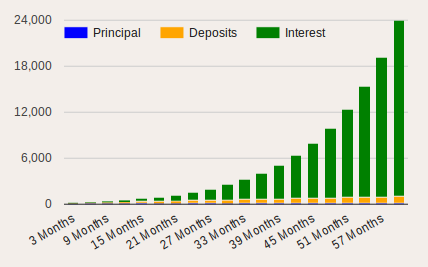

Starting with just a $400 initial investment and generating only a meager $2 (½ STEEM) in daily blogging rewards, the total value of your STEEM POWER could be worth more than $1 million within 5 years!

This is the power of compound interest, as exemplified by the following chart.

Specifics

This example presumes you’ve received 10 free STEEM on signup, purchased 90 more STEEM at an exchange price of $4.6, powered up all your STEEM to STEEM POWER, and that the price of STEEM rises from $4.6 to $46 over the next 5 years. The computation is shown below and note that 23,945 STEEM × $46 = $1,101,470.

(click the image to go to the calculator)

The expectation of a 10X (1000%) rise in the STEEM price over the next 5 years is not totally unreasonably given the very large market capitalizations of traditional social networking behemoths such as Facebook and Twitter. Even with only a double in the STEEM price over 5 years, the above example would end up worth $220,294.

UPDATE: for those readers who are contemplating that this blog post is shilling or painting too rosy of expections, please note that I explained a scenario when a person invests $400 and a meager $2 a day in blogging effort (which is also probably paying them much more than $2 in terms of a new technology learning and social networking experience), so basically they have risked nearly nothing for the shot at up to a $million in 5 years. Please also read my comment replies for more detailed insight into my reasoning.

Steem’s Eventual 90% Interest Rate

The annual interest rate paid for holding STEEM POWER will eventually stabilize at 90%! That is 0.176% per day¹ and 1.24% per week.

Whereas, no interest is paid for holding STEEM.

Those who power up their STEEM to STEEM POWER gain at least 90% more STEEM POWER every year.

Steem’s Current 354% Interest Rate!

post below, the current approximate annual average rate of interest is 354% and will decline gradually as follows over the next months.Per @james-show's comment

| Year | Month | Approximate Annualized Interest Rate |

|---|---|---|

| 2016 | July | 354% |

| 2016 | August | 266% |

| 2016 | September | 214% |

| 2016 | October | 179% |

| 2016 | November | 153% |

| 2016 | December | 134% |

| 2017 | January | 120% |

| 2017 | February | 108% |

| 2017 | March | 98% |

| 2017 | April | 90% |

Steem’s Ongoing Stock Split

The payout of the interest in Steem is a forward stock split.

A forward stock split adds to the number of stocks you own, but it does not increase your investment value. When a company issues a stock split, those who already own stock in the company end up with more stock without making additional investments. If a company issues one share for each outstanding share, then the number of shares doubles, and this is called a 2-for-1 stock split. Because nothing has happened to increase the company’s value, the effect of doubling the number of shares reduces the stock price to half and keeps the company’s value the same. In another example, if a company announces two shares per share outstanding in a 3-for-1 stock split, each share value would fall to a third to keep the company’s value the same.

Steem² mints new STEEM tokens every 3 seconds when a new block is created on it’s blockchain, distributed to pay for our blogging rewards and the miners who validate to secure the Steem blockchain.

Additionally, 9 STEEM POWER are minted for every 1 STEEM that is minted; and the newly minted STEEM POWER are distributed to every existing holder of STEEM POWER proportional to each holders’ share of the total STEEM POWER. This is a forward stock split because every holders’ proportion of the total STEEM POWER remains constant.

Given that the total increase of newly minted tokens is 100% per year (i.e. a doubling of Steem’s tokens annually) and the STEEM POWER is 9/10ths of the increase, then 90% of Steem’s market capitalization is paid as interest to STEEM POWER holders every year.

Whereas, STEEM holders are paid nothing while the total supply of tokens is debased by 100% annually. Thus, STEEM holders lose 0.19% per day³, 1.34% per week, and 50% per year of the total Steem market capitalization.

