In this video, I talk with author and economic analyst John Sneisen about the recent arrests of 6 traders who worked for HSBC, UBS and of course the masters of rigging themselves, Deutsche Bank.

This has been confirmed by a CFTC press release announcing law enforcement action against Krishna Mohan, Jiongsheng Zhao, James Vorley, Cedric Chanu, Jitesh Thakkar and the infamous Andre Flotron.

Deutsche Bank will pay a $30 million civil monetary penalty and undertake remedial relief.

UBS will pay a $15 million civil monetary penalty and undertake remedial relief as well.

HSBC will pay a civil monetary penalty of $1.6 million, and cease and desist from violating the Commodity Exchange Act’s prohibition against spoofing.

This is nothing new. Gold and silver manipulation is something we've been reporting on for years at WAM. Deutsche Bank has been caught in court rigging gold and silver prices many times over. They were also caught alongside HSBC, BNP Paribas, Scotia Bank, Bank of America and many others in 2016 doing just that.

Several of the names listed above have been caught doing this in the past as well.

Gold and silver scares banks. It's an insurance of wealth in the inevitable crash. Like basically every market in the world it's manipulated. We see ridiculous levels of ETFs flowing into the market suppressing the value of gold. The difference is that gold and silver have historical demand, application, scarcity and value. So the banks will continue to manipulate the market, but it won't last forever. Gold and silver are both incredibly undervalued. They're starting to break the bear manipulation in 2018. It just might get out of the bankers' hands!

And of course it's kind of like holding a beach ball under water, constantly gaining pressure, ready to bounce and all it takes is for that holding it down to lose control and it will bounce sky high.

Since 2012 especially, gold has been in an artificial bear market. We will see this end in the near future. Gold and silver have seen manipulation at the hands of banks and governments for decades. Centuries even.

Look at the gold standard. They printed far more IOUs than they had gold in the vaults. This lead to a lot of debt.

Look at the Exchange Stabilization Fund. It utilized gold confiscated under FDR in 1933 to establish itself as a fund. A fund with the main prerogative of manipulating markets, especially gold and silver. Later, much of that gold was used to fund the IMF.

But decentralization is always the natural outcome long term. We will see that decentralization and we will see the banking system and monetary system in general crash. Those holding gold and silver as well as cryptocurrencies will be very happy with the results. A monetary revolution cannot be fought without a few temporary downsides. Stay strong and independent everyone.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

If you like what we do, you can donate to our Bitcoin, Litecoin or EOS addresses below!

Bitcoin:

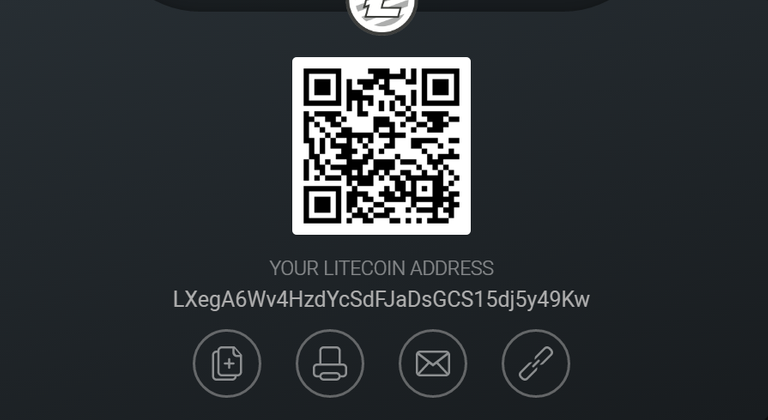

Litecoin:

EOS:

The patsies take the fall, banks get a slap on the wrist with a small fine, and the shit-show starts up again in a few months! Did I missing any details?

Very small penalties when u think of the amount of real $ manipulation could generate. These are little fishies being sacrificed. The big fish made the real money. At this point if they lose control of the beach ball, the resulting tsunami might be too big to contain, which is what I believe the manipulation of the last 10 years is really all about

This is a big problem, these banks made billions rigging the gold and silver market, and they are paying a small percentage of what they stole. The money they are going to pay will go directly back into the pockets of the same banks, again a big problem. No one goes to jail because it was software that was created by subcontractors using a NDA and the software ran the show completely automated. This is happening at every bank and investment firm in every area of the market. With this much automated manipulation, no abrupt crash is going to happen. https://steemit.com/economic/@zubasky/the-slow-deliberate-painful-grind-of-a-downward-economy

I hope they really make an example of these guys. They are in very privileged positions to be traders, already earning a heck of a lot of money and then they choose to pillage the system at a cost to honest people just for their own greed. Sociopaths.

Unfortunately I don’t think it will stop them, thanks mike

thanks for the news

i like it

best wish to you

1.6 million penalty 30 and 15 milion

The dam is breaking and it's good to see that finally, some of those involved in orchestrating these suppression schemes are going to down for it.

I've heard of the ESF sometimes when this topic comes up, but not exactly sure what it is, or how it operates. Now I know it's the tool of the syndicate who confiscated all that gold, it makes much more sense. Just curious, do you happen to know if that gold is accounted for in total available / in existence world wide?

good post, thank you for sharing.

wait .. what ??? Are u serious man ?????

upvote done.....

Thank you for your nice post . .

I am your Fan. . Im inspired by U..

Can U plz visit my blog and give me some tips?

I will be blessed if U follow me . . . #shunnoo

I always make helpful posts.

Even if this isn’t new, it’s still good to know who’s still doing it.

We all know the mainstream media rarely touches it!

So here is a question for any of my co-Steemians. What would be a better "haven" for someone who has a pension fund through an employer who does not have any option to do anything other than be in the Stock Market or Money Market type account allocations? (and no dang-it I cannot liquidate and move it all over into Steem - so don't go there :) ) If I'm hearing this accurately, physical Gold and Silver would be best, but if that isn't an option then what? Would it be better to at least move from the stock market into a money market until this "overheat" is over and pick up bargains or what? It seems that when I think through the implication of what is coming I may just be caught between a collapsing bubble of stocks plummeting or a collapsing bubble of cash failing... find myself a bit at a loss and some thoughts and or point me to a direction to better educate myself on how better to get at this. Frankly my family needs me to think this through well. Thanks in advance for any insights.

If you only have your money in tax advantaged accounts you are stuck with funds they provide. Normally though you should have some cash equivalent fund, something that holds like 7 day notes that is your best bet.

I'm expecting a 5-15% correction in the next 90 days. But after this we will likely resume the bull for another year and maybe even until the end of 2019. Don't sweat "normal" corrections of 10-15%. But a day is coming when the whole thing is over and we enter the next credit cycle and recession and have a massive correction. Likely this is a 2020 event.

If you have cash, physical silver is a good place to buy, because its more liquid than gold and you are likely to be able to spend a $20 market value 1oz silver coin easier than a $1500 oz gold coin. But my favorite position for a gold bull is gold mining stocks because they are leveraged to the price of gold. If gold goes $100/oz, the mining company's profit might go up 100% and the stock price responds accordingly.

Thank you for this. I'll have to get in and see what my specific options available might be.

Aside from how your brand puts the image of George Michael in flailing around in neon colours, the content is consistently top bar.

In regards to these crooked-ass banksters, am I the only one that hopes they keep holding gold & silver down for another year or two...? Or am I just being greedy for wanting to get more...?

Crytocurrencies are our road to crashing the present banking system and its crazy control system.

I love my precious metals the stash grows monthly

GO STEEMIT ❗️🚀 ‼️ Great show fellas 👏👍✌🏼♥️👊🏻