As Central Banks around the world continue to issue currency into the market and allow financial institutions to practice fractional reserve lending, the spending power of the paper in your wallet decreases.

Fiat currency always ends up finding its intrinsic value.....ZERO!

What provisions have you taken to ensure your financial future when the inevitable crash of the Dollar, Pound, Euro and all other fiat currencies occurs?

The Economy is recovering, right?

Governments throughout the world are currently trying to convince their citizens that the economy is recovering and of course the mainstream media are happy to repeat the narrative, but is it true? Frankly....No!

For some reason Government officials seem to think that lying to us is for our own good, could it be that the policies they have implemented have been so catastrophic that admitting it now would prove their ineptitude?

It's the very definition of insanity!

That's exactly what has been going on though since 2008. Call it what you like, money printing, currency creation or my favourite 'quantative easing'. Now that is Orwelian double speak at its very best.

Getting to the question that I posed at the beginning, what are you doing to ensure your economic survival when the inevitable happens and the shit really hits the fan?

I'm not an financial advisor however I have been studying this subject for many years now and while I realise there are many savvy people on Steemit who understand the dire situation we are in I'm also aware that there are still a majority that hope that at some point the bankers and politicians will get it right.

I'm sorry folks but that just ain't going to happen.

With each passing day the currency in your pocket has less and less buying power, the reason for this is inflation. But what is inflation? I'm sure many people have never even asked themselves that question, I mean it's not as if it's a sexy subject or even that interesting. However it is an important one.

Inflation is simply an increase in the money supply, that it!

The more currency the Central Banks issue the less bang you get for your buck. Add to that high street banks lending money they don't have and you have a recipe for disaster. The economic tipping point is fast approaching and the time to act is now. You don't need to be rich you just need to be smart with what you do have. When things get really bad governments are going to be going around desperate to grab anything they can from their own citizens in order to save their own arses, don't be one of the unlucky ones who weren't prepared. They'll help themselves to your savings accounts, nationalise private pension funds, impose new draconian taxes and they will print, print and print again until your savings are worthless.

What can you do?

Like I said I'm not a financial advisor so I can't tell you what to do, I can only tell you what I've done to protect myself and those I love from a life of poverty.

The most important thing to do is research. Don't trust anything you are told regarding the economy coming out of the MSM, they're just spouting the government propaganda to ensure people don't panic. Educate yourself first and foremost.

Eliminate unnecessary debt.

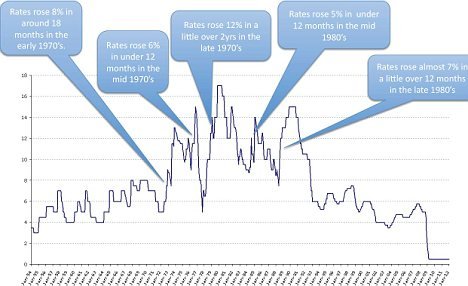

It's very easy to get sucked into the debt trap. Don't overextend, if you don't need something don't buy it especially if you require credit to make the purchase. Interest rates are being held down artificially and at some point the market will wrestle control back over this metric, once that happens it has a tendency to over- correct. How much would your monthly obligations go up by if base interests rates went to 5%? What about 10% or even 15%?

It's happened before and it will happen again.

They had no other debts either, if they had we would have been homeless. So please bare this in mind when considering getting loans and credit cards for luxuries you can live without. You need a roof over your head so prioritise that and ensure you can make your mortgage payments if the rates rise. Please remember that if you rent that will rise too, the property owner will want to recover their extra costs too, from you!

Diversify your assets, spread the risk.

When I first 'woke up' to the economic reality of our current situation I was overwhelmed and frankly scared. I had no idea what to do but refused to panic and decided to do whatever I could to protect what we had. I researched like crazy trying to find out what people had done during times of economic turmoil to protect their wealth and what happens when unbacked currency finds its true value. It was a pretty sobering experience to say the least.

Since then I have done 4 things.

1. Invested in Physical Precious Metals.

I have done this in 2 ways. The first is in the traditional sense as in I bought gold and silver coins and bars which I hold in my own possession. Be sure to use a reputable dealer if you choose to invest, there are many worldwide and Steemit has a big stacker community posting under the tag #steemsilvergold where you can network and find a dealer in your area.

