage of. To be clear, this isn't about timing or dollars, necessarily. It's about trading metals and increasing ounces.

Silver's Changing Market

While gold's use has morphed a bit over the years, its expense has protected it from becoming an industrial commodity in comparison to many other metals. Silver, on the other hand, has been used for a wide array of products, some of which render it all-but impossible to reclaim.

I'm not going to go into the details on where this currently stands in this article. You can read all you want to know, and more, in the 2016 World Silver Survey, as well as in my article linked above and my follow-up article found here. All three get into the supply of silver in contrast with gold, as well as current known stockpiles.

Keep in mind that the known stockpiles are massively different than what truly exists. There's simply no way to know how many people are holding silver and gold in their homes, buried in their yards or stashed wherever. In some countries it's very common. In others it's hardly considered. Yet, even then, those who do so tend to be quiet about it.

AG/AU Ratio

If you don't really care about these numbers, you can skip down to "The Strategy" below.

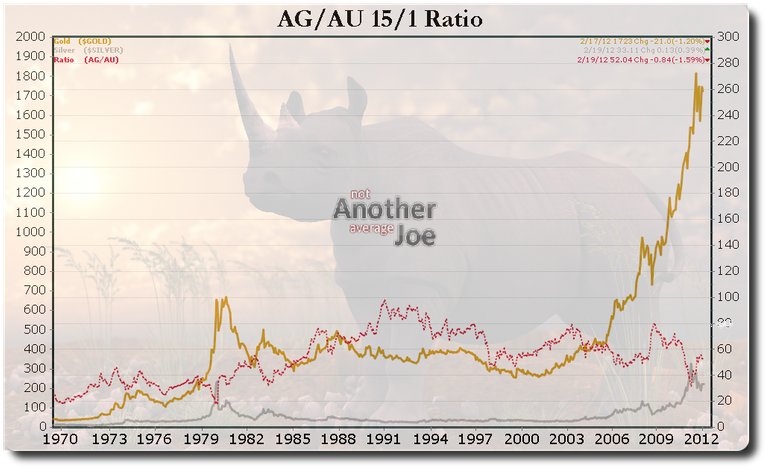

Note that the chart above is a bit dated, but it's still just as applicable. There are three references, silver, gold and the silver/gold ratio (red). As you can see, the ratio has a somewhat inverse relationship with the metals. During silver's peaks, the ratio was at its lowest. It's hard to see clearly, but gold's peak tends to lag silver's, as silver is more volatile.

Some will remember the massive gold and silver moves leading into 1980, with silver peaking at about $50 in January and gold at $850 (21st). The ratio that day dipped to 17. In December, 1979, the ratio hit about 14, when gold was $456 and silver $32.

Again, in 2011, gold and silver peaked. On April 29, silver reached $49.21 per ounce. On that same day, gold reached $1535, bringing the ratio to about 30. A few months later, on August 30th, gold peaked at 1828.50. On the same day, silver reached $40.90, a ratio of about 44. Note the lag. It is likely that this lag reflects electronic trading, which wouldn't have been a factor back in 1980.

Source

Now take a look at the valleys, when the ratio was widest. The highest the ratio has ever been was in February, 1991, when it briefly reached 99. On that date gold hit $364 and silver $3.68.

In December, 2008, the ratio got to 81, when silver was $10.71 and gold $869.75. Then, just a few months ago (March), the ratio again reached 81, with silver at $15.39 and gold $1,240.

Setting dollars aside, if we just focus on the ratio, we can see strong and consistent peaks and valleys. The ratio moved as follows.

- 14 - December, 1979

- 99 - February, 1991

- 46 - November, 2006

- 81 - December, 2008

- 30 - April 29, 2011

- 81 - March, 2016

Having come off of recent lows, it may be that we won't see 81 again. Today, with silver at about $20 and gold at $1,352, the ratio is hovering around 67. According to Elliott Wave Trader, Avi Gilbert, we likely won't see ratios much higher than current levels again. In an update this week, he states,

I do not see anything strongly bearish in the chart. While I can certainly be wrong, the most downside I see at this time is for a c-wave down in the metals charts.

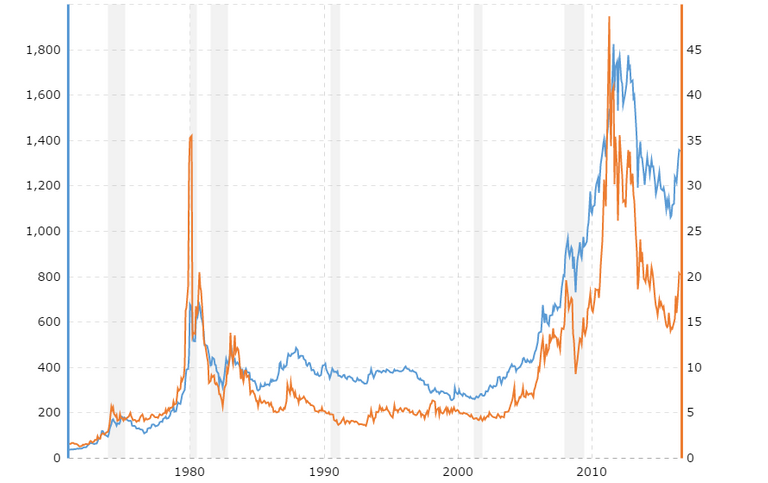

His analysis of gold (GLD) and silver are found in the following charts.

