My Personal Net Worth Report For Q1 2018

Wow, the market really changed course the first three months of 2018. It was as if any money I invested just disappeared. My regular income and investment accounts sure battled it out in this regard.

Still, in the long run, investing on the down periods when everyone is scared is often the way to go. I choose to live below my means so that in the future my means won't require my active effort.

The few times I tell people around me, at work and such, how much I save and side hustle, they say they could never do that.

Exactly! If you want to get away from the crowd, you have to do stuff the crowd isn't doing.

Somone can have a large income but if they aren't saving and investing then it really doesn't matter. Oh, they can have the nice clothes and the fancy car, but their life can change in an instant if they lose their income. They are just doing what the crowd is - spending everything they earn (and often even more so).

Your net worth is the sum of all your assets. Poor people buy things that decrease in value, while those with a wealthy mindset buy investments that usually increase in value.

It is important to note that your net worth is how rich you are, not how wealthy. Wealth is different. It is freedom.

You can be rich, but if you have to go out and work each day then you are not wealthy.

Robert Kiyosaki of "Rich Dad Poor Dad" fame said this of wealth.

"Wealth is a number of days forward that you can survive without working. Wealth is measured in time, not dollars."

So if you invest your money into things that pay for all of your daily living expenses then you are wealthy and free. That is my goal.

Now I am just talking about wealth in the monetary sense, but do know that there are plenty of different areas to be wealthy in - like happiness.

You can be wealthy financially, but it doesn't automatically make you happy.

Ok, enough preaching, on to the 1st quarter results. I ended 2017 with a net worth of $245,379.

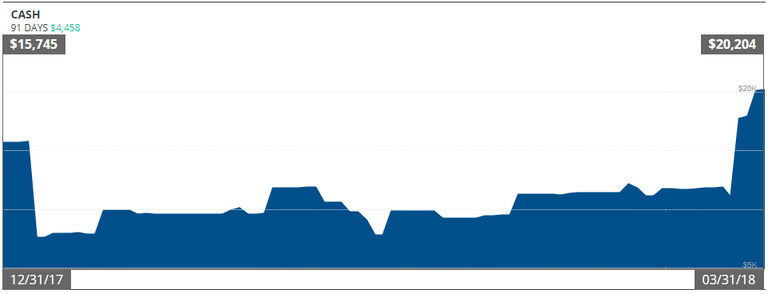

CASH

Starting $15,745 Ending $20,204 [+4,458]

I usually like to hold about $10,000 in cash. This includes both my day-to-day checking funds as well as my emergency fund.

I have almost double that amount.

I am thinking about the future. I would like to be able to buy up a few investment properties during the next down turn. To do so, it is much easier if I have the cash on hand to entice an even lower price from the sellers.

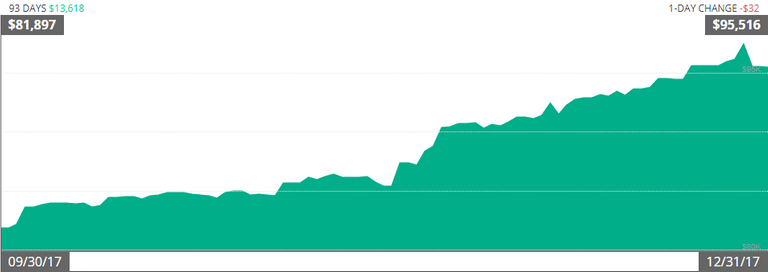

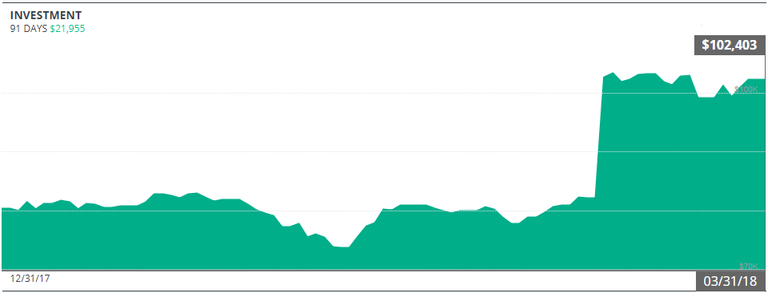

INVESTMENTS

Starting $95,516 Ending $102,403 [+6,887]

This is going to need an explanation.