An interesting effect is that if the price of STEEM did not increase, the market exchange value of each STEEM POWER holders’ holdings would still increase by 90%! And even if the price of STEEM decreased by 50%, the market exchange value of each STEEM POWER holders’ holdings would only decline by 5%⁴.

Whereas, in the former case STEEM holders would lose 50% and in the latter 75% of their market exchange value.

Steem’s Funding Model

The reasons someone might hold STEEM instead of STEEM POWER is that STEEM POWER can only be cashed out (i.e. powered down) in 104 equisized weekly withdrawals. Thus for example, a speculator who expects a rapid rise and then decline in the price might prefer the small weekly 1.34% debasement of STEEM’s value in order to cash out a large expected increase in the price before an expected decline. Additionally all transfers must be done in STEEM, i.e. STEEM POWER must be powered down before they can be transferred.

It is hoped that the transfers due to speculation and payments will dwarf the transfers due to entering and exiting STEEM POWER holdings, so that the funding for blogging rewards and mining is paid as a cost of doing transfers, and not effectively paid by the long-term investors. Because if this did not end up being the case, and STEEM POWER investors were paying the lion’s share of the debasement (such as if almost everyone converted their STEEM to STEEM POWER at all times), then Steem would likely be considered an unsustainable long-term investment (without a revenue model and all funding paid by investors) and the price might collapse. This is why it will be very important to develop Steem’s promotion to speculators and the development of Steem’s ecosystem for payments.

Steem is generating revenue for STEEM POWER investors taken from those who hold STEEM instead of STEEM POWER. We need to upgrade our conceptualization of revenue. Revenue is any gain in value not paid by the long-term investors! It is actually quite a clever paradigm-shift innovation on the definition of a revenue generating investment.

Steem’s Inflationary Model

Because Steem is always minting new tokens, then the STEEM market exchange price is unlikely to rise as rapidly as it probably would have if the Steem design had been deflationary. An alternative design for Steem would have been to take STEEM tokens from STEEM holders instead of minting new tokens. The market valuation effects would be the same on STEEM and STEEM POWER holders.

The only difference would be that bullish speculators would have more motivation to hold STEEM. But the psychological differences would be that STEEM holders would see their number of STEEM decreasing and STEEM POWER holders would see their number of STEEM POWER not increasing. Yet the price would hypothetically be rising faster to compensate and typically speculators tend to chase a rising price, so the price might even be rising more than proportionally faster. I can understand the psychological reasons this alternative design choice was not chosen.

Note the proposed alternative deflationary design (which is not the current design of Steem) could reach zero STEEM money supply (not STEEM POWER) which would then necessitate either a switch to the inflationary design until the supply of STEEM was restored or taking STEEM POWER tokens from STEEM POWER holders. The occurrence of such a “bottoming out” condition would indicate insufficient speculation and transactional demand for STEEM, to prevent debasement of the long-term STEEM POWER investors.

¹ Enter 1.9 in your calculator, press the xⁿ exponentiation key, enter (1÷365), and press the = key.

² ‘Steem’ is the name of the DPoS blockchain database and ruleset which powers Steemit.com.

³ Enter 2.0 in your calculator, press the xⁿ exponentiation key, enter (1÷365), and press the = key.

⁴ 50% of 190% = 95%

As someone who has written multiple (somewhat incorrect) posts on the Steem Power "interest" (which I now better understand to be share dilution), I understand how confusing this stuff is. You might want to clarify what aspect of what you're describing is actually exponential. @bacchist has written a rebuttal to your post, which you might want to address to ensure your audience has a correct understanding of how Steem actually works: https://steemit.com/interest/@bacchist/steem-power-interest-is-not-compound-interest

@bacchist is spreading incorrect information!

Well, that certainly sounds better than "He is wrong!" Remember, the blockchain is forever, just like your reputation here.

I am not trying to hide anything. I thought some seconds after posting that 'incorrect' is a more meaningful word than 'wrong'. I was in quite a rush to quickly respond to @bacchist's FUD and lies. He knows how to contact me on Bitcointalk via private message. He could have discussed the issue with me first, instead of putting his foot in his mouth.

and that the price of STEEM rises from $4.6 to $46 over the next 5 years this is just your opinions, right? you should remember this crypto world, many reason can make price up and also down too, its my opinions

Well I’d say it is my informed opinion that it could possibly spike high (of course not guaranteed) given I've been extensively researching, designing, and studying crypto-currencies and blockchain 2.0 designs since 2013, c.f. my introduceyourself blog post. See also my future market capitalization computation and comparison to Facebook.

