It's been a while since I created a post in this little instructional series, but with everyone stressing over various aspects of financial life these days, it seems time for me to get on with it.

Previously I spoke of creating effective goals and then knowing how to successfully work toward them in terms of what I call one's Inner Game. That's vitally important, but at a certain point, you simply need to know how money works so that you can be guided to success with it. You need to master what I call your Outer Game.

How do you get it?

How do you keep it?

How do you grow it?

And why do some people always seem to have so much more than others?

Without this understanding, your inner guidance system may be calling out all the right moves, but it will be as if it is doing so in a language you don't speak. You won't be able to correctly apply even the very best guidance!

Education

The first thing that's important when you set your mind that you are going to financially thrive is that you need to understand what money even is.

- Fungible - one of the item always has the same value as another of the item

- Acceptable - people recognize it as having value, so will accept it in trade

- Durable - doesn't decay like food items

- Divisible - able to be traded in different sized units

- Scarce - a somewhat limited supply

(Note that I've not put these in order of importance, but instead arranged them in an order that should be easy to remember with the acronym FADDS. That acronym also provides important insight about the history of most money.)

These are the core characteristics. There are others people sometimes include that really indicate "ideal" money, such as a holding its value across time, backed by hard assets, easily transported, and so on. But to be money it really just has to have these 5 attributes.

Types of money many people have used across time include gold/silver coins, shells, beads, and paper script. The paper script was originally backed by other assets like gold, silver, or arable land.

Sometimes countries stop backing their paper script with anything other than a promise that the government will make good on the debt. This is called fiat currency, and is the form of currency used throughout the world at this time. It is important to note that in the history of money, there has never been a fiat currency that lasted even 100 years. They always fail, and the ones present in our world today will too.

The world's reserve fiat currency is currently the US dollar (USD) though it was previously the British Pound and before that it was someone else.

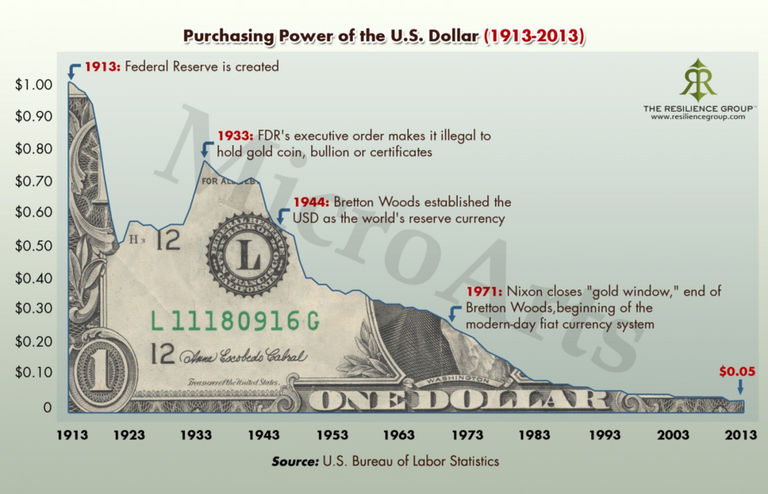

Originally when the USD became the world's reserve currency it was backed by gold, but Nixon withdrew the promise of gold backing for the currency in 1971. Since then the world has floated with no anchor, with all national currencies pegged to one that has no hard asset foundation.

Over time countries have always devalued their currencies, causing the same amount of the currency in your hand to have less buying power over time. This is usually a result of issuing more and more of a paper currency or reducing the amount of actual silver/gold in coins. Whether fiat or hard asset currency, devaluing a currency always leads to economic problems, usually causing that currency to eventually collapse and be replaced by a new currency.

I emphasize again that no currency has ever lasted in a single form for more than 100 years, and usually far less. For example, we can say the USD has been around more than 100 years, but actually there have been many versions of what is called the USD. This version has only existed since 1971, the version unbacked by any hard assets.

Why Do You Care?

The reason I've explained all of this to you is that if you don't understand the world's monetary system, you cannot understand how to get your money plan right for THIS point in time.

You see, there is no perennially right course of action. You are always having to make decisions within a context. For example, this time last year was probably a great time to invest in the US stock market. It however would have been a terrible time to invest in the Chinese or EU markets, all of which are down by double digits over the last year, while the US market was up. Now however would be a terrible time to invest in the US stock market, which is a bubble just starting to deflate over the last month.

