For far too long I've been holding a handful of coins on Bittrex that have been going steadily down. I've heard many traders boast about "never taking a loss" on a trade, and I was jealous. I wanted to be like them.

I was also stupid.

Holding on to a coin you're not particularly interested in because you bought on someone else's advice and expected a quick flip but missed the boat... That's not smart. It's even less smart when you watch the coin go down in value, week after week, month after month. Sure, eventually it might have its day in the sun, but even a 40% bump might not come close to where you originally bought in since it's a percentage of the now lower price.

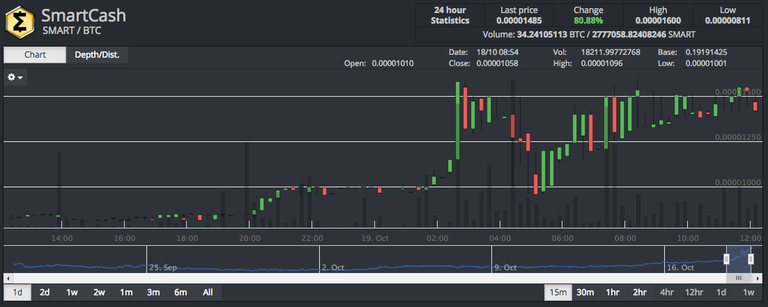

So last night, I ripped off the bandaid, sold half a dozen coins going nowhere for a total of 0.8 BTC and moved them over to Cryptopia to swing trade a bit on SmartCash. I already have my SmartCash holdings tucked away to earn SmartRewards next month, so this is more about increasing that 0.8 BTC to something more. If I pick up some SMART along the way, bonus. As of this morning, I'm up +0.2 to 1 BTC. :)

I was also trying to keep in mind some principles I recently read in this great article:

The Cryptocurrency Trading Bible Two: The Seven Deadly Sins of Technical Analysis

I've been very skeptical of technical analysis and "chartalism" because it seemed remarkably close to post hoc, ergo propter hoc ( "after this, therefore, because of this"). It seemed like a story we tell ourselves to make sense of often near-random data. But then I joined some Facebook groups, and I watched other traders do really well. I saw how fibonacci trading might actually make sense due to human decision making processes being a part of nature, just like everything else we see around us. I saw how previous resistence often becomes future support.

I started learning.

So last night, I took advice from that article: "It’s only by doing that we learn anything in life." I also realized the truth in this quote: "That’s because trading and life are a journey of self discovery." Most of all, I had a lot of fun. Before going to bed, I set a SmartCash sell order at 0.00001496 which hit nicely along with a buy order of 0.00000753 which came so close! The dump I had expected only ended up coming down to 0.00000811. If felt good to have my instincts validated (though it would have been nice to hit that order!)

It's also cool to see a token I blogged about a few days ago up so much with volume increasing and two new exchanges which will pick it up in the next few days and weeks (HitBTC and MonkeyCoin). If you missed those posts, you can catch up on them here:

When it comes to coins you really believe in, especially when the market corrects and goes down, I'm still an advocate of long term holding. At the same time, when it comes to trading opportunities for increasing holdings, trading out can help us avoid a bigger loss. I'm learning to separate out my investor side from my speculator/trader side. I realize most successful projects need both. I'm also learning it's helpful to have my investments tucked away so I feel emotionless about the funds I decide to trade with. That helps me strategically push through sell or buy walls when I'm not too concerned about the market going one direction or the other.

I used to be a bit frustrated at traders, but later I realized it was because they had a skill and understanding I lacked which enabled them to profit while I watched opportunities pass me by. It obviously doesn't always work out that way, but I eventually decided it's a skill I'd like to learn.

So far, I'm having fun.

As I always say, please don't risk more than you're willing to lose when it comes to the speculative environment of cryptocurrency. If you picked up some SmartCash after I mentioned it last time, congrats, and you're welcome. :) If you still want to get in on the fun but don't have a Cryptopia account yet, here's my referral link: https://www.cryptopia.co.nz/Register?referrer=lukestokes

What do you think about trading vs. investing?

