Introduction

There have been hundreds of alternative and copycat coins to come into existence ever since Bitcoin was launched in 2009. Most do not offer improvements to Bitcoin technology, but many have clever or unique brands and marketing themes. Some coins made significant changes to the consensus method (Proof-of-Work/Proof-of-Stake/Hybrid). Other systems add a governance component like Bitshares & Dash to provide a way to determine future features and fund projects. These systems act more like ‘shares’ in a decentralized autonomous organization (DAO). Although there are many advantages to DAOs, the one disadvantage of a DAO is that it can make a coin more political. Most of the changes in alternative coins and ecosystems make them less of a pure ‘commodity’ coin like Bitcoin, a form of digital gold with with no governance and a direct relationship with the real world commodity of electricity. Bitcoin reigns supreme, not only because of the first-mover advantage and network effect, but because of the simplicity and elegance in its economic and technological design. As the Unix philosophy states it’s important for any system to “Do one thing and do it well.” Bitcoin does.

Litecoin is one successful alternative coin that is very much like Bitcoin, but has a few distinct features that differ from Bitcoin. It uses a scrypt mining algorithm that makes it more difficult for ASIC mining, decreases confirmation times to 2.5 minutes and increases maximum coin supply by four times that of Bitcoin to 84 million. Litecoin also has a simple, but important marketing message: Litecoin is the ‘Silver’ to Bitcoin ‘Gold.’ The distinct features and marketing message enabled Litecoin to be one of the the most competitive alternatives to Bitcoin. It currently stands at $800 million in market cap compared to $21 billion for Bitcoin. You can listen to Charlie Lee discuss the origins of Litecoin here.

One remaining key weakness in Bitcoin is its lack of full privacy. Bitcoin is only pseudonymous instead of fully anonymous. As a coin that is supposed to be the ultimate protection for an individual’s financial sovereignty across any & all government jurisdictions, bitcoins can still be tracked, blacklisted and can potentially be made less fungible. Furthermore, financial privacy is an important feature for defense against malicious private and state actors.

Zclassic: Like Bitcoin But Embeds Latest Privacy Tech

Zclassic is a relatively new coin that forked from Zcash and launched November 6th , 2016 without a 'premine' or 'postmine'. Much of the codebase of Zclassic is taken from Bitcoin with a very few distinct changes. Zclassic shortens the confirmation times to 2.5 minutes like Litecoin, adds a memory-hard mining algorithm that should be even more difficult to mine with ASIC machines than Litecoin, and adds the latest zk-SNARKs privacy technology developed by a prolific and talented group of cryptographers and software developers. Hence Zclassic is a high quality commodity coin like Bitcoin and Litecoin.

Why Zclassic and Not Zcash as BitcoinZ?

The main advantage Zclassic has over Zcash is that Zclassic removes an arbitrary 20% founder’s tax. Developers are incredibly important and should be rewarded, but the general public will favor coins with a pure origination story where everyone has an equal opportunity to obtain coins via mining rather than have a portion of coins arbitrarily distributed to any person or group by design, premine, postmine or even a bug. People generally favor open-source developers who aren’t in it for the money. People will generally favor distributions that give no advantage to any specific group or individuals. Ecosystems that distribute coins via mining are perceived to offer the most fair opportunity for the general public to participate. Hence the Zclassic design without a founder’s tax most closely resembles Bitcoin.

The Costs of Marketing

The costs that have gone into building the Bitcoin brand probably has been in the tens of millions of dollars over the last 8+ years through grassroots outreach, business activities and with mainstream press. Even negative news based around Bitcoin including arrests, drugs, and Silk road have brought increased awareness. Although there might be a negative stigma around Bitcoin for being a black market currency, Zclassic’s anonymous technology is bound to get a similar reputation anyways so negative stigma is not a reason to disassociate Zclassic from Bitcoin. The cost to communicate & educate those in the cryptocurrency space and the general public will be orders of magnitude less with the name BitcoinZ because the name will immediately clear any confusion about what Zclassic actually is, namely a version of Bitcoin with the best privacy technology. Hence the Zclassic ecosystem can save tens of millions in marketing and educational costs by rebranding to BitcoinZ.