First, this is from the last quarter of 2017. The reason I am showing you this is because my Scottrade account was taken over by TD Ameritrade. Personal Capital (where I track my net worth) removes all the historical data when an account is unlinked (which then does not show on the graph).

So my investment accounts ended the year with the graph above. An amount that totaled $95,516 at the end of the year.

And it ended the quarter at $102,403. It wasn't for a lack of trying though!

Thankfully, I do most of my stock market investing through Robinhood. There are ZERO fees AND they are adding easy cryptocurrency trading nationwide!

If Robinhood interests you, sign up using this link to get a free share of stock (I will too). Sign up is free and you don't even need to deposit anything to get your free share!

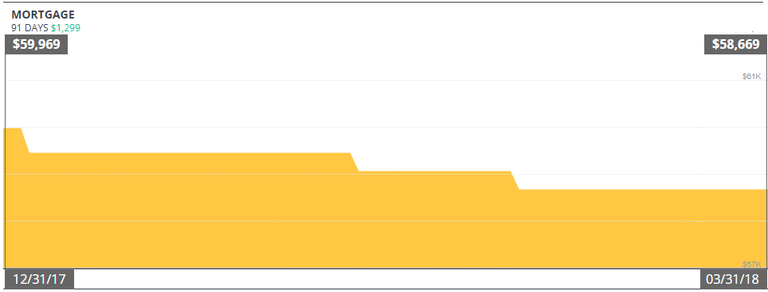

MORTGAGE

Starting $59,969 Ending $58,669 [+1,299]

This is my only debt as I own my cars and pay off my credit cards in full each month.

I used to pay a little extra, but I ended that as I have been wanting to stack up cash. With the interest rates rising, my 3.375% mortgage is looking better and better.

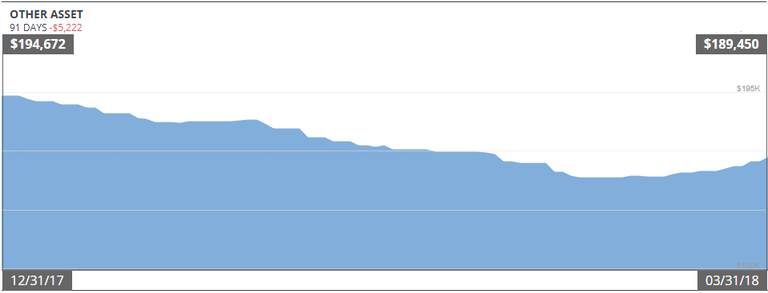

ASSETS

Starting $194,672 Ending $189,450 [-5,222]

This amount includes three cars and a house. And they decreased in value by over $5,000!

The local housing market cooled off a bit and I depreciated my used cars for the new year. It was mostly the house though.

I have other assets not listed here but I choose to not use them to calculate my total net worth.

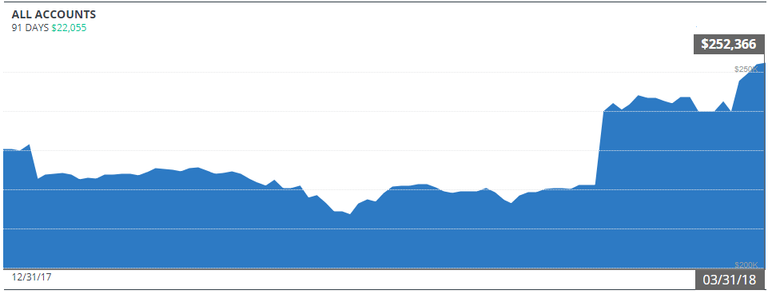

All together this comes out to a net worth of $252,366!

(Remember that the graph isn't accurate as my Scottrade account history was removed. I ended 2017 with a net worth of $245,379.)