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

I'm holding out on my dump as well...can't shake the feeling it seems like a bad time to unload what I'm waiting on. Hodl'ing until something goes wrong with BTC, I guess...

Lost so much during the recent Altcoin recession! :( Suppose to use it to fund my studies but after 60-70% lost on most of them. I'm back to holding mostly Steemt and Bitcoin. I'll attempt trading again some time

Accepting a loss can be emotional. You have such high hopes for your investment and to watch it slowly disintegrate into basically nothing is heart wrenching. Little hopes glimmer here and there, 'hey, it's coming back up!!!', but it's just a flash in the pan. It's like a digital pet you love and want to see do well, but should really be taken out back behind the barn. I've been tempted to cut my losses on my DGB investment, but I feel like it could still come back to life. Props to you for separating your emotions from reality and biting the bullet. I hope SmartCash does well for you :) I'll have to do some more research myself before I buy in.

Hahah! So true. :)

Recently did the same and bit the bullet on a couple coins I had on bittrex in order to buy more of the ones I really liked. Sold STRAT and PIVX bought more NEO. Hate taking an L, but I feel the money has a better opportunity elsewhere.

I'm doing a trading/investing hybrid as well. I still chart and use pullbacks to support levels to add to the long-term positions I'm building. Luckily my years of day trading transitions seamlessly into trading crypto. :-)

Yeah, don't get me talking about STRAT.

Okay, okay, I'll talk about STRAT.

I got in on that one later than many, but still fairly early. I rode it up and sold for a nice profit (I'm not a .NET developer so I was like "meh"). Then I kept hearing SO MUCH about it. People I trust as traders and investors going on and on about how great it will be. I did something I knew was the wrong move. I bought back in for a loss, buying at a higher price than I sold. Full on FOMO move. I watched it crash down since then and it wasn't an insignificant holding amount. So... yeah. I'm a bag holder on this one. I haven't dumped it yet, though I probably should have a long time ago.

Hello @lukestokes

The quoted is the real deal. I have learnt something that's worth more than gold. Thanks for this enlightening post.

@eurogee

I'm really glad you benefitted from it. Thanks for reading.

I dumped all my EOS for a loss, will pick up tons later when the ICO is over 😫😂

Ah, man, that's tough. I'm way underwater with EOS but I haven't dumped them. Too emotionally connected, I guess. I think my plan there is to keep buying in the future and just dollar cost average down a bit.

Yeah, I'm in the same boat on EOS, but that's a HODL for me. I still think it has tremendous long-term potential.

I am very sure that most of the people right here are buying following the advice (or example) of others. A principle that I repeat to myself after making mistakes is: Sometimes you win, most of the times you learn! I can bet that in your case, you have learned a lot so you don't make mistakes so often, but we are humans, and we are far from perfection. Always be positive :)

Oh, I make plenty of mistakes. I try to be open about them also. I think much of success comes from positioning yourself in such a way that you can take risks and recover from losses. Over the long term, the calculated risks work to your benefit. Most people are living pay check to pay check and have no buffer to take those beneficial risks so they can never get ahead.

But yeah, thinking about "mistakes" as cheap educational experiences is a much better perspective.

You are so right. Unfortunately right now I am one of those people, but I am confident that in time things are going to change, and I will have the ocasion to invest into cryptocurrencies. I love the thrill of this just thinking about it!

Start with a baby emergency fund of $500-$1000. From there, get a debt snow ball going, paying off your smallest debts first to get a win. After that, 3-6 months of living expenses in liquid savings. After that, you're ready to start saving and investing. That's Dave Ramsey's baby steps, and they work.

Thank you, I really appreciate all your effort!

Oh, how I can relate to this! Kept buying OAX as the price sunk thinking I was wisely lowering my cost basis, but I can never catch up with the sinking price. Ugh. May be time to finally cut my losses and move on (which, of course, will precipitate an historic rebound LOL!)