The second way is gold in an allocated vault with a pre-pay credit card attached to the account, this allows me to spend the gold if needs be. The account tracks the gold spot price and your balance fluctuates with the it. There are a number of companies that provide this service however I use Goldmoney as I really like the people that run the company, it allows me to move my gold between different countries at the click of a mouse and go and physically remove the gold from the any vault in coin or bar form should I chose too. It's completely insured and I trust the service.

Gold and Silver are the best hedge against inflation and hyperinflation and are real money. Do your research and you'll find many instances throughout history where precious metals have provided protection to owners during economic instability. I'm well aware many people can't afford to buy gold and that's ok, silver is cheap and in my opinion is the most undervalued asset on earth, the price will be many multiples of its current price in the years to come.

2. Invested in Crytocurrencies and blockchain platforms.

Diversification is the key to wealth protection.

You don't keep all your eggs in one basket, right?

If you are new to Cryptocurrencies please make sure you understand what you are investing in and please never, ever leave your coins in an exchange. Get yourself a secure wallet app and/or device to keep them on, there are many and again there is no better place than Steemit in which to learn the ropes.

3. I've prepped.

Now I'm not talking about doomsday prepping, I don't live in an underground bunker armed to the teeth waiting for the apocolypse. I'm talking about sensible prepping to ensure our short term survival in the case of a credit event.

When I say credit event I mean a situation similar to 2008 where banks were reluctant to issue credit to each other and retailers. In this kind of event production and delivery are affected, without credit most companies can't pay for raw materials to produce the products found on the supermarket shelves. Logistic companies can't pay for fuel for trucks to deliver them and just like that the stores shelves are empty!

The 'just in time' delivery system is great in good times however the disadvantages are evident during times of turmoil. Just consider how quickly stores shelves have emptied during weather events in recent years in the US and other places.

Image Source

Imagine what it would be like if there were no resupply for a few weeks, what would you do? You can't grow you're own food overnight so a sensible amount of food, medications, water, toilet roll, batteries, and anything else you couldn't do without should be your priority. Always remember to rotate your supplies to keep them in date and store them in a safe and secure place away from preying eyes and pests. I keep a roughly 3 month supply all of the things we would require if there wasn't the opportunity to buy locally. Better to have it and never need it than to have nothing and end up desperate for a meal.

And finally....

4. I've educated my nearest and dearest.

It took me quite a while to achieve this as I went about it all wrong, I lectured, badgered, nagged and ranted. To no avail. Then I tried posting links to articles in emails and text, again nothing. I was getting a rep as a spammer with my friends and family. It got to the point where people didn't want engage me in conversation no doubt due to them thinking I would end up on another tirade about the economy.

What a complete waste of time!

People don't want to lectured to but they are willing to learn if you approach it in the right way. It needs to be interesting, informative and relevant to them. I finally made traction with my family and friends by getting others to do it for me. There are many great video series available online that can help get the information out to those you care about and my breakthrough came when I got my closest to watch The Hidden Secrets of Money series by the fantastic Mike Maloney. This series is genius because not only do you 'get it' you're entertained at the same time. I recommend you watch it whether you're aware or not as it really is interesting, it's surprising what you think you know but are misinformed.

Anyway my fellow Steemians that's my take on what to best do to ensure your economic future. It's what I've done to ensure mine so I'm not suggesting you do anything I haven't already done. I'm not a financial advisor and have no affiliation with any of the people or companies named in this article. I just want to get the message out to as many people as possible. The more of us that are protected the better. I have made many friends on this wonderful platform and hope that every single one of you do your research, protect yourselves and your loved ones and most important of all, don't worry. You prepare so you don't have to worry after all.

Fiat is going nowhere anytime soon. Governments have enough control and power to make sure of that. As @trucidus said, diversification of assets. That's what should be done, but to say it's going the way of the dinosaur is a bit premature and surely will be for many years if not decades/centuries to come.

They always fail, diversification is so you keep your savings in something that won't end up worthless. You may have so choice but to be paid and transact in fiat but keeping your savings in it is very unwise.

