If you are active in the crypto market, it was impossible not to notice that quite a lot has happened with FTX.

In this post, I will explain exactly why FTX is bankrupt and what impact this has on the entire crypto market.

FTX is a stock exchange founded by Sam Bankman-Fried (SBF), who also founded Alameda Research (a quantitative trading firm).

There have always been rumors that these two had quite a lot to do with each other because of the common founder.

But there was no evidence about this assumption.

FTX had many investors, such as Binance (the largest crypto exchange).

So FTX and Binance got along pretty well and had a partnership.

But eventually, Binance were thrown out of the deal because, according to Sam Bankman-Fried (SBF), Binance does not treat the regulatory conditions globally in the same way as FTX.

When Binance was kicked out as an investor, they got paid out in FTT, which they still hold today.

FTT is an exchange token from FTX, with which you save trading fees on the exchange and benefit from the growth of FTX.

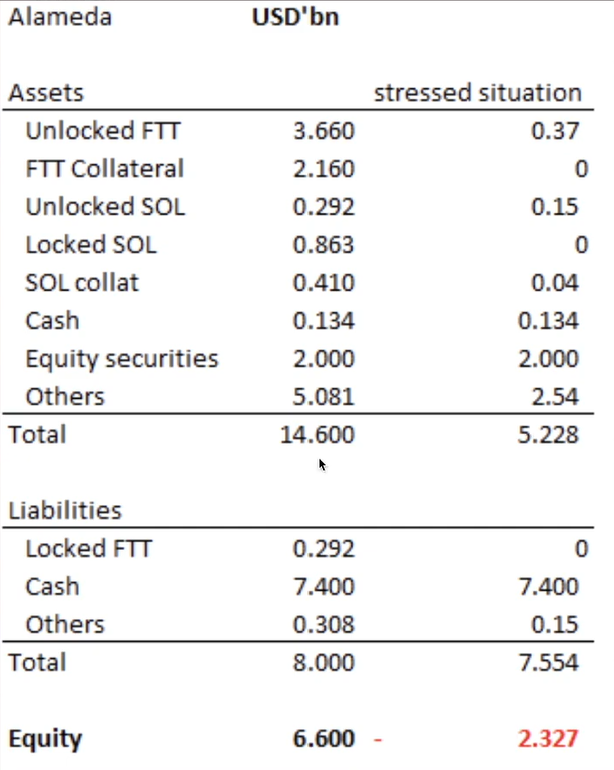

Now, on November 2nd, an article from CoinDesk came out, in which they reproduced the balance sheet of Alameda Research (positions and administrations of their money).

As you can see, quite a lot of assets are held in FTT, which reinforced the assumption that Alameda works with FTX.

The problem with this data was that some assets were not liquid and that Alameda has taken out many credits, for which they needed a collateral.

The data showed that they porbably used FTT as collateral, which is practically their own token since SBF is also the founder of FTX.

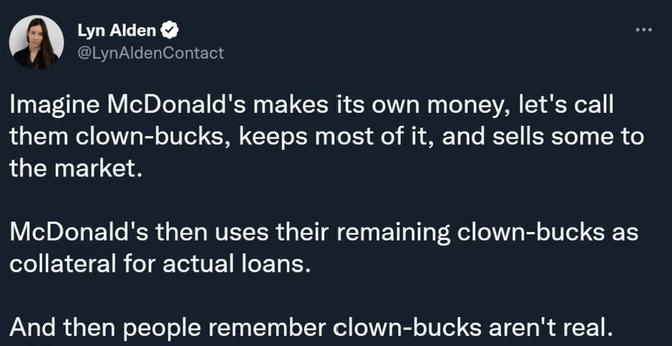

There has been a good example to explain the problem:

If FTX had done the same, it would have meant that FTX would not have been able to pay out all users.

This assumption based on the report has sparked mistrust.

