As an important component of the LBI re-launch, a liquidity pool has been a priority to set up and build. It's been in operation now for around 6 weeks, so its a good time to check in on it and see how progress has been. Let's see how our pool is going, and think about some possibilities.

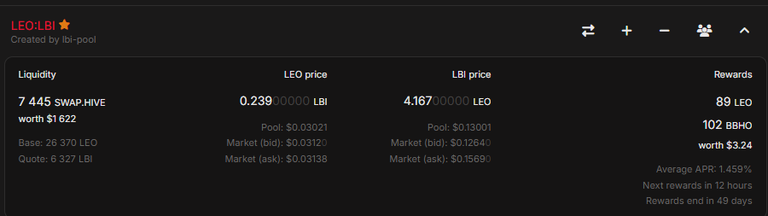

At this moment, the LBI/LEO pool has had 6327 LBI added to it, paired with 26370 LEO. Currently, here is how it looks on BeeSwap

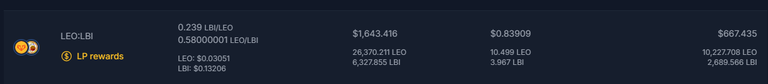

Looking at Tribaldex we can get some more information.

The first thing to note is that LBI is priced in the pool at a premium to the "Asset Backed Value" (ABV). Just an hour or so ago, I put out the daily thread with the asset backed value per token:

https://inleo.io/threads/view/lbi-token/re-leothreads-gfp6pxbw?referral=lbi-token

So we can see that LBI is valued at 3.771 LEO each, and its trading in the pool at 4.167 currently. So, the token is trading at 10% above asset backing, which is a great sign to me personally. It shows that people are buying LBI out of the pool, and placing a premium on the token. On the Beeswap screenshot above you can see that the pool has an APR currently of 1.459%. So we can clearly see that people are not aping into LBI for the massive yields. Dividend yield as seen in last week's update was only 1.74%, so again, no one is bidding LBI up for its massive yield.

Yes, the goals are to build up both of those yields over time, but at this point it is clear that LBI is a low APR investment - for the short to medium term anyway. So, people buying in to LBI now, and prepared to pay a premium to the ABV for the tokens must be confident with the fundamentals of LBI.

The other important consideration is the depth of the pool. While having 6300 LBI and 26000 LEO liquidity is nice, it is still only a bit over 3% of the total LBI supply. It is still a small, shallow pool - which is not surprising with just under 1.5% APR. Buying just 100 LBI out of the pool, an amount worth around $12, would cause a price impact of roughly 2%. So it is still not possible to buy LBI with any great size via the pool.

What is needed to take the next step is bigger rewards. Trading volume is ok, with 10,000 LEO worth of volume since the pool was set up. There has been some arbitrage trade I've seen between the pool and the order book market. But again, no LP providers are going to get rich of trading volume and the swap fees it generates. So, there is really only one way to attract more LBI tokens to be put in the pool, and that is through higher incentives.

Where does the APR come from?

Many tokens incentivize their liquidity providers via inflation. New tokens get minted, and added as pool rewards. The dilutionary effects of this have played out over and over again, across many blockchain eco-systems. Prices of reward tokens almost invariably trend towards a 0 value. It has happened everywhere, but you only need to look as far as CUB DeFi for an example. I won't go into it, but anyone that has been around LEO for a while will remember.

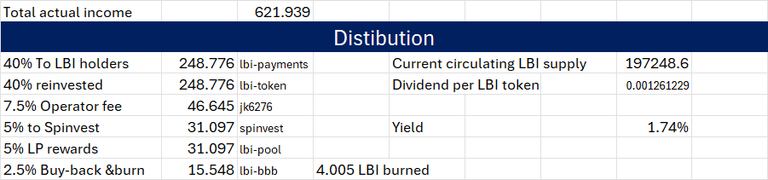

LBI has no inflation. Our token is fully minted, no more can ever come into existence. In fact, LBI is deflationary. A small portion of our weekly income is used to buy back and burn LBI tokens, every week. So there is no dilutionary inflation to use to entice people to add to the pool, which is a very good thing in my opinion. What we do have is a project that generates income, and a portion of our weekly income can be used to incentivize the LP. From last weeks income report, we can see that 5% of our weekly income goes to pool incentives.

The APR for the pool is small, but it is sustained from real income. Each week, I add SOME of those LP Reward funds to the pool distribution contract. The reason I only put some of them is each week is that the current LP distribution contract runs out in 49 days. When I set up the next one, I want to ensure there are funds available to add straight away, so the APR does not fluctuate too much.

What can we do to make LBI LP's more attractive?

Hypothetically, there are a few things we could do. This is where I'm keen to get LBI token holder feedback.