I also pointed out the same compounding scenario would “end up worth $220,294” in the event the STEEM price merely doubles in 5 years (which IMO isn’t taking into account Ethereum’s recent stratospheric price rise over only several months). And the computation doesn’t even include the 354% compounding that is going right now.

Then again, I also pointed out a risk of failure in the “Steem’s Funding Model” section. So I am not saying any outcome is a 100% certainty. Also another important factor is the peak price might not end up being the average price during the 104 weeks required to cash out a STEEM POWER holding.

Also we perhaps need to consider other factors outside the scope of this blog post, such as potential blockchain 2.0 competitors which might copy and somehow improve on Steem.

Thanks for your time in the original post and the follow up posts! You didn't have to take your time to try and lay this out for everyone, but I'm glad you did. I'm in it for the long term! Thanks again....

interesting.

You are forgetting one CRUCIAL element: when more and more people sell their STEEM and STEEM DOLLARS, the prize will fall and your STEEM DOLLARS won't be worth anywhere close to $1 anymore.

Not necessarily true if (and that is a big if) they can generate significant transaction volume from users per what I explained in the “Steem’s Funding Model” section.

The sustainable business model and valuation requires they generate features which will drive transaction volume. We are discussing this aspect in more detail at Bitcointalk.org.

If everyone is becoming a millionaire, everyone wants to cash out. All that insane sell pressure is going to crash your value. Not only that, if you are a millionaire and people are only investing $100,000 every month into STEEM, it's gonna take a real long time to cash out. Imagine if 1000's of millionaires try to do that. You need to stay realistic. Right now the it might look like becoming a millionaire with SteemIt might be doable, and it probably will happen for some people if the platform survives the next couple of years, but certainly not everyone will be able to do it. Maybe a few dozen people, but certainly not thousands or 10's of thousands.

It is frustrating for me when I see that readers have not comprehended the “Steem’s Funding Model” section. Please re-read that section and understand that if transactions can become very great, then the transactions can pay for those who want to cash out, the cost of the blog rewards, and the fees of the miners. Whether transactions can be scaled that high is another question that I didn’t discuss as it is out-of-scope of this blog post. I can’t put every possible issue about Steem in one blog post.

You are making the mistake of assuming that the only incoming¹ demand for STEEM is for investment. If there are compelling reasons to do transactions in STEEM and volume can be very great, then this demand for STEEM can fund everything given the fact that STEEM is debased 90% relative to STEEM POWER.

You readers really need to wrap your mind about this new way of structuring revenue. It seems some of you can only visualize the math from the simplest way, which is causing you to not grasp the paradigm-shift.

If Steem becomes a huge ecosystem, maybe they never want to cash out. Maybe Steem becomes their unit-of-account, life-long savings account, and they pay for everything from it.

I agree. It really could fail. Or it could possibly be magical.

¹ Include even internal demand originating from STEEM POWER powered down to STEEM and transacted.

It's not that i can't wrap my mind around it, i'm just not going to dream and first see how the next 6-24 months develop. Steem might fail at any moment now, you never know. If it survives the next couple of years, it's going to magical indeed :)

I dream for my main activity in life. So far, dreaming has led me to discovering the greatest people on earth in 2016 and they are all in Steemit. Dreaming pays in ways more than money alone.

I am truly tired of read this incorrect info again and again. It is MUCH more for the next several years.

Thanks! You are correct, except not for “the next several years”. My calculations were based on the minimum rate of interest that will be the case by May 2017 and ongoing. The white paper explains that at a minimum ~50 STEEM are created every block (or which 90% or ~45 are distributed to STEEM POWER) and a block is produced every 3 seconds, thus 50 × 20 × 60 × 24 × 365 = 525,600,000 STEEM are minted per year. Given the current outstanding money supply is approximately 91 million STEEM, the current annual debasement rate is 525 × 0.90 ÷ 91 = 519% per year! OMG!

