When the formal press, newspapers, television, even politicians come to comment that the United States has entered into a financial crisis due to the debt, it will be too late, it is always so when a financial news comes on television, it is because you no longer You can do nothing with your savings, since panic has seized the markets and there is not much to do, even if you are not an expert and depend on third parties to perform actions for you.

This chapter only seeks to show certain elements, small news, triggers that today are pointing out that something is wrong, and that it can always be worse. The goal is that those who are interested may already be taking action to protect their heritage in the best way possible.

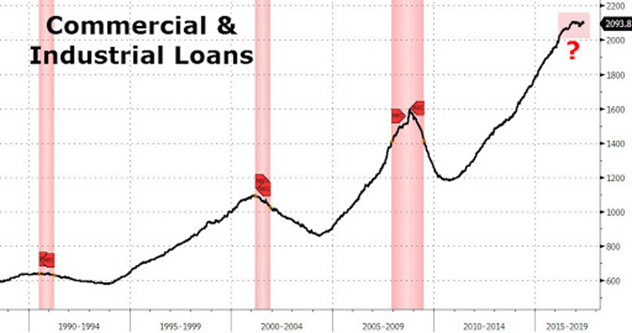

First symptom, private debt

This graph shows us when the industrial debt, and also the commercial debt, reaches its maximum points, is when the crisis unfolds, so happened in the Asian crisis, so happened, at the point com, so happened in the sub prime and so Will continue to happen in the future. But look today is the future.

Today, the debt of certain sectors of the United States is fired and uncontrolled, and productivity has been declining for some time. And what happens when debt corrupts companies.

This: 300 retail companies declare bankruptcy in the United States this year. For debts

Http://www.economiahoy.mx/empresas-eAm-mexico/noticias/8429100/06/17/La-masacre-de-las-minoristas-continua-en-EEUU-mas-de-300-companias-suspenden- Payments-in-the-going-of-the-year.html

Look how the insolvency of people, who are NOT paying their credit cards in the US, have grown.

Or also happen things like popular bank, and care that this has bought Santander, its portfolio becomes more toxic.

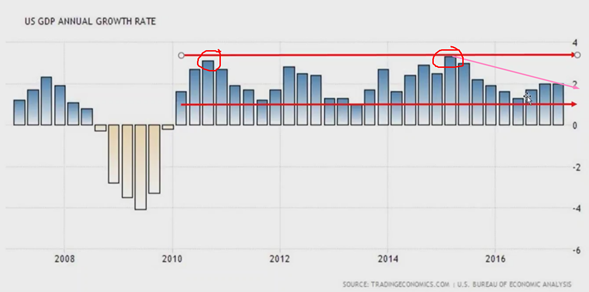

2nd symptom growth

The US growth rate has been oscillating between 1 and 3% for 8 years, but in the same period of time the US economy has historically been more strongly encouraged, with interest rates in Zero, with the issuance of uncontrolled dollars , And other benefits

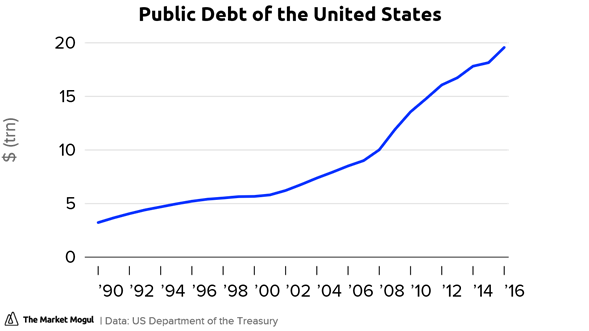

3rd public debt symptom

The United States public debt has historical numbers, the question is how are they going to do to pay that if growth does not rise ?? And even more so if the interest rate continues to rise, because all the debtors whether public or private end up owing more. But I insist growth does not increase ... how to cover that differential that is generated if productivity does not increase.

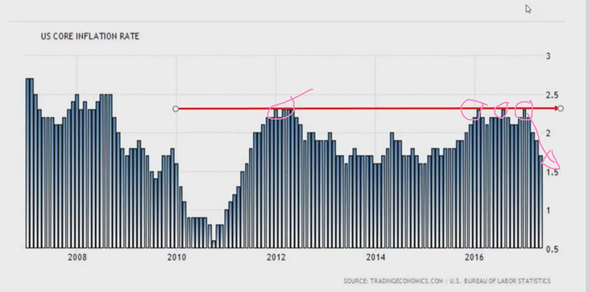

4th symptom of inflation

Worse still can not raise inflation, if prices have not risen with all that incentive is for a very simple factor, there is not enough consumption, for the market to raise prices and worse, that makes understand that the American people are According to the situation, however is a bad situation.

And as final condiment for this dish, as the sp 500. Which has the same 8-9 years growing. Has doubled its value from the bottom of the last crisis, due to the stimulus of the Fed. But he is already exhausted.

5th symptom The American indices in highs

The basic question is whether, with all the debt and quantitative support from the EDF to stimulate the economy, the sp 500 has managed to break all historical peaks and grow by 9 years, but by contrast, the GDP has not managed to stabilize or show the same Promotion, where is all that money (value) difference?

1.-The debt of the united states

2.-Lower interest rates

3.-Raise the American bag to highs

4.-The GDP does not achieve the expected consistency and growth

Well all this is clear, growth has not been expected, even though the companies (sp500) are very overvalued, because the money to fluid easily and very cheap therefore the risk of borrowing to invest in the stock market Has been low, that's a drug cocktail to stimulate the awesome economy. It's like putting redbull, with cocaine and some amphitheatres, all inside a glass of whiskey (burbon of course) and take it to the dry.

How much longer can this continue .... For there is no time left and the symptoms are appearing everywhere, the bubble must and will explode.

If you wish to see the explanation in a complete and detailed way, please put it on Pablo Gil, which in my opinion deserves all the respect and attention possible.

A greetings this Sunday afternoon to all, and I will work in the next chapter where I hope to touch the possible coverages that can do.

Thanks. An even greater financial crisis is coming.

My work: https://steemit.com/bitcoin/@hgmsilvergold/us-dollar-weakness-is-driving-higher-bitcoin-and-ethereum-prices