Check the article I linked to. Trying to catch the falling knife is dangerous business indeed! But yeah, it most like will rebound. Hahah. I saw some stuff in the PIVX world that concerned me so I ended up getting out of that one and not looking back. It's since gone up, for sure, but I like to think the things I ended up buying with it also went up... but that may just be my own story telling. :)

I bought into Smartcash at its lowest and believed in its ideology. So far it’s delightful to see it rise from the ashes. Hope it does well in the future. :)

Yeah, the early pricing, I think, doesn't count much since there wasn't much visibility or market cap. It'll be interesting to see where it goes from here.

Ideally you should never take a loss because eventually there may be a pump some day in the future and if you have sell orders set you will make your Bitcoins back or profit.

But like most rookies I bought POT coin when I first opened a Bittrex account. I bought it at the top and it has gone down, down, down.

Now I realize that when you buy at the bottom, you never lose. It's part of my strategy.

P.S. - I did buy some SMART coin before I saw your post and made my crypto back. Now, it's ALL Profit. Plus I'm holding 4,000 in my SMART Web Wallet.

Nice! It's super fun to get your investment back and have profit left over to play with. I did the same with PIVX and it worked well for me.

I think trading on things is a perfectly reasonable thing. Buy things that are undervalued, sell when they become overvalued. Sure, fine.

But I strongly reject trying to read charts for patterns. I don't think there's anything to be gleaned from that at all, and yet I do know there are tons of people who believe strongly in that.

I mean, since enough people believe in charts, I guess they mean something. If people believed that it's "hard" for stocks or coins or whatever to "Break through" points of resistance, or that graphs shaped like this or that are 'natural' and imply something else, I'm happy to make money off of their craziness. But in both the cryptocurrency world and the stock market world, I think those beliefs are insane.

Brady, I've held this same exact position for years. Until... I started watching traders nail things perfectly. Like... it seemed almost magical. I saw it over and over again. Eventually, I had to suspend my disbelief a little and recognize I was getting data points about reality which couldn't be ignored and required explanation. These were facts I was being presented with that were far beyond statistical noise. As you said, it's possible it's all just a "self fulfilling prophecy" but I don't think it claims to really be anything else. Once I started trading a bit more often, I started to "feel" what other traders were feelings. These are emotion based responses. People (on a bell curve) have similar emotional responses. Get enough data, and those responses can be known within various trading situations with various volume, price history, sentiment, etc.

These patterns start to emerge:

It could be crazy, sure. But when you get around really good traders (they are rare and I happen to be in a group with a handful), you start to see it for yourself.

Give that article I link to a read. If you're able, get around some really good traders (guys that throw around millions of dollars like it's no big deal). Then start to see if the patterns mostly work. It's freaky stuff, for sure, but we humans are part of nature and our emotional fear and reward response mechanisms are determined by our inputs like anything else.

@lukestokes thanks for another great article. I mostly follow and contribute writing and art on Steemit, but when it comes to crypto writers here you're my favorite; I find your writing and way of thinking very relatable. The quote you shared "It’s only by doing that we learn anything in life" is so true. I know I've said this a few times in comments to you and on my blog, but I watched bitcoin grow from the fringe and was always very curious. I've learned so much in the time that I've joined Steemit just by getting my hands in it.

I'd highly recommend to anyone new, learning, or apprehensive to take some of your Steem you earn from posts here, transfer it to Bitshares, and just start playing. Read on coins that interest you, see who else is interested, and buy it with your Steem. I've gained knowledge and comfort that I've put my earned USD into buying BTC. I haven't owned it long, but I already feel those two sides of approaching crypto arguing inside me: I said I'd HODL the BTC I bought, but Smartcash is so exciting right now. I may eventually do something else with that BTC, but I promised I'd at least leave it in my wallet until the hardfork, then I'll have Bitcoin Gold to play with.

As always, thank you Luke for what you do in the Steemit community and thanks for sharing what you learn.

@lukestokes In the early days of computers, long before spreadsheets like Multiplan or Lotus123 existed, I spent five years of my life trying to mathematically and statistically prove that the chart patterns shown above actually work.

