Introduction

I believe that there is a demand for small loans on the HIVE blockchain from users. I aim to fill this gap in the market by providing collateral backed loaning and saving's service for the community with Bear Bonds (B) tokens.

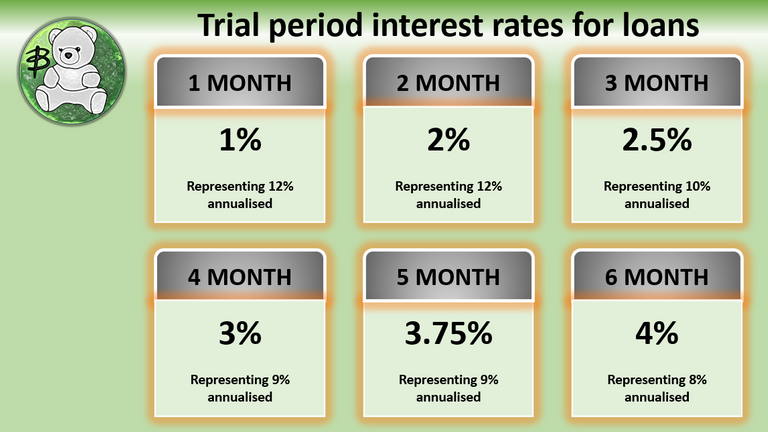

Bear Bonds will go live on the 12th of February 2022 for a 3 month trial period ending on the 12th May 2022. During this time, we will only be trialling loans only with saving's being added at full launch. The trial time will be used to see if there is demand for this service and give me information to help fine-tune the loaning process and make amendments to increase the ease of use for clients before jumping into the deep end.

During this trial, Bear Bonds will be used as a stable token to process loans but in the future, savings and other use cases will be introduced. Bear Bonds will see its biggest growth during the next bear market as new savings and investment opportunities are created. Think of an HBD ecosystem of loans, traditional and gamified savings projects all balled into 1 project and that's where we are headed. We're starting with loans.

Bear Bonds (B) Token

| . | . |

|---|---|

| Token name | Bear Bonds |

| Token ticker | B |

| Decimals | 3 |

| Max supply | 100 million |

| Pegged value | 1 HBD |

| Created and backed by | SPI token @spinvest |

| Operators | @silverstackeruk & @amr008 |

| Instant Liquidity | Provided |

BearBond Accounts

| Account | Used for |

|---|---|

| @bearbonds | Acts as the main bank to provide liquidity. Reports and loan contracts are uploaded from this account. |

| @bearbond-issue | Issues Bear Bonds (B) |

| @bhold | Holding account for collateral |

What are collateral backed loans?

These are loans that require the borrower to provide collateral to secure a loan. This reduces the risk for the lender where the collateral can be used to recoup funds. Common examples of collateral would be property, saving's accounts, stock holdings, precious metals in the real world or BTC in the crypto world. There are many different types of collateral backed loans ranging from under to over collateralized. Under would be providing $50 to borrow $100 and over would be providing $200 to borrow $100 and of course, there is everything inbetween.

Bear Bonds loan model

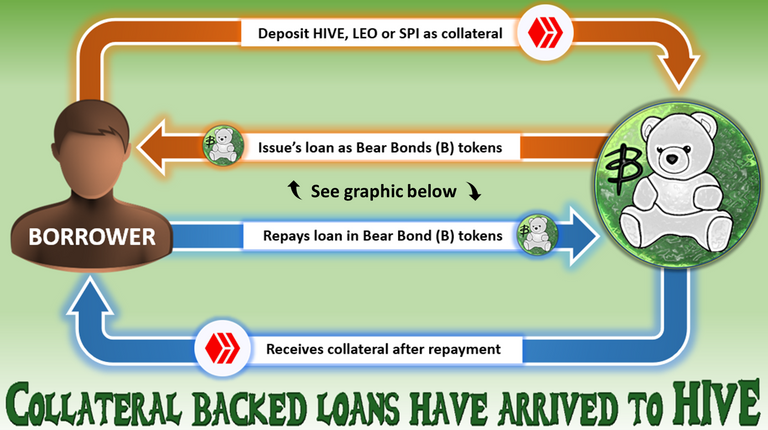

Bear Bonds loans have a LTV (loan-to-value) ratio of 50%. This means to secure a $100 HBD loan, you must provide $200 HBD worth of collateral in the form of either HIVE, LEO or SPI tokens. You are not required to provide any account provide keys to secure a loan.

