Let's go back to the year 1964 in the US and imagine that you have silver quarter dollar coins that contain 90% silver and are worth $0.25 US dollar each (by law).

On year later, in 1965 the US government enacts The Coinage Act of 1965 which reduces the silver content of all new minted quarters from 90% to 40%, but the coin would still be worth $0.25 (by law).

What will happen? (Or actually what happened back then?)

People begin to hoard their old quarter dollar coins and only spend the new quarters. After all, they are both equally good for paying someone $0.25 US dollar.

Gresham's law

This is Gresham's law. A monetary principle stating that "bad money drives out good."

Image source

When Queen Elizabeth I became the Queen of England in 1558, she soon received a letter from Thomas Gresham. Gresham was an English banker and one of England's richest citizens and he pointed out to his queen the importance of sound money. Henry VIII had replaced 40% of the silver content of the British shilling with worthless metal, whereby this bad money pushed the good money out of circulation.

The same happened with the quarter dollar coins in the US in 1965. People began to hoard the silver coins.

Fiat money today

Where one used to create "bad money" by reducing the content of precious metals, this can be done a lot easier today. Since precious metals are no longer used in our coins and money is no longer linked to the price of precious metals at all, you can erode the value of the money by simply printing more of it. And that's exactly what central banks all over the world have been doing for multiple years now. They reduced interest levels to below zero whereby money became free for banks to lend. If something is free, it has no value right?

Bitcoin

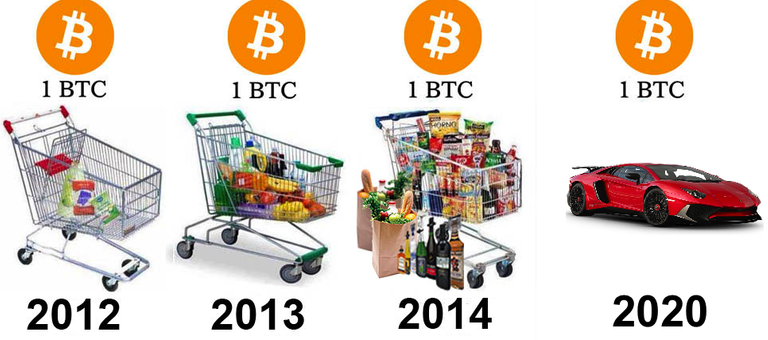

When you notice people hoarding a particular currency, Gresham's law may well apply.

If more and more people begin saving in Bitcoin instead of dollars and dollars are only used to just spend, the velocity of fiat money begins to accelerate to a point where the fiat currency begins to hyper inflate. If the dollar has no demand other than to spend it straight away then it has no value. If fiat money is no longer used as a store of value it is no longer sound money.

When the majority of a countries population prefer to save their value in Bitcoin or another currency instead of the local currency then that currency collapses. In countries such as Venezuela and Zimbabwe, Greshams law is already happening. Their fiat money is so worthless that no one wants to accept them. Therefore the only way to buy food in Zimbabwe is to use the US dollar. People began pricing in US Dollars instead of Zimbabwean dollars.

There may well come a time when it makes more sense to price in Bitcoin rather than US dollars in the future.

When the illusion of fiat money is exposed for what it is, the value of bitcoin compared to fiat will continue to go higher, and higher. The high levels of debts of the financial crisis of 2008 were never addressed, which has made the entire financial economy today into one huge hazard. This empire of paper money will topple soon. That's when Bitcoin will realy take off, but pricing BTC in US dollars will then be irrelevant.

Just HODL!

Sources used:

- https://en.wikipedia.org/wiki/Coinage_Act_of_1965

- https://en.wikipedia.org/wiki/Gresham%27s_law

I do not think so. They will coexist for long time.

Hopefully you're wrong. LOL fiat is the most evil control system we have seen thus far... Every fiat eventually collapses and hopefully that will be sooner rather than later.

Good point @penguinpablo. I'll push back though because the effect of Gresham's Law is dependent on the money actually being used in transactions. The past year has not been a case of Bitcoin holding value as much as it has been speculative. I agree on the general point though. If a stable digital currency were used in exchange then we may well see a repeat of the 1960s when people hoarded their "good" coins and spent the "bad" diluted coin. Great post.

... or even fiat currencies being properly valued (as nearly worthless).

Agree with you overall and appreciate your posts.

I do, however, disagree that when something is free it has no value. The circumstances and environment at the time are important. Whether it is me cleaning a home so it is pleasant for visitors and guest, lending a hand to a neighbour moving house, helping people affected by adverse circumstances - these are given freely at no direct cost to others and they have value in the eyes of others (and also in my own eyes).

The challenge now is the mindset of people - many of us have grown up in a fiat currency world and we will look at a crypto-currency and value it in the fiat currency we have worked to obtain.

Try going to the grocery store to buy some apples, look at the fiat price, then ask yourself " How many satoshis is that?". It is like travelling to a foreign country your mindset converts the foreign country prices to your own countries fiat. In time, if you live in the other country, you start to know what is a reasonable price to pay. Similarly, you never really learn a foreign language until you stop translating the words to your native language.

Roll on the demise of fiat currencies - but watch out for your government(s). Once the masses are comfortable with digital currency I can foresee existing physical fiat money vanishing (except for hoarders and numismatists). The switch will be very easy to flick and the masses will applaud it without really thinking / knowing that they have just passed control back to their government. (Noting that control of existing cryptos is somewhat in the hands of an experienced few).

Good comparisons

It will co-exist and will not replace. Most people still prefer and always will, to have cash on hand. The transactions can be 'hacked'. You're seeing it already that people are losing their coins because of hacks. So you want to have cash and crypto's to co-exist.

The core Empire NEVER hyper-inflates.

Well this is an interesting theory and could very well play out in the years to come. I guess we will all just wait and see!! The future is sure going to be an exciting one!

What a great read, I agree that eventually the dollar will have to be addressed and BTC will continue to be of value. I know the dollar buys less and less common goods every day, such as groceries and the BTC is being recognized and accepted more every day. To me, that speaks for itself.

It may replace fiat money, but never replace cash money. The need of a digital transaction is too complicated to cover all uses of money. It will be just a different kind of cash then, one with a intrinsic value.

I'm in SE Asia where cash is king. But I know places to spend my steemit money in many of the local economies - just by transfer, no fees - done quick. I've sent cash to my son in California by transferring sbd to another steemer who gave him the usd for no fee - just to be nice. I would have paid $20 in fees at least had I sent it through regular channels. I think crypto adoption will snowball quicker than anyone can imagine.

The fees really can be a downer. It's good to have a workaround.

I've recently joined Bittrex to hopefully diversify my crypto basket. The fees will be a big factor on how much fun this will be :+).

Yes, I tend to agree with you. Bitcoin is the tip of the iceberg which gives substance to this thought.

Peace.

@penguinpablo Is that your LAMBO Penguin ??? Yes HODL and just Relax...

The significant motivation behind cash is to track obligation. Actually, the obligation following nature of cash existed generally before the innovation of the principal coin. The sanctuaries of the antiquated close east used to be accountable for following and recording every one of the obligations of their close-by territories. Coins were later imagined to disentangle the organization of the rising iron age realms, who would not like to manage every sanctuary's interesting strategy for recording and taking care of obligation.

Bitcoin does not track obligation well, it is a coin. I owe you 100 piece coins and you owe fred 80 bit coins, and there are just 100 piece coins in the whole world, at that point this obligation data must be dealt with outside the square chain.

This influences me to imagine that bitcoin will never supplant the managing an account framework.

Nice remark but look at ideas like bitshares with lending, obligations etc. An obligation is just a smart contract i would say...

great job😃

It is very possible yes

Nice lambo, feel like that is the meme of the crypto world lol

It will never replace fiat. I just transfered today $25 and got a $6 fee.

That's bad, really bad.

BTC is the biggest ripoff out there but most folks just see the BTC index on the NYSE website. Miners are now taking $20 for transactions. BCC is around $0.01 but I see them going down the same path.

Holy yes!!!😑

yeah .. I agree with that's thanks for information..

wow well post thanks for shearing

@penguinpablo. Very interesting the content of the post. Thanks for sharing.