They do, about 33.33% of the time. In another 33.33% of the time I found the exact opposite of what was forecast happened. In the remaining 33.33% of the times, neither bull nor bear developed. It did nothing.

This was tested with gold, silver, stocks, indices, currencies and commodities. Statistically less than 50% of chart patterns evolved in the forecast way. I could not discover a way to guarantee profits based on the chart alone.

As far as I was concerned, I had disproved all the books ever writtten on chartism and chart theory.

However...... I have come to learn that after you have done your fundamental analysis, and found a promising investment, the chart patterns can be useful to help you time your entry point.

By the way, you made a great comment :

“I'm learning to separate out my investor side from my speculator/trader side.”

Yes, distinguish between safer long term savings, and fun investing.

I really enjoyed reading this as insight to someone else's personal decisions, gains and losses it was enlightening to hear of your mind set and thoughts through this. We all learn by experiences and using these stepping stones in life creates wisdom. I always appreciate stories such as these especially when someone opens up and allows others in and admits loss. I can learn from that. Much appreciated Luke. Enjoyed!

I booked profits today in my Bitcoin Trade and have updated the Trade Diary, Please have a look at it:

Thanks :-)))Hi @lukestokes, https://steemit.com/trading/@aarcee/bitcoin-trade-btc-usd-24-oct-2017

Trading is actually quite straight forward and fun... unless “we” make it complicated (our mind is designed to make things complicated so that it can solve them !!)Hi @lukestokes,

Still making good easy money on Bitcoin, have a look:

https://steemit.com/trading/@aarcee/bitcoin-trade-btc-usd-20-oct-2017

ahhh.. this is sad.. But at least u learnt from it. and we all should learn from this.. by the way great work for us to know about this.. i upvote...

Always learning, always growing. Thanks for reading. :)

Taking a loss is always rough. However now your stronger and got that little extra experience to move forward and do greater. Thanks for sharing & Steem On :)

You're welcome! Thanks for reading. Steem On indeed!

Yea I have some stocks that are down and I just dont want to sell for the loss luckily all of my crypto's are up or just slightly down but I know what ya mean hard to take a loss sometimes

I've never played the stock market game. We've just done mutual funds for retirement. Compared to cryptocurrency, much of that seems kind of silly to me now. Heheh.

Yeah I havent taken a loss either as I watch and learn about the market more, but completely agree. You have to get to a certain point and just making the decision because even though

I think 99% should invest and not trade - including myself :) im much better at trends (like understanding things early on, whats going to catch on etc) than trading! I suck at it

Yeah, me too, but I kind of got sick of sucking at it. I'm enjoying learning a new skill while keeping my "investor" side separate. I try not to let to the two groups talk to each other. Heheh. :)

The Jekyll and Hyde of your crypto-self. Haha.

When I first got into crypto, I was very much of the mindset of "accumulate and hold". After a few months on Steemit, I've learned a lot and got into Bitshares. I've been doing well (percentage-wise) with trading on the Bitshares DEX. I've learned a lot and developed some strategies that seem to be working.

I agree with you. I'm enjoying learning about trading and I'm not really stressed about the trades. Steem Power is most of my "investor side".

Thanks for sharing your experience.

Hi Luke, Loving your posts- keep up the great work! I'm more of a trader because I find the Crypto world incredibly volatile. I rarely hold overnight positions because crypto doesn't follow the same price delivery patterns found in traditional currency pairs. That being said, I'm so glad I held bitshares because that investment grew 10x. I'd like to think it was because of my internal resolve, but truth be told I was frustrated with the bitshares 2.0 transition and said f*ck it- it's only $200....That was 2 years ago :)

Hah! Nice. I wish I had sold some BTS when it ran up to $0.40+. Instead I sold... and bought right back in. Not only that, I did a bitUSD margin I'm still stuck in. Hahaha. Full FOMO mode there.