Using the Bitcoin Brand

There are five other coins listed on coinmarketcap.com that currently use the Bitcoin brand. The Bitcoin brand alternatives seem to have received some investor attention in the last 3-6 months because of the Bitcoin scalability debate.

BitcoinDark currently uses the Bitcoin brand, but it seems to be switching over to a new brand called Komodo. However before the switch BitcoinDark went from $1.5 million in market cap in the beginning of 2016 to $5 million in early 2017 before spiking above $15 million briefly late March/early April. BitcoinDark/Komodo has a very different codebase and feature set than Bitcoin.

BitcoinPlus is a Hybrid Proof of Stake (POS) and Proof of Work (POW) coin. It’s own website claims’ Bitcoin Plus “has a wonderfully chequered history….The original Developer of Bitcoin Plus went by the handle XBC Plus. Once he received the ICO funds he succumbed to the lure of Barbados (or somewhere similar) and went and had a very nice holiday. A team from the Community was formed and 'Took Over' the coin.” Despite that history it has gone from around $10,000 in market cap in the beginning of 2016 to $300k in early 2017 before exploding to over $4 million this last March/April.

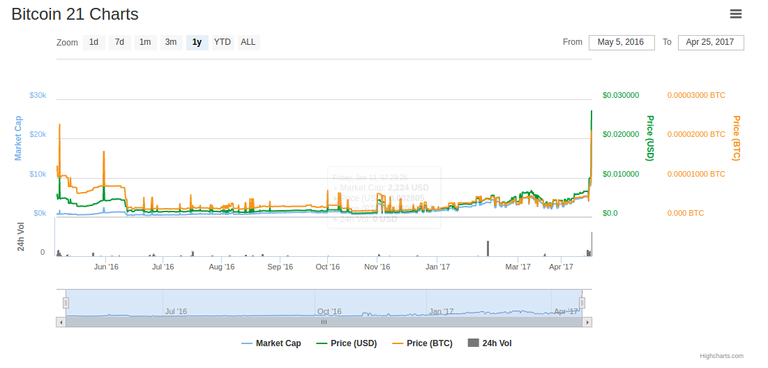

Bitcoin 21 is another coin that was hovering about $1,500 in market cap in early 2017 and jumped to $3,000 in March and went above $20,000 in April. The coinmarketcap.com link to the coin’s main website doesn’t even work.

First Bitcoin is listed on coinmarketcap.com, but seems to show no market cap data and only around $2,000 in daily trade volume. First Bitcoin seems to be affiliated with an OTC penny stock company, a company that seems to be losing money every quarter. Despite what seems to be poor fundamentals, the OTC stock BITCF has gone from 5 cents all the way up to 85 cents this March/April.

Bitcoin alternative brands, regardless of fundamentals, seem to be benefiting greatly from the core Bitcoin struggles. If a Bitcoin brand comes together with top notch technology, development and actual improvements to Bitcoin there should be no reason why the coin & ecosystem won’t do extremely well.

Zclassic/Zcash Weaknesses

Although Zclassic/Zcash are great technologies and improve Bitcoin in several key aspects, especially with privacy, they both used the same trusted setup on origination and there is currently no way to audit money supply in case there was an exploit in the trusted setup or is a bug in the code that allows for additional coins to be created without anyone knowing. Hence Zclassic/Zcash will probably remain a fraction of the market value of Bitcoin unless these key weaknesses are fixed. Finding a way to maintain privacy and provide a global checksum of the money supply should address both these weaknesses of Zclassic/Zcash and enable these systems to rival Bitcoin.

Conclusion

Zclassic has the best opportunity to capitalize on a rebrand to BitcoinZ. No other system is a better fit. Zclassic uses the most advanced privacy technology and the code is developed by a great team of developers. Zclassic, like Litecoin, makes very few changes to Bitcoin and the largest changes to the codebase in Zclassic is zk-SNARKs privacy technology. That would simply be the Z part of BitcoinZ.

[Note: Zclassic holders will have the benefit of receiving new Zen coins 1:1 on May 23rd. Zen is a spinoff from Zclassic that plans to provide end-to-end censorship resistant and anonymous p2p communications and economic activity. It is a great complement to the Zclassic ‘commodity’ coin and should rival Dash and Pivx and other DAO systems that are more feature-rich and have gained a lot of traction and support in the past year.]