I will add this information to my blog post.

1st Actually min:

Which makes the total 40 per block (or 800/min)

2nd The actual current supply is 107,869,765 STEEM (source steemd.com)

But generally yes, pretty astounding percent.

I see I was in a rush and I included the 1 STEEM for PoW, but that was reduced after block 864,000. I will correct my computations in the blog post. I didn’t know that coinmarketcap’s money supply data was lagging that much.

Wouldn't compound interest mean that @dantheman will have more money than it's possible to actually possess?

No. The account @dantheman would have after 5 years 105 million STEEM POWER, so at $46 that would be $4.8 billion. The next Mark Zuckerberg?

The Zuck can't be at the top forever......

You can't assume steem will be worth 46. If you knew that steem will be worth that are you investing your life savings.

I did not suggest anyone invest their life savings.

I discussed the scenario where a steemian invests a meager $400 and $2 of blogging effort per day (which probably returns that individual a profit every day in learning and social networking experience).

I did not only discuss a $46 scenario. I discussed many scenarios including a doubling of the price, complete failure, and even in the comments I have mentioned just increasing your blogging effort to $9 (2 STEEM) per day of earnings will radically change the computations even with only a doubling in the price. That is why I provided a link to and example instructions for the scenario calculator, so readers can do “what if” analysis that fits their situation.

Oooops.

Nice

Nice article. Unfortunately, I cannot put your plan into place. My ball and chain will not let me use anymore fiat to purchase BTC or any other CC. Due to a small inheritance, my ball and chain can claim to be the contributor to most of the money in our joint account. I'm limited to the paltry 2 BTC that I have, and I am certainly not going to put all of my eggs in one basket. Furthermore, I doubt that I will ever be able to construct good enough posts to earn $2.00 per day. Most of this has to do with my ball and chain again. I start getting the nagging if I spend an inordinate time on the internet, rather than hang on every word my ball and chain utters. One could say that I should stand up to my woman, but I am gay, so he's a man. Also, if we came to blows, I am likely to lose that fight. LOLZ

Explain to me your 46 dollar price expectation?

I also pointed out the same compounding scenario would “end up worth $220,294” in the event the STEEM price merely doubles in 5 years (which IMO isn’t taking into account Ethereum’s recent stratospheric price rise over only several months). So I wasn’t only claiming the $46 scenario. And the computation doesn’t even include the 354% compounding that is going right now.

I showed one very easy scenario for reaching a millionaire assuming the best outcome. However, there are other scenarios where one could invest more early and/or earn for example $9 (2 STEEM) a day from blogging and achieve the millionaire computation at a much lower future STEEM price and/or sooner than 5 years. I provided a link to the calculator to do “what if” scenario analysis and I gave example computations so that readers will know how to use the calculator for this sort of computation. I think I have provided much information to aid readers to make up their own minds.

Steem’s money supply will be roughly 421 million tokens in approximately 9 months, then it will double annually, so that gives us an estimated 7 billion tokens money supply at the end of 5 years. So at $46, the market capitalization would be $322 billion. Facebook’s market capitalization is $348 billion today, and that doesn’t include 5 more years of growth and inflation. Facebook only has roughly 1/6th of the world’s population signed up thus far.

I have also pointed out risks of failure for Steem’s business model. So I hope readers aren’t pigeon-holing my blog post by assuming that I claimed only a scenario of a $46 future price.

Unrealistic that Steem will ever be as big as Facebook. Bitcoin on the other hand has 10 billion in market cap which is more realistic. What happens at 10 billion market cap?

Why unrealistic? Provide a cogent argument. Just saying it won’t, is not informational. What is your logic? Steem is a paradigm-shit model. Sometimes these change the world.

Now that's just irresponsible shilling.

Could you even get a clue that I explained a scenario when a person invests $400 and $2 a day in blogging effort, so basically they have risked nearly nothing for the shot at up to a $million in 5 years. How the heck do you compute that as irresponsible?

Perhaps my follow up comments will give you slightly higher reading comprehension than you were able to achieve when you apparently did not read my blog post carefully and entirely.