A TOTAL QUARTERLY INCREASE OF $6,987!

Even with a down market and my home and car value decreasing I still managed to stack away over $2,000 each month.

Oh, and the wife and kids flew last-minute back home to the UK as my wife's grandmother passed away. That cost a good amount as well.

For reference, here are the previous quarter net worth increase results:

Q4 2017: $17,822

Q3 2017: $19,096

Q2 2017: $18,513

Q1 2017: $16,671

Now, these totals do not include any other assets besides what is shown above. No cryptocurrency, no precious metals, not my eBay inventory, nothing else. I choose not to track everything in my net worth, just the common stuff.

This year, I will earn $68,000 from my job. That is about $5,667 per month before taxes. My wife is a stay at home mom to our two kids.

I say this to explain that I am not working for Google or something making $300,000 per year. Just a normal guy supporting a family but with a frugal mindset and the goal to become financially free.

If I can do it, so can you! If you want it bad enough, that is.

I track my net worth using Personal Capital. It is free and works automatically. By tracking your net worth you know where you are, where you were, and where you are heading. The best thing I ever did was start tracking my money.

If you want to start, sign up for Personal Capital using this link and we will both get $20.

This is the key:

Earl Nightingale said it way back in The Strangest Secret. If you lack a role model for whatever you want to achieve, just look what everyone else is doing and do the opposite.

The vast majority do things that take short term pleasure over long term success in whatever field you want to look at. Becoming an actualized human being and creating meaning in life involves picking a distant goal and striving towards it!

edit: BTW I love that you are booking depreciation. You're one in a million!

I will be a millionaire. Just give me time. :)

Awesome, bro! Man, you're a financial guru. Usually people spend beyond their means, but you're the opposite. Very happy that financial freedom is around the corner for you, my friend... :)

Thanks so much, buddy! I'll be retiring from my current job this next February!

Hehe...my friend I'm just speechless. Such a post needs to be seen by everyone. Up to now I'm still keeping my sbds cause it's my first ever fortune in life. I'm also positive in my little mind and everything is set well on my side.

I almost started trading with binace but still scared.

P.S: I felt like boosting your post using a bot but only needed your permission. Allow me if you don't mind.

I believe I will reach that level at one period of time

Of course you can, Jona. Anyone is welcome to share my posts in anyway they see fit.

Wauhh..great.

Excellent progress -

NB - You might like this.. below...it ties in with what you say about freedom and time being what wealth is about.... I'm going to include an updated version in my next regular update (I'm trying to innovate ways of visualising early retirement, it frustrates me that so many people just don't seem to get it!

It basically shows how many months I could survive on my current assets (in green) and so it's a countdown.. NB this is from 2015 and so would look much better now.

No need to be frustrated that others don't see it. Most people won't. So don't have them control your emotions. :D

Oh don't worry I'm not that frustrated.

Besides, I'm a sociologist. This basically means I make a living out of explaining to the the 20% of people who might 'get it' why the other 80% are so stoopid.

It's a living.

Funny how that 80/20 split works in so many areas of life :)

I also keep stumbling across it too.

Very interesting, as usual. Thank you for sharing! I learned of the Robinhood app only recently, as it’s only available in the US. And crypto trading is only available in ten states, with just two cryptocurrencies, if I’m not mistaken. Still, it looks like an awesome tool for investing in stocks and mutual funds. I would definitely give it a go, if it were available in Europe.

Last week I adjusted my monthly automatic direct debit for investing in mutual funds. It used to go into four different mutual funds, investing 25% of the monthly amount into each of them. I have been doing this for over a year now, so I have collected enough data to make my first adjustment. I ditched the Swedish index fund, as quite a few major Swedish companies were plagued by scandals and losses in the recent months. I took all the money from that fund and put it in the best-performing fund of the four (I also knew that fund from before, since I’ve been investing in it since 2014 and it performed consistently well each year). I also changed the percentage allocations for the three remaining funds: instead of splitting the investment equally, I’ll be putting 40% in the best-performing fund and 30% into each of the two remaining funds.

