Cryptocurrency has officially reached the Big Leagues.

- The SEC is losing every case (except Binance who hands-down deserved to lose).

- Political candidates are making promises to voters based on crypto.

- Regulators are cracking under the pressure (example: ETH ETF approval)

- Typical propaganda (like BTC wastes energy) is fading away.

- Banks, hedge funds, and governments are wetting their beaks on the action.

- It's not even 2025 yet; none of these are top signals.

U.S. House Passes Bill Banning Federal Reserve From Issuing a CBDC

Four days ago this news broke that the House of Representatives passed a bill that bans the Federal Reserve from making a CBDC. I didn't want to report on this at the time because I have very strong feelings about CBDCs (aka they basically aren't real and there is no meaningful incentive to actually create them). In addition to this, the fact that the House passed this bill is also completely meaningless because that's not how laws work. It needs to be passed by the senate and also not vetoed by the president. Wake me up when it's real and not just obvious political fluff.

Republicans expressed concerns that a U.S. CBDC could be used to control Americans.

I will admit that this has been a weird and interesting theme.

The core Bitcoin cult has always been barking and crying wolf about CBDCs and this seems to have awoken politicians. So while the law has not been passed yet and CBDCs are not an actual threat... it is noteworthy that lawmakers are suddenly taking these issues seriously to acquire votes. The Bitcoin cult is full of meat-only ice-bath seed-old-hating republicans who have never been catered to in this way. And they do seem to be responding to this special treatment in a positive way... which is funny because the entire grassroots movement was completely anti-establishment. I liked the thing before it was cool; now they are all sellouts it seems.

Democrats said during debate before Thursday's vote that the concerns were overblown and a ban would block public sector innovation and research. Overall, 213 Republicans and three Democrats voted for the bill, while 192 Democrats voted against it.

So democrats want a CBDC eh?

You know it's actually not that obvious what they want because it's just their literal job to disagree with the other side. Welcome to politics. Then again if I was a politician why wouldn't I want the power to just print money out of thin air? So I guess we'll see where this all goes but I'm guessing absolutely nowhere. The current environment is completely inhospitable for a CBDC. USD needs to collapse before that happens, and if USD collapses you won't be worrying about a CBDC you'll be worrying about martial law, curfews, marauders, and starving to death. CBDC won't be high on the list I assure you. In fact I'm sure we'd all welcome it at that point.

Industry participants hailed Wednesday's vote, the first for a bill focused solely on crypto market issues, as a sign that the sector was finally receiving recognition as being significant.

And that's exactly why I chose to report on this issue. Not because the issue matters but because it's actually getting attention now. This definitely all signals that politicians are going to take crypto far more seriously from here on out. I mean imagine what it will be like in 2025 if everyone in this space is x10+ richer than they are now. There's a lot of money and power being thrown around, which is catnip to the politician.

Single issue voters

They are starting to realize they can get votes just based on the one thing. A lot of these crypto enthusiasts don't care about left vs right dynamics. Tell them CBDCs are banned or that ETFs are approved or that Ross Ulbricht will be released and you've got them.

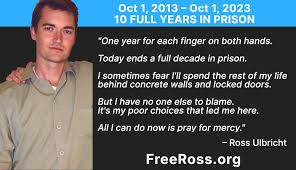

Ross Ulbricht

Yep, Trump is talking about pardoning him... AGAIN. And people are taking him much more seriously this time for whatever reason. Personally I know his case was riddled with corruption. From the federal agents that stole Bitcoin to the botched frame job that claimed he hired literal assassins. The guy created the infrastructure for a free-market and got a life sentence for his troubles, which clearly was not deserved and they just wanted to make an example out of him. Still I'm not voting from Trump because he made some BS pinky promise. In fact I'm not voting for anyone nor have I never voted for anyone in this completely corrupted and broken system. However I will admit that it would be nice if he was released. Ten years is more than enough. I just hope he's got some BTC stashed away somewhere.

Funny how all the powers-that-be have to do is dangle something in front of a Bitcoiner's face and they forget all their principals. Hilarious even. Oh well, these things happen. There are a lot of single issues voters in crypto that have absolutely nothing to do with the whole left vs right dynamic. Instead these people are going to vote for whoever's supporting crypto... unless it's a Bitcoin maxi in which case they might support someone who attacks everything but BTC. So that's fun.

However, both the market structure and the anti-CBDC bills seem headed toward similar fates in the Senate – going nowhere – given that half of congress does not have a counterpart for either piece of legislation.

Conclusion

The bill to ban CBDCs is completely meaningless, but the reporting and attention given to crypto is not. Jerome Powell has already stated his intentions multiple times that the Federal Reserve has no need for this technology, and while we shouldn't necessarily believe that statement at face value the incentives seem to align in that exact direction. The FED doesn't need this tool and it would even serve to undermine what they already do have. But also the FED is a private bank and the ones who actually might want that type of control are the politicians and government themselves, so we'll see how it plays out.

It's interesting that crypto has entered the political arena. It's a surreal experience and by all accounts this type of thing is going to escalate exponentially alongside the spot price. It would seem that money and power and linked at the hip. Crypto is about to gain a lot of power within this cycle. Whether that's a good thing has yet to be decided.

It's crazy to see how politics is jumping into the crypto world. Seems to me like it's more about votes than real change. I'll be curious to see where this goes.

When has politics ever been about real change? 😅😬

You're right on that big brother, I absolutely agree 😂😂😂

How does the outlook for Europe look? They seem to be driving full steam ahead towards CBDCs. I am guessing something more digital needs to come so that they can move fiat onto some sort of crypto system as in its current form, fiat cant compete with the settlement and speed of any crypto tech. The Nasdaq is looking at running 24hrs and fiat cant do that it seems.

What even is a CBDC?

Can we even define it?

Normally with technology we can define things based on what the technology actually is.

A car is a car.

A computer is a computer.

A phone is a phone.

CBDC isn't defined by the tech; it's defined by the entity launching the tech.

Doesn't matter what the code is or what it does.

If it's launched by a government or central bank it's a CBDC.

If a dev team launches it, it's just another shitcoin.

This means that CBDC isn't even a technology; It's a BRAND.

All the value of crypto is derived from the network.

The brand is largely irrelevant except when interfacing with centralized WEB2 systems.

This is why I require actual proof to see if such a thing can even happen.

Really good points. That sort of fits in with my thinking that fiat money is already by definition a CBDC.

Exactly.

And nobody in crypto wants anything to do with that bullshit.

And nobody outside of crypto wants to deal with the technical complexity of crypto.

It's literally a product for no one.

Their target audience is delusion.

Solution looking for a problem confirmed.

I saw someone write that retail might not come in this cycle as they are not interested in the product with the complexity and everything.

lol yeah well everyone knows that retail comes in to buy the top and provide exit liquidity.

circa 2025

Why would this cycle be any different?

There is no added complexity in buying on Coinbase or sending Blackrock a check.

Nobody needs any extra coaching to do those things.

The vast majority of buying has always been off-chain.

To expect anything different this time around is really odd behavior.

But then again that's just part of the cycle.

It's the same exact hysterics every four years.

Clockwork really.

Very true. I was chatting to a normie friend and they can buy all off chain like you mention and he was looking really at just price and what could pump or what looks cheap. Doesnt know anything about the different chains etc. Hard to believe we are half way through this cycle already, 2025 is lining up to be pretty epic.

People try to tell me that China has a CBDC as well.

Nice, so how do I get ahold of some?

Crypto exchanges will list the most hammered dogshit.

Where's the CBDC coin?

We need to think about why an exchange would list literal Dog WIF hat but not a CBDC.

Politicians are always talking about how they are going to do this or that.

Why do we keep believing them?

How is a CBDC going to fix any of the problems?

How is anyone going to trust it?

How are they going to secure a technology they don't even understand?

None of it adds up honestly it's a complete conflict of interest to so many parties.

Including the entire retail banking sector.

Again the entire system needs to collapse first...

Which... Europe certainly could be first in line.

Doesn't change the fact that it hasn't happened yet.

Very true, I have never voted in my life. There is lots of doom ala Schiff that everything will collapse, but it seems very sustainable so far. I certainly couldnt answer those questions, but it fore sure makes sense, especially the conflict between commercial and central banking.

I do know that in the global partnership agreements it was Mexico who, as each country has to have something to offer up towards the agenda, agreed to develop a crypto system. If I were asked to speculate, I think the goal is to link energy to crypto. Meaning a different financial mechanism used to pay for energy cost while using blockchain technology to also be able to shut off accounts anywhere in the world, in other words a complete energy control mechanism. No loss to investors period. Part of a ideology of we've seen over the decades that which works and that which doesn't work, they plan on fixing all that didn't work. (I guess they are so much smarter than their peers)

That was the idea behind the pandemic (fixing the 2030 crash of global financial systems due to baby boomer generation of having 4 retirees to every 2 workers) , the idea behind Ukraine and the idea behind Gaza, these were all systems heavily reliant on the global banking systems, international banking, social government sponsored program.

Germany is the one who had been running all over the continent making these agreements. You either invest in green technologies or you don't get international bank funding. How they set the whole thing up was by guarantying investors no losses if they built the technology for green energy backed by tax payer money into development bank programs. They only pay if investors lose. So when you say "Europe is", well Europe's been running out the door with a lot of stuff, they've been successful with it because they guarantee to investors they'll see no losses, no losses means no losses, otherwise the whole paradigm falls apart. The only way you can guarantee it doesn't fall back on them or the investors is to make sure everybody pays or else.

I saw the other day that Trump is accepting campaign donations now in BTC. I'm not sure how accurate it is, but it wouldn't surprise me. Apparently it is a back pedal from his previous stance. I knew for a while that eventually the lobby would get involved with crypto and from that point on it would be out of our hands. Just look at all the other major issues that the lobby controls. We are just along for the ride now.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 690000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I’m wondering why politics and crypto are having some relationships these days

Looks like politicians are willing to do more of crypto like Donald Trump😅

A question SEC can discontinue ETF or once approved is forever?

I couldn't quit laughing over that statement. You are full on right as, given the current status quo of Americans who don't want CBDC's, politicians don't want to go there. Politicians though, on the other hand, know the only way to get there is by the latter half of your statement if they really wanted to implement one.

You really could have had a career in comedy writing.