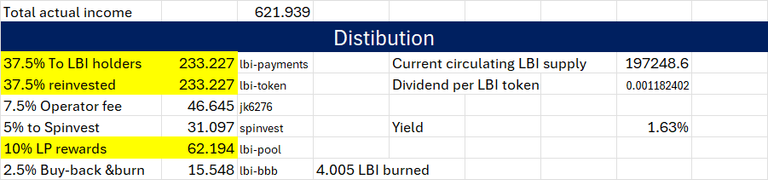

Change the distribution mix. We could tweak our distribution percentages to have more of the income split going to pool rewards each week. Here is a hypothetical, using last weeks income distribution from above:

I highlighted in yellow the numbers I changed. So with just a small tweak, slightly dropping the dividend and re-investment amounts led to being able to double the funds available for LP rewards. It is important to remember that tokens held in the LP are still included in the weekly dividend distribution, so these tokens receive both dividends and pool rewards.Add other rewards. Currently, we have added BBHO tokens to the pool reward contract. These are earned from content and curation from @bradleyarrow's new BBH tribe. These tokens are not recorded on our balance sheet, or income. They get added to the pool contract as a bonus for our liquidity providers. We could add other tribe tokens also, quite easily. We earn some ARCHON, PIMP, NEOXAG, POB, CENT. None of these are on our balance sheet, and could be bonuses for the pool. The question is would that really entice more liquidity? I have my doubts, but it is an option.

Add another pool. Here is the big idea for this post. What if we set up an LBI/SWAP.HIVE pool? I know there are LBI token holders that don't want more exposure to LEO, so enticing them to add to the LBI/LEO pool will be hard. An LBI/HIVE pool might be a much easier sell for these investors. The LBI tokens these days are much more than just a LEO backed token. In fact, LEO is just over 25% of the funds assets. While I was of the belief that the LEO pair was the best option, and I still do hold that belief, a second pool with a HIVE pair could be appealing.

Benefits of a second pool.

Attractive to a wider range of investors. Not everyone likes LEO. Not everyone wants more LEO exposure. HIVE is a common thread for our target investors, and an LBI/HIVE pool could hold appeal beyond the LEO community.

Arbitrage. With an LBI/LEO pool and an LBI/HIVE pool, there opens up the potential for increased arbitrage trading. Price discrepancies between the two pools can be easily traded (likely by automated bots). This would generate more swap fees that liquidity providers would earn. Manual traders may review the daily LBI asset backing thread on Inleo, and initiate trades through the pools based on those numbers.

Options. Easier access to LBI tokens beyond LEO holders could make investing in the fund more attractive.

Downsides

Splitting the available funds between two pools may make both less attractive. Without adding more rewards to the mix, yields on the two pools may not become sufficient to entice people to add funds.

Lack of interest. One deep pool is overall a better experience for traders, investors and holders alike than two shallow pools. Possibly there is just not enough LBI tokens in the hands of active investors to make a second pool viable.

Moving away from our base. LBI is a LEO based project. It's in our name, and a part of our history. As it is, the fund is much less "LEO" than it was previously. By further shifting away from our LEO home, we could risk loosing the support of some of the LEO OG's, who are also LBI holders.

Cost. Setting up a new pool would cost around $100 at current BEE prices. Will it be worth that kind of expense?

Questions for LBI holders.

Would you support setting up a second LP, with LEO/HIVE as the pairing?

Would you support any changes to the "Distribution" of income to add more LP rewards?

Would you like more tribe tokens added as pool rewards?

I'd love lots of feedback in the comments section below.

Thanks for taking the time to read this post, and for all the support for LBI's content.

Cheers,

JK

To learn more about LBI, here are a few recent posts for your information:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-8-week-ending-22-sep-2024-5ie

https://inleo.io/@lbi-token/lbi-increases-its-power-den

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

Posted Using InLeo Alpha

Considering my previous comments, this may sound surprising to you, but I would wait with the decision a bit.

Currently, I put all my Leo divs and Leo rewards into liquidity pool and I guess others do it the same way, so the liquidity will steadily grow week by week.

We need to determine how much the liquidity is growing. Upon this data we should be able to assess whether it is likely for the pool to reach proper liquidity in any sensible period.

I'm wondering if it would be possible for LBI to set up a an arbitrage contract between orderbook, swap.hive:LBI and Leo:LBI pools. Maybe @blocktrades or @khaleelkazi would share their know-how with us. This would cost, but might provide another revenue stream that could be diverted into LP additional rewards.

So, I'd vote to postpone. I'm open for looking for solutions to raised issues.

P.S what if you used mentioned tribes tokens to buy more LBI via Leo pool to burn?