Oh, yes. Robinhood is just getting started in crypto trading and rolling it out in a controlled manner. BUT they are the only platform in which you can sell stocks and immediately use that money to buy crypto - and vice versa. THAT IS HUGE!

Its one reason they are now valued at 5.6 Billion after just about two years of operations.

Yeah, sometimes you gotta drop the losers. I wish you the best in this new investment plan.

Very interesting read.

I live life way below my means most of the time. Recently I have had a few lessons in money management and especially with a new baby here it is a little harder to foresee the future.

The only thing I currently have debt on is my car loan. I live with family and don't pay rent or a mortgage, and only pay the electric bill.

Seeing someone doing a lot on the side to make a better life for them and their family is a good thing I believe.

I am unsure if I will "Jump on the train" but for now I am happy living below my means and trying to pay off my debt to become financially free.

Becoming debt-free is the first goal! (I don't include a reasonable mortgage as we all have to live somewhere - but paying it off is a goal too)

But after you are debt free, all you take home is yours to keep! If you have debt, then your efforts are given to someone else. That is what I call indentured servitude. That is a way of life I am keen to break free from.

.

Yeah, I don't understand those types that are never satisfied.

I'm actually lazy as shit. I have decided the best way I can be lazy as shit in the future is if I work hard now. :D

Nice numbers. My girlfriend's sister looks down on me because she has a big ass house, a bunch of cars, and three horses that don't do shit but sit around and eat money. I'm like, "Uh, I'm actually doing pretty good and I don't owe a penny to anyone and my only major expense is cigarettes; meanwhile your ass is in debt up to your eyeballs."

I just started investing recently with Robinhood and TD Ameritrade. I've had a few lucky breaks that made up for my amateur fuckups. I jumped into penny stocks hoping to get rich quick, where the fuckups happened and I'm about to get into swing trading ETF's. Got any snippits of wisdom you could drop without taking up too much of your time.

Hmm, I'm more of a buy and holder. I hold for at least a few months, if not years.

But the best indicator of short term direction is to look at a chart of the moving average and stochastic lines. When the moving average crosses below the stochastic it almost always will lead to a share price decline, and vice-versa.

Appreciate the transparency @getonthetrain. Yeah that is a nice amount to put back; $2K a month. Congrats and keep on keeping on :)

Thanks, Rob - will do!

Awesome and admirable post. I'm playing catch up due to the financial illiteracy in my family and poor man's mentality. Now I'm trying to just get to teach my kids while they are young...I feel if I can feed them some financial food, I feel I would have done my job when my time is up on this earth.

I have two young ones as well and I need to learn how to teach them about money without turning them off of the lessons.

Nice achievement so far! I'm no where near that, but my stock portfolio is growing at a steady interest rate around 10%/ year so no worries.

10% is pretty good! The compounding at that rate is excellent, but even a few more percent changes the outcome dramatically.

I like seeing how work and discipline are always able to pay off, this is an example of that.

It is also cool the fact you don't include any crypto holdings and their potential for the future, so that is even better.

This is the proper mindset to achieve financial freedom just as you mentioned, I would also like to be financially free one day :D

Cheers man!

I think Steemit is a great avenue for you to achieve that!

Also, since Venezuela is in dark times right now that means NOW is the time to be buying up assets. Just like day follows night, these bad times won't last forever. If you get all you can now, you will reap the wealth in the future.

(Houses, land, farms, businesses, etc - is there a stock market you can get into?)

Well yeah, there is a stock market but with very few companies. And you are right about buying assets right now. Elections are coming next Sunday so let's see what happens.

By far my favorite posts from you are these reports. I digest them word by word and just admire how consistent and patient you are. I admit, I must have the snowflake syndrome (want it all, want it now) and well.. as you know, it hasn't been really working thus far. Your stable growth is nothing shy of impressive.

Thanks for the transparency and sharing, enjoyed it as always!

Yeah, the short term is not the path to wealth. You have to think long-term and work towards your goals. Just like that damn turtle and hare story from thousands of years ago.

This very important about life.

Like it my senior