Because that would have been a massive lack of liquidity

This hasn't had much of an impact, as no one has responded to or confirmed the data of the coindesk report.

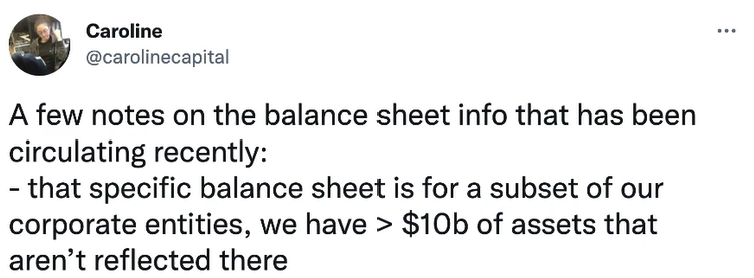

On November 6, Caroline (CEO of Alameda) addressed CoinDesk's report, claiming they still had over $10 billion in assets that weren't on the report.

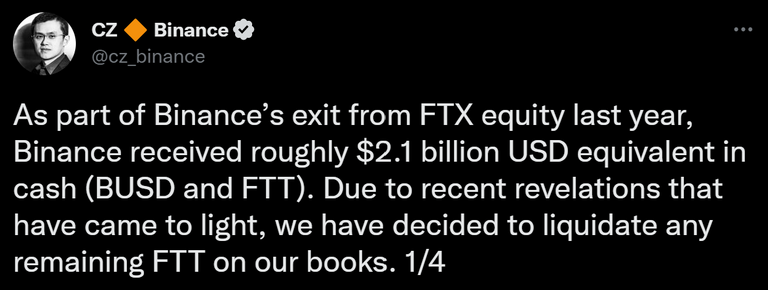

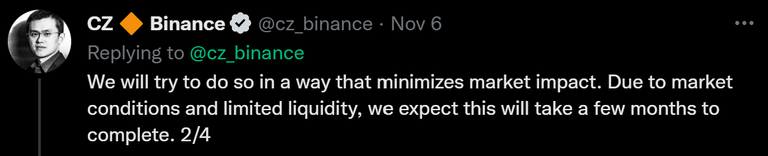

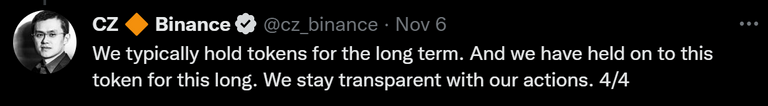

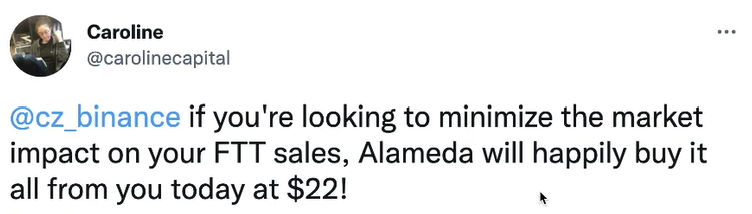

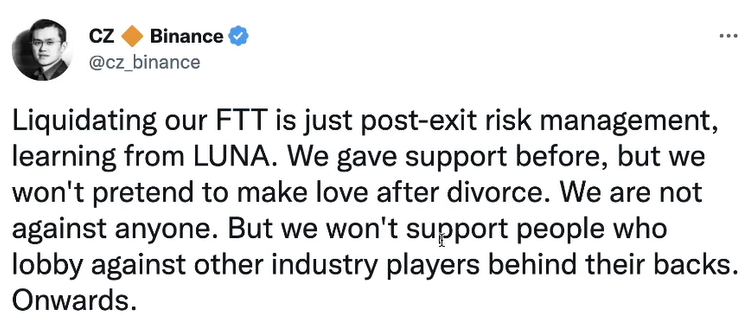

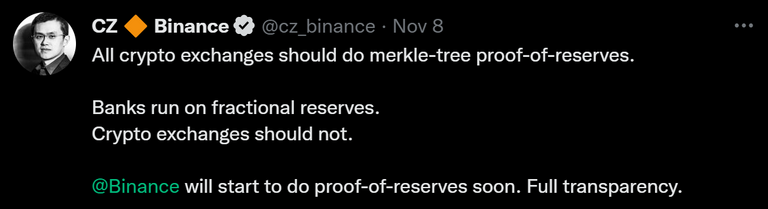

Now less than 3 hours later, Binance founder and CEO Changpeng Zhao (CZ) tweeted that Binance will sell its holdings of FTT to minimize their risk.

CZ's goal was clearly to put pressure on FTX.

It was about exploiting the weaknesses of the other and logically it is also in the interest of Binance to eliminate the competition.

Otherwise, it wouldn't make much sense for him to tell his 7.5 million followers about it before he even sold.

Binance has held over 500 million in FTT, which would have had a big impact on the token if sold, because that's almost 20% of the market cap.

That it gets serious has been noticed when large amounts of FTT were moved to Binance.

Tokens are usually moved to an exchange with the aim of selling them there.

What has happened now is a massive sell-off of the FTT token and a bank run on FTX.

This happened out of fear and to outrun Binance's sale of FTT.