When I bought my first house in 2012 was a great time to buy in the location I was living. I bought at the exact bottom of that market cycle. I also sold at the exact top of the next market cycle. So for me, it was completely a win. But another person sold (to me) at the bottom. And another bought (from me) at the top. So was that house a good investment or not? Well depends on where within those cycles you personally fell, doesn't it?

So that's why I'm giving you all this context. Because where we are in the fiat money cycles of the world matters a lot right now!

You need to do different things in preparing to thrive in these next 5 years than you needed to do preparing for the last 5 years.

What's Brewing

It's all a bubble.

All around the world real estate, stocks, bonds, private equity, even fracking, all bubbles.

The only things depressed right now are precious metals and cryptocurrency. But those are both heavily manipulated markets, so it's hard to know when they will be allowed to rise. One thing we can know is that derivatives have been used in precious metals to facilitate market manipulation by global Federal Reserves (which coordinate with each other), banks, Treasuries and regulatory agencies. They don't even deny it. They call it managing the markets and think it is their job to do so.

I've heard a CFTC member say point blank that they can't let crypto into retirement accounts until there are enough derivatives for it, which there aren't yet. So basically he's saying they can't manipulate it if it grows too large so long as it remains a physical delivery-only market. The size it is now, okay. But big institutional money like pension funds coming in will grow it too large to be manipulated the way it is now. (My interpretation of his words. He just said the part about needing derivatives before it can be allowed as a mainstream investment vehicle.)

So when we think of thriving in such an environment, what does that even mean?

Well for one thing, you need to realize that real estate you now hold is probably going to go down in resale value (though it may continue to hold other value, which I'll speak to more later). Stocks you now hold have probably already gone down in value. Bonds have been artificially inflated, and will probably have to go down in value with yields rising and further depressing stocks. Cash is likely to lose value as governments respond to deflation from all these popping bubbles by printing more money. Inflation will follow deflation.

Aside on the American Special Case

Again, America has the world's reserve currency. So while I'm mostly talking about global currents up to this point, what preparation means does vary a bit between the US and all other nations for this reason.

You see, most USD is not inside the USA. Most of our money is floating around the world. Other nations use it when they want to buy oil, for example, even if we are nowhere near the deal. And we also import a lot of physical goods from other nations. So our dollars all wind up in the bank accounts of those manufacturers around the world. China especially is awash in USD. Other nations hold the USD for transactions they will do with other nations and they also get rid of it by buying things with it. Often they buy US Treasury bonds, so in that way give our dollars back to our Treasury. Even the portion that reaches the Treasury doesn't usually wind up causing inflation because it doesn't go into the pockets of middle class Americans, those who need to spend a lot of their income and who have the ability to spend a bit more and drive up prices. It goes mostly to the military or to retirees, who get such small amounts they still struggle, so certainly cause no inflation.

Because of this dynamic, we can print away our bond debts without experiencing a lot of inflation ourselves. So where other nations issue bonds to finance excessive spending to give their people things the people don't want to be taxed enough to pay for....

America just sells all the bonds it wants, then prints more of its own money to pay off the debts.

Of course, as I mentioned previously, every time a nation prints money they devalue their currency. And the world is getting sick of the US's bullshit. Because of this, while the US will face easier conditions than the rest of the world in these next 5 years, the world is gradually shifting away from reliance on the USD as the world's reserve currency. When the flippening happens, the pain experienced in the US will be like nothing anyone currently living there has experienced before. But, in the meantime...

Though the USD is under a lot of pressure from nations wanting to be rid of it, the reality is that money has to go somewhere. Though the US economy is in bubble territory, other nations are just as inflated, other than their stock markets having already started a decline over the last year. While the US may need to print more money at some point, other nations have already been printing more money. In the near future, the USD will be the best of a bad lot.

At the same time, our Federal Reserve is needing to increase interest rates to try to help meet its goals for the US economy. Unfortunately for the world, increasing interest rates means that their USD denominated debts get much more expensive to repay. And they can't just print USD the way the US can! They have to implement austerity measures, meaning taking things away from their citizens. This further depresses economies.

So we are about to see a period of global contraction, in which the US will probably be the last to get hit, but won't be left out. Eventually the USD will be replaced as the world's reserve currency, and then some of the pain its dollar has inflicted on other nations will come home to it.

Preparation to Financially Thrive During a Period of Global Decline

So what to do?