We can just try to build a lot awareness about this subject and think about parallel thoughts and structures in this system.

for example through such groundbreaking ideas:

http://gradido-university.com/wp-content/uploads/2016/03/Gradido_ebook_en_Edition2_free.pdf

This is the homepage which will soon be also available in English:

https://elopage.com/s/gradido/home-de?pid=1039&prid=111

Or a total different idea:

http://www.wissensmanufaktur.net/media/pdf/plan-b-english.pdf

Innovation and technology are faster now, the big banks in the world have power and money to invest and develop cryptocurrencies on demand by the governs and do not lose the power and control of economy.

Good post. I agree that the banks have so much power over Congress (I'm assuming we are all US) that they will drain the remaining value out of the dollar until the IMF puts us on a North American currency but I think we are only a few years from that if Trump doesn't appoint some folks (to the FED) with gold backing in mind. Read The Creature From Jekyll Island.

When you say government control, you should say bank control. They run the show. They can oust any Rep in DC any time they need to. Also, that control could make BTC illegal in the US. No options to cash out. All it will take a one incident tying BTC to terrorism. They'll probably fake it but they can make it stick.

You've received an upvote from #TheUnmentionables - a SteemIt community full of members who like to kick ass, take names, and occasionally do it wearing (or forgetting to wear) our unmentionables...

Click the Image to Join Our Discord Server:

Please upvote this comment so we can help our members grow faster!

Thanks guys, you're awesome!

Agree with everything you have said here TP, wholeheartedly - including some of the more specific remarks ie Goldmoney, Mike Maloney. Great post. SK.

Thanks my man, just hoping to pay it forward. I was given some great advice in the past and hope to help others. Can you believe this post got flagged though! Gutted.

Thanks for all your support dude. TP

If you want an idea of what will happen when the government kills cash just look into what's happening in India right now.

Oh yeah buddy they went all draconian, there are plenty of examples. Look throughout history, fiat always fails.

Thanks for checking in buddy.

Great advice as always, Dad! ;) <3

Where the bloody hell have you been?

😂😂😂😂😂

Love ya babe 😉

Hahahahahaha 😂

And right back at ya <3

Thank you very much for the care to share this knowledge with others so they may protect themselves for what is surely coming.

This really made me laugh because I can SO relate hahahaa:

Aww, thanks babe.

Thanks for popping in on your birthday ❤️🌹🌻🌺🌷🌸🍾🎂

I hope some people got something from it. It's important that people understand the economic turmoil that is coming. 😉

Another excellent and informative post @tremendospercy and like you say diversification is key! I heard it said that "we're three meals away from anarchy" and I believe it's a quote that holds some genuine validity. I agree with all the ideas you express here and the fact you've tied them together in a cohesive structure that's backed up by reputable contacts and ideas is brilliant. It's great to have this kind of information on the blockchain and I'm sure it'll become a very valuable resource over the coming years. Great work!!

Thanks for the vote of confidence my freind.

Hopefully it will help those unsure what to do to go out do a bit of their own research and protect those they hold dear.

Great article mate! I have been preparing in a very similar way for the last few years now....cheers for the info..

Thanks buddy, it's wise to get ready for the worst.

Cheers for reading.

Diversification into disinflationary assets. Yes, its the name of the game. Of course, if our fiat ever fails completely, I wouldnt worry too much about credit. Digital currencies have helped me completely clear my debt using the debt consolidation powers of places like www.btcpop.co. And other peer to peer lending sites. My credit in the eyes of the beureaus isn't great, but i can command 5btc from pop no problem. They cant wait to lend me. I highly reccomend that everyone pay off their debt as soon as poosible. Hemingway, in the Old Man and the Sea once said, "First you borrow, then you beg." Still %100 relevant today.

I know a lot of people who need help with their debt, cos in SPAIN all the people have a morgage and the salary is down, many people can't pay the debt.Thanks @trucidus!

I am sorry to hear that! It seems that people all over the world are being suppressed by the tyranny of money wizards. I truly hope that digital currencies and the like can play pivotal roles in the freedom of our race. Fight on my Spanish brothers and sisters! The war is just begining. But also, do not lose hope, for the human spirit is resiliant and fierce. I know you must work to make ends meet, but dont forget to spend some of your time searching for answers and help. Both are out there, somewhere

I totally agree buddy, thanks for reading the post and commenting

Spot on advice. Well rounded solutions and a great conclusion.