While anything can happen, his analysis would indicate that the next contraction may be the lowest levels we'll see in metals for the foreseeable future, and perhaps ever. Where will this contraction take the ratio? All we can do is guess, but into the 70s may offer the best opportunity, though at the current 67, perhaps waiting isn't worth the risk.

The Strategy

It's really quite simple. When the ratio is high, you buy silver or trade your gold for silver. When the ratio is low, you buy gold or trade silver for gold. We'll make a few quick comparisons to show how trading the ratio would work.

Source

Scenario 1

Suppose you had $10,000 to invest today, and knew you wanted to buy some gold. This would buy you about 7.39 ounces. And let's also suppose that the next high in gold takes place five years from now, at $3,000. You would then have $22,170 worth in gold.

Scenario 2

You take the same $10,000 and buy silver, gaining you 500 ounces. And let's suppose that in five years, when gold is at $3,000, the ratio drops to 30. This would put silver at $100, which means that your investment now stands at $50,000. Now, if you still want to hold gold, you trade your silver for gold, ending up with 16.66 ounces of the yellow metal. In other words, by going with silver today and trading for gold at a later date, you could end up with more than twice as much gold than if you were to buy gold today.

Conclusion

If you are already holding precious metals, consider trading a portion of your gold holdings for silver. Watch the ratio and wait for it to approach a level where you're ready to trade back. It might not be 30. Perhaps you'd rather do so at 40. Or maybe you want to layer into gold from silver.

Then, depending on your goals, you should gain a little more value in your gold holdings before the next correction. Maybe you'll want to cash out shortly after swapping. Remember, in about four months during 2011 gold gained around 20% between the ratio's low and gold's high.

Whatever you do, take advantage of an opportunity that has a high probability of increasing your total ounces of gold, regardless of how much the price fluctuates.

Rockin' on,

Another Joe

My introduceyourself HERE.

Or instead of gold you could buy farmland, housing or other needed and cash flowing assets. The article is spot on, but holding money in perpetuum is not always the answer, growth and steady income for old age may be. (you do realize that pensions and social security may not be enough if even in existence).

Yeah, it's also assuming that folks diversify according to their own investment philosophies. The focus is just on increasing ounces, regardless of price, where we might be in a boom/bust cycle or other goals.

Well said... and in that regard, there may be a day when the other assets mentioned may also be traded for an increased ounces.

I get your point and have done this in the past actually, not as much as I would have like, thanks again.

I have been a silver investor since 2006. I also only buy physical silver bullion. My fav are Chinese Panda coins. They seem to also do as well as a numismatic. I wish more people understood the power of owning physical metals.

Joe, how do you feel about buying stock in mining companies? Specifically junior miners. It seems that the run ups in precious metals affect those stocks the most, and gains of 500% can be had. I wrote an article the other day about a junior miner that I think will jump.

https://steemit.com/money/@getonthetrain/steemit-stock-watch-could-this-nearly-unknown-stock-be-a-home-run

I like them too. They're a mixed bag and largely speculative. The challenge is to figure out which ones are going to survive and which ones won't. Home runs in that sector will bring massive profits. Because it's so volatile, a basket might be the best way to go, grabbing a few to spread risk. All it takes is one to do really well and, like you said, 500% or more can be realized.

On a more positive note, it does look like we've come off recent lows for the last time. If that's the case, then we might already have our survivors. With that in mind, maybe right now is the best time to get into them. I know some are doing well already.

I agree on the "shotgun" approach to junior miners, you can never be 100% which one(s) are going to make it. But like you said, it could only take one. Thanks for the reply.

I appreciate the article. I'm poor, so i can only afford silver.

I hear you. I hope you're able to get enough to help you out when it finally gets up there.

Yeah, I love silver over gold.

It's been said that in like 20 years the world is out of silver to mine. By than it will even more skyrocket. So I am not sure about converting my silver into gold.

You can always trade back. It's advantageous both ways and we should see at least a couple of swings over the next 20 years. Who knows? Maybe you could double or triple your holdings by then, just trading the ratio on the bigger moves. Of course, you don't have to use it all either. You could do it with smaller amounts. But there's something nice about just letting it sit there too.

looks better :D u got an upvote this time, u may want to look into optimum posting times next. Think US afternoon is popular. your content is actually really good for investors

Thanks

Thank you for taking the time to write this article

You're welcome! :)

I have about 80-90% silver to gold. Been buying for about 10 years. For those who think they can't afford it sometimes I spent as little as $20 to buy some junk silver. Sometimes I spent more. But I bought consistently and now I have enough to be a very wealthy man when the bull market goes parabolic. Thanks for the article. Maybe I will trade the silver for gold some day or maybe not. Another trick for you. I can get $50 an ounce for a silver round where I am. If you can get your silver to somewhere that they don't have it you can profit nicely.