I suggest you read the following three:

https://steemit.com/steemit/@anonymint/it-s-so-easy-to-become-a-millionaire-with-steem#@anonymint/re-syadastinasti-re-anonymint-it-s-so-easy-to-become-a-millionaire-with-steem-20160722t022037599z

https://steemit.com/steemit/@anonymint/it-s-so-easy-to-become-a-millionaire-with-steem#@anonymint/re-magdalena-re-anonymint-it-s-so-easy-to-become-a-millionaire-with-steem-20160721t220901401z

https://steemit.com/steemit/@anonymint/it-s-so-easy-to-become-a-millionaire-with-steem#@anonymint/re-aaseb-re-anonymint-it-s-so-easy-to-become-a-millionaire-with-steem-20160721t213537359z

This blog post is chock full of research on the specifics of the design and funding model. I am amazed to read that you found no value in my past week of intense research and discussion focused solely on Steem which is summarized to some degree in this blog post. I am a blockchain developer and I work full-time on this sort of stuff. I really do not appreciate your snide, flippant, and incorrect remark.

Please be more circumspect. We and Streemit will not benefit from strife and flame wars.

I am also skeptical of whether Steemit can be sustainable, which is what I explained in the section about the funding model. Yet I also recognize that this is a paradigm-shift that has the potential overtake social networking if they can use their wealth to develop something very diverse and capturing many transactions. They obviously do not plan to stay stuck only on blogging. Perhaps you should do some research about the other features and ecosystem projects they are working on. They are loaded with $millions of capital now to pay for development.

". We and Streemit will not benefit from strife and flame wars." Exactly.

It is just irresponsible shilling. Read your posts again lol.

Could you even get a clue that I explained a scenario when a person invests $400 and $2 a day in blogging effort, so basically they have risked nearly nothing for the shot at up to a $million in 5 years. How the heck do you compute that as irresponsible?

Explain why it is irresponsible? Develop your argument with a detailed explanation. Who am I responsible for? Do you mean to imply that readers are too stupid to analyze my blog post and make their own decision of the merits? Thus I am responsible for them as if they are my children?

I don’t see what is irresponsible in terms of explaining the different ways the Steem investment can be analyzed. The entire point of discussion is to consider various perspectives.

Rather I think the issue here is you are a troll who can’t make a cogent point. Are you advocating not explaining to people about the compounding feature of Steem? Are you advocating not presenting the market capitalization of Facebook as a comparison? And why?

We have about the same amount of SP so this was a good post for me.

@Anonymint enjoy reading your posts and also the posts that you have posted back in the day on bitcointalk forums. I am usually a lurker but find myself posting more because of steem's incentives. On bitcoin talk forum I had over 25+ days logged but rarely posted.

Thanks for the post and calculations.

UPDATE: for those readers who are contemplating that this blog post is shilling or painting too rosy of expections, please note that I explained a scenario when a person invests $400 and a meager $2 a day in blogging effort (which is also probably paying them much more than $2 in terms of marvellous learning and social networking experience), so basically they have risked nearly nothing for the shot at up to a $million in 5 years.

Good article, well explained, but i have doubt about steem price, i think it can go down more than a 50% what would happen then?

Well that is one reason I explained in the last section that perhaps deflationary model would have been better. I explained the psychological tradeoff.

I didn't check the math but you're basically saying we're all gonna be millionaires soon? Nice!

If you run some calculations with the calculator I linked to, you will see it is important to start as early as possible with at least 100 STEAM POWER. So you need either an initial investment of $400 or to earn that much in your first month of blog posts. The calculator can help you access various scenarios.

Note I also pointed out one the risks of Steemit failing in the “Steem’s Funding Model” section. I did try to provide a balanced analysis within the scope of issues relevant to the main topic of this blog post.

great work. I really like how many smart people like you publish tools to make steemit better and to help us make more profit.

I wonder why I got a downvote on that one (first one for me). Thanks @anonymint for your up.

It is always nice to have these things explained in detail. But let's not go crazy yet and look 5 year ahead. Lets just see what happens within 3 months. Looking 5 year ahead is a bit too far away. 5 year ago people predicted bitcoin to be worth millions by now. In the meanwhile I just converted all my earned steem to steem power. I prefer to invest in new ideas rather than be short term greedy.

