As 2017 winds up, I look back on what was yet another grueling year for gold and silver investors. As cryptomania exploded around the middle of the year, it seemed like those, including myself, who were battle fatigued with the languishing, albeit sound and prudent instrument of metals heaved their last breaths and started engaging with coins.

licdn.com

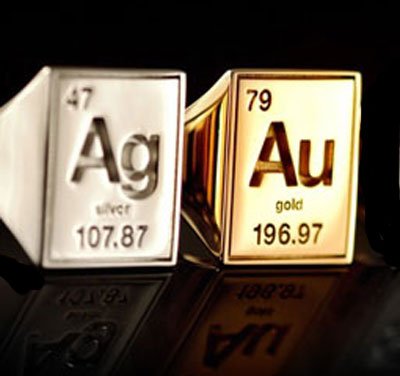

Unlike many, I didn't end up selling a single piece of metal as I firmly believe that it is a safe and time tested way to lock away purchasing power in what is an increasingly fast paced and volatile investment landscape. That said, I wanted to share some highlights that put the year's metal experience succinctly. Credit goes to the article published here.

From the US perspective:

- Gold was up 10%

- Silver up 1%

- S&P500 up 19.9%

- Dow up 24.6%

Some staggering stats on the Dow from Lance Roberts below:

- 70 new highs

- A 5000-point advance in a single year

- 12-straight months of gains

The source article correctly concludes that a positive return for gold in such a stock friendly environment is actually very impressive given the traditional uncorrelated nature of the metal. We also saw near endless war-mongering surrounding North Korea and Russia to a lesser extent yet failed to see the traditional shift into the metals that such moments in time are usually associated with. This likely speaks to a case of "the boy who cried wolf" where investors become accustomed to a certain perennial risk to the point that they become numb to it. Equally likely is the fact that, and even despite the lack of fundamentals, investors just allocated capital to "go along for the ride".

Impressively also, the even more unloved cousin, silver, remained out of negative territory for the year. This is actually a win given the monumental tide of negative sentiment that's been growing and the shift of capital into the crypto space. According to the article...

Silver held off entering negative territory (again, good for an uncorrelated asset when financials hitting all time highs) but that 79:1 gold silver ratio tells the whole story for silver. Silver historically has lower lows which slingshot into higher highs when the market turns. Only 5 times in the last century has this ratio exceeded 79:1 and 3 of those occasions by less than 1. History shows this is it’s ‘resistance line’ and that might well make silver investors very excited….

The story for Aussie investors must factor in the local currency.

- Gold up 3%

- Silver down 5%

- All Ords up 7.6%

I'd written earlier in the year about the lackluster local market performance proving that different geopolitical regions really do result in different market realities. While many of the US-centric alt media outlets discussed the roaring ride in stocks, other countries have found equity investing to be less that impressive. For me, I've now moved fully away from equities activity, holding only two positions. Again according to the article...

Our market continued to reflect a nation trying to deal with a post mining boom reality, near zero wage growth and largely hitched to a property market looking decidedly shaky. The falling USD saw the AUD up and hence taking the shine off our metal returns.

Now for something different, I watched an interview on USA Watchdog with Clif High earlier today. Now Clif is on the fringe of what I consider a sound source, but on the other hand I do like to vary what I subject myself to in terms of sources of information. Here's the interview.

For those interested, gold is discussed at about 38 minutes in and silver at about 42 minutes in. Here are the summary points.

- Silver will be associated with an Energy Coin / Token designed for the movement of silver into more industrial usage.

- Future sees high prices of silver ahead - he sees $600 / oz silver next year and going to $1000 past 2018.

- His predictive data shows a "dehoarding" of monetary silver as it shifts into the industrial space.

- Cryptocurrencies facilitate this transition.

- He sees an explosion of new tech which will boost industrial silver consumption. I think he's going down the IoT path.

- Sentiment will be changing. What's now a negative mood on metals will become much more positive.

- Gold in February will apparently be one third of the value of Bitcoin. There's going to be a relationship between gold and bitcoin.

- New physical gold supply will be coming onto the market. He discusses the Road to Roota hypothesis here.