The money was moved out of FTX because there was skepticism about security since FTT is the token of FTX.

Whether the rumors were true or not, people didn't really care.

As long as there is risk, everyone wants to protect themselves.

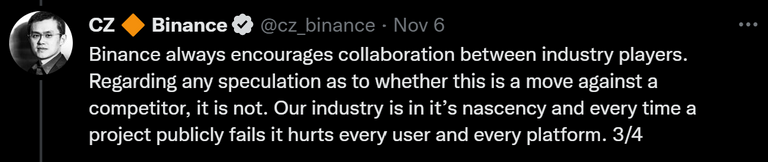

Previously, CZ was offered by the CEO of Alameda Research (Caroline) to buy the FTT tokens from Binance for $22, which was above the current price at the time.

$22 was a pretty important support zone for the FTT token.

Binance, however, did not respond to Caroline instead they tweeted this:

So instead of responding to Caroline, he compared FTX to Luna, showing that his interest was not the quick sale of FTT, but the destruction of FTX.

So the payout of FTX's assets continued and so did the sales of FTT tokens.

Some people claimed that FTX and Alameda Research are insolvent, arguing that they hold 8 billion FTT value, which is illiquid, compared to a real market cap of 3 billion.

Other people thaught that it was all FUD (fear, uncertainty, doubt).

The payouts became more and more numerous.

Within 7 days, hundreds of millions were paid out.

The outflow was so big that there were extreme delays.

People panicked.

At a certain point, nothing could be paid out anymore because FTX was no longer liquid at all.

Something like this shouldn't happen if you manage your funds properly as a stock exchange.

An exchange should always be able to pay out every single user.

Otherwise, crypto exchanges would not differ much from traditional banks.