In a period of decline, you want to preserve the asset values and purchasing power you now have, first and foremost.

Then beyond that you want to see how to grow it, so that you can come out of the period of contraction even better off than you went in. This is what always happens for the rich.

Every cyclical contraction ends with the rich having gotten richer and the poor having gotten poorer.

A big part of this is where each's wealth comes from. Take a look at this chart.

As you can see, the blue line representing people who earn an income from a job has remained pretty flat over the last 60 years or so. In that same period, the wealth owned by those at the very top has increased significantly. That's because they are mostly earning through investments, not labor.

The wealth of the investment class is always protected by Federal Reserve Banks and others tasked with preserving stability within any nation. It is considered in the national interest that that wealth be protected. This is the case even when it means shifting resources from those who work to those who do not work, so long as it isn't taken so far as to cause revolution. This is why Federal Reserve Banks sometimes reduce their mandate to the single goal of limiting inflation. It is hyperinflation that is the greatest risk to stability because it can force the workers to become fighters to save their children. In the US, our Fed has said formally that they are only focused on controlling inflation. Other world Feds have other targets as well, such as target economic growth rates.

So if during contraction all forces conspire to make sure the investment class maintains wealth at the expense of the working class, so long as inflation is controlled, how do you best prepare yourself for such a period?

If you said, "Become a part of the investment class," you would be correct!

Getting in On the Game

You are not going to work your way out of this contraction. I say this as a former business consultant, and a very good one at that: the only use for a side business during this time is to earn more money you can invest. The business itself will not save you.

In fact, small businesses are going to be hit very hard by both deflation and then inflation. I wouldn't even bother starting a business right now, and in the last year I was working (before retiring about a year ago) I would only take new clients who already had a business they were trying to increase revenue for. I would not counsel anyone to quit their full-time job to work on a business instead with the intention of having that support them in a couple years. At one time that wasn't a bad idea if you had 3 years of savings to cover living expenses and a good enough business idea, but now it is not the time.

This is going to be another period in which the things the rich have gain value, or at least hold their value, but the wages of jobs do not keep pace with inflation.

There's actually quite a bit more going on with credit requirements being reduced, while interest rates increase, and so on, but not to overwhelm you with the economics part, I'll skip it. Just realize that there is a tsunami of forces all building together with an immense force behind them. You will be affected. But you can absolutely find safe ground.

Safe Ground

Returning to how I began, looking at what money actually is, indicates what will be the most sound money even as fiat currencies around the world become unstable, and some even collapse.

FADDS - Fungible, accepted, durable, divisible, scarce.

Sounds a lot like gold and silver to me.

Cryptocurrency is a newer addition to this concept of money, and some would argue that it is not accepted, nor are some coins scarce. So decide for yourself if you consider it sound money.

But definitely we can say that gold and likely also silver should be on the list of sound money.

In fact, did you know that the cost of a man's suit in gold has remained the same for over a hundred years? Meanwhile the purchasing power of the USD has fallen 95% over that same amount of time!

I've actually watched it fall by 75% against the Swiss Franc just in the last 30 years.

So investing whatever you can spare into gold is probably a safe bet. Of course, I say this as someone with an undergrad degree in International Commerce and a decade of experience as a business consultant, not as an investment adviser. I don't have any licenses to give out financial advise, and so I can't give you personalized advice for you to take. I can only point you towards the relevant information and suggest you do your own further research so that you can decide what will work for you.

Other Rich People Assets

Aside from precious metals, the rich also hold real estate that returns an income. I'm not talking about one's primary residence (though if things get really bad, an off-grid home with a reliable water supply and greenhouse may be your best investment). I'm talking about farm land, apartment buildings, even mobile home parks.

They also hold works of art, but the ones that are sure to appreciate in value are usually out of the reach of working people. (That's part of why they appreciate so much.)

They also invest in private equity, but that hasn't been doing so well lately and as I said before, I've stopped advising people to even start such companies. That's both the bootstrapping kind and those with VC funding (private equity). So I wouldn't personally expect one to do well on the other side of the deal either.

What else do the rich buy?

Of course there's always bonds, and if you have to hold something in a 401k that may be your steadiest option. Not that you may not see losses, as bond funds do sometimes see significant losses, especially against the rate of inflation. But if US Treasuries go, you've got bigger problems than returns on investments. So as a last line of defense in a retirement account that's something to talk to a financial professional about.