It'll be an interesting year approaching and to wrap up, I'd like to quote Ainslie with a phrase that mirrors my own thinking...

for most, precious metals are an investment in an uncorrelated hard monetary asset. When financial assets are bouncing along the top, it should be neither a surprise nor disheartening to see metals bouncing along the bottom if you have a balanced portfolio. Unless, for the first time in history, we don’t get a correction to a hot financial market…

We silver stackers are an eternally hopeful and optimistic bunch! Every year we hope for the moonshot, and when it does not happen, we're thankful the price stayed so low so we could stock up and increase our stacks! Now, with @steemsilvergold, we get to show off our stacks!

Absolutely! I did this really cool Christmas Stack but I haven't had time to check out the pics and write a post yet.

At least we all have some good times playing with and talking about our stacks before the price eventually goes parabolic! It won't take too big a trigger to get things happening!

I look forward to reading about your Christmas stack @plumey. Was it for yourself or for gifts?

No, it was just a bit of fun. I got all my stack together in the same place, which hasn't happened for a while, so I decided to get some photos before I locked it all away again.

What a neat idea. I've never had my whole stack together, except in the early days when my whole stack comprised of only 1 or 2 pieces!

I just did the post before I go out bush for New Year - enjoy.

Beauty!

I've been thinking the same glass-half-full thing of late @sirstacksalot. If anything, even as a hobby it'd be interesting and exciting but I do still maintain it's more than that... so on with the optimism! Thanks!

Nice write up. No doubt PMs are suffering from depressed sentiment so as a contrarian I shifted some more into them as the crypto mania started peaking. I won't be selling from my physical stack until we go fill circle and we see a new mania in PMs.

Nice approach. I identify as a contrarian too largely and as such didn't sell PMs as I mentioned. I'll admit my PM purchases have slowed but that's due to my limited time resources than much else. Thanks @buggedout!

thx for this nice summary. I agree with you that metals can store value better than any other investment, centuries of trust prove this. I also believe we will see a big rise in metal prices after the FIAT Bubble will burst, the world is now almost 50 years without gold standard or lawful money, this economical event can't be far from hapening

Yep, I agree with you 100%

Yep 100% agreement here too. Glad you enjoyed the summary 👍

I am glad I fell upon precious metals and the upward curve of crypto.

The forward thinking use of blockchain and the opening of the crypto exchange doors is next imo.

It has to be more than $$$. Our species is abusing the natural world gifts over and over again. We have a long road of learning.

Great post. Thx.

And along with that learning comes a painful path of hard lessons I fear. Thanks for the insight @jagged. Some good thoughts there.

Solid metal.

Very impressive and very Informative. keep it up dear.

I will, thanks @cristitaylor!

Whoops, not quite the return we were looking for in silver.

Yes, there is that!

Nice information about previous metals

Thanks @emmaculate!

I think that silver is going to impress and relatively soon.

I've heard it said that the coming rally will be the one you don't want to sell!

do you think is a good time to buy gold ans silver?

Well, I'll pretty much always answer that question with yes. That said, you'd want to be OK with holding it for a long haul. If you are looking to buy for quick FIAT returns then it's less attractive. Hope that helps!

check this out.You have received an upvote from STAX. Thanks for being a member of the #steemsilvergold community and opting in (if you wish to be removed please follow the link). Please continue to support each other in this great community. To learn more about the #steemsilvergold community and STAX,

I'm happy hoarding my few gold and silver coins and bullion. I like to get them out of the safe every now and again, feel the weight of them in my hands and admire their beauty. Holding a print out of your Chess Account or latest super statement just doesn't have the same appeal.

In terms of Clif High, I like him and will watch the video posted with interest. As someone who created a website called weirdaustralia.com, I'm certainly not averse to a little bit of 'fringe' or 'woo woo' as Clif calls it.

All the best for 2018 and happy investing.

Woo woo, yes, that's Clif! Thanks for the detailed reply. I agree that holding a statement has nothing on holding real money. Even over time it doesn't lose its allure. All three best you on the new year @atnicholson!

Excellent wrap up and worth the resteem.

I've held onto my small stacks of silver and will look to do a post on some of my collection in the next few days.

Merry Christmas and here's to 2018. Be ready for some sort of global economic shake up that with the dissipation of free money, we know is coming...