Thanks! $50/ounce? That's a pretty sweet markup. It must be tough to get it there?

Creative problem solving skills :-) I know only one other place you can get silver here and it is a city of a million people.

That's how entrepreneurs stand out. Good job. Wish I could find a gig like that. I'd be flipping it like a madman.

A couple of times in my life I've found things like that. I know that when it happens, it won't last. So I jump all over it and milk it for all it's worth as long as I can. Eventually it turns into peanuts, or just goes away due to supply drying up, competition entering the market or something along those lines. I hope it lasts and takes good care of you.

I have a much more creative gig that has my focus. I get 10 x profit on something but it took a huge amount of work setting up. Perfectly legal. Now I am fine tuning after 4 years if building so I can rest more. Doing my best to delegate. It gets the profit due to my labor in the past. Hopefully I can make it happen with delegation and duplication of my role.

Great post and a very interesting strategy. I hold silver in the form of 1oz coins. What do you think about the mint added value vs saving in bullions?

I suppose one could trade this way with bullion for a bit, because we do see swings, then when they think folks are getting too excited, switch to numismatics. The timing, IMO, would be pretty tricky though.

Well, those are my thoughts, anyway. I hope you do really well with your silver.Thanks @mac-o. For this strategy, I prefer junk or bullion. The problem is that numismatic value often doesn't correlate with market moves. Sometimes it does. Often it lags. It's predicted that only when folks get really excited about metals again, will numismatics have their day.

impressive and beautiful

Thank you!

You have got my attention here

👍

Thanks! I hope a lot of folks see this and are able to bank off it. It's a nice, clean and simple plan with no real pressure.

You can visit my Blog

The Real Deal

https://steemit.com/photography/@bullionstackers/1-kilo-bullion-scottsdale-silver-bar-photo-1

"His analysis of gold (GLD) and silver are found in the following charts."

I've been trying to do my due diligence into this GLD fund. Anyone know why there is a clause in the GLD prospectus that states GLD has no right to audit subcustodial gold holdings? Why would the organizations behind GLD forfeit this right and create such a glaring audit loophole? I have not heard a single good reason for the existence of this loophole thus far. It also doesn't help that GLD claims to be fully backed by physical gold bullion but yet it refuses to give retail investors the right to redeem for any of these ‘claimed’ gold bullion. There are a number of other red flags as well from what I'm reading:

"Did anyone try calling the GLD hotline at (866) 320 4053 in search of numerical details on GLD's insurance? The prospectus vaguely states "The Custodian maintains insurance with regard to its business on such terms and conditions as it considers appropriate which does not cover the full amount of gold held in custody." When I asked about how much of the gold was insured, the representative proceeded to act as if he didn't know and said they were just the "marketing agent" for GLD. What kind of marketing agent would not know such basic information about a product they are marketing? It seems like they are deliberately hiding information from investors.

I remember there was a well documented visit by CNBC's Bob Pisani to GLD's gold vault. This visit was organized by GLD's management to prove the existence of GLD's gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this "GLD" bar was actually owned by ETF Securities."

Lots of concerns with SLV too.

The chart wasn't to offer GLD for investment, but to show the path of gold as tracked by this Elliott Wave statistician. Since it tracks almost parallel to gold, and is the vehicle he uses to follow it, it's what I had access to.

Personally, other than for short term trading, I wouldn't hold GLD or SLV, for the reasons you state and more. A few years ago, there were many accusations that SLV was trading far more silver than it actually had access to. I haven't even really checked it out since. For holding, I'd go with PSLV instead, if I wanted an ETF type instrument.

Great article! Thank you for taking the time to write it. Quick question... Do you use physical gold/silver for this strategy? If so, how do you do your swapping? Do you take it to a local dealer and do the swap at once or do you utilize an offshore or onshore vault for the transaction and storage? I really appreciate it!

Great question.

IMO, it's always a great idea to develop a relationship with a local dealer. Even if you just go in and talk, buy a small coin once in a while, bring him coffee or whatever. Stop in to see him at least once a month. I used to go hang out with a buddy who had a coin shop and learned tons just being there. Then he gave me great deals and cut me in on opportunities once in a while.

I prefer physical, for obvious reasons. but for trading, I trust Sprotts ETFs. There are other ways to go to, such as storage services. I've done some work with Hard Assets Alliance and trust them too. They have some nice options, and you can trade online anytime.

Maybe I'll do a post on options for how to hold metals. I wrote one a few years ago, but it's probably a good time to update it.

Thanks. I was excited to share it, but it looks like it flew under the radar. I hope it helps!

@alaynaspop appears to be a bot that posts this same comment on multiple posts without also upvoting to support the compliment and adding nothing to the conversation. See my post here: https://steemit.com/steemit/@brendio/fighting-a-spambot

Thanks @brendio. Yeah, I just noticed that this morning just before I saw your post. Will check out your article.

Ahh, spambot. Sigh.....