I personally like cash. Money market funds, and also actual paper script. Though in the long run it will lose value, during a period of deflation it will give you the most options.

Though it is good to start positioning yourself now, you will get the most mileage once deflation comes if you have cash. Planning now for what you will do then is probably your best course of action.

Since precious metals and crypto are bouncing along their bottoms now (or what is there production cost at least) this is a good period in which to dollar cost average into those.

That means buy them gradually, but on a regular schedule. Get started now, but don't have a sense of stress or urgency. What I've described above unfolds over a period of years. Deflation probably won't even start being felt for about a year in the US, though sooner in other countries.

Again, the way the US is going to respond to economic troubles here is going to exacerbate them everywhere else, so if you're outside the US you want to take the above that much more seriously, and sooner.

What If You Have No Money to Invest in Anything?

Then you need to supplement any income from a job so that you do have money to invest. I already talked about a side business, but what I didn't talk about is what kind.

I am the cheerleader for passive income. I've been urging people to go in that direction for years, and am heavily involved in it myself. At one point I had 12 different streams of passive income flowing in!

In fact, though my investments have been a big part of my ability to retire so young, my passive income is what makes it truly possible. It covers my living expenses so that I don't have to withdraw from investments during periods in which it is unfavorable to do so. I don't have to ever lock in a loss to access needed funds when a market I'm in is contracting.

Passive income doesn't have to be so large that it takes the place of your regular job. You can still cover most living expenses with it. But the great thing about it is that it allows you to keep that full-time job, have money to invest, and still have free time to spend with family and just enjoying life. I don't know anything else like that.

Because I think passive income is so important, my next article in this series is going to be 100% about that topic. What it is. How you do it. Pluses and minuses of different kinds. And so on. But this post is already quite long, so let's wrap it up.

Ending on a Positive Note

Pray.

A lot.

And I don't say that to be funny. I'm referring back to my previous posts in this Thriving series in which I focus on the mastery of the Inner Game.

As I said, I'm not an investment adviser. I really don't know what you should personally do, and more to the point, I don't know WHEN you should take each action.

Recall my talking about the timing with which I was buying and selling, and how it worked for me where not everyone has such favorable results with the very same actions. The difference is timing.

And when it comes to timing, the master is within you. It speaks to you in the silence. Are you giving it silence in which to speak? Are you listening?

Prayer, which I consider focusing in on what is good and wanted with the expectation of being blessed with the experience of that wanted thing/situation/feeling, is an important aspect of manifestation. You can add an actual verbal request to an entity if that makes it more real for you, but if you don't believe in any Divine entities that's fine too. The main thing is that you believe in the inevitability of your vision coming into being. Find your own reasons to believe.

Meditation is where you listen to actually receive the guidance that will lead you to actions that bring your prayed for vision into reality.

The above financial education I've shared with you is so that the combination of your prayer/envisioning and meditation/listening can guide you in an effective way.

Step-by-step, you will be shown the right things to do at the right time. You will meet with the right people who casually make just the right remark that triggers a memory in you. You will encounter just the right opportunities and recognize their value quickly enough to act before they are gone. You will have a seasoned detective's sense of bullshit, and will have no interest in any scams without even needing to investigate them to know they're scams.

In other worlds, you will be blessed.

Know this: Everything around you can be going down, and you can still be going up. It has been this way for me through every recession I've lived through over the last 20 years. It can be like this for you too.

Enjoy the adventure!

Go silver! It's the most under valued and is the second most used commodity (next to oil) in the world.

Blessed indeed. This is a deeply important piece. Thank-you for taking the time to share such poignant pieces which will help encourage abundance looking ahead. Love & Prayers Always 🙏🎶🌄🍀

Thanks for your kind words. Glad to hear it resonated with you.

thank you Indigo! this is an amazing download!!!

I wonder if you would write into some of what you imagine this looking like?

This is a lot of food for thought and I will chew on it. I'll also take your inner work advice and pray and meditate toward a path of action <3

Well the short answer is, we are going to have to implement the same austerity we’ve inflicted on places like Greece, or else default on our debts. If we default, our bonds will get demolished and with them all our pension funds. We will enter a very long period of stagflation.

Even through that, which is probably 10 years out, we can individually be positioned to thrive though. So there is never reason to be discouraged.

Such good stuff. It's a good compilation of a lot of the things that I've been reading and learning over the last year or so. It's definitely good to be prepared and to invest in things that retain their value. Who cares if gold hasn't gone up in the last 100 years (the price of the suit)?! It's held its value a lot better than dollars!