Thanks a lot for saying so mate. 😉

I'm not too concerned about my mortgage debt.

I only owe Australian dollars, and ten years from now I'll be able to wallpaper the place with those.

The problem could be though @mattclarke & @tremendospercy - Aussie banks also start to realise that dollar are no longer worth much and so they lift interest rates to 20%+ regardless of what the RBA is doing. - and this is going to hurt. We know that our Senior Editor @sirknight is tries to ensure that his mortgage is fixed at low rates for as long as possible to avoid this very scenario.

COMMUNITY NEWS

Interesting. I've always been variable. I want them fighting for me every day, not just once every five years. I also don't want to gamble that I'm a better economist than the bank's economists; although I'm starting to think I might be :)

I'm not sure the banks could spike interest rates without tanking the property market and having half their over-leveraged customers default.

Not a good long term plan, particularly as bail outs are a lot harder to get, down under.

I guess we'll all find out together :)

The central banks are currently controlling interests rates to levels that Govts can afford to pay on their ever increasing debts . This phenomenon only started in 87 before that the buyers set the rate by bidding for the bonds depending on the rate. The only way they can keep doing this is to issue more currency to buy it. The bond market is massive compared to the stock market and will eventually take back control and the rate will be set by the buyers of the debt. For example, would you buy a $1M 10 year US treasury for 0.25%. I wouldn't! And the CB's know this so they buy it so the market doesn't set the rate. It can't continue forever without creating massive inflation. So the currencies either become worthless through over issuance or the market sets the rate much, much higher. Either way it's bad.

Pissing your pants over and over to stay warm.

😂😂😂 love it dude!

That's wise and those who don't fix will suffer.

That's right, they're made of plastic so you can't even wipe your arse with them 😂

Cheers for checking in and commenting buddy.

A really great, accurate, and informative post all-around. Thanks for the gift!

I just reread and had to offer Kudos man 👍

Cheer buddy, I really appreciate the complement.

Thanks for taking the time to read it.

🤘😎

I'll send you an account where you can send your useless fiat currency to and I'll give it to my wife. i am sure it won't be useless then!

:)

Need a spending economy, just give all our money to our better halves and you'll see spending like it's never been seen before!

Haha, nice one Jack!

I totally agreed with you that diversification of assets is one of the steps that we should take. I would like to add property investment as one of the assets that we should diversify into.

I totally agree with you. As everything you just need to go crazy on something. You can start buy buying 1 silver coin, reduce debt and constantly try to improve your finances and self-sufficiency. I believe doing this every month and keep improving it you will have at least more than most people. Very interesting topic my friend. Keep it up!!! @OriginalWorks

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

For more information, Click Here!

To nominate this post for the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!Thanks Roberto.

Buying a little every month is a good idea, it doesn't take too long to get a nice stack.

Thanks for checking in buddy.

No problem. I read somewhere that you should buy in the dips as well in the ups for long run better profitability. Like just keep stacking it. Every little addition will add up to an amazing amount over the years.

Never keep your eggs in one basket. That's the philosophy which does me well. Be it paper money, cryptocurrency, or trust in any one entity, it's always worked for me.

And that attitude should keep you from the poor house 😉

Great work done here and great work done to help others understand what is coming. Only through our collective teachings/guidance/good intentions will some of the flock become conscious and turn right before the edge of the cliff.

I completely agree mate, what a brilliant comment.

Thanks for reading buddy 😉

This post has been manually curated by @openparadigm for @informationwar feel free to use the tag #informationwar

it all about diversify... never put all eggs in a basket.

True story buddy.

Thank you for the post.

Point taken and action to follow!

You're welcome mate, I'm glad you got something from it.

There is no cost to make fiat currency, but there it costs a lot of money to generate 1 bitcoin. In theory unless we start destroying money it should endlessly devalue.

What a great post! Thanks for including the link to educate our family and friends. Yes, it's way more effective to be the messenger than the message for those closest to us.