Start to Finish Process

(Borrowing)

Step 1 - Deposit collateral to @bhold and sign contract uploaded by @bearbonds

Step 2 - Receive loan in Bear Bond (B) tokens to your hive-engine wallet

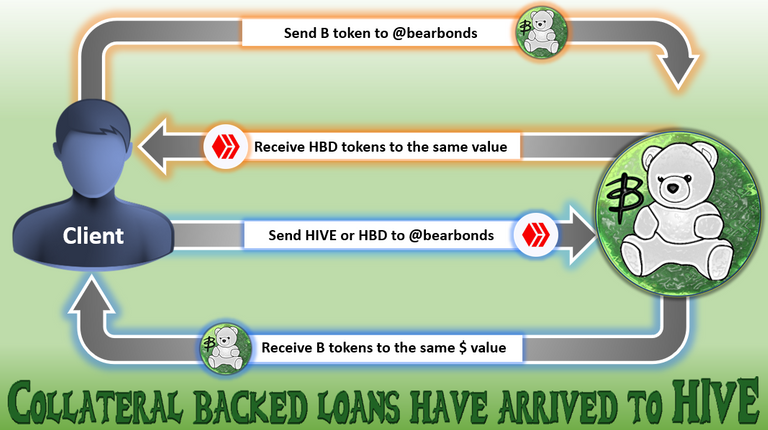

Step 3 - Convert Bear Bonds (B) tokens by sending them to @bearbonds to receive HBD to your HIVE wallet.

Step 4 - Use your loan

(Repaying)

Step 5 - Send HIVE or HBD to @bearbonds through your HIVE wallet to receive Bear Bonds (B) tokens in your hive-engine.

Step 6 - Pay back your loan amount plus interest in 1 transaction on or before the end of the loan term.

Step 7 - Receive your collateral back and transaction complete.

@bearbonds uses coingecko to obtain live price feeds to ensure that all conventions are as accurate as can be.

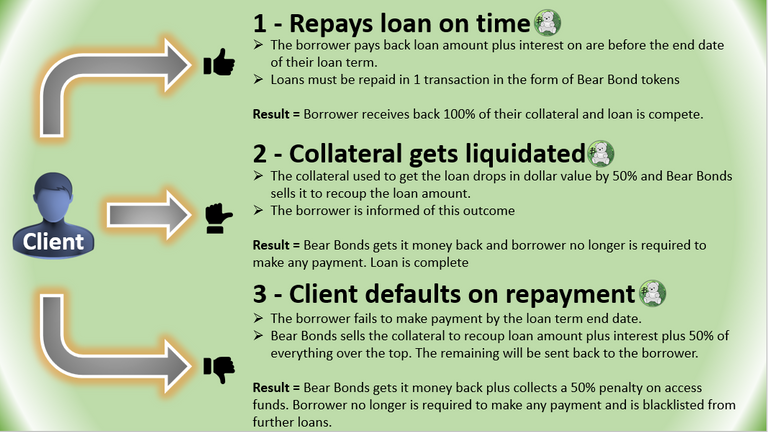

Each loan has 3 outcomes

- 1 is the best outcome

The borrower can repay the loan plus interest at any time from the beginning to the end of the loan term. There is no penalty for repaying the loan early but the interest amount is fixed so no discounts either. We request the loan be paid back in 1 transaction as this is easier to track for both borrower and lender. This also lets the borrower buy Bear Bonds at their own leisure instead of having to make payments on certain dates.

Once the loan plus interest is paid, the collateral will be released but to the borrower.

- 2 is ok, I'd prefer outcome 1

If the collateral you have used drops by 50% in dollar value, Bear Bonds will liquidate your collateral to recoup the loan amount. You will be informed and the loan will be marked as complete. You are welcome to top up collateral if you see the price dropping but there will be no warning provided by us. (maybe someday if SMT's ever become a thing).

- 3 is not good

If there is no repayment by the final date, your collateral will be liquidated to recoup the loan, plus interest, plus 50% of the remaining funds left over. Eg, you take a $100 loan and use $200 of SPI's as collateral and then never make the repayment. If the SPI token price has remained stable, Bear Bonds will sell all your collateral for $200. It takes back $100 for the loan and says $5 for interest. The remaining $95 is split in half with 1 half going to bearbonds and the other back to the borrower that has defaulted. The loan will be marked as complete and the borrower will not be able to take new loans.

Using the Bear Bond token offers flexibility

Instead of having set weekly or monthly repayment dates for loans, we use the Bear Bond token to let borrowers decide themselves. As long as you make repayment by the final date, you are good. Borrowers can buy Bear Bonds weekly, when they have extra HIVE or wait until the day before repayment is due.

Recurring payments

Are you aware that you can set up automatic payments from your HIVE wallet? When making a transfer, a slider is presented in the bottom left corner that lets you set up automatic payments. You input the account you wish you transfer funds to, the amount to wish to transfer and for how many weeks. After you confirm the transaction, all you have to do is make sure you get the funds in the wallet.

If you take a loan of $100 HBD for 3 months and you wanna pay your loan back with content rewards, simply set up a recurring payment to @bearbonds for 8.5 HBD per week for 12 weeks. After 12 weeks, you'd have collected 102 bear bonds tokens. You repay your loan and get back your collateral or take a new loan.

Bear Bonds is aiming to fill the gap for smaller loans on HIVE. We will be starting small and working our way to up a max loan of $1000. There is a loaning service on HIVE already that caters to higher amounts but they require private keys which carry no risk while we require collateral that does carry risk so smaller is better for Bear Bonds model to reduce overall risk.

For our trial period, the minimum and maximum amounts for loans we'll provide are

Min - $25

Max - $250

Assuming the trial is successful, the minimum amount will remain the same with the maximum increasing in increments of $50 until the target of $1000 is hit. Longer loan terms will of 9 and 12 months will be added as the maximum loan amount grows and new forms of collateral will be looked into for post-trial. Any token we use as collateral must have excellent liquidity to offer a quick exit if required and decent volume to provide a stable price so there is a limited list.

What's next?

Template loan contract to include full terms and conditions.

Each new loan will have a contract uploaded to the blockchain and we make HIVE our ledger. Instead of having a terms and conditions post, we will attach them to each loan as that seems more appropriate. Each borrower will be required to provide collateral and sign the uploaded contract before the loan is released. Signing with be a simple comment to acknowledge the contract. This template will be uploaded before the 12th trial launch date.

Questions?

I'd guess a few people will have some questions so put them in the comments below, please and I'll do my best to answer them.

Lastly, this is a brand new account and exposure is key for HIVE users to know this service is trialing. Please rehive this post if you think your followers would be interested and get this on many eyes.

Thank you for taking the time to read through this project introduction.

That's a great feature but it is a centralized solution. Good luck with trial phase.

If you get collateral as HBD, will you be saving it into a savings account to earn 12% yield on top of it? who takes the yield? bearbonds or the person who is taking loan.

Why would someone take a loan if he has 2x the amount? unless that is an asset like BTC they don't want to sell or just saving on taxes?

Its either a tax game or a cashflow game. sending 2x hbd for 1x hbd doesnt make sense on cashflow, but sending LEO or SPI for collateral may make sense.

But I am interested, who gets the divs from SPI?

I could send $200 dollars of SPI for 6 months (8% apr), to get 100 HBD and put them in the savings account to earn 12% 🤔

ECO gets it :) but he has a good mind for gamification.

HBD is not accepted for collateral.

HIVE

LEO

SPI

Yes it's cefi because not sure how this could be set up and run with no single person in charge/accountable. Also bearbonds would earn the yield hence the reason we can offer loans at 10% and under. There is 1 other loaning service on HIVE but it charges 18% roughly.

This is a great idea! Can anyone take part in the trial or are you running it privately at launch?

Open to all!!

Thanks for the feedback

Congratulations @bearbonds! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Just curious if you're limiting the number of loans per person/account as well as the dollar amount? For example, could a person do $250 five times?

Also, an obvious concern is what happens in the event of a tragedy on your end? If you disappear, how are transactions completed and collateral returned?

One last thing...will you be providing a list of acceptable collateral? I assume most of the major tokens/coins will be acceptable but I was thinking more of the HIVE tokens i.e. !PIZZA, OneUp, Leo, Cub, Cartel, etc. Some are obviously more liquid than others. It would be nice to know which are acceptable.

Posted Using LeoFinance Beta

Good point. I guess I'll update the terms to make it 1 loan per 1 form of collateral.

There are 2 people that hold all the private keys plus spINVEST so if I pop my clogs, your collateral is safe.

The collateral accepted will be HIVE, LEO are SPI to start with because they all offer excellent liquidity. Any form of collateral has to be very liquid. Dec would be an example, CUB would be a good one as well.

PIZZA Holders sent $PIZZA tips in this post's comments:

@dagger212(1/15) tipped @bearbonds (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Interesting project, can be an opportunity for quick funds and liquidity in a bull market. As they are bagged to stable, the bear market can be tricky for this type of loan.

Depending on collateral, it can be tricky if it is going the bear market way, as collateral will be worth much less.

Posted Using LeoFinance Beta

Yeah, i agree. Bear market will be tricky, not even HBD is pegged properly adding to the variance. HIVE would need to drop by 50% 3 times roughly to get back to where was between 12-15 cents and there's alot of space in between as well.

I can't even say short term loans help with risk because we're talking about crypto and the price can drop 20% in a single day.

Interesting plan I think it should go over well. Another good reason to buy and hold SPI

Fingers crossed it goes well and a few people try it out. I've always wanted a stable token for SPI and banking seems like a good space for us to leave a mark.

I'll be releasing a sample "loan contract" soon so keep your eyes out for that

So the trial launch is tomorrow? I'll be your first customer, since I just discovered that Neoxian has closed the bank shop haha. After 5 years of watching, but never making use of it, now I need it and it's not there lol.