What is the UBI?

For the purposes of this discussion, the Universal Basic Dividend, or UBI for short, is going to be understood under the context proposed by Dr. Steve Trost’s lecture “The Libertarian, Conservative, Progressive, Communist, (Not Socialist), Case for a Universal Basic Dividend.” In this lecture, Dr. Trost proposes a UBI which would secure $9,000 annually per citizen, regardless of age, from the federal government that is untaxed income. For the average American family with two parents and two children, this would equate to $36,000.

From there, all income made by the family would be taxed at a flat rate of 25%, paying back the $36,000 initially given to them by the time they collectively earn $144,000. As Dr. Trost explains, this would mean a family of four would have to make more than $144,000 a year notwithstanding the UBI to induce a tax positive for the government, thereby dramatically “shifting the tax burden upward.” Dr. Trost also includes some other notable points, including that while the $9,000 used here is an example, the actual value of the UBI will fluctuate annually based on the previous year’s nation-wide GDP. Additionally, in order to fund the program, government expenditures would be capped at 9% annually, thus allowing budgetary room to fund such a large program. Finally, the government cannot enact any taxes which are not at an expressed flat rate as outlined in a constitutional amendment protecting the UBI.

While this program sounds beneficial on paper, there are numerous issues I hold against it that I believe ultimately hinder its implementation.

Logistic Issues

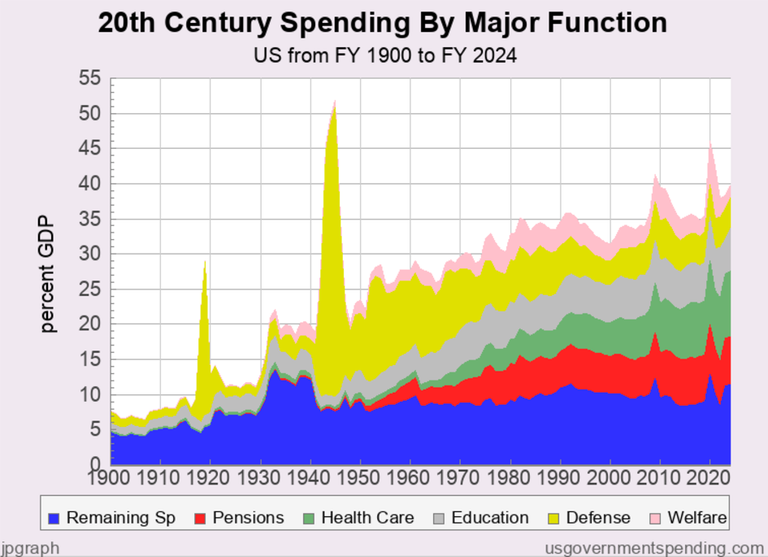

The first issue I wish to address is the 9% government cap on expenditures. In Dr. Trost’s lecture, he refers to the following chart regarding spending of the U.S. government since 1900 (Chantrill).

Should a UBI be implemented, any welfare costs would be eliminated as this would replace such programs, but the money spent on defense, education, pensions, and health care is still significantly greater than the 9% figure suggested. While, yes, it is true that this 9% was fairly easily maintained prior to Roosevelt’s New Deal, this was implemented because the previous method of limited spending enabled an economy and population susceptible to mass economic downturns with no safety nets available. While it could be argued that the UBI would become that safety net, $9,000 is hardly enough for any one individual to live off of annually, especially if they have outstanding debts such as mortgages, utilities, rent, car payments, student loans, etc. The low spending prior to the Great Depression are deeply correlated with a time where the average American citizen was severely overworked and taken advantage of in factory settings through wages equating to $1-3 per week. The spending now, while certainly unnecessarily exorbitant in some areas, is what enables the significantly higher standards of living now experienced then some 100 years ago. A UBI of $9,000 per citizen is simply not effective enough to replace this safety net, nor would it be able to be nearly as effectively coordinated, as it is divided up among the people as opposed to being in the hands of one central, governing entity.

Another issue I take with the UBI is the shifted up tax burden Dr. Trost mentions. While this sounds like a benefit, the median household income in the United States, taken across both single-parent and double-parent households, was $80,610 (Guzman, Kollar). Even the median among married households was only $102,800 annually. This means, using Dr. Trost’s example UBI of $9,000, the median family in the United States is not going to be a net positive for taxation purposes. In fact, even among married households, the government will still not be able to break even on such a program, assuming that there is an average of two children per household. The tax burden shift mentioned would have to be incredibly drastic in order for the government to make enough money to remain operational. Considering more than half of American households would be a negative tax burden, the current taxation rates on the top-earners would have to greatly surpass the 37% already experienced in the top bracket (Durante). At a certain point, such an inflated rate begins to mirror rates seen in the more socialist, European economies, a reality which directly contradicts Dr. Trost’s claims that this is entirely anti-socialist.

Finally, there are some additional challenges I have to a UBI, though these are less immediately important and will therefore not be explored individually as thoroughly as above. Firstly, extending the UBI to citizens of all ages provides financial incentive to parents to have many children which they may not be mature enough or financially stable enough to support. While Dr. Trost does acknowledge this concern and says that the UBI will support them, he does not account for purposefully exploitative parents who will take the UBI for their own purposes. Additionally, the UBI will not be adjusted for high-costs-of-living in different geographic areas of the country. Therefore, this would encourage moving of poorer families to lower-cost areas, which would greatly overpopulate these regions and lead to further class divides. Furthermore, any spending the federal government cannot complete under the 9% cap is then delegated to the states, but this system only unfavorably disadvantages already poorer, rural states with less resources. Compounding this issue is the movement of disadvantaged citizenry to these areas, and now these less-well off states are weighed down not only by the burden of an expanding, financially unstable citizenry, but also a frugal government unable to provide public aid. Finally, a UBI is vulnerable to rampant inflation, as $9,000 essentially becomes the new $0, leading to high prices that only make goods increasingly unattainable for the nation’s poorest.

Unfounded Idealism

At first glance, it is easy to see why a UBI would be appealing. In theory, through taxation, it pays for itself while limiting government bloat and expenditures. Additionally, it helps its nation’s poorest by providing them the financial means to kickstart their lives and propel themselves into better opportunities. However, everything must come at some cost, and the UBI, while sound in its immediate implementation, has long-lasting ramifications that weaken poorest states the most and set up a system that is easily exploitative of the nation’s poorest and already most vulnerable. It is unsustainable in the long-run and will reduce the quality-of-life standards that have been built up through the past 100 years.

References

Chantrill, Christopher. “US Government Spending History.” usgovernmentspending.com, www.usgovernmentspending.com/past_spending. Accessed 29 January 2025.

Durante, Alex. “2025 Tax Brackets.” Tax Foundation, taxfoundation.org/data/all/federal/2025- tax-brackets/, 22 October 2024. Accessed 29 January 2025.

Guzman, Gloria, and Kollar, Melissa. “Income in the United States: 2023.” United States Census Bureau, www.census.gov/library/publications/2024/demo/p60-282.html, 10 September 2024. Accessed 29 January 2025.