Thanks for saying so and you're so welcome. 😉

You need to have a lot of Passive Source of Income to keep yourself self sustained. Awesome post bdw.

Agreed,I have a number of irons in the fire.

Thanks buddy 😃

This train is very fast!

Thanks for your post,

I think that debt is not good but you need to find an assets to invest your saving with more incomes that you pay in your debt, and when invest grow you can pay the rest of your debt.

So true 😉

Wow tremendous effort in putting up this piece. I learnt a lot. Maybe we can take a cue from Venezuela. A failed economy. Inflation skyrocketed. Fiat has become useless.

Thanks for saying so buddy..

It's pleasing when you can help others understand the dire situation that is fast approaching.

Yes, Venezuela is a great example of the way it goes, by all accounts an ounce of silver can get you 1-2 months worth of food there right now! Not bad for something that costs $20!

It is really bad for a country that was truly dependent on its oil. We always say its the black gold's curse. We have countries like Singapore that is doing well but it is also because the government has a bit more integrity and has been keeping inflation in check. In Venezuela, the people are so blessed that it has become a curse. The government can be flagrant in their spending but as long as crude oil price is good, there is no complain. At its worst, 1 day's food ration is supposed to last for a week. Their fiat is worthless now, hence bitcoin, USD, gold and silver comes into play.

It's tragic what is happening there right now I really feel for the people. It's never good to have an economy that relies on one major source of income and sadly the government have made all the wrong decisions in recent years. I fear they may have more misery coming their way in the coming months and years. Let's hope that's not the case as they have suffered enough already.

They are falling to other forms of safety net and one of them is bitcoins. This happens when the govt is shitty and remains in power.

Great post... I just wrote one earlier today about my investment strategy which looks a lot like yours. One thing I do is use profits from BTC, ETH and LTC to buy as much silver as I can on purse.io and some of the less expensive cryptos. I always have a cash out goal and rebut when it dips. Holding the big 3 is crazy (in my opinion).

I will sell all of my assets one day, hopefully when the time is right. I believe the cryptos have a long way to go although the ride will be bumpy.

Thanks for checking in.

Always teaching! <3

Hopefully it'll help some folks ❤️

Thanks Kubster 😉

Well written article. Upvoted

Thank you.

Tell them man! Buy silver or any metal or real asset that you can hold in a crisis. This was a great discussion I actually linked it in a post I was working on when you sent me the link on discord. Check it out.

https://steemit.com/blog/@phelimint/what-is-something-we-are-currently-doing-that-we-going-to-think-is-totally-wrong-insane-in-50-100-years

Will do buddy. It all started with the PM's for me dude.

Cheers for reading I'll check out your post dude. 😉

@penguinpablo has been one of my primary go-to’s since joining Steemit last month. It seems I will add you to the list.

Your post is extremely refreshing; and, by that I mean, as in refresher-course. It is so easy to remember when, in the early 90s employers were begging for people to fill certain jobs, and, then in 2008 hiring freezes were everywhere.

The U.S. doesn’t believe, barring a hurricane, that the shelves could ever be bear. The pantries have been filled on whim for very long.

Relatively speaking, very few are still alive to really remember the 1929 collapse, and soup lines.

But, should Kim Jong-un fulfill his determined goal; for some, your writing will be moot; others, a reminder of what they did to prepare, or should have done.

Thanks for this very insightful post!

Peace.

Thank you for reading the post and leaving a lovely comment. Not having seen rampant inflation in their countries for a long time many people in the west think it could never happen to them. This is a big mistake.

Interesting...Peace.

You can read what I wrote about your post here.Hi @tremendospercy, I just stopped back to let you know your post was one of my favourite reads and I included it in my Steemit Ramble.

If you’d like to nominate someone’s post just visit the Steemit Ramble Discord

Thank you so much for this, that's so kind.

There are some really great pieces in your post ❤️

I also grew up in the seventies. I watched as whole towns withered away. Men who used to work in steel mills were suddenly at the mall selling shoes. People moved away, never to return. I agree with everything you have said and done.

Thanks for saying so! Yeah it was a terrible time for many and we have a similar event on the horizon.

