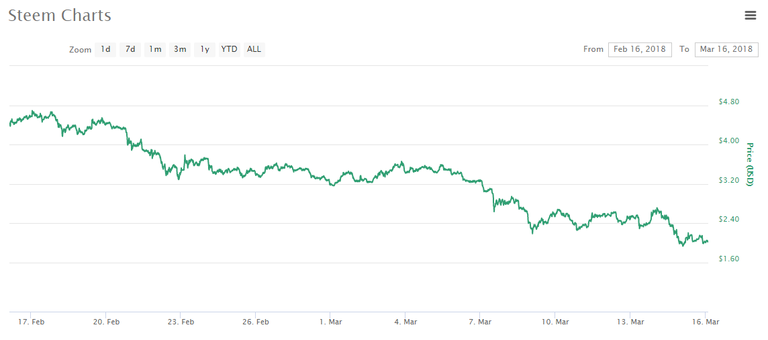

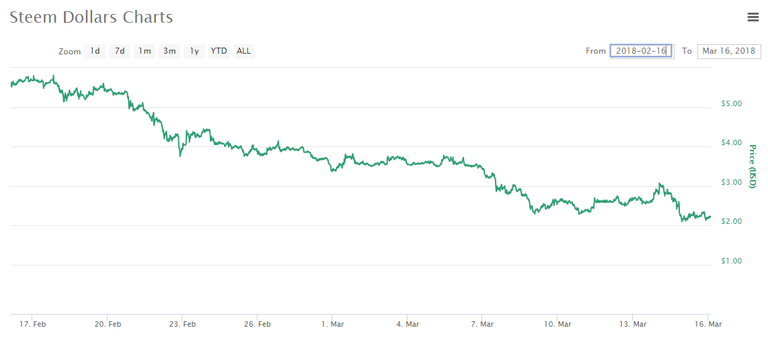

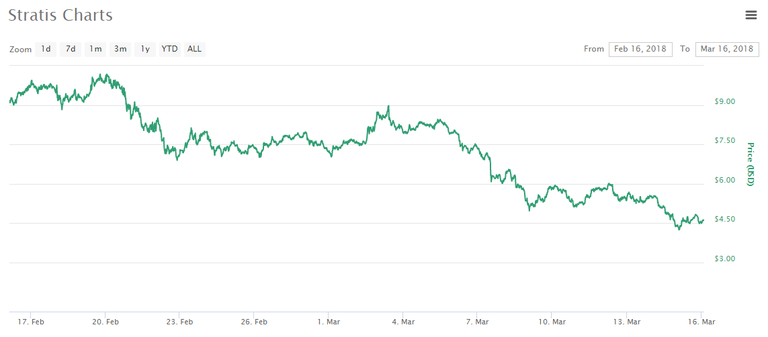

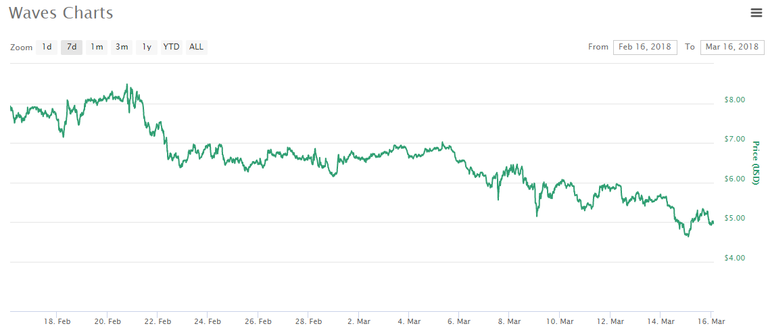

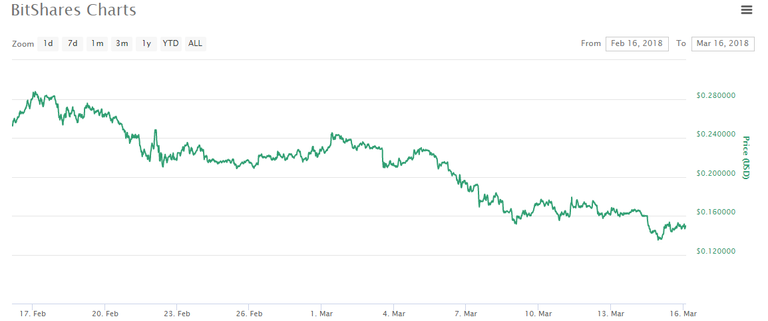

No, it isn't pegged, but there is no clear argument that it is falling because the system is working to get SBD down to $1. It is more likely to be tracking the general trend of the market. SBD has nearly identical trend charts to all 30th-50th place coins over the last month. When you consider that a dozen other coins, including Dogecoin, have had the same price movements, it becomes hard to argue that the value of SBD is being driven lower by design.

Consider the proportion of each day's reward pool that prints in Steem vs SBD.

Right now, it's twice as much value roughly in SBD. It was previously 3x (maybe higher? don't feel like mathing) as much at the recent peak.

It's pretty hard not to draw a line between "massively increasing over-supply (by value)" and "massively decreasing price".

However, I cannot disagree with the chart comparisons. I think the proof will be when SBD doesn't resume a bull run past the old peak while most other coins do, owing to its (future) much higher supply.

Good points, thanks.

I don't think that is unreasonable. I would probably draw that conclusion as well if the trends were so consistent. The market is pretty tightly coupled right now, especially SBD and Steem. I think better proof would be if we saw a divergence of the two. That's what I am hoping for.

It's also worth noting that: