I traded on Bitfinex the entire halving from May until around early or mid-July, even being awake for three days in a row at one point during the Brexit trading there, so I witnessed everything. How did I magically withdraw my funds right in the nick of time before getting goxed? It was not luck. I knew they were insolvent.

There will be lots of criminal investigations of what went on that will probably turn over nothing, but I can tell you right now, this is probably word for word of what happened and how I knew to withdraw my funds:

Another obvious reason they've been insolvent for a long time is, a guy I know from one of the trading channels I'm in (Expanse dev - not franko, the other one) tried to make a 100 BTC withdrawal from Finex like five days ago and what happened? Finex canceled his withdrawal, gave him some bogus excuse, put his account on hold, and refused to let him take funds out.

Finex has also admitted to trading on their own exchange in the past. This is literally a 100% complete recreation of MtGox all over again.

Well, I guess that I will never see my .26 BTC and $250 USDT again. I love how all these exchanges get their cold wallets hacked. You would think brute forcing private keys was a trivial calculation. (Which it is not.)Also, I heard Bitgo is stating the problem is not on their end. How on earth did a "hacker" get a hold of "multiple user's" private keys? Especially when they were supposed to be multi-signature wallets. Does someone have a Quantum computer we know nothing about? (I'm being sarcastic here.) Oh well, glad that I didn't transfer even more coin to Bitfinex to make a few satoshis and pennies from the margin lending.

Creepy AF. Not cool.

I just posted this too - https://steemit.com/bitfinex/@blakemiles84/why-i-removed-funds-from-bitfinex-months-ago

"Fool me once, shame on you; fool me twice, shame on me." Fool me three times, shame on all of us? How many times have we heard people talk about how exchanges could build public proof of reserves systems to avoid this? Why haven't we, as their customers, demanded this? I like the internal STEEM market because we can actually see what's going on. Hopefully this will be the last goxing (if that's what it turns out to be). We should demand verifiable reserves. Cryptocurrencies should not fall into the same central banker disasters of the past.

Unless you are actively trading, I do not know what is so difficult for users to just hold their own coins so that they have 100% control.

They don't even need to be technical, mobile wallets such as Airbitz, Breadwallet, and Mycelium are already super easy to use. The users would have 24/7 100% full access to their private keys. If they wanted to take a step further then they could look into hardware wallets such as Trezor and Ledger etc.

Point is, if you are heavily invested and not actively trading, why aren't you putting your coins in a Wallet where you have 100% control?

One of the their customers will report them to law enforcement for trading against their own customer flow lol.

Great article mate.

Greed strikes again. They were issuing shorts that they did not have backing for. I am currently testing out Magnr because they lend BTC to traders based on deposits made by savers. This is how I earn interest on my deposited Bitcoin while at the same time having the confidence that any BTC Magnr lends is actually backed by real BTC they have on deposit.

@marketingmonk I would be extremely careful with magnr they use the same wallet service "bitgo" as BFX, plus they were keeping customer funds at BFX. I haven't been able to withdraw from magnr in the past even small amounts like 1 BTC sometimes for up to 7 days.

the wild west comes to mind

Great observation. I knew bitfinex was shady and pulled my coins out after the last hack. I even called those scumbags out on twitter last week.https://mobile.twitter.com/domavila/status/758105629345079296

I recommend to store your coins as home. Offline in form of a hard wallet or on your own harddrive. I feel sorry for all who lost money. I know this does not help but try to think of this: money comes and money goes. It's a circle

Make an 'offline' paper wallet, then put private key or seed phrase on Cryptosteel and stash it safely. Buy popcorn. You can trade on exchanges without keeping your BTC on them for months at a time, amirite?

Sounds like speculation to me!

The beauty of the Blockchain is that people will follow the money and see where it ends up. If they really didn't have enough in their wallets to cover deposits, that should also be pretty clear.

It's good that you got your money out before the hack, but I think people often read the seemingly irrational movements of markets as manipulation by individualy, whereas that is rarely the case.

Interesting article nonetheless.

@r0achtheunsavory We now 1% of all bitcoins in existence moved out of p2sh addresses so SOMETHING happened that wasn't just insolvency. But yeah I pulled out the minute that happened too. Sad too because I spent a lot of time training an AI to trade there.

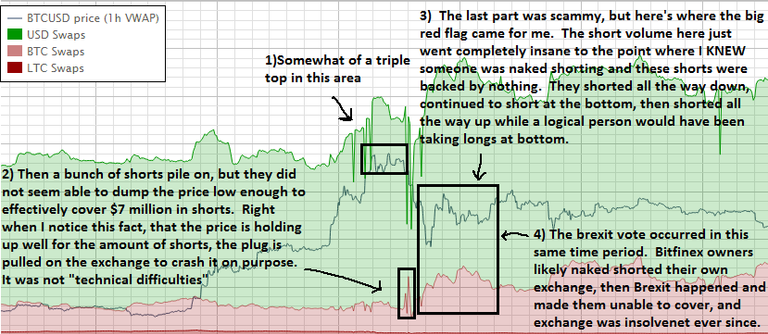

It's strange to me there is not more talk of that highly illogical shorting with huge volume where anyone who was at their computer during the days it was going on would have noticed they were doing the equivalent of setting money on fire on purpose.