That has got to be the most scammy you could possibly do. Capitalizing people with the bitcoin name and logo, peddling your clone coin. This is awful.

Hey Kyle… Not sure what you mean by “capitalizing people”… but I’m kind of puzzled that what you get from this article is that it contains a proposal to do something unethical with the bitcoin name and logo, or that the author is peddling a clone coin.

It’s pretty clear that the creator of bitcoin designed it – intentionally and consciously – for the reuse that’s happening everywhere. And people are not just basing countless currencies and projects on the bitcoin protocol and blockchain, they’re even proposing that entire companies’ and countries’ financial systems be based at least on what bitcoin pioneered, if not on the bitcoin protocol itself. Also seems like even the word “bitcoin” was intended to be a generic name, that is, not a proper noun – like “money” or “coin” or “steel.” (Nobody objects when somebody combines a bunch of different metals and calls the alloy that results “stainless steel.”) IMHO, whoever it was who created bitcoin just wanted to do something good (profoundly good) for the world.

So for those and various other reasons, what I get from this article isn’t a proposal to do something with bitcoin that bitcoin wasn’t intended for or that its creator/s would object to. I get an incredibly helpful analysis of some issues I never would have thought about, with a suggestion for solving a problem that makes a lot of sense now that I’m starting to understand that:

a) it already exists;

b) it’s designed to fill the global demand for privacy;

c) it has no founders' tax;

d) it’s so-far unenhanced (much like bitcoin is) and the emergence of zen coin can allow it to stay that way; and

e) as long as the supply-audit problem is fixed, which it apparently can be (and therefore likely will be), then it’s appropriate (immensely appropriate?) for filling the role of a digital commodity that has the privacy features bitcoin wasn’t designed to provide;

Thanks to the OP for starting this conversation. What do we need to do to get the name officially changed? Anybody know? Suggestions?

... lol well they chose hush anyway so.

I see your argument that anything should be able to use the bitcoin name in the spirit of Satoshi. I would argue it is still quite deceptive to the industry to rename your coin in a way that is confusing with the established leader of the space: Bitcoin. Just because it is an improvement on BTC doesn't mean you just copy the name. There is a reason there is not any other bitcoin clone names being used.

Thanks. Understood. BTW, article mentions Bitcoin Dark, Bitcoin Plus, Bitcoin 21, First Bitcoin.

Yeah all of those are shit, deceptive junk coins.

I can understand this point of view. It can be seen as an opportunistic strategy and may not be viewed favorably by some people. It's not my coin, although I do have an investment in it, just like Bitcoin and others. Also this is a proposal and the ZCL community has to support it. Theoretically anyone can call a coin different names and whatever catches on will probably end up being used. I think BitcoinZ really reflects the essence of the coin better since the technology is mainly a version of bitcoin with a distinct improvement in privacy using zk-SNARKs tech. 1) The 'Z' distinguishes it enough from Bitcoin. 2) The other Bitcoin brands that have been around and mentioned in the post havn't really diminished what Bitcoin is. 3) It's a good marketing strategy for an open-source /non-IP world. Culturally if people are offended, they'll either dismiss it or actively work against it so I think the free market will generally settle things. As long as you aren't trying to pretend to be the core Bitcoin and confuse people I think culturally it's fine. People even have different visions of what Bitcoin is... (Bitcoin Unlimited vs Core)... so ownership only goes as far as those individuals who are using the ecosystem.

Zclassic is forking to Zencash May 23rd.

This post has been ranked within the top 80 most undervalued posts in the first half of May 01. We estimate that this post is undervalued by $3.26 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: May 01 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

This would be epic! I would be all for it but idk, I feel like people wouldn't catch on, too man options out there, too much crap coin to buy maybe one day tho!

Why do you think they wouldn't catch on? It seems like the name Bitcoin-Z says it all. Businesses and individuals need privacy. Tech pros understand zk-SNARKs, but Z as shorthand for privacy is probably enough for the rest of us.

Good points in this blog. I fully understand what you're talking about. The price of a coin should depend on the quality of the product, the team behind it, if proffesional investors believe in it, and a lot more facets. I was wondering if anyone of you uses: https://www.coincheckup.com For a complete crypto analysis on every single tradable crypto out there.