Short-term planners can’t benefit nominally from the exponential growth of compounding, because with exponential growth something very small becomes very large much later. Note the example of the lily pond which consumes 29 days to become half covered yet the final 50% coverage (nominal growth) all occurs on the 30th day.

We do have to consider the possibility that Steem will fail and thus if we have invested a significant amount of our net worth, then some short-term prioritization would be appropriate.

However, the scenario I outlined in this blog post is very meager $400 initial investment and only $2 a day in blogging effort, which is all probably compensated by the learning experience and social interaction. So long-term approach to that scenario is not only appropriate, it is forced because 50% of blogging earnings are paid in STEEM POWER which requires 1 year weighted average time to cash out.

The reason I wrote the blog post was to encourage by explaining a mathematical reason to just use and enjoy the site, regardless if their blog posts are earning only a couple of dollars per day on average. Steem is an experiment, and we are all learning from it.

I understand where you are coming from. And I am following your footsteps. I didn't make a lot of money yet on steemit but the little bit I gained ... 12 steem ... I totally converted it into steem power. I love to invest in new technology, especially when I see a lot of potential in it. So I am not on steemit as a short-term planner. And while I enjoyed reading your post and it is always interesting to predict what might happen ... I wouldn't go crazy yet and just assume we will become millionairs within 5 years. I consider your post as a nice explained good read and I hope your prediction will be 100 % right. But I am not celebrating it yet. Lets just enjoy steemit right now and let the future show us what will come :-)

In hindsight, I wish I had explained in my blog post that in general being invested in blockchain and crypto-currency, is one way to be part of the decentralization revolution that is likely to enrich everyone who is in the sector. Steem provides the average person a way to get onboard blockchain technology doing an activity that they understand and enjoy, while simultaneously also provides the derivative benefits of social networking, such as building new relationships, learning, entertainment, etc..

I will quote from a post I wrote on Bitcointalk recently:

You're a hero for outlining this in a bit more of an easy way to digest than the white paper. Thank you!

Thanks for this post. You really explaned the whole thing about the composite effect of interest on steam power plus way more!

I’m also explaining to Steemians that hypothetically they can get enriched with methodical daily blogging effort; and it isn’t required they earn $100s per week on blogging in order to hypothetically become wealthy over the long-term with Steemit.

well no. not really... what youre really explaining is that if that if Steem increases in value 1000%, and they make SP by blogging, then theyll make a ton of money. But the first part of the parlay is key. And i know i know research math graphs linear bipolar transinduction algorithms you know its going to increase for a fact. But you don't. Youre making a guess. Is it an educated guess? sure. But its still a guess. this article from early 2014 also has a lot of experts making educated guesses about huge gains (including the litecoin guy saying $5k for LTC). Point is, guesses like this should be taken with a grain of salt. And an increase in the value of a currency already coming off a 2000% increase should be considered the icing, not the cake.

Cool Calc everyone needs a visualisation #printing them #greens @anonymint thanks

Minor correction. Block time is 3 seconds, not 5.

Thanks. Corrected the blog post. Thanks for reading so meticulously.

I thought I had read some where that it could vary between 3 and 5 seconds, but I’ve been on a whirlwind of reading about Steem this past week so I must be hallucinating. Lol.

There has to be some degree of dilution, surely. In an inflation model of 100 coins x 2 x 2 x 2 x 2 x 2 (5 years doubling the quantity), we go up to 3200 coins. So initial coins are diluted /32 but are not only expected to preserve their value but x10 each. So, dilution adjusted, it's a 320x we are expecting here.

Nice Article, here is the summary:

• Starting with just a $400 initial investment and generating only a meager $2 (½ STEEM) in daily blogging rewards, the total value of your STEEM POWER could be worth more than $1 million within 5 years! This is the power of compound interest, as exemplified by the following chart.

• This example presumes you’ve received 10 free STEEM on signup, purchased 90 more STEEM at an exchange price of $4.6, powered up all your STEEM to STEEM POWER, and that the price of STEEM rises from $4.6 to $46 over the next 5 years.

• The expectation of a 10X (1000%) rise in the STEEM price over the next 5 years is not totally unreasonably given the very large market capitalizations of traditional social networking behemoths such as Facebook and Twitter.