It could only have been perpetrated by somebody with access to the private keys. And then there is this, which I reposted yesterday from cryptocoinnews, just to get hit by the stupid cheetah bot, which really sucks btw. https://steemit.com/crypto-news/@kingofchaos/bitfinex-s-founder-seemingly-tried-to-start-a-ponzi-scheme

You shouldn't make accusations without proof! You have no idea who were making those traded based only on volume! (How will Steemit turn out when governments attack based on libel claims?)

As far as I'm concerned, there's only two kinds of parties that could have been making those shorts. I watched them for like 48 hours straight and the person doing them did them in a manner where they were literally setting money on fire on purpose. They were even more illogical than trades seen on MtGox.

There was clearly a Gox type event going on at this exchange from that moment once you factor in their convenient "outages" and these nonsensical trades. It's the type of activity you only see when central bankers naked short commodities via their zombie proxy banks, or in this case, likely someone affiliated with the exchange themselves doing it. Especially when they admitted to trading on their own exchange in the past, which is probably illegal in some manner even in this non-regulated market.

It was at that moment I decided to take my funds off this exchange and here we are now.

Which two parties would that be?

You nailed it right here.

Yep, another one gox the dust, or another one bites the gox, i haven't decided yet :)

Please don't listen to this post!

Hindsight 20 20. When your at a bottom, it's difficult to know it is a bottom! Also, one can easily imagine a scenario where someone shorts the market before a brexit vote WHERE THEY THINK THAT BRITAIN WILL STAY AND BTC WILL GO DOWN.

Stop trying to speculate on a market. You may be right, but these markets are hard to predict and are not rational. For example, who would buy at 1200 a pop when the price is parabolic? People did!

Regarding your friend, what was the excuse that finex gave?

This is a very concerning possibility, thanks for bringing these details to light. That may explain the sock puppet account warning about the hack 3 days ago that I posted about here. - https://steemit.com/bitcoin/@pjheinz/is-this-the-bitgo-bitfinex-hacker-and-did-they-also-hack-the-dao

Exchanges, crypto or FIAT work much like Banks. If they are in trouble the customer always pays the price. This is what happened in Cyprus a few years back and with Mt.Gox.

It seems silly to keep large amounts of coins in exchanges. Always diversify with different exchanges and/or your own wallets. Make a trade and jumb out.

MtGox 2.0 confirmed.

I would net be least bit suprised if this was the case to be honest.

The question would be, was this done so that the price would crash and they could be able to settle their own short positions or was it done to justify what they lost?

Interesting information. You've got to be very careful or very sure when you're saying these things though... you don't want to get in trouble for libel. Have a good one and well done on spotting the problem early.

Nice catch, roach (wonders if follow button works yet).

The follow button "works" in that it adds to your follow list but there is currently no UI to see your follow list or a feed of posts from people you follow. Hopefully that is coming soon.

Yea I don't believe the hack one bit fake as hell

@r0achtheunsavory, I see where your premise regarding BitFinex makes sense. Have you discussed your observations with other people? If you have, did they come to the same conclusions you did?

I told a lot of acquaintances to come trade on Bitfinex during the halving. Anywhere from 100 BTC traders to some guy I know that works at a NYC hedge fund that was trading 1000 BTC or more position.

I told everyone to take their funds out when I did because there was far too much shady stuff going on there. Everyone else seemed to feel the same way, but they didn't really examine things enough to notice the specifics of these indicators I posted.

Can someone please send me a PM on my Bitcointalk account bones261 and let me know where I can purchase these rainbow tables that these bitcoin exchange "hackers" are using? I'd really love to quit my day job. 😄

Good catch. Use coinbase instead. They have insurance.

Hopefully we will not have to find out if that insurance actually works or if it's like healthcare insurance.

Nice theory, wouldnt surprise me at all if it was true. Dont trust finex with your money people, they've screwed over this market too many times

I guess I should withdraw my little half-bitcoin from Kraken?

Excellent breakdown. Hard to argue with your conclusion.

Basically, if an exchange starts acting fishy with funds, we all know what's about to happen. Remember that MtGox did the same thing too. Generally, there are warning signs before an event like this.

really bad news, sadly i have to say i dont think we will recover our money, thank you for share

Good insight, thanks. :)

Well, that would explain why BTC prices fell by almost $100 in just days. I love volatility but I prefer it to go the opposite way.

Look at it this way: Bitcoin's deflationary nature ensures that gravity pulls it up. So if it goes down you know it's a good time to buy, almost always! Shorting Bitcoin is a little insane, I think. Although, I took a chance, and made more than 100% shorting it just as the news broke... timed the bottom, and bought on the way up. Mostly luck, timing the bottom... but it was a "solid resistance level".

So just expect anything stored in the exchange is gone then...

This is an very interesting observation. And it was my assumption all along, for many exchange "hacks" we have seen. I think most of the exchanges play the dirty game of shorting their customers. Some of them just got squeezed and had to pull a bad "hack" out off the hat

When an exchange admits they have no cold storage or their cold storage wasn't really cold and got compromised, be sure there is an inside work.

Also interesting note, Inoticed a few months ago on LinkedIn that one of there employees was an active day trader, according to hir profile actively trading at BitFinex

Wow...and just look at what they came up with for a solution

https://steemit.com/bitcoin/@omnesomni/hey-steemers-how-not-to-handle-a-hack-bitfinex-says-it-will-socialize-losses-amongst-all-its-users

SORRY FOR YOUR LOSS! We are sorry that we fucked up badly!