Nbiroz, that's a tough subject. Let me try and answer this...

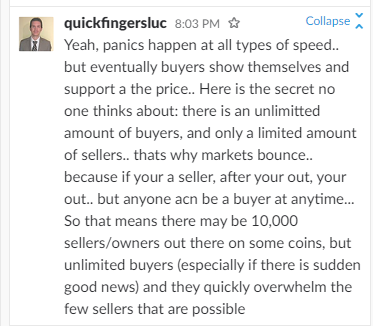

I know Luc mentioned in a Slack comment that panics happen in all types of speed

But he also mentioned in the video above that if there's that grinding down action with no panic in sight... he won't participate:

"Okay there's no panic so it's not going to make me want to jump in and do something"

Luc preferably wants something like this:

But it's more complicated because you also see panics that are in between the 2 mentioned above:

1 hour chart: https://www.coinigy.com/s/i/59db68fa7e92f/

2 hour chart: https://www.coinigy.com/s/i/59db693c74a84/

Stratis is definitely in a panic... but's it's a slow one. You can cancel out the noise by changing from a 1 hour chart to a 2 hour chart. (BTW, Luc took this Stratis trade, bought perfect bottom)

By playing from a 2 hour chart the position trade will take longer to play out though.

So to come back to your TRIG trade. Yes it's in a panic judging by the 2 hour chart. But take this into consideration:

When there's a big panic, look for big strong bases. It will come back quicker to those bases in the short term. So for TRIG that has already happened for the 12655 base.

We are now in a BTC bull-run and when something major is happening to BTC... it's a bit different position trading. Coins can be killed off like AMP in July: https://www.coinigy.com/s/i/59db6bb7ec9a1/ ... so be safe out there and preferably stick to the bigger coins

To give a short mini summary: "Basically, what I am asking is if a panic is a necessary component in position trading I guess"

Yes that's necessary but panics happen in all sorts of speed. The slower the panic, the slower the trade.