Apples and oranges. You can't compare the market cap for a company (like facebook) to the market cap of a cryptocurrnecy like steem. It simply doesnt work.

And even if you could, you can't do it backwards (which is what youre trying to do) the market cap doesnt determine the value, the value determines the market cap. You can't just say "steem is better than facebook, so steem marketcap should be higher, so steem should be worth more as a currency"... well, you can. But you won't be making a ton of sense, imo.

The price of steem and steem power is going to be driven by supply and demand, not by some fantasty about parity with facebooks marketcap.

The hard part is getting out ;)

I know that everyone's all excited about the Steemit platform, but that's not how the economics work. Read https://steemit.com/cryptocurrency/@limitless/the-rise-of-cryptocurrencies for more details.

You will have to deal with both the speculative and transactional value of Steem. As it is, Steem is not very liquid and there are few possible ways to spend Steem. Cashing out is also very slow. Steem effectively acts more like equity in the Steemit system. I hope what you say is true, because in that case, I would be worth many many millions in 5 years, but I doubt that would be the case. I think that eventually many users would be able to make a humble freelance living off Steemit, but very few will be millionaires. Eventually the income distribution would resemble that of Youtube's. However, since Steemit is more decentralized and Steemit doesn't take a cut of your content unlike Youtube, it's possible that the earnings on Steemit will be in the ballpark of double that of Youtube. Still very good, but nothing crazy.

You’re math error is you presume I am writing about users who adopt Steem some months or years from now when the usership is orders-of-magnitude greater.

I wrote specifically about Steemians who do a specific action starting now in the month of July 2016 to maximize their compounding.

The Steemians we have now will only be a small fraction of the eventual userbase and investors of Steem; that is if Steem does prosper and succeed to the potential expectations laid out in this blog post.

Fair enough. I'm still uncertain, as the marketcap for Steemit was already $280 million a few days ago. Remember that Reddit was only worth $500 million in Oct 2014 when it had far more users than Steemit.

If Steemit succeeds (and it might fail entirely instead) it has the potential to exceed Facebook's $348 billion market capitalization. Please see my other comment posts for my detailed reasoning.

The net worth of the world is > $400 trillion. The global GDP > $75 trillion. If the transaction “fees” (the relative dilution of STEEM distributed to STEEM POWER) work out to be 3%, then we’d need $11 trillion of GDP coming through Steem at a $348 billion market cap. That does seem to be far-fetched although not impossible. But that does not include incoming investment flows if it is still growing, coming from that $400 trillion.

But there is another wrinkle to consider. That is the Steem blockchain is DPoS (proof-of-stake), so it means the stake holders could vote to change the protocol and decrease the inflation rate later thus paying less for blogging content; such as charging a flat percentage transaction fees instead of inflation and using that to pay for blogging rewards. Once the system has great adoption, it may no longer be necessary to pay (so much) for blogging as it may pay in other ways such as the derivative commerce.

I don't see a $46 token valuation. By the time that there will be that many tokens, the inflation would be crazy. Even if it's a $1 value per token, I'd consider Steemit a wildly successful company. We all love Steemit here, but let's not get too carried away with crazy hopes.

Exponential growth is hard to be maintained for prolonged periods of time. Look what happened with btc in the last 5 yrs, there will be strong up and down cycles also for steemit, you should try to remodel this forecast adding 1 or 2 down cycles along the way.

In a recent comment, I pointed out that the STEEM POWER stake holders could vote to reduce the rate of exponential debasement (monetary inflation) in the future.

I think the huge interest rate will be counterattacked by a lower Steem price. It won't be exponentially as you say but more organic. That is if Steem actually goes viral like other sites. It really has the potential to doing so since we all know how "boring" browsing Facebook, Twitter and Reddit has become!

It still needs lots of work and new features though.

With all this talk about Interest, youve sort of buried the lead, which is a 1000% increase in steem price over 5 years (which is on top of the recent 2000 percent increase).

In your million dollar scenario, 900,000 of that comes from the market increase, not the interest. Regardless, youre overestimating by quite a bit, even assuming the 10x increase.