Yeah I agree, let's just wait for now

I appreciate your feedback. The current reward contract for the pool still has over a month left to run. Growing the liquidity is a goal, but as you say, it needs to be a week by week proposition, and maybe with a target depth before we even consider a second pool.

As for arbitrage, I see some bots already doing this when the order book and LEO/LBI pool present them with favorable conditions. This is an area I have no skill in, and would have to pay someone to set it up. I doubt the cost for a stand alone arb bot on these markets that are not highly traded would be worth the investment.

A second pool is definitely not something I'm in a rush to do.

Dumping the miscellaneous tribe tokens for either more burns, or more reinvestment, or more pool rewards is a good idea.

My view on the matter:

Wouldn't NOT support it, but I think it doesn't make sense right now. The leo pool is still quite young and building and splitting liquidity now could be bad. So postpone and see if it makes sense down the line has my preference

Yes, but I would probably not touch the reinvestment part, actually I would but increase it rather as this helps grow all the others over time.

Cutting the regular divs has my vote, we did without for years and cutting it back some in favor of more lp rewards and growth makes sense to me.

Personally could do without a bunch of extra garbage tokens. Dumping them to boost other areas would probably be better, whenever it makes sense as it might not have much value anyway

Thanks for the input.

Tend to agree - its too early to add more pools in. Mainly, I am wondering how many LBI tokens are out there in hands that don't want any more LEO, so they wont end up in the pool. Those holders may be happy to pool with HIVE. It's a thought exercise for now. The current LP contract still has over a month to run, might be worth a closer look as that approaches its end.

I expect differences of opinion here. Div's have benefits and drawbacks, and I understand there are lots of different views. I personally really like dividends, but try to find a balance between my preference, and that of other LBI holders. I think a small portion for dividends, with lots of asset growth built in hits a decent balance.

I'm just looking for something useful to do with them. I'm not going to fill the LP contract with a bunch of worthless tokens.

Yeah definitely agree on 1 and 2, as for 3 I think it only makes sense when it becomes a stack with some value. Fun idea: let it build up and check twice a year say around Christmas and May. Anything wortwhile gets distributed as is or as extra leo divs. Like a Christmas and vacation bonus 😄

!pimp

Does this command do anything?

It gives a decent amount of free pimp tokens. Sometimes the bot gets stuck (like now) but always comes.

Does it require any specific amount of staked pimp? Should the post have pimp tag?

Don't remember exactly. I have 100k plus so I get 4 calls. First one pimp, then 5, then 10 and finally 20.

Btw, the command actually worked, turns out comments just moved here to remove spamminess

https://peakd.com/@thepimpdistrict/20240928t080934900z

Join mthe discord for more info

https://discord.gg/MVdzNvu7

I've had a little brief look into PIMP, and it might be something I need to look at further.

It's a good token to delegate some hive (sweet spot is around 1k I think) if you post daily, to grab the votes and some pimp tribe tokens. :)

Most of those tribe tokens are kind of meh, so I am not really worried about that. The LBI/HIVE pool sounds interesting.

What are your thoughts on the income distribution split? I'm keen to change it to have more going to pool rewards, but not sure of the best path to do so. Cut back on "reinvestment" funds (these are mostly used at the moment to buy more INCOME, BXT and BRO), Dividends (these are already small, but an argument could be made diverting some of this would mean more goes to active LBI holders - those adding to the pools - rather than passive, and possibly lost wallets).

LBI/HIVE could be a good second option, but is there enough tokens in active holders hands to build the pool deep enough?

If the rewards are worth it you might be surprised. I think the fact that there are limited LBI out there is a good point. Based on those numbers you should be able to figure out what to expect right? I'm not sure on the distribution split. I just know I have a lot of worth less tokens dripped into my Hive Engine wallet pretty much every day and they are never going to be worth anything. The ones that are I am also buying or earning, not just getting drips from pools.

I wouldn't change much, I think you're doing very well and I would trust in the snowball effect.

If I wanted to make a small change I would eliminate the burning and add it to the liquidity pool. I think the volume is small to burn.

As for the second pool, I think it's too early, I would first consolidate the one that's already there. You can always go to the market to buy with Swap.Hive.

!PIZZA

$PIZZA slices delivered:

(1/10) @yeckingo1 tipped @lbi-token

I will keep adding my Leo rewards to the pool either way.

!pimp

Hello lbi-token!

It's nice to let you know that your article will take 6th place.

Your post is among 15 Bestpolish.hive articles voted 7 days ago by the @hive-lu | King Lucoin Curator by

You receive 🎖 0.9 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 436 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq (Lucoin) and get paid. With 50 Lu in your wallet, you also become the curator of the @hive-lu which follows your upvote.

STOPor to resume write a wordSTART