It's probably a good idea to have some cash on hand because 92-95% of our currency is created through fractional reserve by banks. Therefore, not everyone will be able to withdraw their cash, and there could be a run on the bank.

From what I understand, there's still risk in putting money into money market accounts. The laws are written such that a family of funds can borrow from other funds within the family to pay one fund's liabilities. Therefore, if you are invested in a money market account with XYZ, and one of their funds has a ton of derivatives that go bad, they can take money from your money market account to cover their losses in the other fund. Just something to consider.

Again, I really liked this article. I'm looking forward to the next one where you'll talk about passive income streams!

Yes, money markets aren’t as safe as script, which I hold. But people with 401k plans can’t hold cash in them. They can’t directly put gold bullion in those either. And for most Americans at least, most investment is held in those 401ks. So for them money markets are the closest they can get to cash.

If I had a lot of money in those and was retiring within the next 10 years, as 2 of my sisters do, I think I’d take my chances with money markets and short term US Treasuries and nothing else for now. Plus stack my own precious metals outside the retirement account.

its rich dad poor dad in a nutshell... (maybe even nutshells were money at some point)

but we should prepare. I am lucky to live in Switzerland which has a halfway decent stable economy itself but its not a guarantee since I agree with you that this will be a global thing.

If you are able to go down a lot less then the rest you are going up in comparison...

I am really looking forward to you passive income flow post. I am trying to build up this stream as well and any tips, tricks or methods are welcome.

I also agree that if you are only posting here on steem that this is not a passive income but it can be an additional income if you look at it like a second job. That could also be used to diversify or reinvest as well. or you could power it up and look at the value long term

I am going to a rich dad poor dad seminar in a week, hopefully there will be some interesting stuff there as well and not just a marketing gimmick.

Yes, the core message of RDPD has always been to stop trading hours for dollars if you want to get ahead. That's one of the main things the rich fully apply! Even when someone is an executive, they are paid far more in stock than in salary.

I hope the seminar is full of content instead of marketing too. It's getting to be a thing that famous brands only market the next product and give maybe 10% real content you can't get just by reading their book. Really terrible.

As for the Swiss economy, everything I know about it says it is one of the strongest in the world, but your currency may be a bit over-valued. But again, it's all relative. People have to use SOME money, so you just need to be a better option than others. For that reason, like the USD, the Franc may come through this relatively unscathed. The economy will be affected, of course, but yours will likely be one of the more stable ones for sure. I'd still stay away from real estate for a couple years though, unless it's intended as a rental property and you're sure the numbers work at lower market rental rates.

well, the seminar is free so that is why my fear is that it will be a lot of publicity... we will see, I am not so much into FOMO as I was before

and for the swiss real estate, that is kind of irrellevant for now since I could not afford anything anyway..and I kind of fear that the swiss real estate market might be in bubble territory as well. So there might be opportunities in a few years if it crumbles down and hopefully by then I will be in the position to take advantage of it

The problem with precious metal is that they are hard to transport and store. Moving to a different country? Good luck with sneaking them past customs. Live in Detroit? Cross your fingers that your house isn't going to get broken into.

This is why I think crypto is the way to go!

The international move issue is the biggest drawback to precious metals to me. But unless you have rare/collectible coins, the easiest thing is to sell just before you leave then buy back once you reach your destination. They are pretty interchangeable and internationally available, though depends on where you're going I guess. You can also buy gold and have it stored in vaults overseas. And I definitely wouldn't keep more than a few hundred in junk silver in my house. I know some people worry about confiscation, but I don't. I think that was a one time thing that worked because we were still on the gold standard. Lots of Americans actually had gold that wasn't jewelry then. Now, the government would be far better off confiscating from bullion companies and miners than anything else. Far more collected with far less public pushback at a time when people are also much less trusting of their government than they were in '33. So I think for local storage a safe deposit box is still a good choice for all but emergency stashes.

Still, in the end, crypto is far more portable. If it gets to a point where some limited supply coins are also widely accepted as money, I think it's the better money for most people.

The problem with selling off and then buying it all back is all the transaction costs I guess. You will get whatever spread that your gold broker is going to sell and buy your gold for to convert it to fiat1, then there will be transaction cost to convert the fiat1 to fiat 2. Then, fiat2 back to gold.... This is an actual problem I faced when I was trying to figure out a best way to move assets from 1 country to another without losing it's value.