A) because steem power interest behaves as though its compounded annually, not monthly.

and

B) because not all your blogging steem power will increase 10X, since youll get some later on. So for exmaple the 15SP blogging reward you get in the last month of the 5 years might hardly increase at all.

https://steemit.com/interest/@sigmajin/how-anonymint-and-bacchist-both-got-it-wrong

It's great to look at the possibilities of steam growing in value, & price! It's just a matter of when, not if.

It's very likely that we see a lot of other use cases for steem, besides steemit itself, therefore further pushing the price.

we will see @anonymint ! i appreciate much your explanation 8]

There is still a long way to go. So much todo. But it could happen.

Thanks for good explanation!

Where exactly can we see how many steem power equals how many reward power? you know like a calculator. like 100steem power = 0.01$ of reward. Can we find this somewhere?

I also would like to know this good question kuriko

Brilliant article. Life has been shitty for me in recent years but I am now daring to dream that one day I might be able to afford just a very basic roof over my head.

See you all on the moon.

You can do it!

I'm determined!

Im not cashing out my Steem power for sure. Let's hold this forever!

Can I just say what a relief to find someone who actually knows what they are talking about on Steemit. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I just do not believe youre not more popular because you definitely have the gift.

great explination. stay steemy

It's not the currency appreciation I am excited about. The pro rata equity among creators and curators is.

According to my calculations the daily interest rate is even higher!

I am not sure where to check the official numbers, but 2 days ago it was about 1% daily. If you make the calculation it means 3700% per year.

As I know the witnesses also set up the interest rate, so it can lowered any time.

Thanks for this post

Hmm, 5 years, Good job, now let me list a few things I am going to do when I am a millionaire.

Love the post. I do have a question though - does blogging, even if it earns a few cents, have a major impact? I think you kinda inplied that. Or can you get there just holding steempower? I only ask as im taking a couple months out for exams lol

Since the current average annualized rate of interest is 354% for this month and dropping every month to 90% by April 2017, it really pays in terms of compounding to get as much STEEM POWER as fast as you can for the next several months, then one could relax and take it more slowly.

if you have a chance to earn as much steem is to buy early like now for example. And also buy on the dips in price to have a chance to earn real steem power. The money will become secondary compared to how you can influence this platform if it becomes as big as Reddit. For sure this platform already has a built in audience from the crypto world.

Professor Al Bartlett begins his one-hour talk with the statement, "The greatest shortcoming of the human race is our inability to understand the exponential function."

a man can dream

Okay - you got me - I scrolled down first and voted

but

I'm going back up to read. I won't show this article to my wife though because every time I talk about crypto currency and the money that I'm making or can be made, I notice our credit card bill goes up significantly.

hmm I don't fully get it.

but

I like it!

How's inflation a good thing? The whole Bitcoin idea was to fight against inflationary control by central banks. Still trying to understand what's going on here.

They see it as good because the inflation is first payed out to them, where they can sell at full price before the debasement hits everyone else.

I gave this article an up vote because it is very well thoroughly explained and it does make sense. To wait 5 years for an investment, maybe, if you have enough patience.

There is one thing I do not yet understand: how much money is given as rewards on a daily basis? How is the money created to give as rewards? I realized that market cap is involved, but what are the specifics?

The money for blogging rewards comes from newly mined steem power(i think its 25% of newly mined steem power)... So, instead of it being like BTC, where the miners just keep all of the newly mined coin, in steem the miners only get a portion. The rest goes to blogging rewards and curation rewards.

I'm extremely grateful for your research.

The price of steem should go down as the interest of steem power goes up cancelling each others effect. Unless new buyers come into the equation, this is like a ponzi.

I had less math understanding of Steem when I wrote this blog than I do now. My latest blogs explain better my understanding. The ratio of SP to non-SP would need to be very low in order to achieve the compounding I speculated about in this blog post.

This broke everything down for me that I was unable to comprehend on my own. Thanks for your share! You've got my vote!

Unfortunately I assumed the rate of positive interest (an inverse of debasement) of the STEEM POWER at 90% in this blog, which is not realistic. Please see my latest blog for clarification on the corrected math.

I am unable to edit this blog, so I can only make this correction in comments.