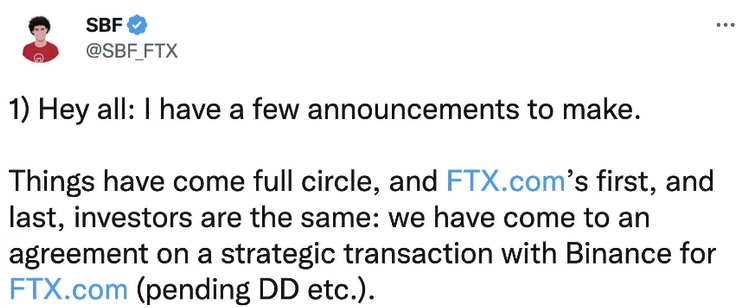

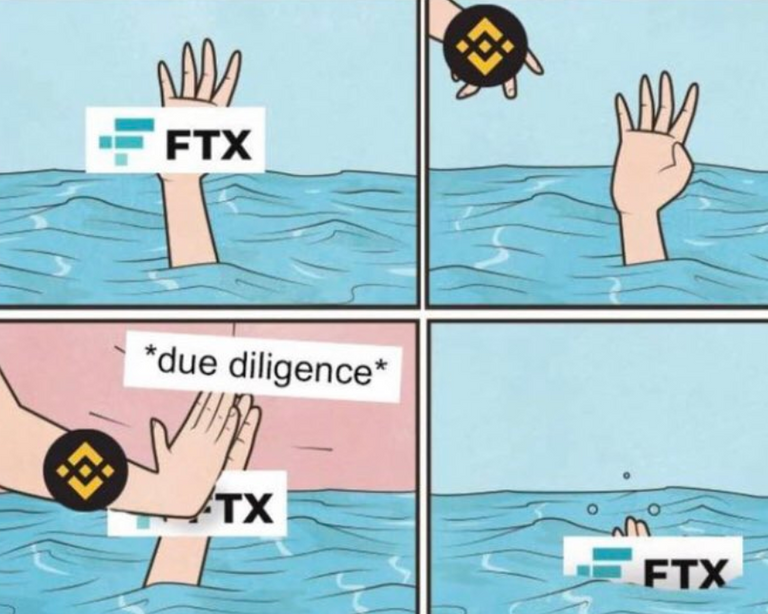

Eventually, FTX asked Binance for help.

Binance agreed to buy FTX in its entirety and to help with liquidity.

And the possible deal has been published.

The announcement of the possible deal was initially positive, but then ended negatively when it was realized that it was not yet clear whether the deal would really take place.

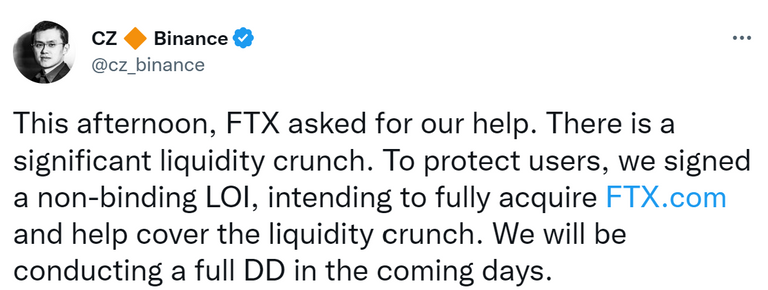

Binance first wanted to take a look at FTX's books to see if everything was okay, as FTX said.

Later Binance said that it is very unlikely that they will be able to make the deal.

Presumably, they agreed to the deal that SBF publicly admits that FTX is broke.

Meanwhile, FTX is desperately looking for other investors. However, many see it as impossible that someone will enter into such a deal.

I think there is no salvation and FTX is dead. The money is frozen and clients can't take their assets out.

FTT and other projects (such as Solana) previously held by Alameda and FTX have crashed.

This is because FTX and Alameda have sold their assets to be able to pay out more capital to clients.

Market participants who also knew this or simply panicked also sold.

FTT collapsed and now moves towards 0.

The site of Alameda Research is down:

Payouts of FTX are stopped:

For people who have their money on FTX, there is still a chance that they will get it back if someone would still take over FTX.

But I don't think that's going to happen.

