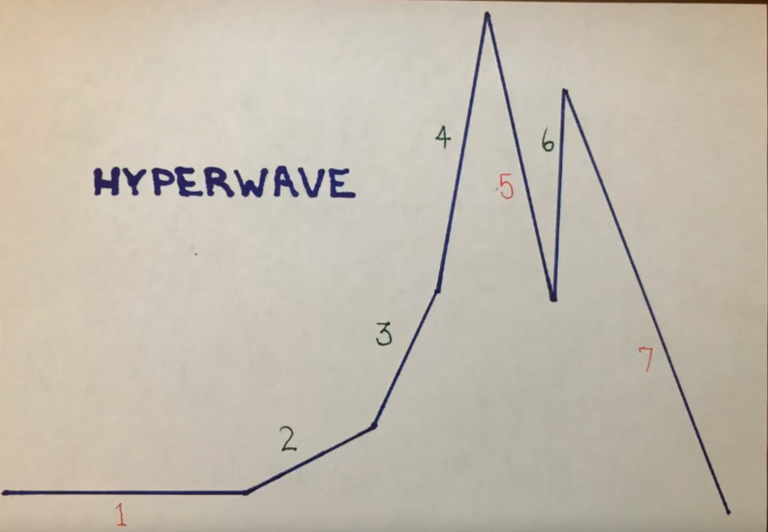

Yesterday @sacred-agent shared a post where Tyler Jenks and Tone go through a chart patterning technique called Hyperwaves, which is essentially a subclass of a Bubble. I'm pretty fascinated.

Technical Analysis

For people that don't trade much there's basically two main ways that people will try to investigate whether an investment is a good idea or not. You can inspect the fundamentals of a business or you can look at what price is doing. For those that like fundamentals it's essentially looking at the books of a company to figure out profit, loss, cash on hand, earnings, EBITDA, and all the other accounting aspects to determine if the company is a solid investment. For those that look at technical analysis it's the rough suggestion that price already includes market knowledge of fundamentals mixed with fear and greed and is essentially a stronger estimate of fundamentals mixed with current sentiment about the investment.

Technical analysts tend to think that fundamental analysis is a waste of time. They think fundamentals are already included in the price on the screen. Fundamentalists tend to think that technical analysis is no better than reading tea leaves or consulting Mrs. Cleo about investment opportunities. They would argue you can't judge future price action by what candlesticks say.

For those that follow technical analysis there are a handful of patterns in hourly, daily, weekly, and monthly charts that stand out as strong indicators of overall price action, which can be predictive of future price action. There seems to be many indicators and patterning approaches to figuring out what price is going to do. Tone has a sequential counting system. In the video linked above Tone and Tyler mention Haejin as a practitioner of Elliot Wave counting, and discuss that as another way to investigate price moves from looking at price charts.

The big picture: hyperwaves as a subset of bubbles

Most people are aware of the term bubble. It means a highly inflated market that is likely to pop with a sharp decline in price. Getting in at the beginning could make someone a fortune. Getting in at the high could lose someone a fortune. Studying trends in how bubbles work would benefit investors. A subset of bubbles is a chart that Tyler made called a Hyperwave.

For a hyperwave to fit the bill all price action for red ranges 1,5,7 must stay below the threshold, and for 2,3,4,6 the price must stay above the threshold. It's allowed to thrash about however it wants above or below where appropriate so long as it doesn't break those lines.

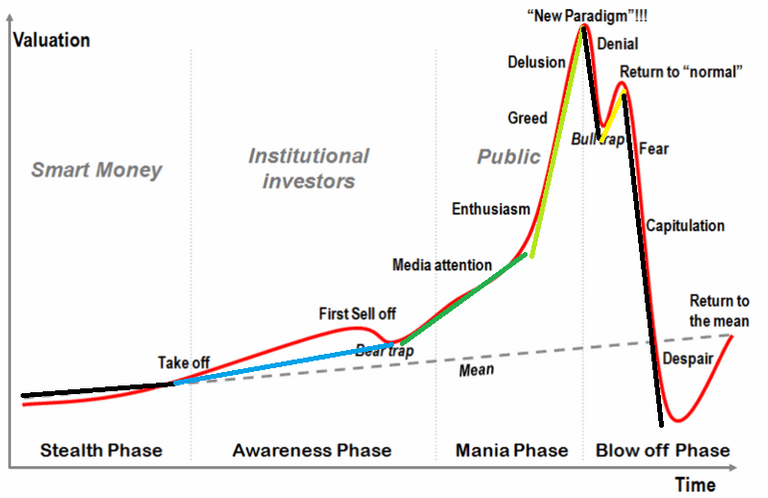

Bubbles

For folks that study bubbles there's a pretty standard chart that folks like to reference:

There's a pretty good similarity between the bubble approach and the hyperwave approach. Tyler mentions that it's better to use Hyperwaves because on a chart with rounded edges it's difficult to know where you are. On a chart that has sharp lines you can tell more easily highs and lows and when trend lines have been pierced indicating large changes in direction.

I've done my best to markup the bubble with Hyperwave lines:

. The various colors just mark the different stages, but the black lines represent the lines where trending price has to stay below.

. The various colors just mark the different stages, but the black lines represent the lines where trending price has to stay below.

Bitcoin

According to Tyler and his theory it looks like bitcoin is in a hyperwave. One might think that we already had the bubble when bitcoin went up to 20k, but that doesn't necessarily appear to be the case. We're at a critical junction point over the next few days as bitcoin seems likely to go well past 20k or drop down possibly as far down as 5-7k (and bounce off of the 2 line) or even down to 1.4k (basically fully crash).

Bitcoin has two tough challenges ahead from a technical analysis pattern and a hyperwave pattern. There's is a resistance line that has held since 20k btc. It's been tested a few times, but Tone declared it usually takes 5-6 hits on a resistance line before it breaks. We haven't seen that many yet.

Additionally, from a hyperwave perspective, bitcoin is up against a possible wave 3 line. If it pierces the line and stays below then either wave 3 hasn't formed or wave 3 just died. It would appear that hyperwaves get a 1/4 shot of making it in wave 2. Those in wave 3 are closer to 4/5 make it through. The question that's looking to be answered over the next few days are: Will bitcoin make it over the resistance line that's been around since 20k btc, will it make it over a critical resistance line of 11.2k and stay above it, and will it stay above the wave 3 hyperwave line. If those conditions are met then it looks promising that bitcoin despite having a recent all time high is barely into wave 3 of the hyperwave and is going to blow away previous all time highs.

if those conditions aren't met then price is likely to fall back to the wave 2 line between 5-7k, or the wave will collapse entirely and die at 1.4k or so (possibly to try again).

What's the deal again?

BTC needs to stay above wave 2, and wave 3, reach over the downward sloping resistance line that's been there since 20kbtc, and rely on the key support/resistance lines at 10.1k and 11.1k btc.

If it fails it could fall back to Wave 2 levels. Or just falter completely and go back to 1k btc levels.

For those looking for hope

For those looking for some hope there's a story from an Elliot wave perspective that bitcoin has recently completed it's first set of impulse waves, followed by a mild correction, and soon to start the most vigorous set of impulse waves that would conceivably have the force necessary to shatter resistance lines and bring bitcoin to new all times highs and still only be in wave 3 of the overall hyperwave. Actually it's really still just the start of wave 3.

Steem

Well, it's likely a moot point if bitcoin fails, and we'll know if bitcoin fails in the next week or so. It'll either be up over 11k or down below 5-7k. That said I was still interested to try to craft a hyperwave chart for Steem and see what it might look like.

To my knowledge that's the first public chart drawn of a hyperwave for Steem. I'm not sure. But if btc holds, then it shouldn't surprise anyone that effected alts could hold, and we might be looking at continuing wave 3 for Steem. This would put the minimum price for Steem through the summer towards 7-10 range, and then assuming wave 4 hits put Steem in a race to a minimum price of 30-50 Steem. This spike would be followed by a bull trap, and then a strong plummet maybe in early 2019.