Have a nice day!

Good post @penguinpablo

I think crypto currencies will replace fiat at some point, but i am not sure it will be bitcoin. At the beginning bitcoin might be an alternative , but with a time another player should come in a game.

Bitcoin cannot be used as day to day money due to :

This can definitely be learnt by time travelling and with the abscence of this, then surely its a posibility.

Thanks for explaining so an average guy can understand.

Thanks, very best

Very unlikely. What Bitcoin is missing is a government backing to give it more security and to help social engineering. Bitcoin does not do this and why it will not be as valuable as other fiat currencies.

Governments are the problem. Many do not feel secure with their government. The people that do want their government are those who find it a good mechanism to control the populus and the people who rely on the government to provide their sustenance (or even a basic income).

Governments did serve a purpose in this area, like many government run utilities. Their function was to provide services that a business would (or could) not invest in. We now see many utilities where demand has grown, infrastructure is in place and a profit can be made - the business community is buying these from governments.

Maybe it is time that money is run as a decentralised digital currency. The constructs of digital currencies are now being fine tuned - give this a little time and we should be 90-95% there - which is better than fiat money.

thats a great post i appreciate your blog.

The Coinage Act of 1965 completely eliminated silver from quarters and dimes. It reduced the silver content in the Kennedy Half Dollar from 90% to 40%.

I asked a question on another article and never got an answer. Hopefully some crypto-expert here will see my question and be able to answer it.

Coins like bitcoin are said to have a limited supply and Steem's inflation rate will be reduced year by year until the inflation rate is so small it would be considered negligible.

When that point is reached, or even before, it would be very expensive to mine for new coins. What happens when it is no longer worth mining (or in steem's case) running a witness server? If there is no longer any money to be made from running these servers, who is going to keep them operating and why would they?

If these servers all shut down, what happens to the ledger that stores who owns what? Does the entire system simply disappear?

That Lambo is what the IRS employees are going to be driving when they send out their lover letters to folks that forgot to mention BTC profits since 2016. The late fees and penalties will be unfathomable.... At least in central bank owned countries like mine. If anyone thinks the tax man is ignoring a $300,000,000,000 industry basically built over two years, please wake up. Divide your crypto profits in half or the IRS will take it all.

All smoke and mirrors..The big banks and auto industries were bailed out...The promise to ease the debt of the common man...as you stated so accurately, was never addressed...promised with an empty hand...

Fast-forward a few years, and things look very similar in spite of the booming market...the credit card and student-loan debts of the common man remain an out-of-control train.

If the laws don't change, making it impossible to attain either of these debt-traps without collateral, I predict the printing presses will just keep creating more money out of thin air, as sad as that sounds.

The debt value looks more like a Zimbabwe monetary dollar.

However, if we keep talking about starting another war, that creates a lot of 'jobs', the unaddressed trillion-dollar debt-can will be kicked into the next generation. What value follows trillion? Zillion? Hmmm...smh...

Peace.

interesting concept

Most interesting, @penguinpablo. Almost at the same time I have written similar text in Serbian:

https://steemit.com/money/@lighteye/bitkoin-pitanja-i-odgovori-i

It's nice to see I'm not alone in this kind of thinking :)

Fiat money will never cease to exist, but bitcoin will beat it up. It is possible that bitcoin may latter be what will be use to transact worldwide.

@seyiodus.

I already know some people who put all there 401k into bitcoin, I might do the same next year. I'm sure the dollar is on its last leg.

EXCELLENT article, very informative and I couldn't agree more. Reposted on FB. Please consider following my post if you find them of interest!

PURA VIDA!

COIN MAN says... Have you considered a Reset of our U.S. Coinage...??? Since the Paper (Debt) Notes have lost (in my opinion) 99% of their Buying Power, there's only ONE CENT of Buying Power remaining... Therefore, I think this gives us "Just Cause" to Re-Value our U.S. Coinage with an increased Purchasing Power of 100 Times what it is now, to make up for the loss, the Federal Reserve Notes have experienced... Feel free to read all about my Pocket Change Theory...

COIN MAN by @pocketechange