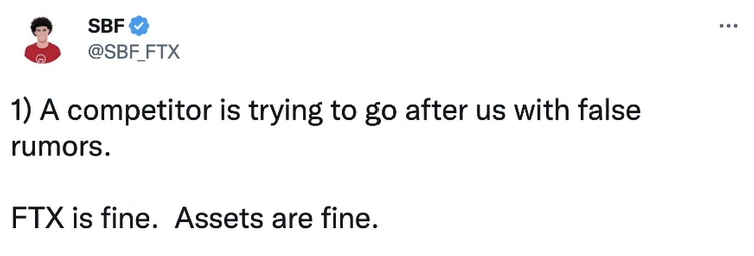

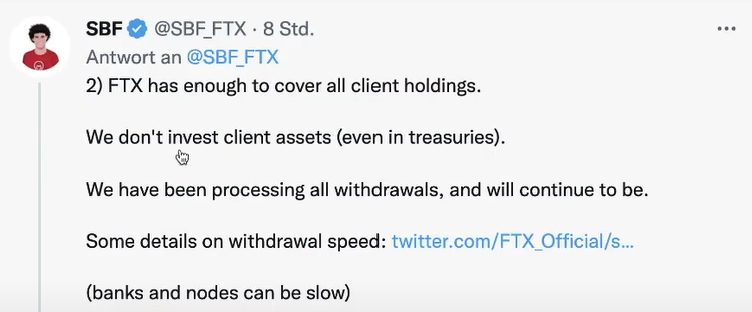

The craziest thing about this whole situation is that SBF tweeted during the chaos that everything was fine and there would be no reason to panic.

He knew what could happen and still lied to his own users.

The official FTX account also replied to people on Twitter that everything was fine.

SBF and FTX deleted their tweets later.

Trust is massively broken.

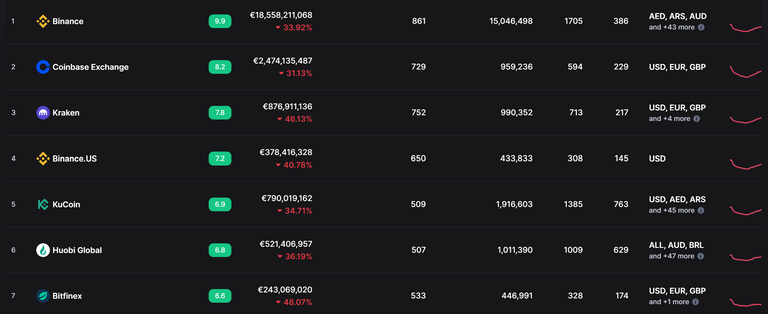

Not only for FTX, but also for other exchanges.

Because many wonder whether other exchanges would also go bankrupt if there were a bank run.

In the last few days so much has been cashed out and postponed as almost never before.

The sales figures of cold wallets, such as the Ledger, went up massively.

The question now is whether all this would have happened without CZ's tweets.

What can definitely be said is that FTX ultimately had liquidity problems.

Nobody saw something like this coming, nobody noticed it before. It came out of nowhere.

It's crazy how quickly an exchange can go bankrupt and how a CEO loses over 10 billion in net worth overnight.

FTX wasn't just some small company out to scam people.