I believe it is a duty of ours who have seen these events and lived through such times to warn and remind others of what happens and to be prepared. I also believe that we should also remind everyone that although hard times may come knockin at our door, a new day shall also dawn. Be prepared for the hard times but keep hope and good spirit alive in our hearts for a better and brighter future. Will it really be bad in the long run that this current system of usury, unjust weights and unjust measures will be abolished?

Great comment.

No it won't, I'll be happy to see the back of such an unfair system. It'll be worth the short term pain.

Wow thats another amazingly well put together and informative post @tremedospercy ! I need to buy some gold too, but then like you say best to have it in your hand eh ?? I mean look at this ! My latest post shows the dark times ahead for sure !! ! https://steemit.com/news/@gomeravibz/has-fort-knox-been-emptied-of-its-gold-a-15-year-old-newspaper-article-from-the-globe-called-gold-is-gone-say-s-yes

Yeah, in your own possession is safest.

I saw the post mate, a great piece of work buddy.

Thanks for checking in, reading and commenting.

I do see some strong base to whatever you've written. Governments do seem to be worried about how the new market is shaping up. Thanks for such a detailed heads up. You're right, we gotta buy what we really need to buy and let everything else go for now.

So yes, as you said, I'm going to prepare and prepare well for what's coming.

Thanks mate and good on ya for protecting yourself.

Great article!

It always made me thinking, gold/silver/cryptos are kind of doomsday asset class, they goes against inflation. I really wish everything shall be fine and there are no crash in the market whatsoever, although my gold/silver/cryptos might not appreciated as much. However, ‘The best thing you can do for the poor is..not be one of them’ -Andrew Matthews. So, protect oneself and help others in need. Your sharing is great, did you share it elsewhere? I do think most of us in steem should mostly know this perspective.

Not so joking: I kept also my paper crypto-wallet (public key only) in my physical wallet, too.

Thanks for reading the article. I don't work on any other platforms or social media.

I keep all my crypto offline in hardware wallets. Apart from Steem that is.

Informative post, Fiat is science fiction for the rich! I hope people wake up and smell the java, fiat is in a death spiral. And governments know, that is why they are hopping on the crypto train.

Have a great day!

Thanks. Dude I love this!......

That is a great statement my man.

The Goverment will do anything to save themselves which is big problem for their citizens, when a Government runs out of money they only have 2 options print more or steal it. They've already done the first so........

Thanks my friend. :-)

There is only one way to have a government that actually works, take money out of politics. People serving in government should do so without getting paid megabucks. Power, Corruption and Greed, are the mainstays of politics and the war hawks love to keep the wheel turning.

War is business and business is good, for these folks. And to keep that wheel turning, they need to keep the fiat illusions alive and well. And to that I say...

Peace!

I completely agree. We used to have statesmen but sadly we now have career politicians owned by big business.

Thank you for sharing bro,it's useful post👌👍😃

You're welcome dude.

You call it still money. But its debt. Its a debtpaper. There will be no USD left if all give back that paper. I hope you get it. USD and EURO is just monopoly copyright paper. Its only there because of credit created with 0 work.

I dont think we will see stockmarket crashing. We will see the opposite. Inflating price for stocks. And gold, silver and bitcoin of course...

Yes I understand all unbacked currencies are debt notes, I wrote the post to hopefully steer those who aren't aware to that fact. And I agree the stock market will go insane as more currency is created and thrown at it. That's why I like real money, gold and silver as well as the money of the future - crypto's.

Thanks for your input buddy, hopefully the unaware will see our interaction and go educate themselves.

This is a well-thought-out way to consider the future. I, personally, am skeptical of almost everything that I have going so I diversify just because it seems the best way to go... then, of course, I get lazy and stop doing some of them.

It's just good sense to spread your risk.

Thanks buddy.

We are about to close on the sale of a rental property this week that will pay off the very last debt we owe! It's been a long process to pay of mortgages, but I agree 100% regarding being debt-free. If you are in debt, that puts you in a compromised position with your bank - and that's when things are "normal".

We do stock canned goods, but we're not very good at rotating through them. We don't use a lot of canned goods (we garden when we can), but it's just so hard to toss old cans lol. What do you do about that?