Hyperwaves are slow; except in crypto

In the presentation I linked at the top Tyler and Tone talk about multiple 40+ year investment trend lines that go through hyperwaves. Tyler says he has over 300 charts that fit the pattern. What's unique about crypto is the time it takes to complete these. The flow of funds is absolutely massive and basically unparalleled in financial history. What takes the stock market 15-80 years to complete a cycle can be done in less than 5 in crypto.

Do I believe these things?

Honestly, I'm not sure. I'm still just reporting what I watched and read for the last 8 hours. I hope it's right, but as Tyler says "Hope is a bad investment strategy." I do think that if bitcoin can get back up to 11-12k it looks very promising for a very healthy recovery.

Investment advice

Guys, I've been trading for like a month. If you trust me to make your financial decisions you frankly deserve to lose all the stake you have. I'm doing my best to learn about technical analysis and decide on whether I like and or trust it. I'm mostly reporting my studies and trying to apply them. This is for my educational purpose. This is for my entertainment. I'm just sharing my journey with you. Do your own due diligence and talk to your own financial advisers as you make financial decisions for you and your family.

People

You can find Tone here

You can find Tyler here

This post has been revived by steem-forever and will get extra rewards. This happens when a post is upvoted on steem-bounty.com after the 7 day post life.

Users can simple upvote via steem-bounty.com continously, so posts can live and earn rewards forever.

Authors can share their steem-bounty.com links and get upvoted forever.

We hope this will allow everyone to earn more meaningful rewards over longer timeframes than before.

Man, I really need to start using the word "wave" in my analysis. Seems to be the attention grabber. I enjoyed the review of their analysis. That downtrend line is something I have watched and talked about for a while now, referencing the descending channel that it helps make up.

As for the bubble or hyper-wave, that is the topping pattern I look for.

On a daily chart, we possibly already did that top, but on a weekly not really and historical research I usually see it on the weekly, but it's not black and white of course.

It would be the quickest "bubble" in history if 20k was the top, one of several reasons I'm willing to gamble on it not being it.

it's be nice to see Steem break away from bitcoin values on the market side...let Steem pick up value regardless of what bitcoin does.

its up to our community to create that value

Great discussion of fundamentals v technical analysis @aggroed. I would add that from a macroeconomic sense, perhaps the most important driver to any bubble is public perception and narrative.

I still suspect the cryptocurrency narrative is in its earlier stages, and waiting for the narrative to grow in noise and numbers is what will drive your crypto portfolio value in the months-years to come.

I am a big fan of Stanley Druckenmiller's philosophy of liquidity and investing based on massive capital flows chasing trends, rather than focusing on the more micro fundamental or TA metrics. I review fundamentals (namely debt, free cash flow, margins, etc.) and think loosely about TA when viewing a chart, but for me it's all about being long the narrative (or short, if that suits to situation).

Currently reading the book below, I recommend anyone serious about the space pick it up and read it. Provides a nice context to several previous manias and is written in a logical prose.

Definitely dig the wake-up call at the end that you're just learning and interested in it. I think otherwise, a lot of people would take your word as gospel, since you're a high profile witness.

I have a hard time believing in these various wave theories. Humans LOVE patterns, and we're very good at convincing ourselves that they're all over the place. That being said -- large groups of people tend to operate in ways that allow macro-analysis of systems to be possible. From my own background in civil engineering, there are daily curves that define typical or expected peak hours and intensity of water usage. I'll admit that this is significantly more complicated and sentiment based, but it doesn't sound completely impossible.

Thanks for sharing. Here's hoping that Steem continues to gain in value!

Very nice and informative blog regarding hyperwaves and bubbles. Your post is useful for investment in crypto market. You presented a good analysis.

Stay blessed

This actually was the only explanation of a hyperwave that actually has made sense to me, thanks @aggroed you really put together one hell of an educational blog. Much love! No wonder you're the top witness, must have quite the education and iq. I have a lot of respect for your writing and thinking abilities. Much love.

Glad it helped. I'm a former college professor. I like to take complicated things and try to break them down to less complicated and more easily digestible (intellectually) bits.

Actually it reminds me on salman khan, he founded khanacademy on his math intructional videos. Very helpful stuff, and that intelligence eminates. You’re a golden example of what steemit is all about and it makes me thrilled to have gotten a response from you. I hope someday my skills develop too so my blogs are as relevant and inspiring. Thanks again aggroed your fantastic. I hope when i can afford post secondary i get an instructor of your quality.