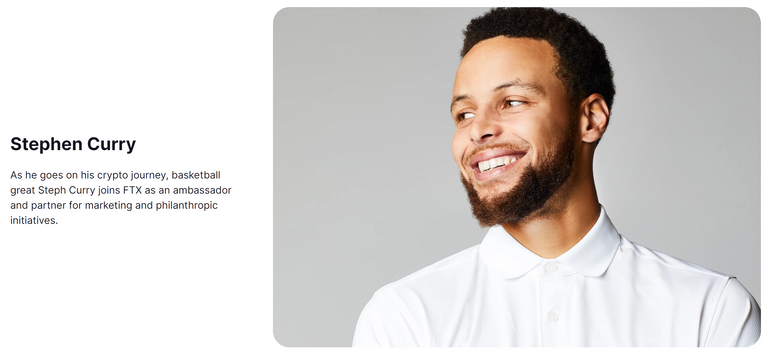

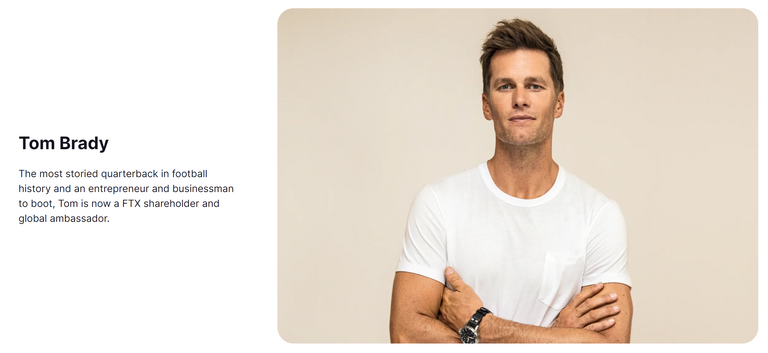

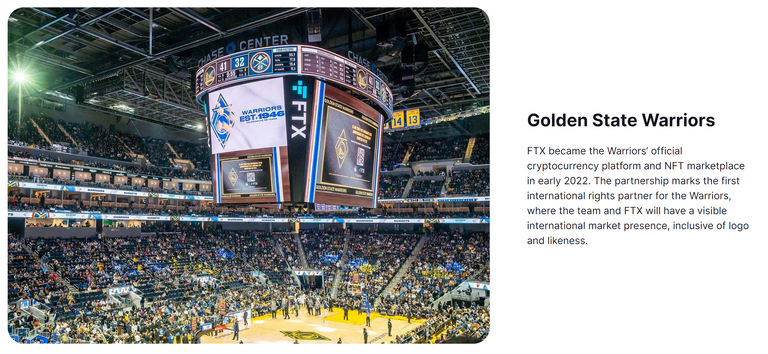

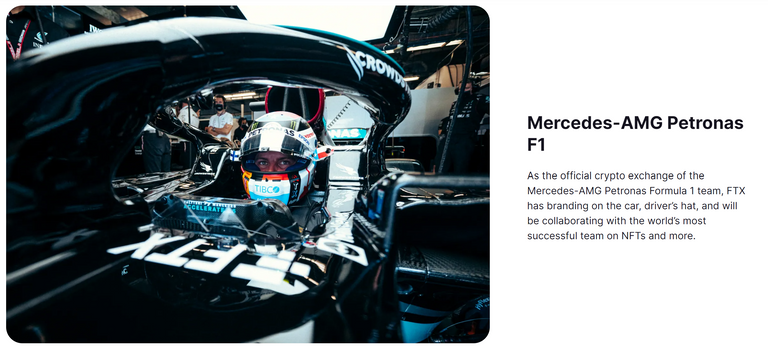

The exchange had partnerships with large companies, such as Blackrock.

They even had their own arena.