I agree that confiscation shouldn't be an issue in the US. But outside of developed countries it is still an issue.

Yes, you do lose on the fees. But presumably this is going to be a very rare event. If one is very internationally mobile, then I definitely would go with remote vault storage I pay for. It is simply wise to have some precious metals, despite the drawbacks. Maybe just have less of that and more of crypto.

Definitely good point on the possibility of confiscation outside the developed world! In fact, it's pretty clear that China has been trying to get its citizens to buy gold with the intent that if they need to go back on the gold standard even partially, they will confiscate the gold of the people. I forget their exact (translated) phrasing, but it basically came down to their counting all gold in the country, including in private hands, as belonging to the Chinese government.

What an avalanche of financial knowledge and writing skills. Even as I am nowadays more aware of financial issues, the role money plays in the world and in my pocket, I have the feeling the world has no time to unfold as you predicted because of a big war. In spite of that, I look forward to reading your next post!

Well I certainly hope there won't be a world war. If there is, all of this still happens, just more quickly. And the recession likely becomes depression.

Thank you so much for this, I’m going through a bit of financial crisis and it’s tough trying to invest in new opportunities whilst in a bit of a pickle, which is why when you said to supplement income from a job, it spoke to me because I’m trying to do that at the moment.

The way you finish it off also gave me a bit of hope as well that things will get better.

Posted using Partiko iOS

The great thing about crises is that they create opportunities. By preparing for the next one now, you can be well positioned to end the period better off than you started.

The next time I am able to write about this, I hope you'll find some of the passive income approaches work for you.

Thanks and yes, long term financial freedom comes from passive income. It’s not easy to set it up at first, but it comes with time.

Posted using Partiko iOS

Great post with some great insights. Only hoped to get some better advice from "What If You Have No Money to Invest in Anything?" haha. Hoped to see how to make money if you don't have any...

Anyways I like the idea of passive income too, but I haven't discovered many ways for it yet. Steemit is/was one of them and I really enjoy it. I hope it continues to offer passive income as the prices go up again and while we can buy in cheap for that time.

Yeah, the next post is the one that's more about that. This one is already super long.

I don't consider Steemit passive income. There's too much work involved for it to be passive. But it is a great way to earn crypto instead of having to invest to get it.

Cryptocurrency won't be sound money until it reaches Mass Adoption Point (MAP). It is certainly disruptive to markets and gaining its way to relevancy around the globe little by little. In time it will be very valuable.

I think so too. It has to be a long game. We're just lucky we can earn it here on steem right now!

This is genius. I would love to talk to you about all this sometime....

Posted using Partiko iOS

Glad it struck home with you. It's complex in that there are a lot of parts, but actually each part itself is pretty simple. Just takes a lot of time to draw out all the little dots and connect them.

Great and informative post indeed! I have been thinking about this as well as I agree that we on track to see this happen in the next couple of years. One thing I have had on mind to consider as well is the thought of also paying down debt as it could help improve cash flows in both the short and long term to better prepare and being able to handle the downturn. Thanks for sharing!

Yes, this is my thought too. Don't take on any new debt and get rid of any you have.

I've actually been sharing this information in livestreams for months now, and a number of people have responded with the thought that they should build up debt now! They had thought that it would get so bad the government would have to write down/off debts. I had to break it to them that that only works for rich corporations! What happens to everyone else is that you have no flexibility to take advantage of any "once in a lifetime" opportunities.

A great article! I just came across this today. Followed you, @indigoocean!

Glad it resonates with you. It's important stuff I hope more and more people will become aware of.

Enjoy the ride! Cryptorollercoaster!

You got a 31.92% upvote from @ocdb courtesy of @indigoocean!

Discord channel for more information.@ocdb is a non-profit bidbot for whitelisted Steemians, current max bid is 20 SBD and the respective amount in Steem. Check our website https://thegoodwhales.io/ for the whitelist, queue and delegation info. Join our

ocd-witness through SteemConnect or on the Steemit Witnesses page. :)If you like what @ocd does, consider voting for

Hi @indigoocean!

Your UA account score is currently 4.652 which ranks you at #1608 across all Steem accounts.

Your rank has dropped 2 places in the last three days (old rank 1606).Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

In our last Algorithmic Curation Round, consisting of 404 contributions, your post is ranked at #15.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server