This is cool, hyperwave makes studying and understand the market abit easier. That price action part is really great

Very interesting, thanks for sharing. Elliott Wave is interesting but I've heard the argument put that cryptos are a bit "young" to be subjected to full substantive analysis; although you do start to wonder how much of this becomes a self-fulfilling prophecy when you have 1,000s of traders (potentially armed with significant pots of cash) all following the same enshrined patterns...?

Honestly @aggroed, i wouldn't take much for granted the "knowledge" that people say they have about Elliot Waves.

Check this article for a good reference: https://www.investopedia.com/university/advancedwave/

Elliot waves is too subjective to have some statistical applicability, wich is the basis of Technical Analysis.

I never heard of these hyperwaves, but from what i read, it looks too convenient to turn a bubble pattern in a positive pattern. Honestly, so far, i don't bite it.

Also, be ware when paying attention to "Analysts" that say that prices of assets moves like quantum waves. This just doesn't make sense.

There is only two things that move prices: Supply and Demand. If more people are buying, the price goes up. If more people are selling, the prices go down.

The technincal indicators are only references to how the players on the markets tend to behave at certain prices.

It's a hard road to join the game my friend, but not an impossible one.

Thank you @phgnomo for writing this, as it has saved me from having to put a comment together that would end up a lot less polite than yours. There is much I would also add to your comment but I'll leave it for now :). Mind you I do feel a post coming on regarding voodoo and holy grails, but I guess we all went down these rabbit holes in the beginning and @aggroed will be no different.

Markets are a weird world. Probably because there is so much money involved, and so much promises of easy money.

But i think the main problem is that people are misdirected to the make money part before trying to learn how things work for real.

That way, only one kind of player wins: the sharks.

It's not by mistake that the players on the markets are called smart money and dumb money.

This gives me a huge crypto bonner.

supper

This post is an amazing educative post ,thanks for sharing my friend.

Very good post friends I really like a friend if there is time please visit my blog there may be that you like.

great post.

Thanks for the information, it was useful.

this is very good post @aggroed thanks for adviced dear

Steem always decrease in graph.. What can we do to infuence the graph?

Technical Analysis is perfect .

it is wonderful post.

nice post. Thanks for sharing.

Thanks for sharing. Very educational. Thanks @journeyfreedom

Great post .

Thanks for sharing

So wonderful post .. Thank you for sharing good information .

Best of luck .

I am still learning about bitcoin from experts. And this information is very important to me. I will continue to consume bitcoin. Thnks a lot

First time hearing something like this. Not that I'm super advanced in the subject I just like to explore.

Thank you for sharing! Waiting for more.

Your post is helpful for me. Love this post.

Very interesting post. I lile this post. I am new kid on steemit. Your post very helpful for me

This technicall analysis is quite educative but how do newbies like me get along.?

nice blog

@aggroed Thank you for the advice :) lol ..

Thanks for explaining hyperwaves and showing how it might apply to Bitcoin and Steem. You are a very good teacher. The more I understand about impulse and resistance the more I feel like this...

Man, your ability to write neutral analyses is one of the best I've seen on Steemit (and elsewhere). I would say that I hope line 3 will become a reality, but since hope is a bad strategy, I guess I will rather hope that the price stays low for a while.

Your analysis is always well thought out and presented with multiple scenarios. But at the end, you always take yourself down saying you don’t know what you’re talking about. Stop doing that!

Nobody knows which way the market is going, but your analysis provides scenarios for people to expect and therefore be able to manage their risk around them.

Talk about risk management rather than bagging yourself. Your work is good and worth the resteem!

Nice post @aggroed

Very banefit

you got me hooked man. i am looking for the hyperwave everywhere now.

You got a 19.36% upvote from @buildawhale courtesy of @aggroed!

If you believe this post is spam or abuse, please report it to our Discord #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

Nine months after, the trends have been almost perfectly matched! Excellent result, @aggroed, I have to make an updated hyperwaves version in Serbian :)