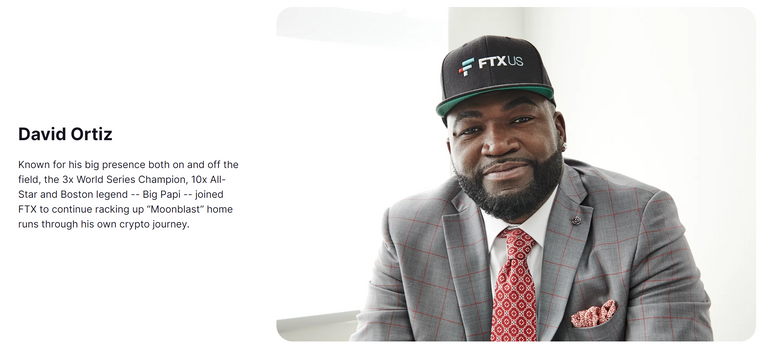

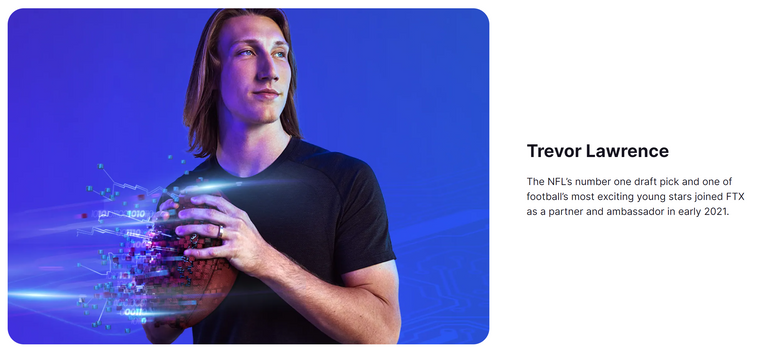

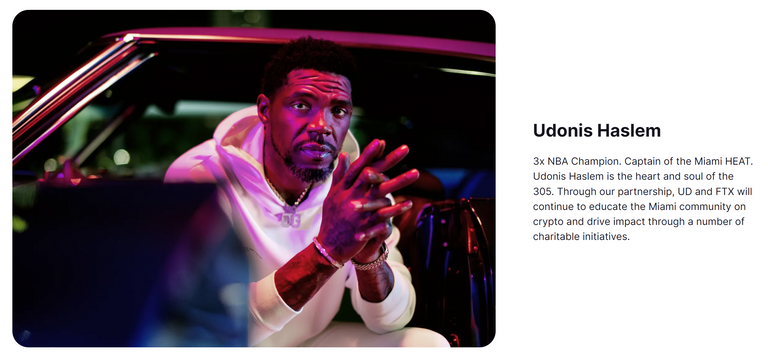

Below: some partnerships of FTX

And this company is now practically dead...

I expect that we will see more blood on the streets in the next few days specially in projects, that were backed mostly by FTX and Alameda.

NOW: who are the winners and losers in this whole situation?

The clear losers in this situation:

- Users of FTX who could not pay out their funds on time

- FTT holders who still hold their bag

- Alameda & FTX itself

- All sponsors and investors of FTX or Alameda

- Projects like Solana (impacted through no fault of their own)

- Miners (new lows = harder to mine btc & crypto)

Development of the entire crypto market is now delayed.

The media will be all over this.

We`ve lost a ton of credibility which will be hard to regain.

Thousands lost their funds.

Many will leave and never come back.

The clear winners in this situation:

- Binance (new customers & less competition)

- People who take action against crypto (politicians & skeptics)

- People who asked for new lows to buy cheap (btc now < 18k)

Surely there are also people who have made profits by shorting or selling, but there are mainly losers among market participants.

What we can assume is that it is better that it happened now instead of later.

People can buy cheap now and on the next bullrun, bull sentiment will be unanimous with less resistance on the way up.

It is also good when people disappear who have not dealt well with responsibility and external capital.

These people were a threat to the crypto space.

This will push even more transparency initiatives by major players who now have a responsibility to be better to survive / thrive.

One might ask: Can we learn anything from this?

CZ described in a tweet what he sees as learnings after this situation.

CZ has also suggested that in the future, exchanges will have to show what they are doing with users' funds and whether they are on the verge of bankruptcy.

This is a good approach to a more credible future with exchanges.

But one should not forget that exchanges are central parties.

Binance has more and more power.

There are also other important learnings from users.

- NOT YOUR KEYS, NOT YOUR COINS

No matter how old this saying is and no matter how much you think how modern and regulated the exchanges are today.

You should not forget what Bitcoin actually stands for:

Self-Custody

That's why many are now getting a cold wallet.

It is not the first time that a large stock exchange is bankrupt.

- TRUST NOBODY

Even the richest or smartest person in the world can spread lies.

No matter how long trust has been built or how good a person's reputation is, always be skeptical.

Don't get emotionally attached to a person or company.

When it comes to your money, you always have the responsibility yourself. No financial advisor in the world can take responsibility away from you.

If you have read and understood my report, then you now have a much better understanding about the last few days and the destruction of FTX.

Feel free to read my last posts. They are all linked here:

https://ecency.com/crypto/@benjammann/crypto-and-defi-table-of

Congratulations @benjammann! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!