Get better at rotating!

Stock rotation is a valuable skill.

And get rid of the tins, I try to only buy jars.

Cans are not as good, they have far more plastic in touch with the food, and they can oxidise more easily than jars, that are kept upright and dry and protected.

But mainly the plastic lining is a problem.

If you ask me.

Which you didn't but anyway

lol

Good advice! I should probably just do some of my own canning in jars. Although the only thing I've ever canned/jarred is salsa verde. It's tasty, but not sure I could survive on that.

depends what choices you had.

better than a poke in the eye with a sharp stick

You betcha ass it is!

That's great to here you're clearing your debt Moro.

And storing a bit of extra food is just good sense.

I don't buy into the sell by date BS on cans babe. I've eaten from cans that are supposedly years out of date, then again I used to drink tap water in India so I've probably got an iron constitution or a tape worm that's eating all the bad stuff for me 😂😂😂

Thanks for taking the time to read and leave a great comment babe ❤️

Makes me think that Extreme Couponing might be the way to go now, lol.

that's where I have been living

Total Ahorro is the total savings for each ticket

Oh, I don't read the dates on most things. But I did have a bunch of canned peaches I bought explode, so I had to toss them all. Not really sure what happened there!

Wow, exploding peaches! What are the odds? Have you told the guys in discord?

Haha, no didn't even think of it!

Cryptocurrency and the blockchain is the future of financial institution.

I agree but it may not be a smooth transition.

Good post, well written. Not sure I agree totally with your basic premise, but I'm thinking about it. What you are doing makes sense, because there are always opportunities for a disaster, whether man-made or natural.

Any idea why sneak would want to do you like that. Even if I disagreed with every word you wrote, there would still be no reason I can see for it.

All unbacked currencies throughout history have always failed, our governments are doing the exact same thing that has happened many times throughout history, debasing the currency to inflate away their debts. It happens quite often just not in our lifetime yet.

I have no idea about the flag, some people like to flag I guess for no other reason than that they can.

Diversify, yes that is the key. Let's prepare and be ready, that does not hurt.

Exactly buddy 😉

This wonderful post has received a bellyrub of 10.26 % upvote from @bellyrub thanks to this cool cat: @tremendospercy. My pops @zeartul is one of your top steemit witness, if you like my bellyrubs please go vote for him, if you love what he is doing vote for this comment as well.

Great post, OMG forever by the way.

Thanks mate 😉

Well written and constructed, for some reason you lost $10 dollars off your tally when i upvoted you sorry for that :-/ resteemed

I saw that, it looks like I may have been flagged. I don't know how to tell but it's pretty disappointing.

Thanks buddy 😉

Hope i didnt do it by mistake, you deserve every cent you were awarded, it must of took some effort to produce this post

It wasn't you buddy, I got flagged by a whale by the looks of it, so unfair.

Lets get the harpoons out, weve got a rougue whale in our midst. Seriously though i find it quite disturbing that a whale can wield that much power. Is there anything to stop the MSM or other establishment entity buying up enough steem to start and censor posts??? Its got me thinking now :-/

Dont cry you still got around 100SBD. They regulate the value and they are allowed.

Its about voting. Both up- AND down-vote.

Flagging should really only be used to stop plagiarism, racist, cruel, and plain wrong posts. Not for a differing opinion on a fair subject. It's not the money it's the injustice.

I see plenty of posts that I don't agree with but would never flag a post for that reason, opinion should be respected.

But regulating the value with a flag is allowed. I am free with my vote. If post got to much value i can regulate it down.

I still respect this opinion even if i regulate the value down. Then it still got value.

Only less. Others regulate it up. Its just free market of opinions.

It would be a good experience for your happy life

Thank you for your posting

You're welcome.

Keep in mind when you are stacking that governments are not above taking your precious metals from you. They have done it before and if they need to, they will do it again.

The US did it however gold and silver were still used as money back then. It was just gold not silver, they didn't go door to door it was a voluntary programme. After than they banned ownership until they went total fiat in 74.

Amazon may start accepting Bitcoin as early as October !!!

https://steemit.com/cryptocurrency/@rinaalone/amazon-may-start-accepting-bitcoin-as-early-as-october