How you didn't sell any ZEN coin

trading makes me crazy...sucks me in and consumes my brain...could be different if I put enough work and research in, but I would have to move away from some of the other thing happening in my life to free up brain space...i think for now I will read the glory story of traders and enjoy the profits of holding my crypto's for my chillens future...i think they will appreciate that...and my emotional presence...

oh and yes buy smartcash

http://moneymakingway.com/amazon-review-sites/

It's always hard when you rip off the band aid the first times, but those kinds of scars will only make us more seasoned as traders. In an ideal world, we have 100% gains, but in the world we live in, striving for a little loss as possible is the best we can hope for.

Sorry for your loss, it also happened me in past and I know how hard it is to take. Take lesson out of it, rethink strategy and try again.

I spot in your post this sentence:

Believe is feeling. Avoid believe.

Analyse and always doubt in your analysis.

Great investor Philip Fisher was always concern about his decisions, even after he bought company shares.

It may seem a little bit silly, but always worry, at least a bit.

We are investors we are trying to predict future. Lets not be childishly self confident in this hard art.

I held onto Stellar for six months, and sold thinking the same thing, they will never rally again, but low an behold it was 3x over the low. I got out before the rise.

Luke Stokes, yours was a beautiful story of letting go. I remember long ago taking a meteorology course some decades ago and one thing that impressed me profoundly was the concept of the storm surge by coastlines in the hurricane's path. Before the gargantuan storm comes with a great flood across the intertidal zone, first the ocean gets sucked back and when this happens it seems like the beach suddenly extends out a vast distance depending on the contours and depth of the waters off the shoreline. The same thing happens with tsunami, before the crushing waves crash down angrily wrecking havoc and murder on the coast and inland, the water is seemingly sucked out to the horizon and it appears like the beach can extend out for a great distance as far as the eye can see to where the sun might rise or set.

You were brave to let go, at a loss, even though it was a difficult thing to do. I know a lot of people who go to the crypto-casino and struggle with quitting while they're behind, they think if I just throw more money at it, things will turn around, but if your heart is not there, as in the case with that cryptocurrency, you did the right thing in saying goodbye. You might have quit while you were behind, which isn't easy, really. And so the great storm is coming for you. SmartCash https://smartcash.cc/ is going to be your storm surge, you sold that other coin and picked up some Smarties (my nickname for SmartCash). Give it time, nurse it, cultivate it, the hurricane is coming. SmartCash is going to be one of those cryptocurrencies where if you hold onto it for years to come, you will look back with puffed-chest pride and say I made a great move and now I got rewarded prodigiously for it. The SmartCash rewards program is really nice, and every month you hold on to your Smarties you are sure to get a nice little bump.

Thank you for your thoughtful and insightful sharing, I really enjoyed reading your article, there were moments I found it to be heartwarming (because I too struggle with some of the things you go through in a broader context of life) and it certainly pulled on my heart strings, because letting go is hard to do. We humans are hardwired to sometimes not be able to let go, even when we know it's the right thing to do. I hope you continue to acquire SmartCash, and I hope you hold on to them till the day the great hurricane comes and all your dreams come true. If you get a chance sign up for the forum on https://smartcash.cc/ I noticed they are very helpful when it comes to questions being asked, even the most banal questions are answered with politeness and promptness.

Cheers

I'm definitely not a trader--too time consuming and stressful. I'm like you were, where I'd hold coins way too long and through lots of ups and downs that would have made a trader rich. Mostly I buy and hold POS type coins so that I can always keep the principle and sell of the "interest" to either cash out or fund other crypto-investments. In that way, if I make a mistake selling that interest too low I know it will always come back. This is precisely why I'm looking at smartcash right now. I'd buy and hold whatever I originally buy and sell off interest.

BTW, did you ever get into Diamond (DMD) after we chatted about it? If you did, you're probably pretty happy. If not, well it's never too late, but smartcash is definitely cheaper.

Nah, I kept looking at it, but never got it. I've done very well on a other coins though. I know there are a lot of great options out there.

Hah! I haven't heard of the vomit point. Thankfully, I don't get too emotionally wrapped up in this stuff. If I let go of one thing, I often win on something else (as I'm so far doing with SmartCash).

Thanks for the reminder, I'll check out you post.