The Fed has been casually, slowly, and in agonizing leisure, increased interest rates. Commercial banks usually follow suit by passing that off onto their customers. Increased rates on savings account means more people saving. That means more money in their pockets over time. But what happened this time around?

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

STEEMIT: https://steemit.com/@themoneygps

T-SHIRTS: http://themoneygps.com/store

MY FREE eCOURSE - Financial Education Taught in Simple Illustrative Videos:

http://themoneygps.com/freeecourse

Sources:

https://goo.gl/UpprQe

In This Episode:

The Fed has been casually, slowly, and in agonizing leisure, increased interest rates. Commercial banks usually follow suit by passing that off onto their customers. Increased rates on savings account means more people saving. That means more money in their pockets over time. But what happened this time around?

fed federal reserve central bank

How Long Will Banks Screw Their Customers On Deposit Rates...As Long As You Allow Them To | Zero Hedge

http://www.zerohedge.com/news/2017-07-12/how-long-can-banks-screw-their-customers-deposit-ratesas-long-you-allow-them

Want a Higher Interest Rate on Your Bank Account? Tough Luck | Fox Business

http://www.foxbusiness.com/features/2017/07/12/want-higher-interest-rate-on-your-bank-account-tough-luck.html

Americans are hoarding money in checking accounts

https://www.usatoday.com/story/money/2017/07/13/americans-hoarding-money-checking-accounts/472736001/

Monthly Federal Spending Tops $400B for First Time

http://www.cnsnews.com/news/article/terence-p-jeffrey/monthly-federal-spending-tops-400b-first-time

In SF, family earning $138K may soon qualify for 'middle income' affordable housing - SFGate

http://www.sfgate.com/local/article/SF-family-of-two-making-less-than-138k-now-11284347.php#photo-13030609

IMF warns Canada on housing, trade; urges caution on rate hikes

http://www.reuters.com/article/us-imf-canada-idUSKBN19Y1VW

IMF Executive Board Concludes 2017 Article IV Consultation with Canada

http://www.imf.org/en/News/Articles/2017/07/13/pr17278-imf-executive-board-concludes-2017-article-iv-consultation-with-canada

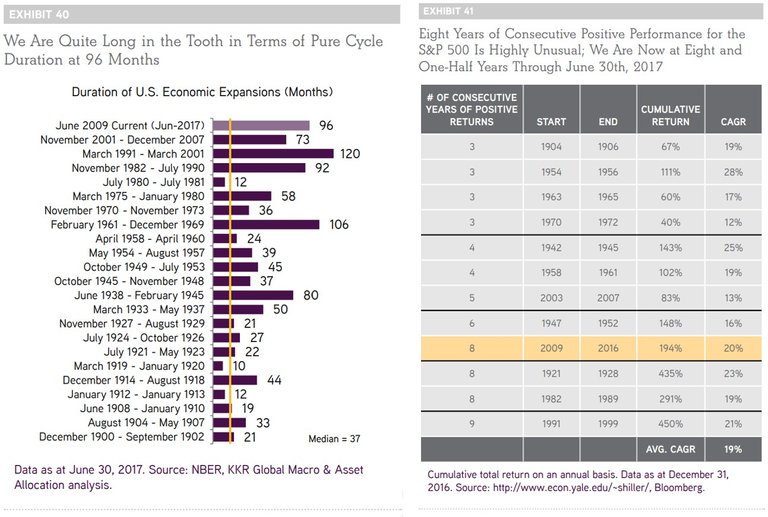

2017.07.13 - KKR3.jpg (1293×870)

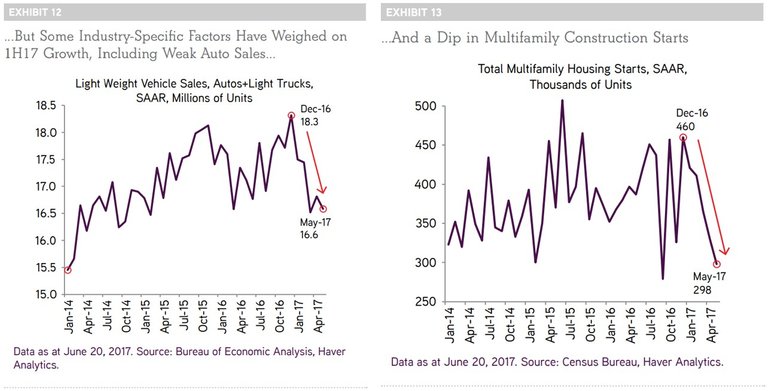

2017.07.13 - KKR2.jpg (1284×653)

2017.07.13 - KKR5.jpg (1209×1305)

Peter W. Smith, GOP operative who sought Clinton's emails from Russian hackers, committed suicide, records show - Chicago Tribune

http://www.chicagotribune.com/news/local/politics/ct-peter-smith-death-met-0713-20170713-story.html

Solid info as usual @themoneygps

Deposit are definitely not to be considered safe by any means. Not for me anyway.

😉😏😎

Time to take the control out of the hands of the real criminals! For they will screw anyone as long as they allow it.

Indeed, the case... for the moment anyway.

"Buy Bitcoin" 😝😜😋🤑😏😉😎

Thank you for all of the time, energy and effort you put into your work.

You are appreciated! Steem on 🐳!

Agreed.

And thank you!

In your opinion, are deposits safe?

@themoneygps ha-ha you make me laugh with this baiting question - I hope you get a long chain of replies on this thread ;)

I am not going to give you my "OPINION" - rather, here is the fact:

Bank deposits are unsafe, because:

The New Rules Have Gone Into Effect.

Or download the 2012 FDIC pdf file: The FDIC and Bank of England have codified the new global financial rules into policies

The banking cartel made their protection racket very clear with “Resolving Globally Active, Systemically Important Financial Institutions”.

Thank you for the info!

Blockchain policy implementation is coming and many citizens haven't heard this yet.

Do you recall back in 2013 Martin Armstrong wrote:

Sharing the evidence that reveals the globalists' script for civilization is what my efforts are focused on. Decades ago it was a many disparate pieces to a jigsaw puzzle, today many of the pieces are fitted and reveals much, but not all.

However, I find value in this research - it allows forecasts and signals emerging events - much like a farmer needs to know the seasons and the approaching storm clouds to be better prepared and respond appropriately.

not only savers have been royally screwed but investors as well. since the "yellen put", volatility has been almost non-existent. That means option premiums are much lower for those of us who sell options to earn income.

interesting point.

There is no interest in savings for anyone. Banks offer nothing for us. I would think that most of the money wouldn't be hoarded in banks but put into other areas such as Gold, Silver, and Cryptos. I can see this taking place for the retirees though. I don't want any cash in the banks. I keep only the bill paying amounts in there.

I agree. Banks are great for our day to day but it's crazy to keep that as a place for savings as many do.

Time to diversify out of the $US. Gold, Silver and major cryptos. Some cash on hand. Remember food is always a good investment. I expect asset price deflation due to tight credit coming, and, consumer price inflation due to supply problems. Cash in the bank is cash at risk.

All great points.